Acetic Acid Market Research, 2033

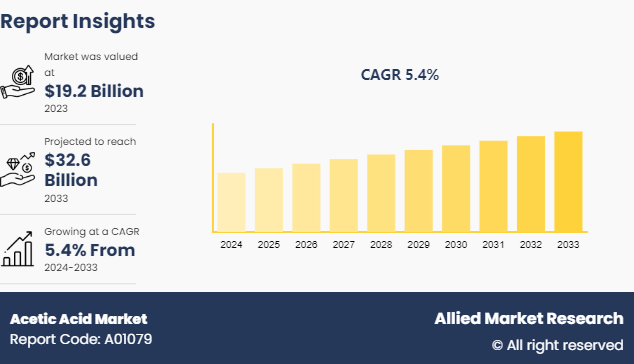

The global acetic acid market was valued at $19.2 billion in 2023, and is projected to reach $32.6 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

Market Introduction and Definition

Acetic acid is a colorless liquid organic compound with a pungent smell and a sour taste, widely recognized as the main component of vinegar apart from water. It is a weak carboxylic acid, often produced both synthetically and through bacterial fermentation. Acetic acid has a broad range of applications across various industries. In the chemical industry, it is a key raw material for producing vinyl acetate monomer (VAM), which is essential for manufacturing paints, adhesives, and coatings. It is also used in the production of acetic anhydride, which is vital for synthesizing cellulose acetate, a component in photographic film and textiles. In the food industry, acetic acid serves as a preservative and flavoring agent. Additionally, it plays a role in the pharmaceutical industry for producing various drugs and as a solvent in the production of certain chemicals and plastics.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The acetic acid market is fragmented in nature among prominent companies such as Eastman Chemical Company, Celanese Corporation, HELM AG, SABIC, East India Chemicals, LyondellBasell Industries Holdings B.V., Kakdiya Chemicals, Prakash Chemicals International Private Limited (PCIPL) , Innova Corporate (India) , and Anant Pharmaceuticals Pvt. Ltd.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global acetic acid market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 2, 200 acetic acid-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global acetic acid market.

Key Market Dynamics

Factors such as a rise in industrialization, urbanization, increase in the disposable income, improvement in the standard of living among people, and rise in demand for packaged food are responsible for the growth of the food & beverage industry where acetic acid is used as preservatives. According to a report published by the Press Information Bureau in February 2024, the food processing sector has emerged as an important segment of the Indian economy in terms of its contribution to GDP, employment and exports. During the last seven years ending 2021-22, India’s food processing sector has been growing at an average annual growth rate (AAGR) of around 7.26%. The increasing consumption of ready-to-eat meals, snacks, and beverages is thus boosting the acetic acid market.

Furthermore, the rapid increase in the population, rise in pharmaceuticals research and development (R&D) , up-gradation in technology, increased focus in the healthcare field in a developed and developing nations such as the U.S., China, and India, and rise in the incidence rate of chronic disorder has surged the demand for acetic acid in the pharmaceutical sector. Acetic acid is used for the synthesis of various drugs and medicinal compounds. Moreover, it is used in the production of aspirin, acetaminophen, and other essential medications. According to a report published by the Government of Canada in 2024, the value of total pharmaceutical sales in Canada have increased by 56.4% to $34.1 billion from 2012 to 2021. Thus, the growing pharmaceutical industry, driven by increasing healthcare needs and advancements in medical research, is significantly contributing to the demand for acetic acid market.

However, acetic acid production primarily depends on petrochemical feedstocks, such as methanol and carbon monoxide. The prices of these raw materials are highly volatile and subject to fluctuations based on global oil and gas prices. Any significant increase in the cost of these feedstocks can directly impact the production cost of acetic acid, making it less economically viable for manufacturers. This factor may hamper the growth of the acetic acid market during the forecast period.

On the contrary, the increasing awareness of environmental issues and the need to reduce carbon footprints are driving the demand for sustainable and bio-based acetic acid. Traditional acetic acid production methods, which rely on petrochemical feedstocks, are associated with significant greenhouse gas emissions. The shift towards bio-based acetic acid, produced from renewable biomass sources, is gaining momentum as a more sustainable alternative.

