Accumulator Charging Valves Market Research, 2033

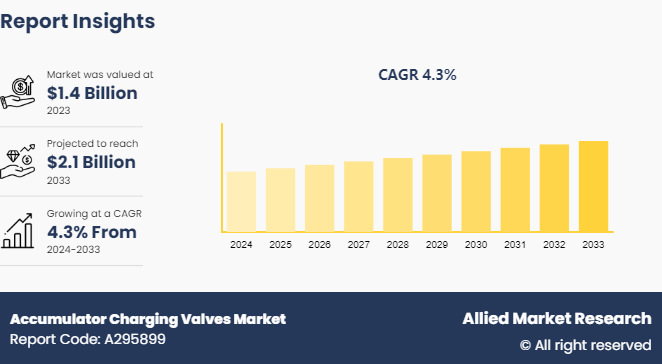

The global accumulator charging valves market size was valued at $1.4 billion in 2023, and accumulator charging valves industry is projected to reach $2.1 billion by 2033, growing at a CAGR of 4.3% from 2024 to 2033.

Market Introduction and Definition

Accumulator charging valves are specialized components within hydraulic systems responsible for regulating the flow of hydraulic fluid to and from an accumulator. These valves manage the charging and discharging processes of the accumulator, a device that stores hydraulic energy under pressure. These valves play a crucial role in hydraulic systems by controlling the flow of fluid into the accumulator during the charging phase, allowing the accumulator to store energy by compressing gas or a spring. When hydraulic pressure needs to be released or utilized, the accumulator charging valve facilitates the controlled release of stored energy, directing the flow of hydraulic fluid from the accumulator back into the system.

Key Takeaways

Over 1,500 product literatures, industry releases, annual reports, and various documents from major accumulator charging valves industry participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

The accumulator charging valves market report covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Market Dynamics

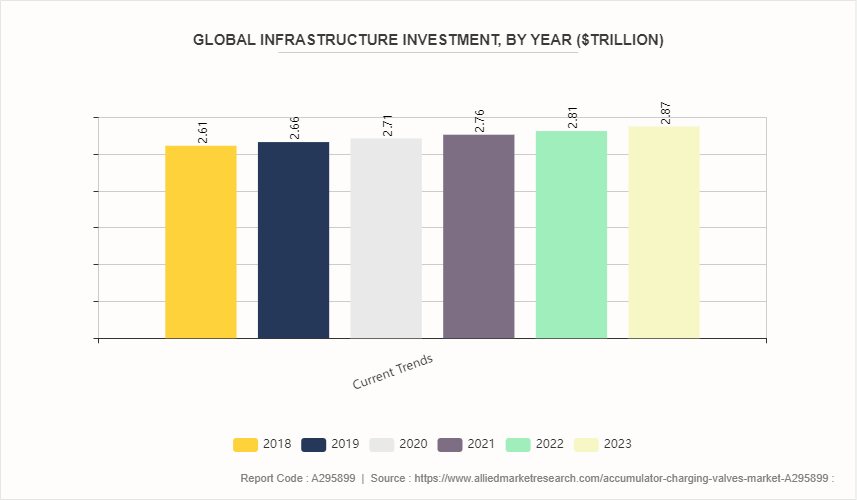

As accumulator charging valves are majorly used in several applications in construction industry, accumulator charging valves market is expected to possess high demand during the forecast period due to rapidly increasing construction industry across the globe. For instance, the global construction industry is expected to increase at a growth rate of four percent during 2024. This growth in the construction industry is supported by increasing infrastructure demand and commercial construction demand throughout the year.

Moreover, technological advancements have facilitated the integration of smart features within accumulator charging valves. Incorporating sensors, monitoring systems, and automated controls have elevated these valves to a new level of efficiency and safety. These smart functionalities enable real-time monitoring of pressure levels, flow rates, and system conditions, allowing for proactive adjustments and predictive maintenance, ultimately enhancing overall system reliability. All these factors drive the demand for accumulator charging valves market. For instance, on Sept 25, 2023, according to the Union Power and New & Renewable Energy Minister of India, the country will likely achieve its 500GW renewable energy target before the 2030 deadline. As of 2023, India had 424 GW of power generation capacity, which included around 180 GW from non-fossil fuels and another 88 GW in the works.

Maintenance and service requirements pose a significant challenge to the growth of the accumulator charging valves market, impacting their widespread adoption across industries. The intricate nature of these valves necessitates regular upkeep and servicing to ensure optimal performance within hydraulic systems. However, these maintenance needs often result in downtime, affecting operational continuity and productivity for industries reliant on hydraulic machinery. Moreover, the need for periodic maintenance creates interruptions in operations, impacting production schedules and efficiency. Downtime for maintenance or servicing of these critical components within hydraulic systems can lead to reduced output, affecting overall productivity and profitability for industries heavily reliant on continuous machinery operation. All these factors hamper the growth of accumulator charging valves market.

Technological innovations in valve design are a driving force behind the expansion and evolution of the accumulator charging valves market. These innovations offer opportunities for enhanced efficiency, safety, and adaptability within hydraulic systems across industries. Advancements in materials science and engineering enable the creation of valves with superior durability, corrosion resistance, and longevity. Materials such as high-strength alloys or advanced polymers allow for valves capable of withstanding harsh operational conditions, extending their lifespan and reducing maintenance needs. This innovation in material design not only enhances the reliability of accumulator charging valves but also minimizes downtime for maintenance, offering cost-effective solutions for industries. All these factors are anticipated to offer new growth opportunities for the accumulator charging valves market during the forecast period.

