Abrasives Market Size & Insights:

The global abrasives market size was valued at $42.6 billion in 2022, and is projected to reach $67.0 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Introduction

Abrasives play a crucial role in a wide range of processes that include grinding, polishing, buffing, honing, cutting, drilling, sharpening, lapping, and sanding. The abrasive action is usually performed by embedding the abrasive particles in a matrix (like grinding wheels or sandpaper), applying them as loose grains, or bonding them into solid forms. Their efficiency and suitability are influenced by several factors such as grain size, hardness, toughness, friability (the ability of grains to fracture), and bonding material.

One of the largest consumers of abrasives is the metalworking industry. Abrasives are extensively used for grinding, cutting, deburring, surface preparation, and polishing metals. In automotive manufacturing, abrasives ensure that metal parts achieve desired tolerances and smooth finishes. Engine components, crankshafts, camshafts, and gear teeth are shaped and refined using abrasive techniques. High-speed cutting and precision grinding of alloys, stainless steel, and hardened metals depend on advanced abrasives like CBN and diamond abrasives.

Key Takeaways

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

The abrasives market is fragmented in nature among prominent companies such as 3M Company, Bullard Abrasives, Inc., Carborundum Universal Limited, Deerfos, Hindustan Abrasives, Osborn Lippert India Private Limited., Robert Bosch Power Tools GmbH, Saint-Gobain, and SAK ABRASIVES LIMITED.

The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions. Moreover, the report covers sub-segments that are studied across all regions.

Latest trends in the global abrasives market such as undergoing R&D activities, regulatory guidelines, and government initiatives, are analyzed across 16 countries in 4 different regions.

More than 3,500 abrasives-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global abrasives market.

Market Dynamics

Rise in industrialization and manufacturing activities are expected to drive the growth of the abrasives market. The demand for abrasives used in grinding, polishing, and finishing processes increases proportionally. In the automotive sector, for instance, abrasives are essential in manufacturing engine components, body parts, and precision machined surfaces, helping to achieve the high-quality standards required for vehicle safety and performance. Similarly, the aerospace industry relies heavily on abrasives for finishing turbine blades, airframe components, and other critical parts, where precision and surface integrity are paramount. The construction sector utilizes abrasives for concrete cutting, surface preparation, and finishing applications, supporting the expanding infrastructure projects worldwide. The National Reconstruction Fund (NRF), passed in March 2023, allocated $15 billion to the manufacturing sector. In April 2024, the government announced a $22.7 billion investment over a decade to support domestic green hydrogen, solar-panel manufacturing, and mining of critical minerals. The CHIPS and Science Act allocated $39 billion to bolster semiconductor manufacturing. By June 2024, $32.8 billion had been allocated, with federal loans and tax credits reaching $75 billion.

However, high initial investment for advanced equipment is expected to restrain the growth of the abrasives market. Modern abrasive production involves new technologies such as precision grinding machines, automated bonding processes, and high-temperature furnaces, all of which demand substantial capital expenditure. This capital-intensive nature poses significant barriers to entry, especially for small and medium enterprises (SMEs), limiting their ability to compete effectively with larger, well-established players. The cost of procuring and maintaining advanced machinery not only strains the financial resources of these smaller firms but also slows down their adoption of newer technologies that can improve product quality and operational efficiency. As a result, SMEs may struggle to scale their production capabilities or innovate, which can hinder market diversification and reduce competitive dynamics.

Moreover, the development of eco-friendly abrasives is expected to provide lucrative opportunities in the abrasives market. The abrasives industry is witnessing an increasing demand for eco-friendly and non-toxic abrasive products. Traditional abrasive manufacturing and usage often involve materials and processes that can generate hazardous dust, chemical waste, and significant energy consumption, raising environmental and health concerns. Manufacturers are innovating to develop abrasives that minimize environmental impact without compromising performance. In December 2024, Saint-Gobain launched Lumeos™, a brand platform dedicated to sustainable abrasive solutions. The debut product, AZ25L abrasive grain, emphasizes lower environmental impact while maintaining industrial-grade performance. Moreover, in December 2024, Saint-Gobain Ceramics, Specialty Grains & Powders introduced AZ25L, an advanced abrasive grain under the Lumeos line, reinforcing the company's commitment to sustainability.

