GIS in Telecom Sector Market Statistics - 2023

The global GIS in Telecom Sector Market was valued at $1,633 million in 2016, and is estimated to reach $3,272 million by 2023, growing at a CAGR of 10.59% from 2017 to 2023. GIS in telecom sector enables industries to capture real time network performance, signal strength, customer base, and preferred product such as data and call rate. This software is implemented on cloud as well as on premise.

Increase in demand for augmented reality & virtual reality in the industries such as healthcare and production fuels the demand for GIS in telecom sector, thereby fueling the market growth across North America and Europe. However, LAMEA is expected to account for the least share in the global market as compared to other regions, due to uniform smartphone penetration across Latin America.

The cloud-based model is adopted by the industries due to greater reach, flexibility in terms of usage & cost, and requirement of less maintenance. The global GIS in telecom sector market is expected to witness significant growth rate, due to the rise in demand of GIS applications for mobile & broadband services and increase in demand of network installation across the developed and the developing regions, including North America, Europe, and Asia-Pacific.

The Asia-Pacific GIS in telecom sector market is expected to register the highest CAGR during the forecast period. Government is spending huge in building smart cities and increase in investment on research & development on 5G technology, which drives the growth of the GIS in telecom sector market. In addition, the developing countries such as China, India, and Japan invest a big amount in digitalization, which is expected to offer lucrative opportunities for market expansion. Moreover, growth in demand for app-based services are the key drivers for the growth of the Asia-Pacific GIS in telecom sector market.

Furthermore, Middle East & Africa are expected to gain traction due to increase in investment in IT infrastructures. However, lack of awareness toward the software and dearth of skilled professionals required for installations related to the software are expected to restrain the GIS in telecom sector market growth during the forecast period.

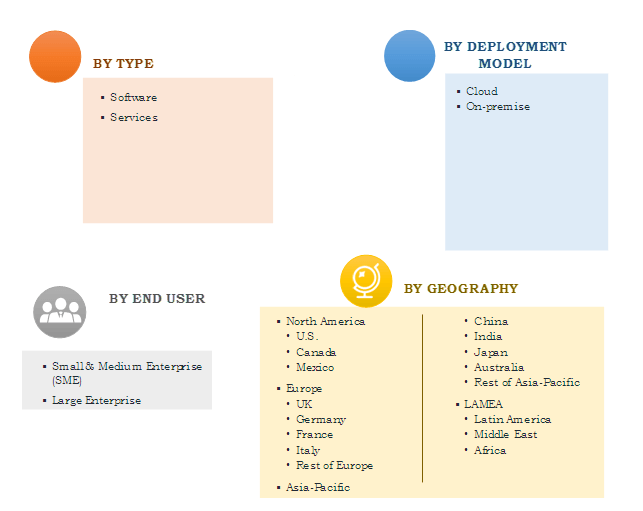

The global GIS in telecom sector market is segmented on the basis of type, deployment model, end user, and geography. The type covered in the study include software and services. By deployment model, the market is bifurcated into cloud and on-premise. Based on end user, it is divided into small & medium enterprise and large enterprise. Based on region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the report are Bentley Systems Incorporated, Blue Marble Geographics, Cyient Ltd., ESRI (Environmental Systems Research Institute) Inc., Harris Corporation, Hexagon AB, Pitney Bowes Inc., RMSI Inc., Spatial Business Systems Inc., and Trimble Inc. The report includes the key strategies adopted by these players and the detailed analysis of the current trends, upcoming opportunities, and restraints in the global GIS in telecom sector market in addition to their impacts.

