Advanced Driver Assistance Systems (ADAS) Market Overview

The global advanced driver assistance systems market size was valued at USD 40.4 billion in 2022, and is projected to reach USD 133.7 billion by 2032, growing at a CAGR of 13% from 2023 to 2032. The advanced driver assistance systems (ADAS) refers to a class of electronic parts used in cars that offer the driver a smarter driving experience. These systems include distinctive sensors like laser, infrared, radar, image, ultrasonic, LiDAR, and image sensors. Deployment of ADAS in vehicles to enhance comfort and ensure safety on road is anticipated to be one of the major trends being witnessed in the automotive industry. The rise in the need for safer driving conditions increases the demand for an assistive driving system among the customers, which in turn propels the growth of the ADAS market.

Key Market Trends & Insights

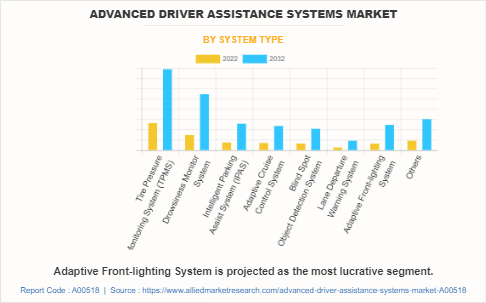

- Adaptive front-lighting systems are set to witness strong growth.

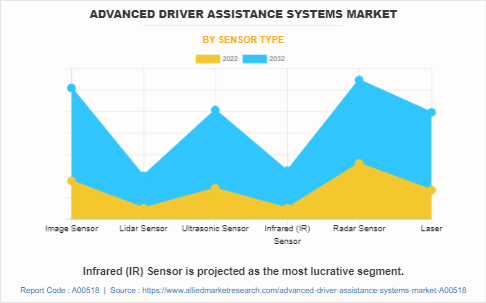

- Infrared (IR) sensor adoption is expected to rise significantly.

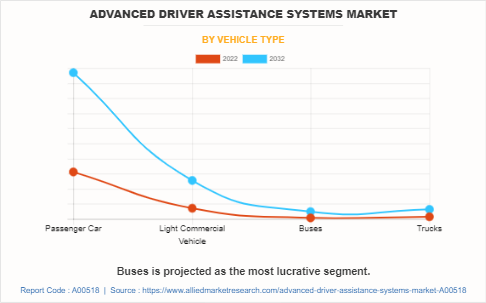

- Bus segment is projected to show notable market growth.

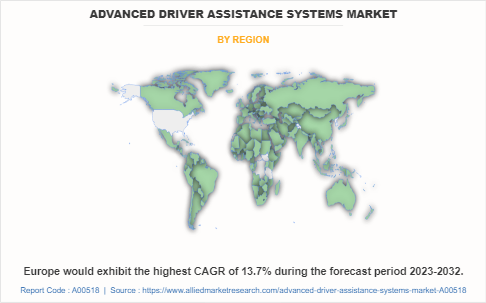

- Europe is forecasted to record the highest CAGR in the market.

Market Size & Forecast

- 2032 Projected Market Size: USD 133.7 billion

- 2022 Market Size: USD 40.4 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 13%

Report Key Highlighters:

- The advanced driver assistance systems market studies more than 15 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The advanced driver assistance systems market includes several players such as Autoliv Inc., Continental AG, DENSO Corporation, Magna International Inc., ROBERT BOSCH GMBH, Valeo, NXP Semiconductors, Panasonic Corporation, Renesas Electronics Corporation, and Texas Instruments. Key strategies such as partnership, acquisition, product launch, contract, product development, expansion, and other strategies of the players operating in the market are tracked and monitored.

Introduction

The advanced driver assistance system provides various advantages such as reduction in loss of property & life, decrease in the rate of accidents, and others. ADAS consists of safety functions that are designed to improve pedestrian and passenger safety by minimizing both motor vehicle accidents and severity. Advanced driver assistance systems warn the driver of potential danger and help the driver to remain in control to prevent accidents and reduce severity if possible.

Factors such as high demand for safety features and increased demand for comfort while driving foster the growth of the advance driver assistance systems market. In addition, stringent safety rules and regulations are anticipated to propel the growth of the market. However, high initial cost and complex structure and lower efficiency in bad weather conditions hinder the growth of the advance driver assistance system market. Furthermore, technological advancements in the advanced driver assistance systems and production of multifunctional systems are anticipated to provide a remarkable growth opportunity for the players operating in the market.