Segments Overview

The abrasives market is segmented on the basis of type, material, end-use industry, and region. On the basis of type, the market is categorized into bonded abrasives, coated abrasives, and super abrasives. On the basis of material, it is divided into natural abrasives and synthetic abrasives. On the basis of end-use industry, it is classified into automotive, metal fabrication, machinery, electronics, construction, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

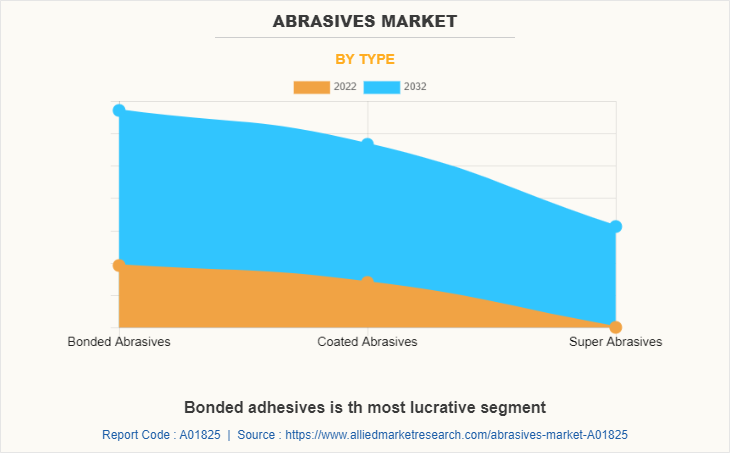

Abrasives Market By Type

On the basis of type, the bonded abrasives segment was the largest revenue generator in the abrasives market and is anticipated to grow at a CAGR of 4.9% during the forecast period. In bonded abrasives, the abrasive grains are embedded within a matrix often made of vitrified, resin, or rubber bonds that holds them in place while allowing the exposure of fresh abrasive particles as wear occurs. The abrasives' size, shape, and toughness significantly influence the performance of the bonded abrasive product. In October 2023, Compagnie de Saint-Gobain S.A., a French enterprise, formed a partnership with Dedeco International Inc, a specialty abrasives producer based in the US. This collaboration allows Saint-Gobain Abrasives to distribute Dedeco’s Sunburst line of thermoplastic-bonded abrasives, aiming to expand its range of products for its North American customer base.

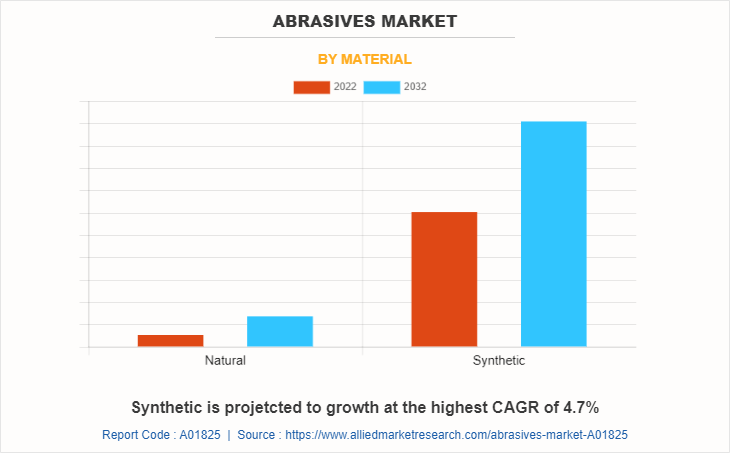

Abrasives Market By Material

By material, the synthetic segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.7% during forecast period. The expansion of industrialization and manufacturing activities globally is a significant driver of the synthetic abrasives segment. Industries such as automotive, aerospace, electronics, metalworking, and construction rely heavily on synthetic abrasives for grinding, cutting, polishing, and surface preparation. The increase in demand for precision components, advanced materials, and high-quality finishes in these industries fuels the need for synthetic abrasives; thus, boosting the abrasives market growth. In April 2025, the European Green Deal enforced stricter carbon footprint regulations in manufacturing, impacting synthetic abrasives production. In the U.S., bonded abrasives manufacturing plants emitted over 1.5 million tons of CO₂ in 2022, prompting calls for more sustainable practices.

