Biopesticides Market Research, 2031

The global biopesticides market size was valued at $8,737.8 million in 2021, and is projected to reach $33,638.9 million by 2031, registering a CAGR of 13.9% from 2022 to 2031.

Biopesticides are essentially microbial toxins that can be defined as a biological poison derived from a microorganism, such as a bacterium or a fungus. Pathogenesis by microbial entomopathogens occurs by the invasion of the pathogen through the gut of the insect followed by its multiplication, resulting in the death of the insect.

Key Market Trends and Insights

Region wise, Asia-Pacific generated the highest revenue in 2021.

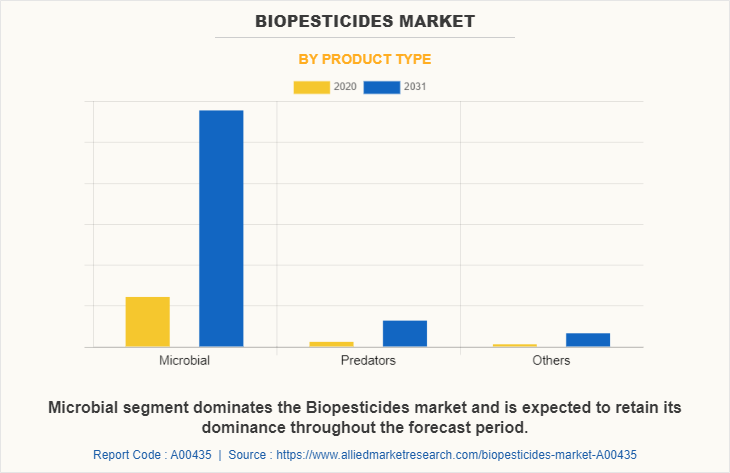

The global biopesticides market share was dominated by the microbial segment in 2021 and is expected to maintain its dominance in the upcoming years

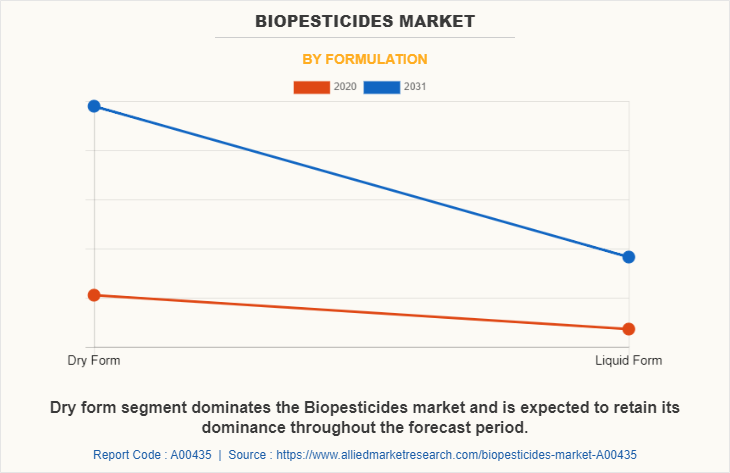

The dry form segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 8,737.8 Million

- 2031 Projected Market Size: USD 33,638.9 Million

- Compound Annual Growth Rate (CAGR) (2022-2031): 13.9%

- Asia-Pacific: Generated the highest revenue in 2022

Key Takeaways

On the basis of biopesticides market analysis for region, Asia-Pacific accounted for the largest revenue share of the global market, registering a significant CAGR from 2022 to 2031, followed by North America.

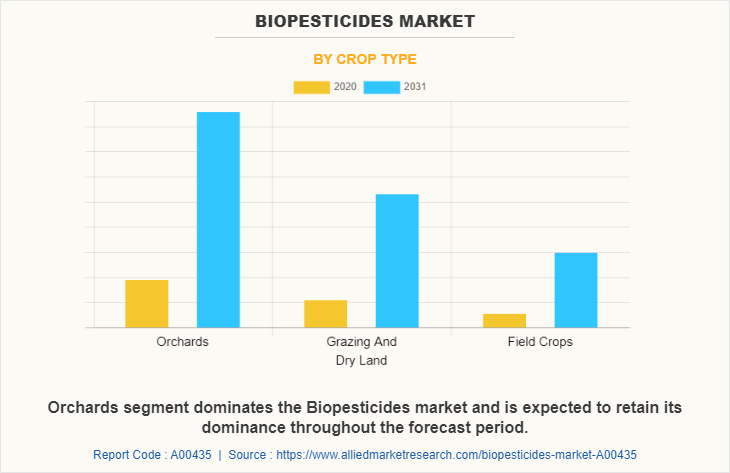

On the basis of market trends in 2021, the orchards crop type segment accounted for majority share, and is expected to grow at the highest rate.

North America is anticipated to grow at the highest CAGR of 13.8% from 2022 to 2031 in the market forecast period.

In 2021, the U.S. generated the highest revenue, accounting for approximately more than one-fourth share of the global market.

Brazil is anticipated to grow at a significant CAGR of 15.4% during the forecast period.

Market Dynamics

The growing preference for organic food drives the biopesticides market since these products are required for sustainable and organic agricultural techniques. Consumers increasingly prioritize health-conscious options and ecologically friendly alternatives, encouraging farmers to use biopesticides as a safer and more environmentally friendly pest management solution. This trend is bolstered by severe controls on chemical-based pesticides and growing awareness of their negative impacts on health and the environment, making biopesticides the preferred option in the agricultural industry.

