Acrylic Adhesives Market Research, 2033

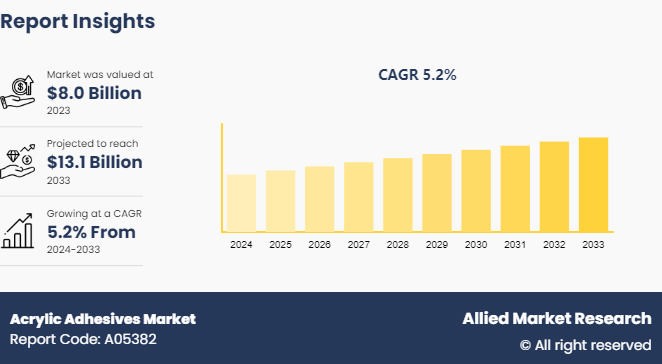

The global acrylic adhesives market was valued at $8.0 billion in 2023, and is projected to reach $13.1 billion by 2033, growing at a CAGR of 5.2% from 2024 to 2033.

Market Introduction and Definition

Acrylic adhesives are adhesives formulated from acrylic polymers. These adhesives are known for their versatility and wide range of applications across various industries. Acrylic adhesives offer several key properties, including high bonding strength, excellent durability, and resistance to environmental factors such as moisture, heat, and chemicals. They also typically exhibit fast curing times, enabling efficient assembly processes in manufacturing environments.

In addition, acrylic adhesives often provide good adhesion to a variety of substrates, including metals, plastics, glass, and wood, making them suitable for diverse bonding requirements. Their transparency and ability to maintain clarity over time making them particularly useful in applications where aesthetics are important. Overall, acrylic adhesives are valued for their strong and durable bonds, versatility, and ability to withstand challenging environmental conditions, making them a preferred choice in many industrial and commercial applications.

Key Takeaways

- The acrylic adhesives market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major acrylic adhesives industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve ambitious growth objectives.

Key Market Dynamics

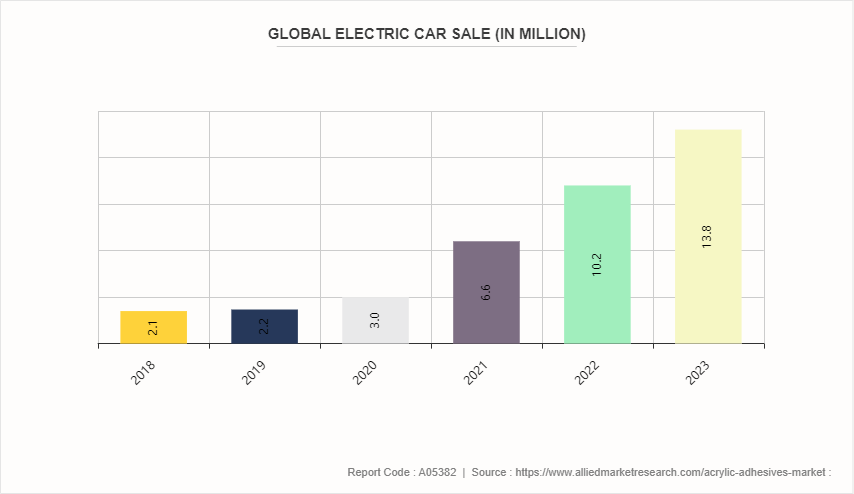

The growth of the automotive industry is a significant driver for the expansion of the acrylic adhesives market. Acrylic adhesives are increasingly favored in automotive manufacturing due to their superior bonding strength, versatility, and ability to withstand harsh environmental conditions. The demand for materials that can effectively bond a variety of substrates, such as metals, plastics, and composites, has surged as the automotive industry advances towards lightweight and fuel-efficient vehicles. Acrylic adhesives meet these requirements, offering robust performance in high-stress applications and contributing to vehicle durability and safety. In addition, the automotive sector's shift towards electric vehicles (EVs) further boosts the growth of the acrylic adhesives market. The India Energy Storage Alliance report projects that the country's EV industry will grow at a compound annual growth rate (CAGR) of 36% until 2026. The International Organization of Motor Vehicle Manufacturers (OICA) reports that by 2021, there were 57, 054, 295 passenger cars produced worldwide, up from 55, 834, 456 in 2020.

