5G NTN Market Overview

The global 5G NTN market size was valued at USD 3.2 billion in 2022, and is projected to reach USD 93.6 billion by 2032, growing at a CAGR of 40.6% from 2023 to 2032.

The prevalence of 5G devices is a key driver for the growth of the 5G NTN market. As more consumers and businesses adopt 5G technology and upgrade their devices to 5G-enabled devices, the demand for reliable, high-speed connections on the 5G NTN network is expected to increase. In addition, 5G devices offer faster data transfer speeds and greater network capacity than other devices. This encourages users to consume more data-intensive content and engage in data-driven applications such as high-definition video streaming, online gaming, augmented reality, and cloud-based services.

Furthermore, growing demand for data-intensive applications and services is a key market driver. However, propagation delay and low latency due to large distance between satellites and terrestrial use is a major factor hampering the growth of the market. The distance between satellites and terrestrial infrastructure introduces significant propagation delays, which is the time it takes for signals to travel back and forth between the two points. This latency can impact real-time applications that require immediate response, such as interactive games, self-driving cars, and remote-control systems. Inherent delay can affect the user experience and performance of time-sensitive applications.

Contrarily, with the development of 5G and 6G, the demand for NTN is increasing, which is a great opportunity for the 5G NTN industry. Ground connectivity can provide extension and connectivity in areas where ground infrastructure is limited or nonexistent. Remote rural areas and harsh environments such as mountains, deserts and oceans can benefit from NTN’s high-speed data services. By expanding coverage, the NTN helps bridge the digital divide and ensures connectivity in underserved areas.

5G non-terrestrial network (NTN) uses satellites or high-altitude platforms such as drones or balloons to provide users with 5G wireless connections. These networks are developed to address the challenge of providing connectivity in remote or hard-to-reach areas where traditional terrestrial networks cannot reach.

The report focuses on growth prospects, restraints, and trends of the 5G NTN market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the 5G NTN market.

Segment Review

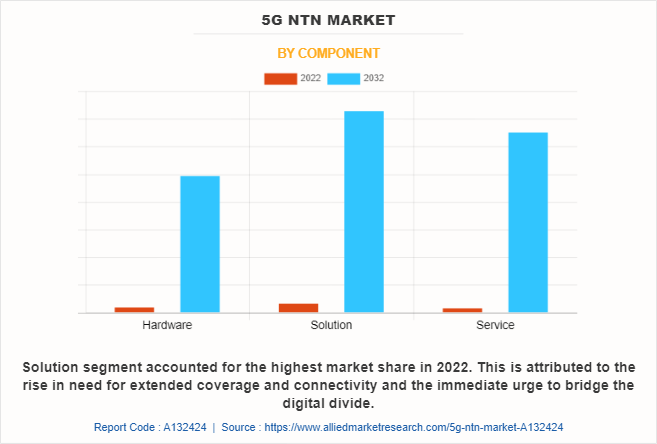

The 5G NTN market is segmented on the basis of component, application, end user, location and region. On the basis of component, it is categorized into hardware, solution, and service. By application, it is divided into near enhanced mobile broadband (EMBB), ultra reliable and low latency communications (URLCC), and massive machine-type communications (MMTC). On the basis of end user, it is classified into maritime, aerospace and defense, government, mining, and others. On the basis of location, it is categorized into urban, rural, remote, and isolated. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the solution segment attained the highest 5G NTN market size in 2022. This is attributed to the rise in need for extended coverage and connectivity and the immediate urge to bridge the digital divide. In addition, advancements in satellite communication technology such as development of high-throughput satellites (HTS), improved signal processing techniques, reduced latency satellite constellations, and advanced coverage antennas are driving the growth of solution segment.

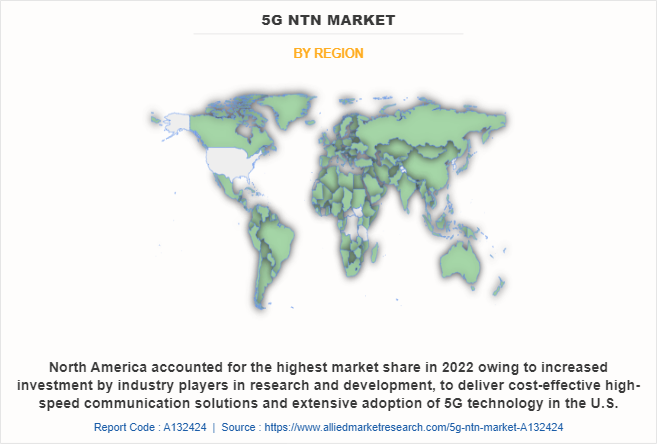

On the basis of region, North America held the highest 5G NTN market share in 2022 owing to increased investment by industry players in research and development, to deliver cost-effective high-speed communication solutions and extensive adoption of 5G technology in the U.S.

Key Market Players

The report analyzes the profiles of key players operating in the market such as Qualcomm Technologies, Inc., Thales, ZTE Corporation, Rohde & Schwarz, MediaTek Inc., Nokia, Telefonaktiebolaget LM Ericsson, Intelsat, Spirent Communications, and Keysight Technologies. These players have adopted various strategies to increase their market penetration and strengthen their position in the market.