Segment Overview

The accumulator charging valves market forecast is segmented on the basis of type, application, and region. By type, the market is classified into single accumulator charging valves, dual accumulator charging valves and others. Based on application, the market is segmented into heavy machinery and equipment, oil and gas, automotive, construction and others. Region-wise, the accumulator charging valves market share is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The pivotal factors encouraging market growth in North America include the rise in minerals mining operations and significant growth in the aerospace and defense industry. As per the U.S. Geological Survey (USGS) , in 2021, the U.S. mines produced nearly $90.4 billion in minerals in 2021, which is more than 23% higher compared to revised 2020 production totals.

In North America, 85% of mining is regarded as surface mining in which the overlying mineral layer (known as the overburden) is eliminated, and then the mineral is removed with the use of shafts or tunnels. A two-part process is involved in surface mining that involves the power of hydraulics. Application of accumulator charging valve is significantly observed in hydraulic equipment. Hence, increased use of hydraulic equipment in different applications across end-use verticals is projected to create lucrative opportunities for the accumulator charging valves market growth throughout the forecast period.

Competitive Analysis

Key players in the accumulator charging valves market overview include ZF Off-Highway Solutions Minnesota Inc., Poclain Group, HYDAC International, Bosch Rexroth Africa Group of Companies, Bucher Hydraulics, Hydrotechnik Test Engineering Ltd, HAWE Group, Motorimpex, Weber Hydraulic GmbH, Leader Hydraulics and others.

Key Manufacturers Overview

HYDAC International: Hydac International GmbH mainly operates in Industrial Machinery & Equipment Manufacturing. It offers various products and services such as Hydraulics & Filtration, Control Technology, Thermal Management, Drive Technology, Engineering, and services such as fluid engineering. Its products includes filtration technology, hydraulic accumulators, sensors, mounting & connection technology, and power units. In hydraulic power, it provides a range of power units build with air and water-cooled motors and oil-immersed motors and having max pressure range 50-500 bar.

Bosch Rexroth AG: Bosch Rexroth AG primarily engages in mobile and industrial equipment manufacturing. It caters to different markets such as Assembly Technology, Electric Drives and Controls, Industrial Hydraulics, Linear Motion Technology, Accumulator Charging Valve, Mobile Hydraulics, Electronics and IoT.

Key Industry Trends

Compact and lightweighted designs: Manufacturers are extensively spending over research and development in order to discover innovative materials and discover new manufacturing techniques in order to achieve lighter valve designs without degrading performance. Such innovations are expected to boost the sales of accumulator charging valves across several end-use applications such as aerospace and mobile applications. The above-mentioned factor is expected to create lucrative growth opportunities for accumulator charging valves market across the globe during the forecast period.

Incorporation of Smart Technologies: Manufacturers are increasing their focus towards integration of smart technologies, such as sensors and electronic controls, into accumulator charging valves, in order to achieve increased efficiency, attain real-time monitoring, enhanced system performance remote operation, and predictive maintenance, and reliability. Such innovations are expected to increase sales of accumulator charging valves throughout the forecast period.

Key Country Standards/Certifications for Accumulator Charging Valves

Canada: Canadian Registration Numbers (CRN) can be obtained by making an accumulator from ASME-certified material using ASME design standards, and then applying for the registration number. Each province has its own registration number, thus the final destination of the accumulator must be known. Some provinces accept alternative design codes like PED for specific markets such as farming and mining.

China: Accumulators shipped to China must be approved by the Special Equipment Licensing Office (SELO) . SELO is based on ASME and PED standards. A complete audit is required and it starts with a proposal to receive Chinese certification. After that document is reviewed, test samples must be submitted. Once the test pieces are approved, inspectors conduct an audit at the accumulator manufacturing facility and review the documented quality-control manual. Further, they examine and review the heat codes and material traceability process. With Chinese approval, a manufacturing license is then issued. Additionally, paperwork before and after the purchase of the accumulator must be submitted to China for tracking purposes.

American Bureau of Shipping (ABS) : Accumulators on shipping vessels and oil rigs require this certification. Accumulators to be added to a Product Design Assessment Certificate must meet ASME design requirements, plus any additional ABS requirements. Manufacturers can obtain an ABS Certificate of Manufacturing Assessment and many accumulators are listed on the Bureau’s List of Type Approved Products. An ABS-approved inspector must witness testing at the manufacturer of all ABS-approved accumulators.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the accumulator charging valves market analysis from 2024 to 2033 to identify the prevailing accumulator charging valves market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the accumulator charging valves market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global accumulator charging valves market news, accumulator charging valves market trends, key players, market segments, application areas, and market growth strategies.

Accumulator Charging Valves Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.1 Billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 312 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Poclain Group, ZF Off-Highway Solutions Minnesota Inc., Weber Hydraulic GmbH, Motorimpex, Bosch Rexroth Africa Group of Companies, Leader Hydraulics, HAWE Group, Bucher Hydraulics, Hydrotechnik Test Engineering Ltd, HYDAC International |

Loading Table Of Content...