The Federation of Automobile Dealers' Association (FADA) released figures showing that sales of electric vehicles in India increased by 49.25% year over year to 15, 29, 947 units in 2023. In addition to the country's fast urbanization, the Indian government has launched a number of efforts to encourage the production and use of electric vehicles. The goal is to reduce emissions and advance e-mobility. The first interest in and exposure to electric mobility was facilitated by the National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME I and II) .

EV production requires specialized adhesives for battery assembly, thermal management, and vibration damping, where acrylic adhesives play a crucial role. The ongoing trend of vehicle electrification and the increasing adoption of smart and autonomous vehicles are expected to increase the demand for high-performance adhesives. Furthermore, the automotive industry's focus on sustainability and reducing emissions aligns with the benefits of acrylic adhesives, which often have lower volatile organic compound (VOC) emissions compared to other adhesives. This compatibility with environmental regulations enhances their appeal. Consequently, the dynamic growth of the automotive industry is poised to significantly propel the growth of the acrylic adhesives market in the coming years.

Environmental and regulatory concerns pose significant challenges to the growth of the acrylic adhesives market. Acrylic adhesives often contain volatile organic compounds (VOCs) and other chemicals that can have adverse environmental and health impacts. As awareness and concern about environmental sustainability increase, regulatory bodies around the world are implementing stricter regulations to limit VOC emissions and ensure the safe disposal of chemical waste. Compliance with these regulations can be costly and complex for manufacturers, requiring substantial investment in research and development to create low-VOC or VOC-free formulations. In addition, obtaining certifications and ensuring ongoing compliance adds to operational costs. These increased costs can decrease the profit margins and make acrylic adhesives less competitive compared to other types of adhesives that might not face the same level of regulatory scrutiny. Furthermore, as consumers and industries increasingly prioritize environmentally friendly products, the demand for traditional acrylic adhesives may decline unless they are adapted to meet new environmental standards. This regulatory landscape not only creates barriers to market entry for new players but also forces existing manufacturers to innovate continuously, posing a restraint on market growth and potentially limiting the adoption of acrylic adhesives in certain applications.

Advancements in medical device manufacturing present lucrative opportunities for the growth of the acrylic adhesives market. As the medical sector evolves, there is an increasing demand for innovative devices that require reliable and durable bonding solutions. Acrylic adhesives are highly favored in this industry due to their exceptional biocompatibility, strong bonding strength, and resistance to sterilization processes such as autoclaving and gamma radiation. These adhesives are essential in assembling various medical devices, including disposable devices, wearable health monitors, and complex surgical instruments. The rise of minimally invasive surgical techniques and the development of microfluidic devices also fuel the need for precise and robust adhesive solutions. In addition, the ongoing trend towards home healthcare and portable medical devices further amplifies the demand for acrylic adhesives, as these devices must be lightweight yet sturdy and safe for prolonged use. As regulatory standards for medical devices become more stringent, the reliability and performance of acrylic adhesives make them a critical component in ensuring compliance and patient safety. Overall, the integration of advanced acrylic adhesives in medical device manufacturing not only enhances product performance but also drives market growth, reflecting the sector's rapid innovation and expanding healthcare applications.

