Global Accelerometer and Gyroscope Market Research, 2030

The Global Accelerometer and Gyroscope Market size was valued at $2.61 billion in 2020, and is projected to reach $4.03 billion by 2030, growing at a CAGR of 4.8% from 2021 to 2030. An accelerometer is a sensor that detects linear movement of any device in one particular direction and measures the overall acceleration of a device, which includes the static acceleration from gravity when the object is not in motion. On the other hand, a gyroscope is a sensor that identifies the angular movement of a device around each axis.

Accelerometers & gyroscopes are suitable in applications such as navigation, automotive, and consumer electronics. These sensors are widely used in airbags to activate them in case of a crash, in gaming consoles for enabling better motion control, in several phones for recognizing tap gestures, and in automatically changing the orientation of the screen in electronic devices when they are rotated.

Growth of the global accelerometer and gyroscope industry is anticipated to be driven by factors such as continuously growing defense expenditure across the globe and rising demand from the consumer electronics industry. Moreover, the development of the autonomous vehicle sector fuels the accelerometer and gyroscope market growth. However, the low accuracy of accelerometer and gyroscope sensors acts as a major restraint on the global market. On the contrary, an increase in the adoption of automation in industries & homes and high demand from the Asia-Pacific are expected to create lucrative opportunities for the expansion of the global accelerometer and gyroscope industry.

Segment Overview

The global accelerometer and gyroscope industry is segmented into type, dimension, industry vertical, and region.

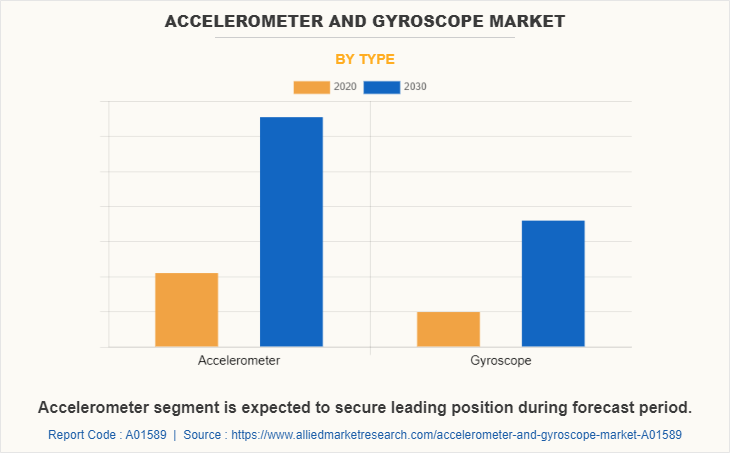

By type, the market is bifurcated into accelerometer and gyroscope.

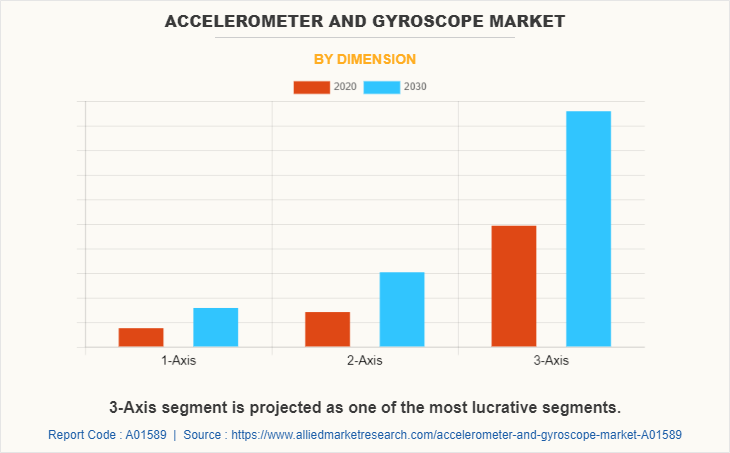

Based on dimension, it is segregated into 1-axis, 2-axis, and 3-axis. Depending on the industry vertical, it is categorized into consumer electronics, automotive, aerospace & defense, industrial, healthcare, and others.