Market Landscape and Trends

The expansion of the 5G NTN market is driven by the development of 5G networks and the increasing availability of 5G devices. Governments and telecom companies are investing heavily in 5G infrastructure, expanding the market. In addition, the need for 5G connectivity is driven by the need for Internet of Things (IoT) applications and applications, such as connected homes, driverless cars, industrial automation distributed work and systems, and edge computing are two new business models enabled by 5G connectivity that are expanding the business. In addition, 5G network services are set to enable increased flexibility, network and performance through network virtualization and SDN technologies These advanced technologies make it possible to isolate network services from hardware, which in turn provides network services more flexible and dynamic.

Moreover, edge computing is becoming increasingly important in the 5G NTN market. By keeping computing and storage capacity closer to the edge of the network, edge computing effectively reduces latency and facilitates real-time deployment This integration is crucial in supporting applications such as in autonomous vehicles, smart cities and industrial IoT, because it enables faster decision making, and improves the user experience so the 5G NTN project is constantly evolving with new manufacturers who are coming.

Top Impacting Factors

Growth in Demand for Data-intensive Applications and Services

The combination of 5G technology and non-terrestrial communications infrastructure, such as satellites or high-altitude sites, enables the growing data needs of various applications and services to be met There is an increasing demand for high-speed connectivity and reliability with high-quality video content and increasing streaming capacity. 5G NTN networks offer faster download and streaming speeds, and enable a seamless streaming experience, including 4K and 8K video content.

Additionally, data-intensive applications often rely on big data analytics and AI algorithms to gain insights and make informed decisions. The 5G NTN network will provide the fast, seamless connectivity needed for real-time data processing, enabling agile analytics and AI-driven services such as predictive maintenance, personalized recommendations, and scheduling and around. Relying on low-latency connections, 5G NTN networks can provide the bandwidth and responsiveness necessary for autonomous vehicles, traffic management and vehicle networks, improving vehicle safety and performance so these factors are driving the 5G NTN market growth.

Increase in Adoption of 5G Devices

The proliferation of 5G devices is a key driver for the market. Demand for reliable, high-speed connectivity on 5G NTN networks is expected to increase as more consumers and businesses deploy 5G technology and upgrade their devices to 5G-capable devices does the work. In addition, 5G devices will offer faster data transfer speeds and greater network capacity compared to previous devices. This encourages users to consume data-intensive content and participate in data-intensive applications such as high-definition video, online gaming, augmented reality, and cloud-based services.

Rise in data consumption drives the need for robust and scalable connectivity solutions such as 5G NTN networks to support these demanding applications. In addition, industries such as manufacturing, logistics, healthcare, and utilities require robust, low-density networks for applications such as real-time analytics, automation, remote operations, and data-intensive processing It is important to support the tests for communication and coverage.

3GPP Evolution Toward NTN Interworking and Integration

The 3rd Generation Connectivity Program (3GPP) is an organization that develops and maintains standards for telecommunications. Combining terrestrial networks with non-terrestrial networks (NTNs), such as HAPS flying in the stratosphere or satellites in LEO or GEO, is one of the new 5G capabilities driving market demand and also, the 3GPR R17 standard requires NTN to work. It continues to evolve into 5G-Advanced and has become an integral part of the 3GPR 18 R18 Action Plan. Moreover, the use of future direct satellite connections with mobile phones will spread across many individual and end-user applications, greatly expanding the functionality of satellites Globally pushing hard for new convergent technologies, for integration chains accelerate and encourage integration between cellular satellite groups.

For instance, in February 2023, AccelerComm, the Layer 1 5G IP specialists, and TTP, an independent technology and product development company based in the UK, announced that they are jointly formulating a high-performance 5G LEO Regenerative - base station for deployment on low-earth orbit (LEO) satellites. The project combined expertise and IP from the two companies and additional technology from partners to propose a dedicated 5G regenerative gNodeB solution tailored to support high-performance 5G services in the challenging environment of a Non-Terrestrial Network (NTN). Therefore, these trends are driving the growth of the 5G NTN market.

Propagation Delay and Low Latency Due to Large Distance Between Satellites and Terrestrial Use

The distance between satellites and terrestrial infrastructure introduces significant propagation delays, which is the time it takes for signals to travel back and forth between the two points. This latency can impact real-time applications that require immediate response, such as interactive games, self-driving cars, and remote-control systems. Inherent delay can affect the user experience and performance of time-sensitive applications. In addition, users have come to expect ultra-low latency and high-speed connectivity, with the advent of 5G. The delay caused by the large distance between satellites and terrestrial infrastructure may not meet these expectations, especially in scenarios where near-instantaneous responses are crucial. If the latency introduced by 5G NTN networks is not significantly improved, it could hinder user adoption and acceptance of these networks.

