Enterprise Resource Planning (ERP) Market Overview

The global ERP market size was valued at USD 16.3 billion in 2023 and is projected to reach USD 40.6 billion by 2033, growing at a CAGR of 9.4% from 2024 to 2033. Factors such as increase in need for operational efficiency and transparency in business processes and rise in demand for data-driven decision-making are expected to fuel the ERP market growth. In addition, surge in adoption of cloud as well as mobile applications is expected to drive the growth of the enterprise resource planning (ERP) market. However, availability of open-source applications and higher investment and maintenance costs are expected to hamper the growth of the enterprise resource planning (ERP) market. On the other hand, increase in demand for ERP among small & medium sized enterprises and technological advancements in enterprise resource planning software are expected to provide lucrative opportunities for the market growth in the coming years.

Key Market Insights

By component, the software segment held the largest ERP market share in 2023.

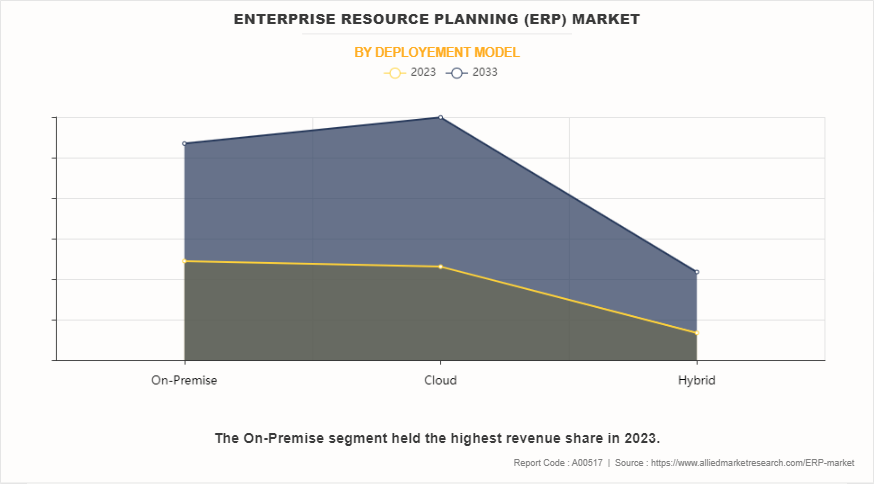

By deployment mode, the on-premises segment held the largest share in the enterprise resource planning (ERP) market for 2023.

By end user, the large enterprise segment held the largest share in the enterprise resource planning (ERP) market for 2023.

By business function, the finance segment held the largest share in the enterprise resource planning (ERP) market for 2023

By industry vertical, the manufacturing segment held the largest share in the enterprise resource planning (ERP) market for 2023

Region-wise, LAMEA is expected to witness the highest CAGR during the ERP market forecast period.

Market Size & Forecast

2033 Projected Market Size: USD 40.6 Billion

2023 Market Size: USD 16.3 Billion

Compound Annual Growth Rate (CAGR) (2024-2033): 9.4%

What is Enterprise Resource Planning (ERP)

Enterprise resource planning (ERP) is a modular software system primarily designed to integrate the main functional areas of an organization's business processes into a unified system. An ERP system includes core software components, often called modules, which focus on essential business areas such as finance and accounting, human resource (HR), production and materials management, customer relationship management (CRM), supply chain management, and others. ERP software enables efficient resource management and integration of organizational activities and its implementation enhances the operational efficiency, thus providing competitive edge to enterprises.

ERP Market Segment Review:

The enterprise resource planning (ERP) market is segmented on the basis of component, deployment model, enterprise size, business function, industry vertical, and region. On the basis of component, the market is bifurcated into software and service. By deployment model, the market is categorized into on-premise, cloud, and hybrid. As per enterprise size, it is divided into large enterprises and small and medium-sized enterprises. Depending on business function, it is classified into finance, human resource (HR), supply chain, customer management, inventory management, manufacturing module, and others. By industry vertical, it is segregated into manufacturing, BFSI, healthcare, retail & distribution, government & utilities, IT & telecom, construction, aerospace and defense, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of deployment type, the on-premise segment dominated the global ERP market share in 2023 and is expected to maintain its dominance in the upcoming years, owing to enhanced data security, greater customization options, and control over infrastructure, making it a preferred choice for industries with stringent compliance requirements. However, the hybrid segment is expected to witness the highest CAGR during the forecast period, due to its flexibility, combining on-premise security with cloud accessibility, cost efficiency, and seamless scalability for growing business needs.

