PEGylated Protein Therapeutics Market Overview:

The global PEGylated protein therapeutics market was valued at $10,388 million in 2017, and is estimated to reach at $17,813 million by 2025, registering a CAGR of 6.9% from 2018 to 2025.

PEGylation is the process of covalent and non-covalent attachment of polyethylene glycol polymer chains to molecules, such as a drug, therapeutic protein, or vesicle. PEGylated protein therapeutics is estimated to show significant market growth during the forecast period, majorly due to the, growth in demand for PEGylation, rise in number of chronic diseases, and presence of strong pipeline drugs. In addition, PEGylated molecules offer some advantages, such as extended half-life, reduced toxicity, lower immunogenicity, and increase in proteolytic protection, that further support the market growth. On the other side, higher process cost associated with PEGylation and patent expiry of certain drugs are projected to hinder the market growth.

PEGylated Protein Therapeutics Market Segmentation

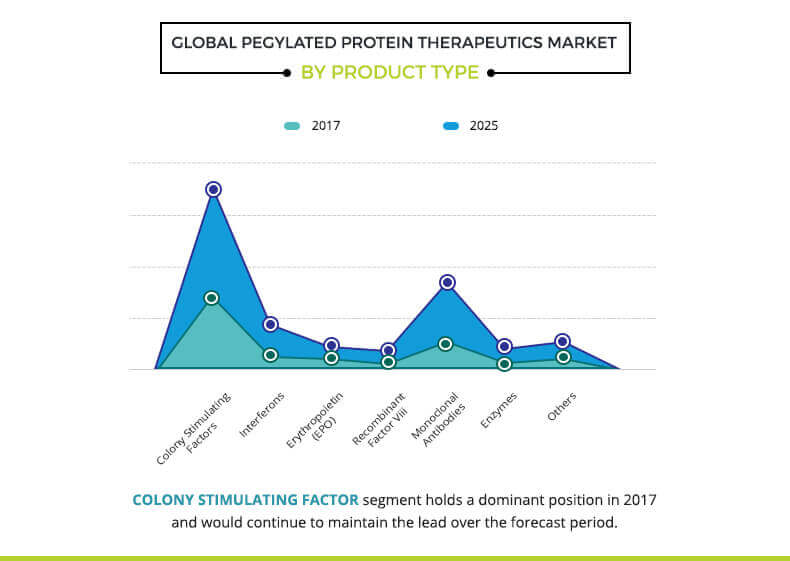

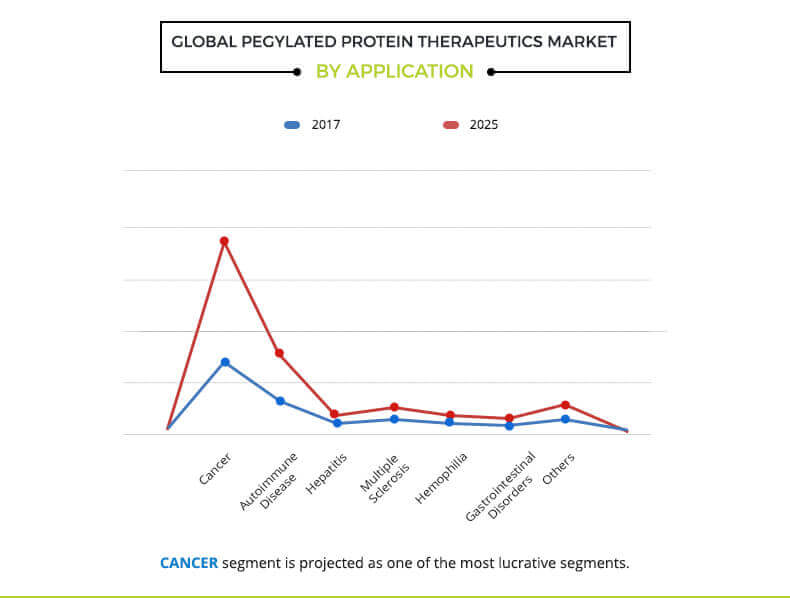

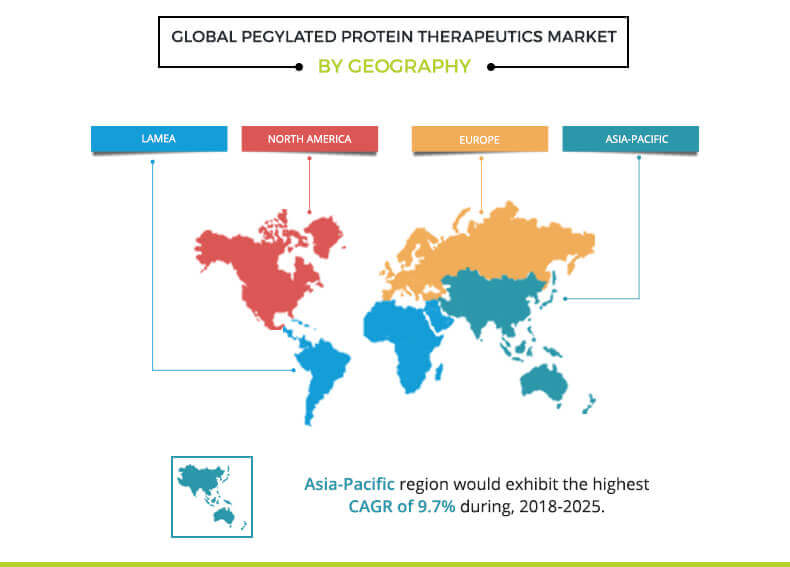

The global PEGylated protein therapeutics market is segmented based on product type, application, sales channel, and region. Based on product type, the market is segmented as colony stimulating factor, interferon, erythropoietin (EPO), recombinant factor VIII, monoclonal antibody, enzyme, and others. Based on application, the market is categorized as cancer, autoimmune disease, hepatitis, multiple sclerosis, hemophilia, gastrointestinal disorder, and others. According to sales channel, the market is divided into hospital pharmacy, online provider, and retail pharmacy. Based on region, the market is studied across North America (U.S. and Rest of North America), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, rest of LAMEA).

Segment Review

Based on product type, the colony stimulating factor segment generates the highest revenue, due to high incidence of infection associated with chemotherapy, and developments made by major players. On the other side, the interferon segment is estimated to exhibit fastest market growth during the forecast period, owing to its use in highly prevalent viral infections and low risk of adverse effects.

According to application, the market is dominated by the cancer segment and is anticipated to remain dominant during the forecast period, due to the high prevalence of cancer worldwide. The cancer segment is also expected to exhibit the fastest market growth during the forecast period.

Snapshot of Asia-pacific PEGylated Protein Therapeutics Market

