B2B2C Insurance Market Research, 2032

The global b2b2c insurance market was valued at $4.3 billion in 2022, and is projected to reach $10.5 billion by 2032, growing at a CAGR of 9.6% from 2023 to 2032.

B2B2C insurance stands for Business-to-Business-to-Consumer insurance. It is a type of arrangement where an insurance company partners with another business, like a retailer or a service provider, to offer insurance products directly to the end customers of that business. For instance, a popular online shopping platform partnering with an insurance company to offer protection plans for the products they sell. When a customer buys an item, they might have the option to also purchase insurance coverage for it. This way, the insurance is seamlessly integrated into the shopping experience. In simple terms, B2B2C insurance is like a behind-the-scenes collaboration between businesses and insurance companies to make sure customers have easy access to insurance options while using a particular service or buying specific products.

The emphasis on enhancing the customer experience is a major driving factor for the B2B2C insurance market growth. This is achieved through the seamless integration of insurance options within the transactional process, providing consumers with a sense of security and trust in their purchases. Furthermore, the B2B2C insurance model offers an expanded market reach, as insurance companies forge partnerships with established businesses. This collaborative approach not only broadens the customer base but also augments the potential for increased sales and revenue streams.

However, the intricate task of technological integration demands meticulous planning and execution, while regulatory compliance across diverse industries and regions calls for unwavering commitment to legal standards which hampers B2B2C insurance market growth. On the contrary, the B2B2C insurance model offers a remarkable opportunity for data-driven customization. By leveraging customer data, businesses and insurers can tailor insurance offerings to individual preferences and risk profiles, thereby fostering a deeper sense of customer loyalty and driving sustained profitability.

The report focuses on growth prospects, restraints, and trends of the B2B2C insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the B2B2C insurance market size.

Segment Review

The B2B2C insurance market outlook is segmented on the basis of type, enterprise size, distribution channel, application and region. On the basis of type, the market is bifurcated into life insurance and non-life insurance. Based on enterprise size, the B2B2C insurance market is bifurcated into large enterprises and small and medium-sized enterprises. Based on distribution channel, it is divided into online and offline. On the basis of application, the B2B2C insurance market it is bifurcated into individual and corporate. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

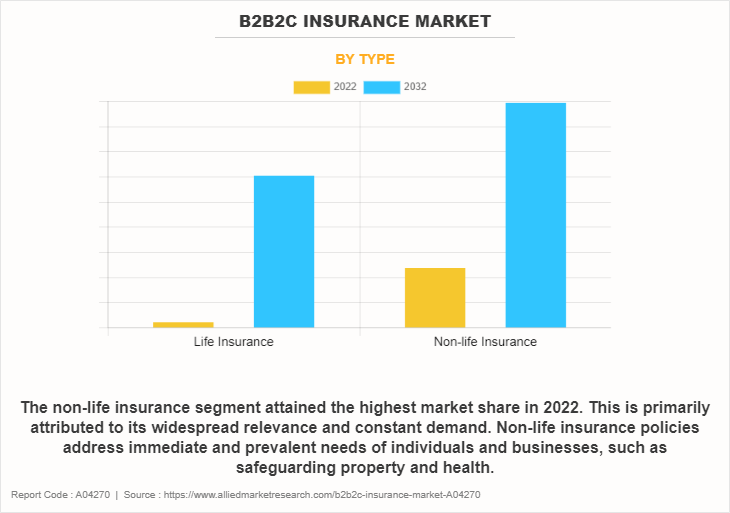

Based on type, the non-life insurance segment attained the highest market share in the B2B2C insurance industry. This is primarily attributed to its widespread relevance and constant demand. Non-life insurance policies address immediate and prevalent needs of individuals and businesses, such as safeguarding property and health. Moreover, the accessibility and affordability of these policies make them widely adopted. Businesses often seek non-life insurance to shield their assets from unexpected events, and individuals opt for policies like health and auto insurance for personal security. On the other hand, the life segment is attributed to be the fastest-growing segment during the forecast period. This is attributed to the fact that there is an increasing awareness of the importance of life insurance, driven by growing financial literacy and a desire for long-term financial security. In addition, as individuals and families seek to plan for the future, life insurance provides a crucial tool for ensuring financial stability in the event of unexpected circumstances. Moreover, advancements in life insurance products, including more flexible and tailored offerings, are making them more appealing to a broader audience.