By region, North America dominated the ERP market share in 2023 for the enterprise resource planning market, owing to the region's advanced IT infrastructure, high adoption of cloud-based solutions, significant presence of key market players, and increase in demand for automation. However, LAMEA is expected to exhibit the highest CAGR during the forecast period. This is attributed to increasing digital transformation initiatives, rising investments in IT infrastructure, growing adoption of cloud-based ERP solutions, and government efforts to modernize industries across the region.

What are the Top Impacting Factors in ERP Market

Driver

Rise in Need for Operational Efficiency & Transparency in Business Processes

Traditionally, most of the businesses invest most of the time and effort in communicating business information and making decisions. Organizations aiming at becoming successful continuously seek for systems that will help them serve their clients and increase their profit margin. Presently, ERP systems have become strategic platforms, providing a solid foundation and information backbone for businesses among emerging countries. A fully integrated ERP system helps to capture and create accurate, consistent, and timely relevant data and assist to take better business decision. With better visibility into operations, businesses can make informed decisions, optimize processes, and reduce operational bottlenecks, which propels the ERP market size.

In addition, companies are adopting ERP systems to improve efficiency and ensure a better information integration. Organizations need to access all relevant information quickly to take a necessary business action, owing to increased competition and rapid changes in business environment. An ERP system scales and deals with the global competition while introducing efficiency and transparency in operations which is expected to propel the growth of the market.

Restraints

Higher Investment and Maintenance Costs

- Majority of software vendors offer ERP software for industries such as manufacturing, healthcare, telecom, retail, and aerospace & defense. The initial investment to acquire and implement an ERP system is substantial. The global ERP software vendors such as Microsoft, SAP, Oracle, and IBM Corp. charge high cost for their solutions. In addition, these software vendors charge high fees for maintenance and support function, thereby limitsing the adoption of ERP solutions. The total annual cost of maintaining and updating the ERP system includes internal cost (user training, salaries for IT, project management, and others), external costs (IT vendors, contractors, and others), and maintenance & support fee paid annually to application vendors. Moreover, software providers charge higher prices due to which enterprises are not ready to spend more on applications, which limits the adoption of ERP software. Furthermore, end users are not showing willingness for upgrade and renewals due to high cost of these services, which significantly hampers the growth of the market.

Opportunity

Increase in Demand for ERP Among Small and Medium Enterprises

ERP applications have helped organizations to bring clarity and visibility in their business. Most of the large organizations are able to leverage the benefits of ERP. Presently, small and medium enterprises (SMEs) gain the same benefits, such as increased business efficiency, simplified business processes, and others by integrating ERP services. ERP serves as an ideal choice among SMEs, as it directly affects their operating margins. For instance, SMEs have become one of the major end-user segments for ERP solutions in India, as about 60% of the SME sector has integrated ERP solutions into their business. A cloud-based ERP is most preferred by SMEs, as it facilitates organizations to purchase ERP solution on a lease basis.

In SaaS ERP software, the cloud is a host site where the ERP applications and data are stored, and the computing takes place on remote servers. As SMEs have limited resources for the implementation and maintenance of ERP, thus leading to increase in adoption of cloud-based ERP software, thereby creating several opportunities during the forecast period.

Which are the Leading Companies in Enterprise Resource Planning (ERP)

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the enterprise resource planning market.

SAP SE

Infor Inc.

Oracle Corporation

Microsoft Corporation

Sage Software Solutions Pvt Ltd.

SYSPRO

Unit4

IFS

Workday Inc.

Acumatica, Inc.

QAD Inc.

Deltek, Inc.

Priority Software

Ramco Systems Ltd.

Odoo SA

Intact (Aptech Business Systems Ltd.)

Epicor Software Corporation

Tally Solutions Private Limited

Zoho Corporation

MYOB Australia Pty Ltd.