Market Segmentation

The global advanced driver assistance systems (ADAS) market is segmented on the basis of system type, sensor type, vehicle type, and region. By vehicle type, ADAS market is categorized as passenger car, light commercial vehicle, buses, and trucks. Based on system type, the ADAS market is divided into tire pressure monitoring system (TPMS), drowsiness monitoring system, intelligent parking assist system (IPAS), adaptive cruise control system, blind spot object detection system, lane departure warning system, adaptive front lighting system, and others.By sensor type, the market is fragmented into image sensor, LiDAR sensor, ultrasonic sensor, infrared (IR) sensor, radar sensor, and laser.By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA

Market Dynamics

The Asia-Pacific advanced driving assistance system market is anticipated to grow at a significant rate during the forecast period, due to supportive macroeconomic factors such as increase in income, increase in purchasing power, and changing lifestyle due rapid urbanization and rise in awareness about active safety systems. Advanced driver assistance systems is expected to be in high demand in the near future in countries like China, Japan, and India.

Image sensors are used in a wide range of applications such as photography, medical, and others. These sensors have witnessed impressive growth in advanced driver assistance systems industry. Image sensors are used in various applications such as park assist, lane departure warning, and collision avoidance systems for projecting the outside picture to the driver. The development of NCAP car ratings in developed nations, such as Japan, Brazil, and European countries has led to the remarkable commercial opportunity for image sensors.

Leading manufacturing companies such as BMW, Audi, Ford, Toyota, Onsemi and GM, majorly invest to develop ADAS to sustain the intense competition in the industry. For instance, in May 2023, Onsemi launched Hyperlux automotive image sensor with a 2.1 μm pixel size, 150 dB ultra-high dynamic range (HDR) and LED flicker mitigation (LFM) across the full automotive temperature range, the Hyperlux family offers high performance, speed and advanced features to propel the next generation of advanced driver assistance systems (ADAS) forward. The introduction of vision-based inputs by ADAS would present promising opportunities for the image sensors industry.

However, functions associated with ADAS such as park assistance, lane departure warning, and collision avoidance, are heavily dependent on the use of image sensors. Therefore, increased demand for these features is expected to drive the image sensors market growth. The use of ADAS in low-cost cars is expected to present lucrative opportunities for the global advanced driver assistance systems market.

The automobile industry in the Asia-Pacific area has grown recently. The region is among the most lucrative for investment and has significantly boosted the world's auto sales. By establishing their corporate headquarters or manufacturing plants in countries like China, Japan, and India, which are the area's automotive centres, the major automobile firms have focused on expanding in the region. Due to the robust economic climate and ongoing rise in household disposable income, it is projected that the market for luxury vehicles will increase throughout the region. emerging nations like China and India, Japan, Australia, and others.

For instance, in August 2021, Toyota and Lexus launched a new assistance service to its drivers in the moments following a collision. Collision Assistance is a just-in-time support service that provides guided instructions to help drivers navigate a post-collision repair process. Numerous manufacturers have ventured into the region due to the flexibility of establishing manufacturing facilities.

Automotive manufacturers in North America have targeted key automobile players such as Ford Motors and General Motors by offering them advanced sensors. In addition, they are providing ADAS products to the aftermarket of North America as well. The regional agencies have mandated the use of TPMS sensors in all passenger vehicles to check the tire pressure at any point of time. Advancements in auditory and tactile warning systems improve the performance of drivers and are more effective than dual modal systems (auditory-visual and tactile-visual).

Automotive manufacturers have focused on developing low-cost assistance systems that cannot be tampered with. The region has witnessed a shift in concern from crash mitigation to collision avoidance in the small vehicle segment. The rise in demand for such technology equipped vehicles has enforced automakers to incorporate advanced safety features to ease consumer perception and safety concerns. The automakers and system providers in North America have integrated image intensifiers into complex systems that enable peripheral night vision.

Which are the Top Advanced Driver Assistance Systems (ADAS) companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the ADAS industry.

- Autoliv Inc.

- Continental AG

- DENSO Corporation

- Magna International Inc.