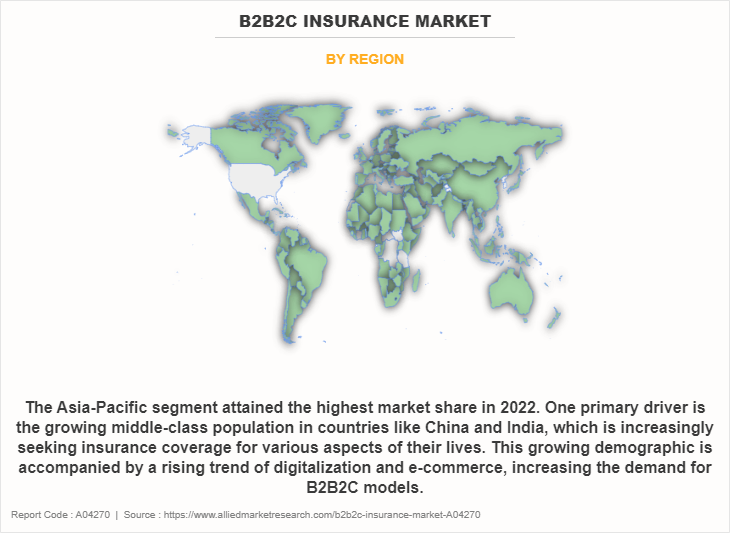

On the basis of region, Asia-Pacific attained the highest growth in 2022. Asia-Pacific's forecasted rapid growth in the B2B2C insurance market is due to its increasing middle class, digitalization, and a relatively underpenetrated insurance landscape. The region is experiencing a surge in consumer demand for a wide range of products and services, including insurance, driven by economic growth and rising incomes. Moreover, the Asia-Pacific market is characterized by a proactive approach toward technological advancements and digital platforms, creating opportunities for the expansion of B2B2C models. As consumers in this region become more tech-savvy and insurance-savvy, businesses are eager to tap into this growing market.

The report analyzes the profiles of key players operating in the B2B2C insurance market such as AXA Partners Holding SA., Allianz , American International Group, Inc., Zurich Insurance Group, China Life Insurance, Berkshire Hathaway Inc., Prudential plc, ICICI Lombard General Insurance Company Ltd., UnitedHealth Group, and Munich Re. These players have adopted various strategies to increase their market penetration and strengthen their position in the B2B2C insurance market share.

Competition Analysis

Recent Partnerships in the B2B2C Insurance Market

On October 10, 2023, Allianz Partners, a world leader in B2B2C insurance and assistance services, and bolttech, an international insurtech, announced a partnership to provide embedded device and appliance protection insurance across Asia Pacific and the United States. The strategic cooperation agreement aims to bring together each company's complementary strengths to offer best-in-class solutions enabling business partners to add insurance and protection products to customer journeys at the point of need. The cooperation between Allianz Partners and bolttech will deliver embedded solutions for business partners such as retailers and e-tailers for electronic products and household devices, telecommunication providers, banks, insurers, and original equipment manufacturers (OEMs). The collaboration aims to make it easier and more convenient for customers to purchase protection at the point of need for a range of household products, including mobile and digital devices, and household appliances (white and brown goods).

Recent Product Launches in the B2B2C Insurance Market

On June 1, 2023, Lexasure Financial Group announced the introduction of a cloud-driven business-to-business-to-consumer (B2B2C) platform to help insurance firms to improve competitiveness, expansion, and profitability. The LexasureCloud 1.0 digital insurtech platform is a primary component of Lexasure’s digital approach, together with the platform’s B2C customer portal for life insurance investments, as well as general reinsurance B2B risk management portal Atlas. The core modules are reinsurance-as-a-service (RaaS), which provides one-stop access to underwriting capacity through tailormade reinsurance tools, and policy management, which enables insurers to easily view and manage current policies and automated regulatory compliance. They also include claims management, data and analytics, as well as financial capital management modules.

Top Impacting Factors

Enhanced Customer Experience

The integration of insurance offerings within the transactional process of a business-to-business-to-consumer (B2B2C) model fundamentally enhances the overall customer experience. This result in providing consumers with the option to procure insurance coverage seamlessly alongside their primary product or service acquisition. By providing customers the convenience of safeguarding their purchase, this approach instills a sense of security and trust, contributing significantly to heightened satisfaction levels and fostering enduring relationships between the consumer and the involved businesses. Therefore, enhanced customer experience offered by B2B2C insurance market is a major driving factor.

Integration Challenges

The successful implementation of a B2B2C insurance model necessitates a seamless incorporation of technological infrastructure, operational processes, and data systems between the insurance entity and the partnering business. This entails the harmonization of diverse software platforms, interfaces, and databases. Achieving this level of integration can be a complex and resource-intensive undertaking, as it mandates meticulous planning, robust IT frameworks, and diligent testing protocols to ensure a fluid and cohesive operational environment. Thus, integration challenges hampers the growth of B2B2C insurance market.

