Accounting Services Market Research, 2032

The global accounting services market was valued at $628.4 billion in 2022, and is projected to reach $1.5 trillion by 2032, growing at a CAGR of 9.2% from 2023 to 2032.

Accounting services include a wide range of financial and accounting services provided by professional accountants, audit firms, or financial professionals to individuals, businesses, or organizations. It includes tax preparation and counseling, as well as tracking spending and earnings.

The increase in environmental, social, and governance (ESG) reporting are key drivers for the growth of accounting services market. Many governments and regulatory bodies worldwide are introducing ESG reporting requirements. This compels companies to disclose their ESG performance, which includes environmental sustainability, social responsibility, and corporate governance practices. Businesses turn to accounting services for accurate and compliant reporting to meet these regulations. In addition, the surge in trend of error-free & less time-consuming transactions and growth in awareness regarding outsourcing financial and accounting operations are the major driving factors for the accounting services market.

However, regulatory challenges, and accounting scandals are major factors that hamper the growth of the accounting services market. Continuous adaptation to evolving rules and standards raises operational costs and generates uncertainty. Regulatory authorities, in response to accounting scandals, have intensified their examination of financial practices. This results in additional compliance burdens for accounting firms and businesses, influencing their inclination to seek external accounting services market. Contrarily, rise in adoption of IoT and block chain-based accounting service platforms presents a significant opportunity for the accounting services market. IoT devices are capable of collecting real-time financial data, such as sales, inventory, and expenses, with a high degree of precision. This data is automatically integrated into accounting systems, reducing the risk of human errors and improving financial reporting.

The report focuses on growth prospects, restraints, and trends of the accounting services market analysis. The study provides Porter's five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the accounting services market.

Segment Review

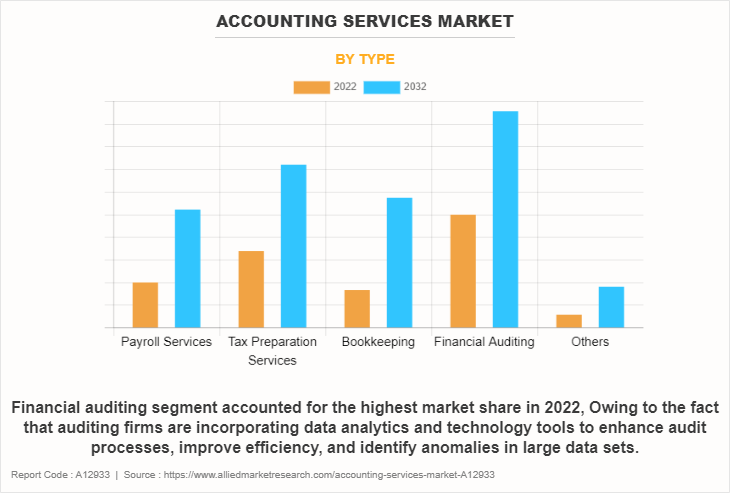

The accounting services market is segmented on the basis of type, end user, and region. On the basis of type, it is categorized into payroll services, tax preparation services, bookkeeping, financial auditing, and others. On the basis of end user, it is classified into finance sector, manufacturing and industrial sector, retail sector, public sector, IT and telecom industry, others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the financial auditing segment attained the highest accounting services market size in 2022, Owing to the fact that auditing firms are incorporating data analytics and technology tools to enhance audit processes, improve efficiency, and identify anomalies in large data sets.

On the basis of region, North America held the highest accounting services market share in 2022, owing to the fact that many accounting firms in North America are focusing on industry-specific expertise. They are tailoring their services to cater to the unique needs of clients in sectors such as healthcare, real estate, technology, and non-profit organizations.

The report analyzes the profiles of key players operating in the accounting services market such as Ernst & Young Global Limited (EY), ADP, INC., KPMG International Limited, Delloite, Plante & Moran, PLLC, BDO, RSM International Ltd., McKinsey & Company, Grant Thornton International Ltd (GTIL), and PwC. These players have adopted various strategies to increase their market penetration and strengthen their position in the accounting services market.