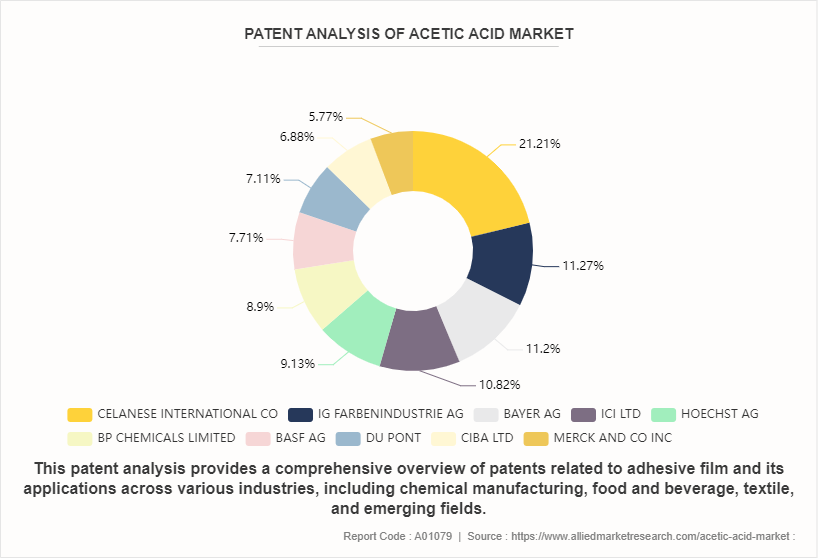

The analysis encompasses patent trends, key patent holders, technological advancements, market segmentation, competitive landscape, and future outlook within the acetic acid market. Patent filings related to adhesive film have shown a steady increase over the past decade, indicating growing interest and investment in acetic acid R&D.

Market Segmentation

The acetic acid market is segmented on the basis of application, end-use industry, and region. By application, the market is classified into acetic anhydride, cellulose acetate, vinyl acetate monomer, chloracetic acid, and others. By end-use industry, the market is divided into chemical manufacturing, food and beverage, pharmaceutical, textile, agriculture, personal care and cosmetics, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Asia-Pacific represents a significant market for acetic acid, this is attributed to the proliferating demand for acetic acid from various end-use sectors such as textile, agriculture, food & beverage, chemical manufacturing, and others which in turn have led the acetic acid manufacturers to increase their production capacities. Furthermore, increase in agricultural exports where acetic acid is widely used as a natural herbicide for weed control may lead the acetic acid market to witness a significant growth. Moreover, India’s textile sector is increasing rapidly which has forced the acetic acid manufacturers to produce more efficient biphenyl used for dye carrier purposes. For instance, according to a report published by Indian Brands Equity Foundation in May 2022, India's home textile exports grew at a healthy rate of 9% in 2021. This may fuel the growth of the biphenyl market in the Asia-Pacific region.

Additionally, the growing elderly population couples with rise in self-grooming activities have led the personal care and cosmetics sector in Japan where acetic acid is used as a raw material in various personal care products such as shampoos and conditioners, for its ability to balance pH levels and improve the stability of formulations. According to a report published by International Trade Administration in 2023, Japan’s cosmetics and personal care products market is world’s third largest market after the U.S. and China with home to 3, 000 beauty care companies, including global brands of Shiseido, Kao, Kosé, Pola Orbis, and others. Thus, the growth of personal care and cosmetics sector in Japan may fuel the growth of the acetic acid market during the forecast period.

Competitive Landscape

The major players operating in the acetic acid market include Eastman Chemical Company, Celanese Corporation, HELM AG, SABIC, East India Chemicals, LyondellBasell Industries Holdings B.V., Kakdiya Chemicals, Prakash Chemicals International Private Limited (PCIPL) , Innova Corporate (India) , and Anant Pharmaceuticals Pvt. Ltd. Other players in the acetic acid market include Mudanjiang Fengda Chemicals Co., Ltd, BHAGWATI CHEMICALS, Pandora Industries Pvt. Ltd., Akshar Chemical India Private Limited, and others.