High manufacturing costs and short shelf life are important barriers to expanding the biopesticides industry. Biopesticides tend to require additional sophisticated production procedures and greater raw material prices than typical chemical-based pesticides, making them a greater expense for farmers. Furthermore, their reduced shelf life and susceptibility to environmental conditions like temperature and humidity complicate storage and transportation, restricting their broad use. These issues provide impediments to market penetration, particularly in areas with underdeveloped agricultural infrastructure.

Segment Overview

The biopesticides market is segmented on the basis of product type, formulation, crop type, and region. On the basis of product type, the market is segmented into microbial, predators, and others. By formulation, the market is segmented into dry form and liquid form. On the basis of corn type, the market is segmented into orchards, grazing & dry land, and field crops. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Russia, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, and rest of LAMEA).

By Product Type

According to biopesticides market trends, on the basis of product type, the microbial segment dominated the global market in 2021 and is expected to be dominant during the biopesticides market forecast period. The microbial segment is expected to grow with a CAGR of 13.8%. Microbial biopesticides have gained popularity that has increased substantially in recent years, as extensive usage of the types of microbial biopesticides has enhanced the crop quality and had helped to save from foreign attack of bacteria, fungus, and other contaminants.

By Formulation

On the basis of formulation, the dry form segment dominated the global market in 2021. Dry form of biopesticides is the most common form available in the market. The dry form is useful to the user since it allows for several uses. Dry biopesticides can be applied directly to crops or blended in a solution to be applied as a spray. The dual application of dry biopesticides has grown in favor among users.

By Crop Type

According to the biopesticides market growth, by crop type, the orchard segment was the segment in which the biopesticides are used the most for protecting the crop from foreign contaminants. Orchards are the crop that is most vulnerable for getting spoiled by pest and insects. Therefore the usages of biopesticides on orchards are the most. The emerging economies, such as India and China, have witnessed significant adoption of orchard farming due to which the use of biopesticides have increased in their regions.

By Region

Region wise, Asia-Pacific dominated the biopesticides market in 2021, and is expected to be dominant during the forecast period. The dominance in the market is largely due to existence of agricultural operations in Asia-Pacific region, and the availability of several variants of microbial and predator biopesticides for different pest, insects and contaminants that are preferred by the users for safeguarding their crops. Increase in demand for biopesticides in the agricultural sector of Asia-Pacific drives the growth of the biopesticides products.

Competition Analysis

The players operating in the global biopesticides market have adopted various developmental strategies to expand their biopesticides market share, increase profitability, and remain competitive in the market. The key players profiled in this report include AgBioChem, Inc., AgBiTech Pty Ltd., Ajay Bio-Tech Ltd., Amit Biotech Pvt. Ltd., Andermatt Biocontrol AG, Arizona Biological Control, Inc., BASF SE, Bayer AG, Kemin Industries, and Novozymes A/S.

KEY BENEFITS FOR STAKEHOLDERS

The report provides a quantitative analysis of the current market trends, estimations, and dynamics of the market size from 2022-2031 to identify the prevailing opportunities.

Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

In-depth analysis and the market size and segmentation assist to determine the prevailing biopesticides market opportunities.

The major countries in each region are mapped according to their revenue contribution to the market.

The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the industry.

Biopesticides Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Formulation |

|

| By Crop Type |

|

| By Region |

|

| Key Market Players | Arizona Biological Control, Inc., Bayer AG, BASF SE, Amit Biotech Pvt. Ltd., AgBiTech Pty Ltd., kemin industries, Novozymes A/S, Ajay Bio-Tech Ltd., AgBioChem, Inc., Andermatt Biocontrol AG |

Analyst Review

The biopesticides market is expected to grow at the highest rate, owing to increase in adoption, specifically in emerging countries, such as China, India, Japan, and Korea. Moreover, the production cost of biopesticides is relatively low in Asia-Pacific compared to other regions.

Several advantages that boost the growth of the global biopesticides market during the forecast period are reduced environmental damage, targeted action, the necessity for smaller amounts for effective coverage, and quicker decomposition. Furthermore, the popularity of biopesticides increased substantially in recent years, owing to extensive research. In addition, the techniques for mass production, storage, transport, and application of biopesticides have improved in recent years and are anticipated to provide lucrative opportunities in the future.

However, factors such as lack of profit from niche market products, for example, bioinsecticides based on baculoviruses, including the Cydia pomonella granulosis virus (CpGV), typically are selective for just one or a few species of insect. These are expected to hamper the market growth.

A recent trend that has gained traction in the global biopesticides market is the growth in public concern over the potential health hazards of synthetic pesticides and the steep increase in the cost of cultivation leading to the exploration of eco-friendly pest management tactics that includes Integrated Pest Management (IPM).

The global biopesticides market size was valued at $8,737.8 million in 2021, and is projected to reach $33,638.9 million by 2031

The global Biopesticides market is projected to grow at a compound annual growth rate of 13.9% from 2022 to 2031 $33,638.9 million by 2031

The key players profiled in this report include AgBioChem, Inc., AgBiTech Pty Ltd., Ajay Bio-Tech Ltd., Amit Biotech Pvt. Ltd., Andermatt Biocontrol AG, Arizona Biological Control, Inc., BASF SE, Bayer AG, Kemin Industries, and Novozymes A/S.

Region wise, Asia-Pacific dominated the biopesticides market in 2021

Extensive use of various types of microbial biopesticides to enhance the quality of the crop & land, increase yield & productivity, and help save crop from foreign attack of fungus, bacteria, and other contaminants drive the growth of the global biopesticides market.

Loading Table Of Content...