- Robert Bosch GmbH

- Valeo

- NXP Semiconductors

- Panasonic Corporation

- Renesas Electronics Corporation

- Texas Instruments

What are the Top Impacting Factors

Key Market Driver

High Demand for Safety Features

Because there are more and more car accidents happening all around the world, people are realizing how important it is to have safety technologies in cars. These technologies include things like airbags that pop out in case of a crash, systems that help the car stay on the road and avoid crashes. Moreover, road traffic injuries leading to death are higher among teenagers. These factors are leading to the growing demand for safety features in vehicles. Automobile companies are developing and introducing safety features to meet the needs of the customers. Thus, high demand for safety features drives the growth of the advanced driver assistance system market.

Increased Demand for Comfort While Driving

Consumers are inclined toward comfort while driving due to the increase in purchasing power. Application of advanced driver assistance system, such as adaptive cruise control and parking aid systems, have been introduced to provide comfort to drivers. However, the driver can overrule the system at any time. Other systems such as intelligent parking systems, adaptive cruise control system, night vision system, and others which support the driver for lateral control of the vehicle are in continuous development phase.Additionally, as consumers' spending power has improved, there has been a noticeable increase in the desire for ADAS system. This factor fuels the ADAS market growth during the forecast period.

Stringent Safety Rules and Regulations

Countries have implemented laws and regulations for vehicles to install safety systems such as lane departure warning systems and tire pressure monitoring systems in their vehicles within a stipulated period. For instance, starting in April 2015, the Indian government will require all new commercial vehicle models to include high-tech brake systems. This is done by amending the motor vehicle statute. Several countries now have laws requiring the usage of technologies including car airbags, passenger seat belts, lane departure warning systems, driver monitoring systems, drowsiness monitoring systems, kid safety systems, pedestrian safety systems, and others.

Automakers must also obtain safety ratings from groups like the Insurance Institute of Highway Safety (IIHS), New Car Assessment Programme (NCAP), and International Centre for Automotive Technology (ICAT) in order to obtain the sales licence for automobiles on the market. Thus, all these safety rules and regulations made by the government are anticipated for the growth of advanced driver assistance systems market in the coming years.

Restraints

High Initial Cost and Complex Structure

The high cost associated with installing applications in vehicles is expected to reduce the growth of the advanced driver assistance systems market as this factor increases the cost of the car. Factors such as the higher cost involved in the installation of ADAS is leading to the higher cost of cars. The prospect of providing premium features in vehicles incurs additional expenses to consumers in the form of hardware, applications, and telecom service charges, which eventually hamper the growth of the ADAS market.

Moreover, the serviceability of the vehicle is difficult, and requires skilled workers due to several electronic components and sensors. Complex structure of systems reduces the shelf life of vehicles. Thus, high initial cost and complex structure is expected to have a significant impact on the growth of the advanced driver assistance systems market.

Lower Efficiency in Bad Weather Conditions

Environmental changes act as a restraint for advanced driver assistance systems. This is because sensor or camera associated with ADAS face difficulty in tracking moving objects during bad weather conditions. The applications of advanced driver assistance system do not work effectively in harsh weather conditions. Vision-based systems especially have poor outcomes in bad weather and low light conditions. Moreover, other environmental factors such as lightning & thunderstorm, and heavy rain also affect the market growth. Hence, low efficiency in bad weather conditions hamper the adoption of advanced driver assistance systems across the globe.

Opportunity

Technological Advancements in Advanced Driver Assistance System

Companies are installing a wider range of features and technologies in their vehicles to provide comfort to consumers and to increase sales. In addition, technological advancement in electronic components, such as sensors and smartphones which are supported with wireless communication & cloud systems provides better surrounding information and improves the safety of the consumers. The dynamic advancements in technology such as intelligent parking assist system that help cars to park smoothly without the involvement of a guide to give directions, night vision system which is useful in area where no or less light is there, lane departure system, and brakes at the sign of danger, have increased the sales of automobile industry.The ADAS market forecast indicates a significant growth, attributed to technological advancements and the rising need for improved vehicle safety.

Moreover, the integration of various electronic equipment is expected to be introduced in the near future. Thus, technological advancements in advanced driver assistance systems are anticipated to provide a remarkable growth opportunity for the key players operating in the ADAS market.