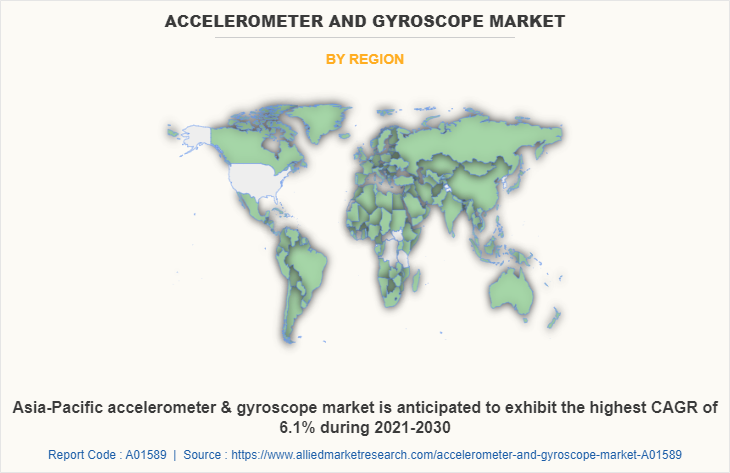

Region wise, the accelerometer and gyroscope market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, Taiwan, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific dominated the accelerometer and gyroscope market in 2020 and is projected to register a significant growth rate during the forecast period, owing to growth in the automotive segment. Also, Asia-Pacific is expected to witness significant growth by the end of the forecast period, followed by LAMEA.

Leading accelerometer and gyroscope market manufacturers such as Analog Devices Inc., Honeywell International Inc., and STMicroelectronics are focusing on their investments in technologically advanced, cost-effective, and more secure products and solutions for various applications.

Top Impacting Factors

The prominent factors that impact the accelerometer and gyroscope market growth include a surge in demand for consumer electronic devices, high military spending, and a rise in several vehicles globally. However, the low accuracy of accelerometer and gyroscope products restricts the accelerometer and gyroscope market. On the contrary, an increase in the production of autonomous vehicles is expected to create lucrative opportunities for the market.

Competitive Analysis

Competitive analysis and profiles of the major players such as Analog Devices Inc., Honeywell International Inc., InvenSense, Northrop Grumman, NXP Semiconductors, Robert Bosch, Infineon Technologies AG, STMicroelectronics, Kionix Inc., and Murata Manufacturing Co. Ltd. have been covered in the report.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the global accelerometer and gyroscope market size, along with current trends and future estimations to depict imminent investment pockets.

- The overall accelerometer and gyroscope market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current accelerometer and gyroscope market forecast is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the accelerometer and gyroscope market share of key vendors.

- The report includes the market trends and the market share of key vendors.

Accelerometer and Gyroscope Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Dimension |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Tdk Invensense., NXP Semiconductors N.V., Murata Manufacturing Co. Ltd., Stmicroelectronics N.V., Kionix, Inc, Infineon Technologies Ag, Analog Devices Inc., Northrop Grumman Corporation, Honeywell International Inc., Robert Bosch Gmbh |

Analyst Review

The global accelerometer and gyroscope market is flourishing at a rapid pace. However, low accuracy of accelerometer and gyroscope products is still a concern for new entrants. Market players are generously investing in R&D activities to develop improved solutions to improve accuracy of accelerometer and gyroscope products. In addition, according to industry experts, it is essential to optimize affordable prices for accelerometer and gyroscope products for long-term growth.

Growth of the global accelerometer and gyroscope market is anticipated to be driven by factors such as continuously growing defense expenditure across globe and rising demand from the consumer electronics industry. Moreover, development of the autonomous vehicle sector fuels the market growth. However, low accuracy of accelerometer and gyroscope sensors acts as a major restraint for the global accelerometer and gyroscope market. On the contrary, surge on adoption of automation in industries & homes and high demand from Asia-Pacific region is expected to create lucrative opportunities for the accelerometer and gyroscope industry.

Key players of the market focus on introducing technologically advanced products to remain competitive in the market. Partnership, acquisition, and product launches are expected to be the prominent strategies adopted by the market players. Asia-Pacific accounted for a major share of the market in 2020, owing to the presence of major players in the region. Also, Asia-Pacific is expected to grow at the highest CAGR, owing to rise in adoption of accelerometer and gyroscope in a variety of fields.

The global accelerometer and gyroscope market size was valued at $2.61 billion in 2020, and is projected to reach $4.03 billion by 2030, registering a CAGR of 4.8% from 2021 to 2030.

The prominent factors that impact the accelerometer and gyroscope market growth include surge in demand of consumer electronic devices, high military spending, and rise in number of vehicles globally. However, low accuracy of accelerometer and gyroscope products restricts the accelerometer and gyroscope market growth. On the contrary, increase in production of autonomous vehicles is expected to create lucrative opportunities for the market.

Accelerometers & gyroscopes are suitable in applications such as navigation, automotive, and consumer electronics.

Asia-Pacific dominated the accelerometer and gyroscope market in 2020, and is projected to register significant growth rate during the forecast period, owing to growth in the automotive segment.

Analog Devices Inc., Honeywell International Inc., InvenSense, Northrop Grumman, NXP Semiconductors, Robert Bosch, Infineon Technologies AG, STMicroelectronics, Kionix Inc., and Murata Manufacturing Co. Ltd.

Loading Table Of Content...