UK IVD Market Overview:

UK IVD Market is accounted for $2,148 million in 2016, and is estimated to reach $3,127 million by 2023, growing at a CAGR of 5.4% during the analysis period (2017-2023).

In vitro diagnostics are the medical devices, which are utilized to determine the diseased conditions. They require biological samples such as blood, urine, stool, tissues, and other body fluids, to detect diseases, conditions, and infections. These tests are easy to perform and offer accurate results. In addition, IVD has wide range of application in diagnosis of various diseases such as, infectious diseases, diabetes, cancer, cardiology diseases, autoimmune diseases, nephrology, and HIV/AIDS.

High rate in incidences of chronic diseases, advancement in IVD techniques, and rise in demand for minimally invasive techniques are expected to fuel the market growth during the analysis period. However, strict reimbursement policies and stringent government regulation in terms of product approval restrict the growth of the market.

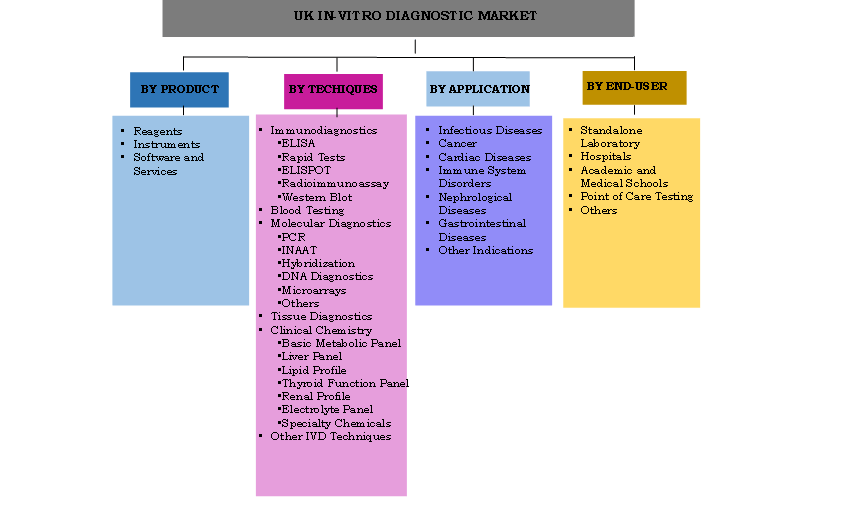

UK IVD Market Segmentation

Segment Review

Based on product type, the market is categorized into reagents, instruments, and software & services. The reagent segment accounted for the highest market share in 2017, and the software and services is expected to grow at the highest growth rate during the forecast period. The growth of the reagent market is attributed to the recent introduction of new novel reagents and wide availability of effective and cost-efficient reagents. On the basis of technique, the immunodiagnostics segment captured the highest market share in 2016, owing to the increase in demand of personalized medicines. On the basis of application, infectious diseases segment captured the highest market share in 2016, due to rise in prevalence of infectious diseases and growth in preventive healthcare awareness among the population. Based on end users, the standalone laboratory segment captured the highest market share in 2016, primarily due to non-availability of complex tests in hospitals and commercial clinics.

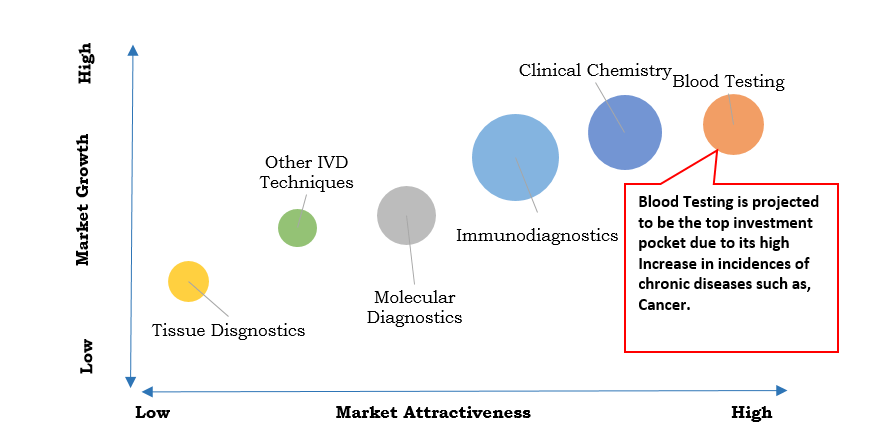

Top Investment Pockets

Increase an Incidences of Chronic Diseases

IVD market in the UK is in its growth phase due to increase in incidence of chronic diseases such as arthritis, cancer, cardiovascular diseases, neurodegenerative disorder, and diabetes. According to WHO, 75% of the total population suffers from one chronic condition, while 50% with two or more conditions. Thus, high rate of such diseases increases the demand for the IVD market.

Emergence of Minimally Invasive Technologies

IVD refers to diagnosis of disease caused by infection or disorder in laboratory conditions. Normally urine, saliva, blood, and others are used for analysis by minimally invasive technology. These minimally invasive techniques require a smallest possible incision in the body followed by the insertion of a long thin tube with a small camera. The images are projected on the monitors in the operating rooms to provide surgeons a magnified view of the internal organs and help detect and cure the disease. Moreover, advancement in minimally invasive techniques increase the demand for IVD market due to less incisional procedures. In this technology penetration process are being replaced by radiation to destroy the target tissue through high intensity of ultrasound beam.

Key Market Benefits:

- The study provides an in-depth analysis of the UK IVD market with current trends and future estimations to elucidate the imminent investment pockets

- The report provides a quantitative analysis from 2016 to 2023 to enable the stakeholders to capitalize on prevailing market opportunities

- Extensive analysis by technology and application helps understand various trends and prevailing opportunities in the respective market

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which predict the competitive outlook of the UK IVD market.

UK IVD Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By TECHNIQUE |

|

| By APPLICATION |

|

| By END USERS |

|

| Key Market Players | BAYER AG, ALERE INC, SYSMEX CORPORATION, BIO-RAD LABORATORIES, DANAHER CORPORATION, BIOMERIEUX, THERMO FISHER SCIENTIFIC INC, JOHNSON & JOHNSON, BECTON DICKINSON AND COMPANY, F. HOFFMANN-LA ROCHE AG |

Analyst Review

In vitro diagnostics (IVD) refers to diagnosis of diseases caused by infection or disorder in laboratory conditions. Biological samples such as, urine, saliva, such as blood, stool, urine, tissues, and other body fluids are utilized for analysis of several disease. IVD tests analyze biological samples using technologies such as polymerase chain reaction, microarray techniques, sequencing technology, and mass spectrometry for sample test preparation.

The UK IVD market is growing due to increase in government expenditure in healthcare sector, rise in incidences for chronic diseases, and growth in demand for non-invasive techniques. In addition, rise in prevalence of chronic and infectious diseases such as cancer, tuberculosis, diabetes, HIV, and others also drive the UK IVD market. In addition, government initiatives for the improvement of healthcare sector and rise in technological advancement is expected to provide high growth opportunities for the IVD market.

Major companies involved in the UK IVD market are Thermo Fisher Scientific Inc., Alere Inc., Biomerieux, Danaher Corporation, F. Hoffmann-La Roche AG, Becton Dickinson and Company, Bio-Rad Laboratories, Bayer AG, Sysmex Corporation, and Johnson & Johnson.

Loading Table Of Content...