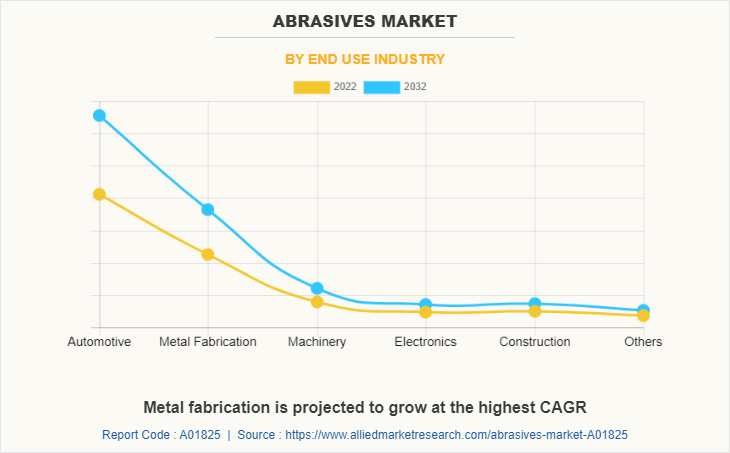

Abrasives Market By End Use Industry

By end use industry, the automotive segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.8% during forecast period. In the manufacturing of automotive engines and transmission components, abrasives are essential for grinding metal surfaces to tight tolerances, improving performance and longevity. Additionally, during the body manufacturing phase, abrasives help in smoothing out welds, removing rust, and preparing surfaces for painting. This ensures an aesthetically pleasing finish while also protecting the vehicle from corrosion. In May 2025, General Motors (GM) announced an $888 million investment in its Tonawanda propulsion plant in Buffalo, New York, to boost production of a next-generation V8 engine, reflecting a strategic shift in response to market demands.

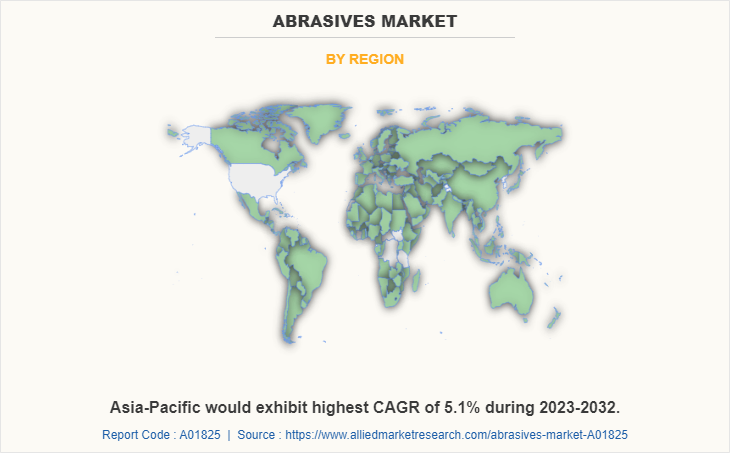

Abrasives Market By Region

The Asia-Pacific abrasives market size is projected to grow at the highest CAGR of 5.1% during the forecast period and accounted for 42.1% of abrasives market share in 2022. China, being the largest manufacturing hub in the Asia-Pacific, dominates abrasive consumption owing to its expansive automotive and electronics manufacturing industries. The rise in infrastructure projects and the booming real estate sector have also fueled demand for abrasives in construction activities. India’s abrasives market is growing rapidly, supported by its expanding automotive industry and increasing adoption of advanced manufacturing technologies. Moreover, the Asia-Pacific region is witnessing the growing adoption of synthetic abrasives like silicon carbide and aluminum oxide, favored for their superior performance and cost-effectiveness. The rise in small and medium enterprises (SMEs) engaged in metalworking and fabrication is further contributing to regional abrasive usage. In October 2024, China's 14th Five-Year Plan for the Circular Economy (2021–2025) emphasizes resource efficiency and recycling. This policy encourages the development of eco-friendly abrasives and promotes sustainable practices in manufacturing, aligning with global trends towards environmental responsibility.