Asia-Pacific presents lucrative opportunities for the key players operating in the PEGylated protein therapeutics market, owing to high population base, development in healthcare infrastructure, and rapid rise in prevalence of chronic disease. However, current lack of awareness is estimated to hamper the market growth in Asia-Pacific.

The report provides an extensive competitive analysis and profiles of the key market players, such as Amgen Inc., AstraZeneca PLC, Biogen, Inc., F. Hoffmann-La Roche Ltd. (Genentech, Inc.,), Horizon Pharma plc., Leadiant Biosciences S.p.A., Merck & Co., Inc. (Schering-Plough Corporation), Pfizer Inc., Shire plc (Baxalta), and UCB S.A.

Key Benefits for Stakeholders

- This report entails a detailed quantitative analysis of the current market trends from 2017 to 2025 to identify the prevailing opportunities along with strategic assessment of global PEGylated protein therapeutics market.

- Market size and estimations are based on a comprehensive analysis of the applications and developments in the industry.

- A qualitative analysis based on innovative products facilitates the strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the PEGylated protein therapeutics industry.

PEGylated Protein Therapeutics Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Application |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Pfizer Inc., AstraZeneca PLC, Leadiant Biosciences S.p.A., Amgen Inc., Horizon Pharma plc., Biogen Inc., F. Hoffmann-La Roche Ltd. (Genentech, Inc.,), Shire plc (Baxalta), UCB S.A., Merck & Co., Inc. (Schering-Plough Corporation) |

Analyst Review

PEGylated protein therapeutics are protein drugs which are subjected to PEGylation for pharmacological enhancement. PEGylation of proteins is performed by covalent conjugation of polyethylene glycol (PEG) to increase the molecular weight of proteins. The rise in molecular weight increases the half-life of the drug in plasma causing reduction in dosing frequency. In addition, PEGylation also results in low toxicity and low proteolytic degradation. PEGylated protein therapeutics are indicated in the treatment of diseases such as, hemophilia, rheumatoid arthritis, cancer, and other chronic diseases. The growth of the PEGylated protein therapeutics market is propelled by the escalating number of chronic disease patients and presence of numerous drugs in the pipeline. Furthermore, advantages offered by PEGylation are anticipated to boost the market growth in the forecast period.

The use of PEGylated protein therapeutics is highest in North America, which is attributed to presence of major key players, high purchasing power, and rise in awareness associated with chronic diseases in the region. North America is followed by Europe and Asia-Pacific. In addition, abundance of pipeline products for the treatment of PEGylated protein is anticipated to drive the market growth.

Loading Table Of Content...