Furthermore, the 5G market is highly competitive as terrestrial networks offer low-latency connections and high-speed data transmission. Latency issues caused by long distances between satellites and terrestrial infrastructure can benefit terrestrial networks in terms of user experience and performance. This competitive landscape may affect the adoption rate and market growth of 5G NTN networks. Overall, propagation delay and low latency devices is major restraining factor for the growth of the market.

Doppler Frequency Shift Owing to Mobility Issues

Doppler shifts caused by user or vehicle movement can cause signal distortion, fading, and increased bit error rates. These effects degrade the quality of the received signal and affect overall communication performance. Unreliable signals could hinder the rollout and deployment of 5G NTN networks, especially in applications that require consistent and stable connections. Moreover, when a user or vehicle is moving at high speeds, rapid changes in Doppler frequency can cause frequent signal interruptions and disconnections. This could negatively impact real-time applications that rely on continuous, uninterrupted connectivity, such as self-driving cars, teleconferencing and remote-control systems. The possibility of service disruption could prevent users and businesses from taking full advantage of 5G NTN solutions.

Need for NTN in Evolution Toward 5G and 6G

Non-terrestrial networks can provide extended coverage and connectivity in areas where terrestrial infrastructure is limited or non-existent. Remote rural areas and demanding areas such as mountains, deserts and oceans can benefit from NTN for high-speed data services. By extending coverage, NTN helps bridge the digital divide and ensure connectivity in underserved areas. Moreover, the integration of NTN into 5G and 6G networks has the potential to greatly augment their capabilities. Through the redirection of traffic from ground-based networks to satellites or high-altitude platforms, NTN has the ability to alleviate network congestion and enhance overall performance. This becomes particularly vital in densely populated urban areas or during large-scale events where there is a significant demand for data-intensive applications and services.

For instance, in February 2023, for direct communication between smartphones and satellites, particularly in distant places, Samsung Electronics Co., Ltd., a global leader in advanced semiconductor technology, has acquired standardized 5G non-terrestrial networks (NTN) modem technology. Samsung intends to include this technology into its Exynos modem offerings, speeding up the commercialization of 5G satellite communications and laying the groundwork for the Internet of Everything (IoE) era, which will be driven by 6G. Therefore, these factors will enhance growth prospect for the industry.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the 5G NTN market forecast from 2022 to 2032 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of market outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists in determining the prevailing 5G NTN market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global 5G NTN market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global 5G NTN market trends, key players, market segments, application areas, and market growth strategies.

5G NTN Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 93.6 billion |

| Growth Rate | CAGR of 40.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 315 |

| By Application |

|

| By End User |

|

| By Location |

|

| By Component |

|

| By Region |

|

| Key Market Players | Nokia, Keysight Technologies, Intelsat, Rohde & Schwarz, ZTE Corporation., Qualcomm Technologies, Inc. , Thales, MediaTek Inc., Spirent Communications, Telefonaktiebolaget LM Ericsson |

Analyst Review

As per the insights of the top-level CXOs, a 5G non-terrestrial network (NTN) is a wireless communication network that uses satellites, drones, or other aerial platforms to provide high-speed internet and other communication services. 5G NTN operates in space or the upper atmosphere, allowing for global coverage and increased capacity. Furthermore, technological advancements are the major trends driving the popularity of 5G NTN market. Key players in the 5G NTN market are focusing on innovation to strengthen their market position. In addition, the need for 5G networks is driven by the need for Internet of Things (IoT) applications and applications, such as connected homes, driverless cars, industrial automation distributed business and systems, and edge computing models enabled by 5G networks that are expanding the business.

The CXOs further added that market players are adopting strategies like partnership for enhancing their services in the market and improving customer satisfaction. For instance, in February 2023, Samsung, a South Korea-based mobile device manufacturer, launched a new, secure, and standardized 5G non-terrestrial network. Samsung's NTN technology will assist global telecom operators, mobile device manufacturers, and chip manufacturers in improving service interoperability and scalability. This technology will be integrated into Samsung's Exynos modem solutions, speeding the commercialization of 5G satellite communications and opening the road for the 6G-powered Internet of Everything (IoE). Therefore, such strategies are expected to boost the growth of the 5G NTN market in the upcoming years.

Moreover, some of the key players profiled in the report are Qualcomm Technologies, Inc., Thales, ZTE Corporation, Rohde & Schwarz, MediaTek Inc., Nokia, Telefonaktiebolaget LM Ericsson, Intelsat, Spirent Communications, and Keysight Technologies. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry

The global 5G NTN market size was valued at USD 3.2 billion in 2022, and is projected to reach USD 93.6 billion by 2032

The 5G NTN market is projected to grow at a compound annual growth rate of 40.6% from 2023 to 2032.

The key players profiled in the report include 5G NTN market analysis includes top companies operating in the market such as Qualcomm Technologies, Inc., Thales, ZTE Corporation, Rohde & Schwarz, MediaTek Inc., Nokia, Telefonaktiebolaget LM Ericsson, Intelsat, Spirent Communications, and Keysight Technologies.

North America held the highest 5G NTN market share in 2022 owing to increased investment by industry players

Growth in demand for data-intensive applications and services, increase in adoption of 5G devices and 3GPP evolution toward NTN interworking and integration majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...