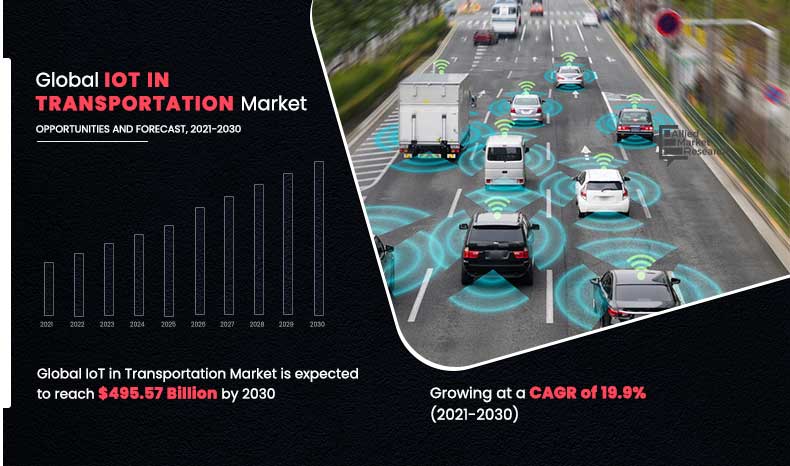

IoT in Transportation Market Statistics, 2030

The global IoT in transportation market size was valued at $83.25 billion in 2020, and is projected to reach $495.57 billion by 2030, registering a CAGR of 19.9% from 2021 to 2030.

IoT for transportation is the networking of objects via embedded sensors, actuators, and other devices that gather and transmit data about real-world activities. Use of IoT enabled technology is changing the way that the transportation sector operates. In addition, IoT technologies help to provide customers with more accurate, up-to-date, real-time data to better plan journeys, and improve communication. Moreover, it provides ability to track things such as train speeds, aircraft part conditions, roadway temperatures, and number of vehicles at an intersection using IoT enabled technology can all help to improve the safety of our transit systems worldwide.

Enhanced internet penetration and decreased cost of powerful sensors & controllers drive growth of the market. In addition, growth in information, communication, & technology (ICT) fuels growth of the market. However, poor internet infrastructure in developing nations is expected to impede the market growth. Furthermore, adoption of cloud computing and analytics is expected to provide lucrative opportunities for the market growth.

By mode of transport, the roadways segment dominated the IoT in transportation market in 2020, and is expected to continue its dominance in the coming years as it addresses problems such high maintenance cost, accidents, and loss of life. However, the rail segment is expected to witness growth at the highest rate during the forecast period. Improvement of operational efficiency, passenger experience, and the operators’ return on investments are expected to fuel the market growth in railways.

Region wise, the IoT in transportation industry was dominated by North America in 2020, owing to large number of vendors and favorable government policies. However, Asia-Pacific is expected to witness growth at the highest rate, owing to large population base and hub for global goods transportation.

The report focuses on growth prospects, restraints, and trends of the IoT in transportation market analysis. The study provides Porter’s five forces analysis to understand impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the IoT in transportation market share.

Segment Review

The global IoT in transportation market is segmented on the basis of type, mode of transport, application, and region. By type, it is categorized into hardware, software, and services. By mode of transport, it is divided into roadways, railways, airways, and maritime. By application, it is classified into traffic congestion control systems; automotive telematics; reservation, toll, & ticketing systems; security & surveillance systems; remote monitoring; and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global IoT in transportation industry includes Alcatel-Lucent, AT&T Inc., Garmin International Inc., IBM Corp., Denso Corp., Thales Group, General Electric, Verizon Communications Inc., Cisco Systems, Inc., and TomTom N.V. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

COVID-19 Impact Analysis

The IoT in transportation market is projected to decline, owing to COVID-19 situation due to various government, public, and other organizations adopting work from home culture for their employees. In addition, owing to implementation of lockdown by majority of governments the transportation industry was heavily affected. In addition, one of the most popular ideas for using IoT in the transport sector, which is currently being discussed is automated and contactless interaction. Moreover, owing to growth in concern regarding parking spot for trucks, many transportation agencies introduced automated place to park their trucks and at the same time stay safe by limiting the COVID-19 spread. Reservation and payment process is both automated and contactless. Considering the operational part, a special camera will record the license plate at the entrance of each truck and only in case of prior reservation, a truck can enter the parking lot contactless.