Market Landscape and Trends

The demand for accounting services has shown significant rise in the past decade, which is mainly backed by growing awareness regarding outsourcing financial and accounting operations. Countries globally have mandated regulations and laws that forces companies to undergo audits through authorized accounting services providers to understand their financial position. In addition, the adoption of cloud-based accounting software is on the rise, enabling real-time data access, automation, and collaboration between accountants and clients. AI-driven tools are being used for tasks like data entry, expense categorization, and fraud detection, increasing efficiency and accuracy. Moreover, GST checking helps businesses and individuals ensure that their tax returns and payments are in compliance with the prevailing GST regulations. It helps identify any discrepancies and errors that may lead to non-compliance. Further, financial accounting allows for the evaluation of an entity's performance over time. This includes assessing the effectiveness of cost management, revenue generation, and overall financial efficiency. These are the major trends in accounting services industry.

Top Impacting Factors

Surge in Trend of error-free & less Time-consuming Transactions

The adoption of advanced accounting software and automation tools has revolutionized financial processes. These technologies reduce the likelihood of human errors in data entry, calculation, and reporting. Accountants now rely on automated systems to streamline routine tasks, allowing them to focus on more complex financial analysis and strategic planning. Moreover, the move towards error-free and less time-consuming transactions enhances overall efficiency and productivity. Businesses can process financial data faster and with greater accuracy, which is crucial for decision-making, financial planning, and meeting regulatory compliance requirements. In addition, efficient and error-free communication greatly reduces the need for discipline and accountability. This helps companies reduce operating costs. Accounting services that involve automation and technology can pass these cost savings to clients, making their businesses more attractive. Therefore, these factors foster the growth of the accounting services market.

Increases in Environmental, Social, and Governance (ESG) Reporting

Many governments and regulatory bodies worldwide are introducing ESG reporting requirements. This compels companies to disclose their ESG performance, which includes environmental sustainability, social responsibility, and corporate governance practices. Businesses turn to accounting services for accurate and compliant reporting to meet these regulations. Further, investors, customers, and other stakeholders increasingly consider ESG factors when making decisions. They demand transparency and accountability in ESG reporting. Businesses seek accounting services to ensure the accuracy and credibility of their ESG disclosures to meet these expectations and enhance their reputation. In addition, there is a growing societal awareness of environmental and social issues. Companies are expected to take on greater responsibility in these areas. Accounting services enable businesses to measure, report, and improve their ESG performance, aligning them with these expectations. Therefore, these factors are driving the accounting services market growth.

Growth in Awareness Regarding Outsourcing Financial and Accounting Operations

Outsourcing finance and accounting services often result in significant cost savings for businesses. This is particularly attractive for small and medium-sized enterprises (SMEs) and start-ups with limited financial resources. Professionalism can be acquired without the cost of running an internal finance department through outsourcing. Moreover, outsourcing firms employ financial and accounting professionals with specialized skills and knowledge. This expertise ensures that financial and accounting tasks are handled efficiently and in compliance with relevant regulations, reducing the risk of errors and financial penalties. In addition, outsourcing allows businesses to concentrate on their core competencies and strategic priorities. Delegating financial and accounting tasks to specialists frees up internal resources and enables companies to devote more time and energy to their primary business activities. Furthermore, outsourcing providers place a strong emphasis on data security and confidentiality. They implement robust cybersecurity measures to protect sensitive financial information, addressing one of the top concerns in today's digital business environment. Therefore, these factors foster the growth of the accounting services market.

Regulatory Challenges, and Accounting Scandals

Rapidly changing and intricate accounting and tax regulations pose challenges to ability of accounting firms to remain compliant. Continuous adaptation to evolving rules and standards raises operational costs and generates uncertainty. Regulatory authorities, in response to accounting scandals, have intensified their examination of financial practices. This results in additional compliance burdens for accounting firms and businesses, influencing their inclination to seek external accounting services. In addition, accounting scandals can damage both individual accounting firms and the reputation of the industry. Clients may exhibit more caution when selecting an accounting service provider, fearing potential harm to their reputation. Further, there is a growing demand for greater transparency in financial reporting, as a response to accounting scandals. This may necessitate more rigorous internal controls and documentation, intensifying the workload for accounting firms and businesses. Therefore, these factors are anticipated to restrict the growth of the accounting services market.

Rise in Adoption of IoT and Block chain-based Accounting Service Platforms

The accounting services market has increasingly adopted & implemented internet of things and block chain-based technologies. These technologies help in adding advanced proficiencies, such as easy accessibility and transparency to the accounting services platforms, which further boost the market growth. Moreover, IoT devices are capable of collecting real-time financial data, such as sales, inventory, and expenses, with a high degree of precision. This data is automatically integrated into accounting systems, reducing the risk of human errors and improving financial reporting. Furthermore, blockchain technology ensures the security and immutability of financial transactions. This transparency and trustworthiness in financial records can attract businesses looking for reliable accounting services. Therefore, rise in the adoption of IoT and block chain-based accounting platforms is expected to foster the accounting services market growth in the upcoming years.