Competitive Landscape

The global abrasives market profiles leading players that include 3M Company, Bullard Abrasives, Inc., Carborundum Universal Limited, Deerfos, Hindustan Abrasives, Osborn Lippert India Private Limited., Robert Bosch Power Tools GmbH, Saint-Gobain, SAK ABRASIVES LIMITED, and Sterling Abrasives Limited.

Recent Key Developments in the Abrasives Market

In August 2023, 3M inaugurated its first abrasive robotics lab in Bengaluru, India, marking its 17th globally. This facility aims to advance automation in abrasive applications, reflecting India's growing market for such technologies.

In October 2023, Tyrolit Group announced acquisition of Acme Holding Company, a U.S.-based abrasives manufacturer located in Michigan. It is a move to integrate the business portfolio of grinding with specialty abrasives solutions. This makes Michigan manufacturing facility company’s seventh facility in the U.S. and will prove to be influential in vital industries such as foundry, steel, and rail.

In December 2024, Saint-Gobain launched Lumeos™, a brand platform dedicated to sustainable abrasive solutions. The debut product, AZ25L abrasive grain, emphasizes lower environmental impact while maintaining industrial-grade performance.

In October 2023, Saint-Gobain announced a partnership with Dedeco Abrasive Products, a specialty abrasives manufacturer, where Saint-Gobain would market Dedeco’s sunburst abrasive line. This partnership aligns with company’s comprehensive goal of delivering abrasive solutions.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the abrasives market analysis from 2022 to 2032 to identify the prevailing abrasives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the abrasives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global abrasives market trends, key players, market segments, application areas, and market growth strategies.

Abrasives Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 67 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 336 |

| By Type |

|

| By Material |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Saint-Gobain, Osborn Lippert India Private Limited., SAK ABRASIVES LIMITED, Sterling Abrasives Limited, Robert Bosch Power Tools GmbH, Carborundum Universal Limited, Hindustan Abrasives, 3M Company, deerfos, Bullard Abrasives, Inc. |

Analyst Review

According to CXOs of leading companies, the global abrasives market is expected to exhibit high growth potential during the forecast period. The growth of industries, such as automotive, aerospace, construction, electronics, and metalworking, directly impacts the demand for abrasives. Increased manufacturing activities and infrastructure development contribute to the rise in demand for abrasives used in processes such as cutting, grinding, polishing, and surface finishing. Moreover, the growth in infrastructure development, including residential, commercial, and public projects, drives the demand for abrasives used in construction applications, which include cutting and shaping concrete, stone, tiles, and other building materials, as well as surface preparation and finishing processes.

In addition, the automotive sector is a significant driver for the growth of the abrasives market. Abrasives are used extensively in automotive manufacturing processes, such as metal grinding, polishing, and surface preparation. The demand for abrasives in the automotive industry is influenced by factors such as consumer demand for vehicles, technological advancements in the sector, and global automotive production trends. CXOs further added that sustained economic growth and development of the industrial sector have increased the popularity of abrasives.

Escalating demand from building and construction sector, Robust demand from automotive sector, Rapid establishments of manufacturing and industrial sites, and Rise in demand from metal fabrication and machinery industries are the upcoming trends of abrasives market.

Automotive, metal fabrication, machinery, electronics, construction, and others are the leading application of abrasives market.

Asia-Pacific is the largest regional market for abrasives market.

The abrasives market was valued for $42.6 billion in 2022 and is estimated to reach $67.0 billion by 2032, exhibiting a CAGR of 4.7% from 2023 to 2032.

3M Company, Bullard Abrasives, Inc., Carborundum Universal Limited, Deerfos, Hindustan Abrasives, Osborn Lippert India Private Limited., Robert Bosch Power Tools GmbH, Saint-Gobain, SAK ABRASIVES LIMITED, and Sterling Abrasives Limited are the top companies to hold the market share in abrasives market.

Loading Table Of Content...

Loading Research Methodology...