What are the Recent Developments in the ADAS Market

In March 2023, Valeo SA received contract from American robotaxi company for third-generation SCALA 3 LiDAR system. Valeo SCALA 1 and 2 made conditional autonomous driving in traffic jams a reality. SCALA 3 dramatically increases the domain of operation.

In December 2022, Magna International Inc. acquired Veoneer Active Safety business from investment firm SSW Partners for $1,530 million. Veoneer Active Safety systems provide early warnings to alert drivers to prevent accidents by using features such as autonomous emergency braking, forward collision warning, and blind spot detection..

In April 2021, Denso Corporation developed advanced driver assistance technology featured for New Lexus LS, & Toyota Mirai. Advanced driver assistance technologies are essential to help drivers safely operate vehicles in driving scenarios.

In February 2020, Continental AG expanded its structure & started production of radar sensors being built in New Braunfels, Texas. The purpose of the new building is to expand its capacity for the production of radar sensors.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the advanced driver assistance systems market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ADAS market trends, key players, market segments, application areas, and market growth strategies.

Advanced Driver Assistance Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 133.7 billion |

| Growth Rate | CAGR of 13% |

| Forecast period | 2022 - 2032 |

| Report Pages | 276 |

| By System Type |

|

| By Sensor Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | AUTOLIV INC., Renesas Electronics Corporation, Denso Corporation, Texas Instruments Incorporated, Panasonic Holdings Corporation, Continental AG, NXP Semiconductors, Valeo SA, Magna International Inc., Robert Bosch GmbH |

Analyst Review

The global advance driver assistance systems market is expected to witness high growth rate in the future, owing to the rapid growth of the automotive sector.

The use of advanced driving assistance system technology has increased in various applications such as adaptive cruise control system, lane departure warning system, park assist, blind spot detection system, and adaptive front lighting system. This system has gained prominence in China, India, and Japan.

RADAR sensors are as applicable in adaptive cruise control, park assist, and blind spot detection. This segment is anticipated to witness significant decline during the forecast period, owing to the increased adoption of ultrasonic sensors, which are affordable and show multiple functionality.

In current scenario, the regional government plays a vital role in driving the advance driver assistance systems market by implementing safety regulations to reduce traffic-related accidents. Countries in Europe prefer using vehicles with advanced driving systems due to stringent government regulations. Decrease in the prices of sensors technology and rise in demand for ADAS applications drive the global market. Moreover, benefits such as reduced rate of road accidents and enhanced comfort level while driving fuel the demand for ADAS.

The market growth is supplemented by proactive industrialization efforts, increased manufacturing output due to technological advancements, and high standards of living. This would allow the emerging markets to evolve, both from the demand as well as the supply side. Asia-Pacific is expected to witness significant demand for ADAS systems, owing to increase in per capita income of the population. Moreover, the demand for new technologies, such as park assistance, tire pressure monitoring, adaptive cruise control, and drowsiness monitor system, is expected to increase in the near future.

Magna International Inc., Autoliv Inc., Continental AG, Robert Bosch GmbH, Valeo, Denso Corporation, NXP Semiconductor, Panasonic Corporation, Renesas Electronics Corporation, and Texas Instruments are key players that occupy a significant revenue share in the market.

The top companies to hold the market share in Advanced Driver Assistance Systems are Autoliv Inc., Continental AG, DENSO Corporation, Magna International Inc., ROBERT BOSCH GMBH, Valeo, NXP Semiconductors, Panasonic Corporation, Renesas Electronics Corporation, and Texas Instruments.

The estimated industry size of Advanced Driver Assistance Systems is $40.4 billion in 2022.

The largest regional market for Advanced Driver Assistance Systems is Asia-Pacific.

The leading system type of Advanced Driver Assistance Systems Market is tire pressure monitoring system (TPMS).

The upcoming trends of Advanced Driver Assistance Systems Market in the world are technological advancements in the advanced driver assistance systems and production of multifunctional systems.

The top companies to hold the market share in Advanced Driver Assistance Systems are Autoliv Inc., Continental AG, DENSO Corporation, Magna International Inc., ROBERT BOSCH GMBH, Valeo, NXP Semiconductors, Panasonic Corporation, Renesas Electronics Corporation, and Texas Instruments.

Loading Table Of Content...

Loading Research Methodology...