Increased Collaboration of SMEs with E-commerce Players

The high growth of small & medium-sized businesses collaborating with e-commerce players and connecting with other online applications, such as automated bank feeds and automated billing features, is expected to drive accounting software adoption during the forecast period. Moreover, it improves efficiency by keeping track of all accounting transactions and managing money inflows & outflows of the business. In addition, an online interface has emerged as a better solution for managing a company's accounts and can easily manage account payables, account receivables, business payroll, general ledger, and other business modules. In addition, the tax rules in the e-commerce sector can be complex, especially when dealing with international transactions. Accountancy services can help SMEs navigate the complexities of e-commerce taxation, ensure compliance and reduce the risk of tax-related issues. In addition, accounting services can help SMEs manage and settle payments received from e-commerce platforms, including processing payment gateway fees, currency conversion and discrepancy resolution. Therefore, these trends are projected to further drive the growth of the accounting services market during the forecast period.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the accounting services market forecast from 2022 to 2032 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of accounting services market outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the accounting services market segmentation assists in determining the prevailing accounting services market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global accounting services market trends, key players, market segments, application areas, and market growth strategies.

Accounting Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.5 trillion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 341 |

| By End User |

|

| By Type |

|

| By Region |

|

| Key Market Players | Grant Thornton International Ltd (GTIL), KPMG International Limited, PwC, delloite, BDO, McKinsey & Company, Ernst & Young Global Limited (EY), RSM International Ltd., ADP, Inc., Plante & Moran, PLLC |

Analyst Review

The accounting services refer to the industry in which accounting firms, professionals, and related service providers offer a wide range of financial and accounting services to clients, which can include individuals, businesses, government entities, and non-profit organizations. Furthermore, enhanced financial transparency is crucial for maintaining trust among stakeholders, such as investors, creditors, and regulatory authorities. Accounting services play a pivotal role in ensuring accurate financial reporting and providing stakeholders with a clear view of a company's financial health. In addition, the increasing emphasis on sustainability and Environmental, Social, and Governance (ESG) reporting has led to a growing demand for accounting services that track and report on non-financial performance metrics. These services are vital for companies aiming to demonstrate their commitment to sustainable practices. Moreover, the trend toward outsourcing financial functions, including Chief Financial Officer (CFO) services, is on the rise, particularly among small and medium-sized businesses looking for cost-effective financial management and strategic financial guidance. These driving factors collectively contribute to the continued growth and importance of the accounting services market.

The CXOs further added that market players have adopted strategies such as partnership for enhancing their services in the market and improving customer satisfaction. For instance, in December 2022, RSM Canada LLP, a leading global provider of audit, tax and consulting services, announced that it has entered a reseller partnership with Vic.ai, the artificial intelligence (AI) platform for accounting productivity and financial intelligence. RSM, a longtime Vic.ai customer, will be offering Vic.ai solutions to its clients, which include entities in financial services, facilities services, hospitality, and the nonprofit sector, among others. Therefore, such strategies are expected to boost the growth of the accounting services market in the upcoming years.

Moreover, some of the key players profiled in the report are Ernst & Young Global Limited (EY), ADP, INC., KPMG International Limited, Delloite, Plante & Moran, PLLC, BDO, RSM International Ltd., McKinsey & Company, Grant Thornton International Ltd (GTIL), and PwC. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The accounting services market is projected to reach $1474.28 billion by 2032.

The accounting services market is estimated to grow at a CAGR of 9.2% from 2023 to 2032.

Surge in trend of error-free & less time-consuming transactions, increases in environmental, social, and governance (ESG) reporting, and growth in awareness regarding outsourcing financial and accounting operations contribute towards the growth of the market.

The key players profiled in the report include accounting services market analysis includes top companies operating in the market such as Ernst & Young Global Limited (EY), ADP, INC., KPMG International Limited, Delloite, Plante & Moran, PLLC, BDO, RSM International Ltd., McKinsey & Company, Grant Thornton International Ltd (GTIL), and PwC.

The key growth strategies of accounting services players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...