Recent Key Strategies and Developments

- In November 2023, INEOS acquired Eastman’s acetic acid business including its the 600 kiloton acetic acid plant and all associated third party activities. This strategic acquisition has enhanced INEOS’s product offerings for acetic acid.

- In March 2023, KBR, a leading U.S. multinational engineering group has acquired an acetic acid technology called Acetica. This strategic acquisition may enhance KBR’s product offering for methanol and carbon monoxide-based acetic acid across various end-use sectors.

Industry Trends

- In August 2021, researchers from India have reported the use of acetic acid as an antimicrobial edible food coating agent. The diversified food culture has a significant demand in the development of such kind of innovation and acetic acid can be an efficient solution; thus, fueling the growth of the acetic acid market.

- Recent advances in the acetic acid market have witnessed the development of bio-based acetic acid using bioethanol derived from agricultural feedstocks. Companies such as Godavari Biorefineries, Sekab, and others are constantly engaged in R&D activities for producing highly efficient acetic acid for various end-use industries. This factor may further augment the growth of the acetic acid market during the forecast period.

Public Policies by Geography

Several acts and regulations have been set-up to safeguard the use of acetic acid across various end-use sectors. For instance:

in U.S.

- Toxic Substances Control Act (TSCA) (15 U.S.C. 2601 et seq) requires chemical manufacturers to report the production, use, and disposal of acetic acid to ensure it does not pose an unreasonable risk to health or the environment.

- The Clean Air Act (CAA) (42 U.S.C. 7401 et seqd) controls acetic acid emissions and ensure compliance with National Ambient Air Quality Standards (NAAQS) .

- The Resource Conservation and Recovery Act (RCRA) (42 U.S.C. 6901 et seq) regulates the disposal of hazardous wastes, including waste containing acetic acid, ensuring proper management and disposal practices.

In Europe

- European Chemicals Agency (ECHA) Regulation (EC) No 1907/2006 regulates the registration and evaluation of acetic acid, ensuring its safe use and handling throughout its lifecycle.

- The Classification, Labelling and Packaging (CLP) Regulation (EC) No 1272/2008 states that acetic acid must be classified, labeled, and packaged according to CLP regulations to communicate its hazards effectively.

- The Food Additives Regulation - Regulation (EC) No 1333/2008 states that acid used as a food additive must comply with safety assessments and usage limits established by the EFSA.

In Asia-Pacific

- Regulations on the Safe Management of Hazardous Chemicals (2011) in China have classified acetic acid as a hazardous chemical, requiring compliance with safety, handling, and disposal regulations.

- The China’s National Food Safety Standard Act (GB2760-2014) regulates the use of acetic acid as a food additive must comply with specific standards regarding its use and maximum allowable levels in food products.

- In India, Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011 states that acetic acid used in food products must adhere to standards set by the Food Safety and Standards Authority of India (FSSAI) .

These regulations ensure the safe production, and use of acetic acid, protecting consumers, workers, and the environment across different regions.

Key Sources Referred

- National Promotion and Facilitation Agency

- U.S. Development Authority

- East West Bank

- International Trade Administration

- Invest India

- U.S. Environmental Protection Agency

- European Union (EU) Regulations

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the acetic acid market analysis from 2024 to 2033 to identify the prevailing acetic acid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the acetic acid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global acetic acid market trends, key players, market segments, application areas, and market growth strategies.

Acetic Acid Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 32.6 Billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | LyondellBasell Industries Holdings B.V., Anant Pharmaceuticals Pvt. Ltd., HELM AG, Kakdiya Chemicals, Celanese Corporation, East India Chemicals, SABIC, Innova Corporate, Prakash Chemicals International Private Limited (PCIPL), Eastman Chemical Company |

| Other Key Market Players | Jiangsu SOPO (Group) Co., Ltd., BP Plc, Daicel Corporation, Shandong Hualu-Hengsheng Chemical Co. Ltd., Shanghai Huayi (Group) Company, Yankuang Cathay Coal Chemicals Co. Ltd., Kingboard Chemical Holdings Ltd. |

Loading Table Of Content...