Account Reconciliation Software Market Insights:

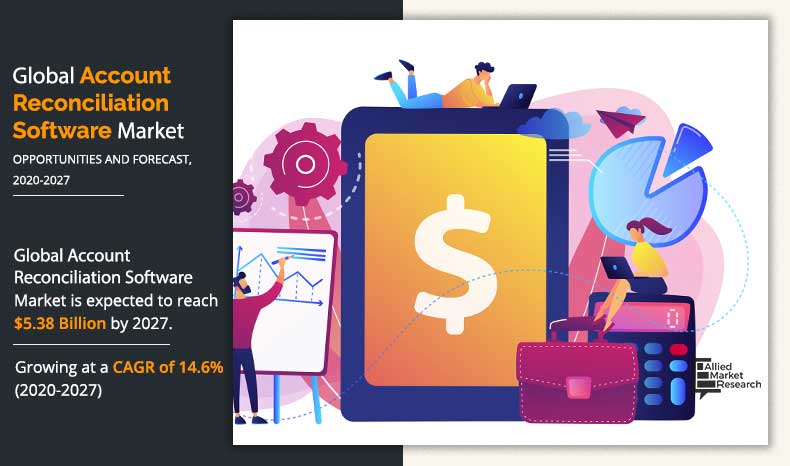

The global account reconciliation software market size was valued at $1.82 billion in 2019, and is projected to reach $5.38 billion by 2027, growing at a CAGR of 14.6% from 2020 to 2027.

Reconciliation is a process of comparing internal financial records against monthly statements from external sources such as banks, financial institutions, and credit card companies. Many banks and fintech companies are using account reconciliation software to manage their payments record in their internal cash register and to identify human errors. In addition, rising need to enhance error detection software in banks and in various other financial institute across the globe drive the growth of the market.

Increase in online transactions among various industries and rise in need for reconciliation management system drive the growth of the account reconciliation software market. In addition, growing adoption of automated banking solutions across the globe to reduce reconciliation time fuels the growth of the market. However, various security issues in account reconciliation software hampers the growth of the market. Furthermore, higher adoption of account reconciliation software among the SMEs and rise in usage of machine learning and artificial intelligence in account reconciliation software are the factors expected to provide lucrative opportunities for the growth of the market.

By Component

Software is projected as one of the most lucrative segments.

The large enterprises segment is expected to garner a significant share during the forecast period. Increase in need to manage huge number of customers along with rise in awareness of security events drives the growth of the account recon software among large retailer. However, the SMEs segment is expected to grow at the highest rate during the forecast period, owing to rapid adoption of cloud-based account recon software by various SMEs to enhance their operational efficiency and reduce the operating cost. This drives the growth of the account reconciliation software market in this segment.

By Deployment Model

On-Premise is projected as one of the most lucrative segments.

Region wise, the account reconciliation software market was dominated by North America in 2019 and is expected to retain its position during the forecast period. The major factors that drive the growth of the market in this region include rising government initiatives to improve and maintain the reconciliation process and to reduce errors in accounting. However, Asia-Pacific is expected to witness the highest growth rate during the forecast period due to increasing presence of account reconciliation software vendors, and growing government support in the developing countries of Asia-Pacific.

By Enterprise Size

Large enterprises is projected as one of the most lucrative segments.

The report focuses on the growth prospects, restraints, and trends of the account reconciliation software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the market.

By Reconciliation Type

Bank Reconciliation is projected as one of the most lucrative segments.

Segment Review:

The account reconciliation software market is segmented on the basis of component, deployment mode, enterprise size, reconciliation type, industry vertical and region. In terms of component, it is bifurcated into software and service. By deployment model, it is segmented into on-premise and cloud. In terms of enterprise size, it is segmented into large enterprise and small & medium enterprises. As per reconciliation type, it is divided into bank reconciliation, customer reconciliation, inter-company reconciliation and others. In terms of industry vertical, it is divided into BFSI, manufacturing, retail & e-commerce, healthcare, IT & telecom, energy & utilities, government & public and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Industry Vertical

BFSI is projected as one of the most lucrative segments.

The key players profiled in the account reconciliation software market analysis include AutoRek, BlackLine, Inc., Broadridge Financial Solutions, Inc., Fiserv, Inc., Oracle Corporation, Quickbooks, ReconArt, Inc., SAP SE, Sage Software Solution Pvt. Ltd., and Xero Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

By Region

Asia-Pacific would exhibit the highest CAGR of 16.4% during 2020-2027.

Top Impacting Factors:

Substantial savings for SMEs with high volume bank reconciliation needs

Bank reconciliation is a necessary yet time-consuming and difficult process for both large and small & medium size enterprises. Hence, bank reconciliation software enables large and small & medium size enterprise to perform bank recs with greater accuracy in less time. This drives the growth of the market. In addition, bank reconciliation helps organizations to get a clearer picture of their cash status in less time and with fewer resources. This fosters the growth of the market. Furthermore, rise in credit card payments and need for generating electronic bills & online bills propel the growth of bank reconciliation software among the end users. In addition, bank reconciliation provides an unprecedented level of flexibility, intelligence, and automation for reconciling bank activity and daily payments, which fuels the growth of the market.

Growth in usage of machine learning and artificial intelligence in recon software

Artificial intelligence is an integral part of different recon software and development. Different recon software manufacturers such as Oracle Corporation, SAP SE, Fiserv, and others are leveraging machine learning and artificial intelligence into the development of their recon software models, which is providing a lucrative opportunity for the growth of the market. For instance, in 2018, SAP SE introduced its SAP cash application, which improves the reconciliation process and cash flow management through the use of artificial intelligence methods and machine learning. Moreover, various retailers are implementing artificial intelligence in reconciliation software to reduce human errors in the accounting process and to increase the safety of the bank transactions. In addition, AI allows retailers to get a better insight of the customer transaction and helps in improving the visibility of each and every transaction. Thus, providing a lucrative opportunity for the market.

Key Benefits for Stakeholders:

- The study provides an in-depth analysis of the global account reconciliation software market forecast along with the current & future trends to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the global account reconciliation software market size is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market for the period 2020–2027 is provided to determine the market potential.

Account Reconciliation Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Opreating System |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | SAP SE, Quickbooks, Xero Limited, Fiserv, Inc., Sage Software Solution Pvt. Ltd., ORACLE CORPORATION, ReconArt, Inc., Broadridge Financial Solutions, Inc., AutoRek, BlackLine Inc. |

Analyst Review

The adoption of account reconciliation software has increased over time due to the developments in the fintech industry and enhancements in supportive government regulations across the globe. In addition, the ability of the software to improve the accounting flow of the organization is increasing its popularity among the end users. Furthermore, small & medium enterprises are adopting cloud-based account reconciliation software for reducing the operational cost of the company and increasing the security of the transactions.

Increase in economic strength in developing economies is expected to provide lucrative opportunities for the market growth. The key players are focusing toward product development and increasing their presence in North America and Asia-Pacific, owing to growth in competition among local vendors, in terms of features, quality, and price. In addition, these players are adopting various business strategies to enhance their product offerings and strengthen their foothold in the market. For instance, in March 2020, AutoRek partnered with Nationwide to provide AutoRek client with cloud-based financial controls and data management platform for a period of three years.

Loading Table Of Content...