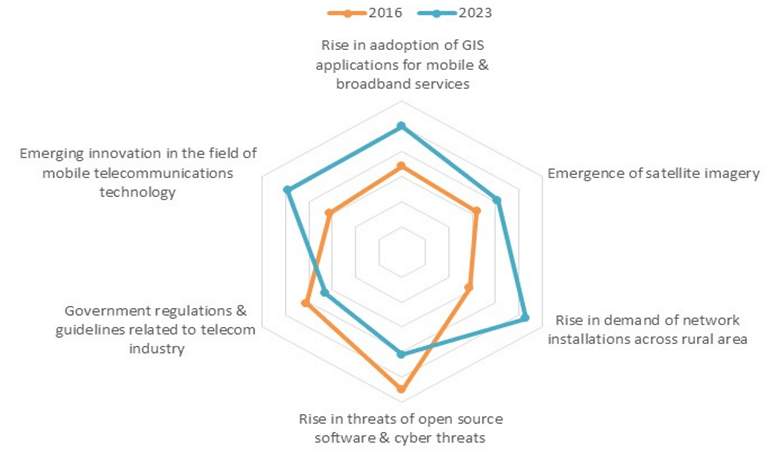

Top Impacting Factors

Rise in Adoption of GIS Applications for Mobile & Broadband Services

GIS applications involve mapping, geocoding, modeling, routing, and analyzing software. Thus, the use GIS in telecom sector increases business productivity by providing platform to collaborate with CRM systems, networks, database, fault management system, and wireless location, which is expected to boost the growth of the GIS in telecom sector market in the near future.

Emergence of Satellite Imagery

Rise in demand of satellite images by the companies such as Apple and Google for providing maps and increase in government spending to develop and built smart cities drive the GIS in telecom sector market.

Rise in Demand for Network Installations Across Rural Area

Due to lag of telecom infrastructure, rural areas are untapped with the technology, internet, and other digital platforms. Thus, rise in broad network coverage and large connectivity, boost the market growth.

Key Benefits of the Study:

- In-depth analysis and dynamics of the global GIS in telecom sector market are provided to understand the market scenario.

- Quantitative analysis of the current trends and future estimations from 2017 to 2023 is provided to assist strategists and stakeholders to capitalize on the prevailing market opportunities.

- Porter’s Five Forces analysis examines the competitive structure and provides a clear understanding of the factors that influence market entry and expansion.

- A detailed analysis of the geographical segments enables the identification of profitable segments for market players.

- Comprehensive analysis of the trends, subsegments, and key revenue pockets of GIS in telecom sector market is provided.

GIS in Telecom Sector Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Deployment Model |

|

| By End User |

|

| By Geography |

|

| Key Market Players | SPATIAL BUSINESS SYSTEMS INC., TRIMBLE INC, CYIENT LTD, HARRIS CORPORATION, PITNEY BOWES INC., ESRI INC., HEXAGON AB, BENTLEY SYSTEMS INCORPORATED, BLUE MARBLE GEOGRAPHICS, RMSI INC. |

Analyst Review

GIS in telecom sector is the technology that integrates information, creates maps, and interpret geographical data and information such as number of households and customer base on particular location. The global GIS in telecom sector market is expected to reach $3,272 million by 2023, owing to rise in adoption of GIS applications for mobile and broadband services, emergence of satellite imagery, and rise in demand for network installation across rural area. However, rise in threats of open source software & cyber threats and government regulations & guidelines related to telecom industry is expected to hamper the GIS in telecom sector market growth.

GIS in telecom sector is majorly used by small & medium enterprise and large enterprise. This software identifies existing network load & network coverage and forecasts demand to perform capacity analysis. Spatial data is used to analyze the attributes including preferred network, type of telecom plan usage, and usage pattern in the particular area. It has emerged as an effective tool for data handling problem, 3D mapping, analytics, and geocoding technology in the recent years.

In 2016, the cloud deployment was the highest contributor, terms of revenue, in the global GIS in telecom sector market. In addition, software segment contributed significant revenue to the GIS in telecom sector market, majorly from North America. Furthermore, the cloud deployment segment is anticipated to witness the highest growth rate during the forecast period, due to greater flexibility and less maintenance required by the user.

Key market players have adopted various strategies, such as new product launch, business expansion, and strategic alliances, to create more awareness about the GIS in telecom sector market and increase its adoption across various industry verticals.

Loading Table Of Content...