By Type

Softwate segment is projected as one of the most lucrative segments.

Top Impacting Factors

Enhanced Internet Penetration

Increase in penetration of wireless technology boosts growth of the IoT in transportation industry, owing to rise in need for advanced technological solutions such as robots, drones, and self-driving vehicles drives the need for an advanced wireless communication solution. Further, modern internet of things solutions is equipped with next generation 5G wireless network tech that enables faster data transferring and offers highly reliable & more secure infrastructure. Further, surge in demand for high-speed data exchange rates across large numbers of interconnected devices drive the need for IoT in transportation market. In addition, rise in adoption of LoRaWAN (Long Range Wide Area Network) across the Internet of Things application is expected to offer significant growth opportunities for the market during the forecast period.

By Application

Traffic Congestion Control System segment is projected as one of the most lucrative segments.

Adoption of Cloud Computing and Analytics

Increase in adoption of analytics and cloud computing among automobile and shipping & aviation industry manufacturers, owing to advantages such as fuel efficiency, security, enhanced uptime, reliability, enriched IT service, increased flexibility of data access, and operational speed. Cloud computing and analytics combined with IoT offers transportation agencies an upper hand in managing business operations in efficient and timely manner. In addition, cloud-based analytics help the transport industry to reduce their operational costs as well as to reduce infrastructure & storage cost of the organization. Furthermore, cloud-based analytics offers institutes with superior security and provides enhanced safety to critical data of the organization, which provides lucrative opportunities for the market.

In addition, cloud computing also helps the transport industry in analyzing large quantity of data set and to enhance their analytics skill, which in turn, is increasing demand for IoT in the transport industry. Furthermore, rapid adoption of connected devices across various education institutes and government initiatives to increase digitization across the industry vertical propels growth of the market.

By Region

Asia-Pacific would exhibit the highest CAGR of 22.6% during 2021-2030.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the IoT in transportation market forecast along with the current trends and future estimations to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on the global IoT in transportation market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the IoT in transportation market size from 2021 to 2030 is provided to determine the market potential.

IoT in Transportation Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Mode of Transport |

|

| By Application |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The Internet of things (IoT) is a network of embedded computer devices, data, and things that are uniquely integrated in current internet infrastructure. It has also enabled creation of a web of communicative networks between humans and machines, which is projected to improve capacity to govern infrastructures such as smart/intelligent transportation, smart cities, smart grids, smart homes, and others. In addition, application of IoT in the transportation industry provides high security and standards, as well as other social and economic benefits.

Key providers of the IoT in transportation market such as AT&T Intellectual Property, Cisco system, Inc., and Nokia Corporation account for a significant share in the market. Various companies are partnering to increase the IoT capabilities with the larger requirement. For instance, in March 2021, Nokia has signed a reseller agreement with ClearWorld, an alternative energy systems provider to sell ClearWorlds smart poles initially to U.S. cities and military bases as part of Nokia’s smart city solutions portfolio. Deployed in locations such as parks, parking lots, and roadways, the ClearWorld connected digital pole supports applications such as video analytics, Wi-Fi access points, gunshot detection, smart lighting, and license plate reading. Partnership with ClearWorld for smart poles enables Nokia to be a comprehensive solution provider of smart urban infrastructure solutions for cities.

In addition to the increase in demand for weather forecasting services, various companies are expanding their current services to continue with the rise in demand. For instance, in March 2021, Thales launched its first ever digital event dedicated to rail transport, the “Smart Mobilty Experience”. This event will be the occasion for clients and partners of the rail ecosystem to discover new products and major innovations, as well as to exchange about digitalization and the future of rail. In addition, Thales is offering solutions to transport passengers safely and with best possible experience, supervises operations with accurate situation awareness, and optimizes transport service efficiency. Using digital technologies such as IoT, 5G, cloud & web IT, data analytics & AI, Thales designs innovative solutions such as digital signaling, train autonomy, mobile ticketing, passenger flow analytics, data driven operation control, smart maintenance, which drastically impacts the way people travel.

Furthermore, market players are expanding their business operations and customers by increasing partnership and collaborative operations. For instance, in July 2021, Microsoft announced to acquire AT&T’s Network Cloud technology and intellectual property, as well as making job offers to several hundred AT&T engineers. In return, AT&T will move its 5G mobile network to Azure. The companies will start with AT&T’s 5G core, and expand from there.

Loading Table Of Content...