Data-driven Customization

The B2B2C insurance model offers a distinctive opportunity for data-driven customization of insurance offerings. Due to the collaborative venture between businesses and insurance providers, a large number of customer data becomes available. This information can be leveraged to craft highly personalized insurance solutions tailored to the distinct preferences, behaviors, and risk profiles of individual customers. Such tailored offerings not only prompt a heightened sense of relevance and value but also serve to support customer loyalty and engagement, ultimately translating into elevated conversion rates and sustained profitability for the involved entities. Therefore, data driven customizations in the B2B2C insurance market will provide ample opportunity for growth in the upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the B2B2C insurance market forecast from 2023 to 2032 to identify the prevailing B2B2C insurance market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the B2B2C insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the B2B2C insurance market players.

- The report includes an analysis of the regional as well as global B2B2C insurance market trends, key players, market segments, application areas, and market growth strategies.

B2B2C Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.5 billion |

| Growth Rate | CAGR of 9.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 461 |

| By Application |

|

| By Type |

|

| By Enterprise Size |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Zurich Insurance Group, Allianz, UnitedHealth Group Inc., Prudential plc, AXA Partners Holding SA, Berkshire Hathaway Inc., Munich Re, China Life Insurance Company Limited, ICICI Lombard General Insurance Company Ltd., American International Group, Inc. |

Analyst Review

The B2B2C insurance market has witnessed significant growth due to several key factors. The increasing demand for personalized insurance solutions has been instrumental. This market segment allows businesses to collaborate with insurers, offering tailor-made policies that cater to specific customer needs. In addition, advancements in technology have played a pivotal role. The integration of data analytics, artificial intelligence, and IoT devices enables insurers to accurately assess risks and provide more precise coverage. Moreover, the growing awareness among businesses about the benefits of offering insurance services as part of their product portfolios has spurred market expansion. This not only enhances customer loyalty but also creates an additional revenue stream for businesses. Furthermore, regulatory changes and the evolution of distribution channels have streamlined the process, making it more accessible and attractive for both businesses and consumers. These combined factors have contributed significantly to the growth and vitality of the B2B2C insurance market.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on October 10, 2023, Allianz Partners, a world leader in B2B2C insurance and assistance services, and bolttech, an international insurtech, announced a partnership to provide embedded device and appliance protection insurance across Asia-Pacific and the United States. The strategic cooperation agreement aims to bring together each company's complementary strengths to offer best-in-class solutions enabling business partners to add insurance and protection products to customer journeys at the point of need. The cooperation between Allianz Partners and bolttech will deliver embedded solutions for business partners such as retailers and e-tailers for electronic products and household devices, telecommunication providers, banks, insurers, and original equipment manufacturers (OEMs). The collaboration aims to make it easier and more convenient for customers to purchase protection at the point of need for a range of household products, including mobile and digital devices, and household appliances. These strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include AXA Partners Holding SA., Allianz, American International Group, Inc., Zurich Insurance Group, China Life Insurance Company Limited, Berkshire Hathaway Inc., Prudential plc, ICICI Lombard General Insurance Company Ltd., UnitedHealth Group, and Munich Re. These players have adopted various strategies to increase their market penetration and strengthen their position in the B2B2C insurance market.

The increasing demand for personalized insurance solutions has been instrumental. This market segment allows businesses to collaborate with insurers, offering tailor-made policies that cater to specific customer needs. In addition, advancements in technology have played a pivotal role. The integration of data analytics, artificial intelligence, and IoT devices enables insurers to accurately assess risks and provide more precise coverage.

. It is a type of arrangement where an insurance company partners with another business, like a retailer or a service provider, to offer insurance products directly to the end customers of that business.

Asia-Pacific is the largest regional market for B2B2C Insurance

the estimated industry size of B2B2C Insurance is projected to reach $10,495.97 million by 2032, growing at a CAGR of 9.6% from 2023 to 2032.

AXA Partners Holding SA., Allianz , American International Group, Inc., Zurich Insurance Group, China Life Insurance, Berkshire Hathaway Inc., Prudential plc, ICICI Lombard General Insurance Company Ltd., UnitedHealth Group, and Munich Re

The B2B2C insurance market outlook is segmented on the basis of type, enterprise size, distribution channel, application and region. On the basis of type, the market is bifurcated into life insurance and non-life insurance. Based on enterprise size, the B2B2C insurance industry is bifurcated into large enterprises and small and medium-sized enterprises. Based on distribution channel, it is divided into online and offline. On the basis of application, it is bifurcated into individual and corporate. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Partnership and product launches are the key growth strategies of B2B2C insurance market Players

. On the basis of application, it is bifurcated into individual and corporate.

Based on type, the life insurance segment is attributed to be the fastest-growing segment during the forecast period.

Loading Table Of Content...

Loading Research Methodology...