Next generation diabetic therapy and drug delivery market Overview:

Next generation diabetic therapy and drug delivery systems are used to improve the adherence to insulin in a diabetic patient, which in turn helps reduce the risk of complications related to sudden changes in blood sugar level. As oral and inhalable insulin helps to painlessly manage the blood glucose level, they have the potential to replace injectable insulins. Advanced diabetic therapy in the form of insulin patches, continuous glucose monitoring systems (CGMS), and artificial pancreas help improve management of blood sugar level and reduces the risk of any diabetic-related complications. The U.S. next generation diabetes therapy and drug delivery market was valued at $446 million in 2015, and is estimated to reach $6,510 million by 2023, registering a CAGR of 33.0% from 2017 to 2023.

The U.S. next generation diabetes therapy and drug delivery market growth is attributed to the rise in the number of diabetic patients in the U.S. along with the increase in disposable income among the diabetic patients. The benefits of using these advanced devices over conventional products and rise in the healthcare expenditure are expected to increase the demand for these advanced diabetic products, thus fueling the market growth. However, cost restraints among low and middle-income population and less variability in products are expected to hamper this growth.

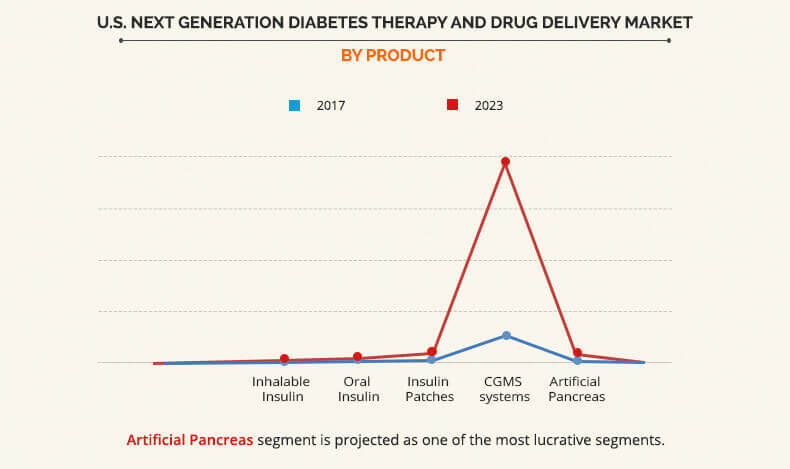

Product segment review

Based on the products, the market is segmented into inhalable insulin, oral insulin, insulin patches, CGM systems, and artificial pancreas. CGM systems segment dominates the market owing to the availability of large number of FDA approved CGM devices leading to high adoption rate of these devices.

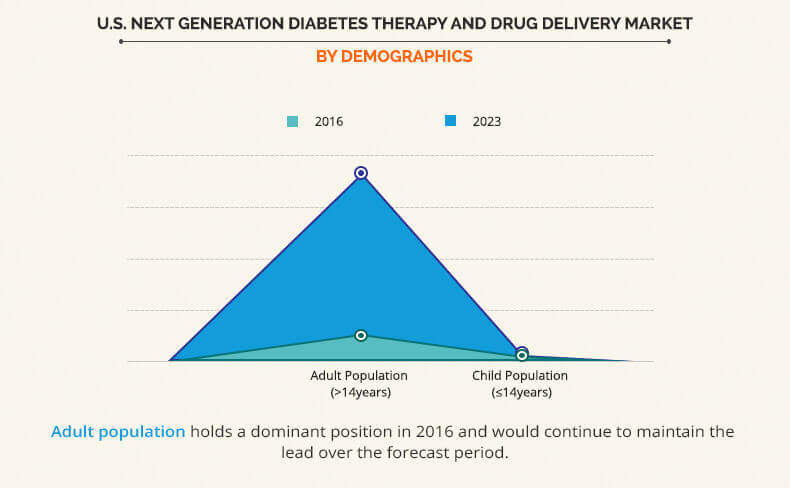

Demographics segment review

Depending on demographics, the market is bifurcated into adult and child population. Adult population is the dominant segment that contributes toward the market growth as almost 90% of the diabetic population in U.S. are above the age of 18 years.

The key players profiled in this report include Abbott Laboratories, Echo Therapeutics, Inc., F. Hoffmann-La Roche Ltd., GlySens Incorporated, Medtronic Plc, Sanofi, Novo Nordisk, MannKind Corporation, Dexcom, Inc., and Senseonics Holding, Inc.

Other players in the value chain include Enteris BioPharma, Synertech, Zosano Pharma Corp., Relmada Therapeutics, Inc., Eli Lilly and Company, and Transdermal Specialties Inc.

Key Benefits

- This report entails a detailed quantitative analysis of the current market trends from 2014 to 2023 to identify the prevailing opportunities.

- Market estimations provided in this report are based on comprehensive analysis of the key developments in the industry.

- The U.S. next generation diabetes therapy and drug delivery market is comprehensively analyzed with respect to product type, demographics, indication, and end user.

- The development strategies adopted by key manufacturers are enlisted to understand the competitive scenario of the market.

U.S. Next Generation Diabetes Therapy and Drug Delivery Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Demographic |

|

| By Indication |

|

| By End User |

|

| Key Market Players | GLYSENS INCORPORATED, SENSEONICS HOLDINGS, INC., SANOFI, F. HOFFMANN-LA ROCHE LTD., NOVO NORDISK A/S, MEDTRONIC PLC., ECHO THERAPEUTICS, INC., MANNKIND CORPORATION, ABBOTT LABORATORIES, DEXCOM, INC. |

Analyst Review

Oral and inhalable insulin reduces the risk of skin irritation due to needles as well as is a painless mode of insulin delivery. This in turn increases the demand in the market. Therefore, they are also expected to replace injectable insulins.

With the advancement in diabetic therapy systems such as insulin patches and artificial pancreas, the amount of insulin that needs to be introduced into the patients’ body is adjusted according to the blood sugar levels using a computer algorithm. The automated version of these systems help the patient lead a normal life and reduce the complications related to hypo- or hyperglycemia. Such advancement in diabetic technology is expected to help boosts the growth of the market.

The use of other advanced diabetic systems such as insulin patch, CGM system, and artificial pancreas help in adherence to medication in diabetic patients and improve the quality of life of diabetic patients. The U.S. next generation diabetes therapy and drug delivery market is expected to experience an exponential growth owing to increase in demand for advanced diabetic products, high incidence of diabetes in U.S., and rise in healthcare expenditure.

Loading Table Of Content...