What are the Most Recent Product Launches in the ERP Industry

In October 2024, Sage acquired Anvyl to enhance supply chain technology solutions. The acquisition will allow Sage to deliver a cost-effective Supply Chain Execution (SCE) solution that provides SMBs with complete visibility across their entire supply chains

In March 2023, SYSPRO, a global provider of industry-built ERP software for manufacturers and distributors, announced new capabilities to its latest ERP release with enriched functionality for improved internal and organizational controls, a connected supply chain, deeper business intelligence and digital dexterity.

In January 2023, Unit4 launched Unit4 Marketplace, a new platform where its independent software vendor, reseller, and service partners can showcase their innovative, bespoke industry and vertical Apps that link to Unit4’s ERP solutions.

What are the Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ERP market analysis from 2023 to 2033 to identify the prevailing enterprise resource planning market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the enterprise resource planning market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global ERP market trends, key players, market segments, application areas, and market growth strategies.

Enterprise Resource Planning (ERP) Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 499 |

| By Industry Vertical |

|

| By Component |

|

| By Deployement Model |

|

| By End User |

|

| By Business Function |

|

| By Region |

|

| Key Market Players | Priority Software, SYSPRO, Acumatica, Inc., Microsoft Corporation, Workday Inc., Ramco Systems Ltd., SAP SE, Zoho Corporation, Unit4, Intact (Aptech Business Systems Ltd.), Sage Software Solutions Pvt Ltd., IFS, QAD Inc., Tally Solutions Private Limited, Odoo SA, Deltek, Inc., Oracle Corporation, Epicor Software Corporation, MYOB Australia Pty Ltd., Infor Inc. |

Analyst Review

The increase in the use of ERP solutions across many industry verticals such as manufacturing, BFSI, retail, and healthcare, is the major factor for the ERP market growth. Organizations can boost their productivity and efficiency by integrating their operations, critical business processes, and resources management activities on a multi-access point network of single ERP systems. As a result, businesses are embracing ERP systems to save IT costs and streamline business operations. Moreover, the use of ERP system enables businesses to link their operations with their suppliers, channel partners, and consumers, which enables them more efficiently manage their inventory levels. Such applications of ERP software in modern business enterprise are fueling the growth of the enterprise resource planning (ERP) market.

The key providers of the enterprise resource planning (ERP) market such as IBM Corporation, Microsoft Corporation, and Oracle Corporation account for a significant share in the market. With larger requirement from ERP software, various companies are establishing partnerships to increase ERP software capabilities. For instance, in January 2021, Microsoft Corp. announced plans to integrate Microsoft Teams with SAP’s intelligent suite of solutions. The companies formalized an extensive expansion of an existing strategic partnership to accelerate the adoption of SAP S/4HANA on Microsoft Azure.

In addition, with increase in demand for ERP system, various companies are expanding their current product portfolio with increasing diversification among customers. Moreover, market players are expanding their business operations and customers by increasing their acquisition. For instance, in December 2021, Wipro Limited announced the acquisition of LeanSwift Solutions, an ERP, e-commerce, digital transformation, supply chain, warehouse management systems, business intelligence, and integrations solutions provider based in U.S. The acquisition aligns with Wipro’s strategy to invest and expand its cloud transformation business through Wipro FullStride Cloud Services. LeanSwift through its capabilities in both the consulting and implementation space, will complement Wipro’s Infor cloud practice, and will also establish Wipro as a market leader in the Infor industry cloud services. The combined entity will provide Wipro an edge in key transformation deals, especially in the manufacturing and distribution industry, combining Infor CloudSuite and broader cloud-native digital capabilities.

ERP refers to software solutions designed to integrate and manage core business processes such as finance, HR, supply chain, manufacturing, and customer relationships, all in a unified system.

The forecast period for the enterprise resource planning (ERP) market is 2024 to 2033.

The base year is 2023 in the enterprise resource planning (ERP) market report.

The total market value of the enterprise resource planning (ERP) market was $16.3 billion in 2023.

The market value of the enterprise resource planning (ERP) market is projected to reach $40.6 billion by 2033.

Loading Table Of Content...

Loading Research Methodology...