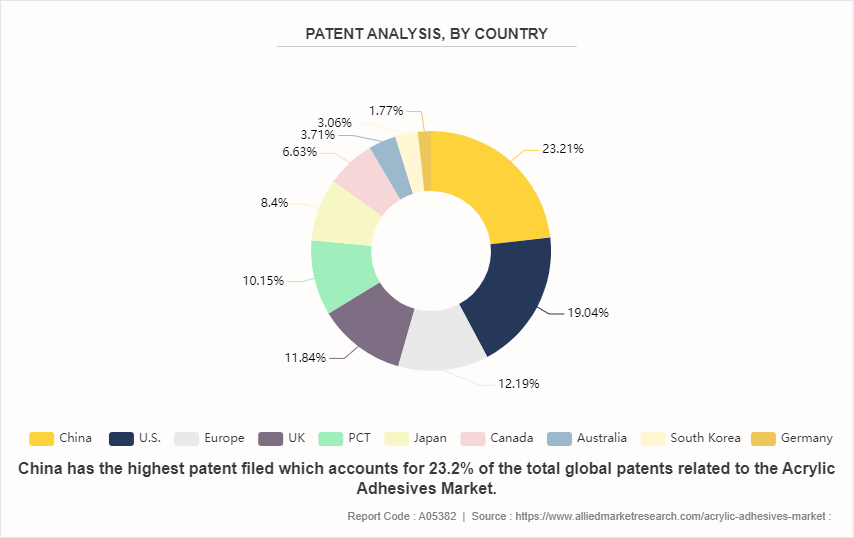

Patent Analysis of Global Acrylic Adhesives Market

Patent analysis reveals the geographical distribution of patent filings related to acrylic adhesives, with China leading at 23.20%, followed by the U.S. at 19.04%. The Europe and the UK contribute significantly at 12.19% and 11.84%, respectively. These figures reflect the global interest and investment in acrylic adhesive technologies, with major economies like Japan and Canada also making notable contributions. The data underscores the competitive landscape and innovation hubs within the acrylic adhesives market, highlighting regions where research and development efforts are concentrated, driving advancements and market growth.

The Global Increase in Electric Car Sales will Boost the Growth of the Acrylic Adhesives Market

The global surge in electric car sales is poised to significantly boost the acrylic adhesives market. Electric vehicles (EVs) require high-performance adhesives for various components, including battery packs, interior panels, and lightweight structures. Acrylic adhesives, known for their strong bonding properties and resistance to environmental factors, are ideal for these applications. As EV manufacturers seek materials that enhance vehicle durability and efficiency, the demand for acrylic adhesives is expected to rise correspondingly. This trend reflects a growing intersection between automotive innovation and adhesive technology, driving market expansion in the acrylic adhesives sector.

Market Segmentation

The acrylic adhesives market is segmented into type, technology, end-use industry, and region. By type, the market is classified into acrylic polymer emulsion, cyanoacrylic, methacrylic, and UV-curable acrylic. By technology, the market is divided into pressure-sensitive, solvent-based, reactive and others. By end-use industry, the market is classified into electrical and electronics, building and construction, transportation, medical, consumer goods, paper and packaging and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the acrylic adhesives market include 3M, Henkel Corporation, Avery Dennison Corporation, H.B. Fuller Company, Sika AG, Dow Inc, Arkema Group, Huntsman International LLC, MAPEI S.p.A., and Pidilite Industries Ltd.

Recent Key Strategies and Developments

- In August 2023, Bostik, the adhesive solutions branch of Arkema, introduced the first all-temperature, wash-off label adhesive in the market, marking a growth in its sustainable offering. Flexcryl ClearCycle 1000 adhesive with all-temperature, wash-off technology has been formally recognized by the Association of Plastic Recyclers (APR) as achieving or surpassing the toughest Critical Guidance Criteria for its compatibility with PET bottle label recycling and its contribution to recycling streams.

- In July 2022, in Kosi, Mathura, Mapei began building its third production site in response to demand from Northern India.

- In June 2022, The H.B. Fuller Company introduced several innovative adhesives at PRINTPACK INDIA® 2022 that address the expanding trends in e-commerce packaging and sustainable consumer goods.

- In April 2022, Toyochem Co., Ltd. introduced new acrylic pressure-sensitive adhesives (PSA) with low odor and low volatile organic compounds. Oribain EXK 21-046 is appropriate for usage in enclosed areas, such the interiors of buildings and cars.

- In March 2022, the introduction of 3M VHB Extrudable Tape, a new production bonding solution that raises the bar for automation, ease of use, and sustainability across industries, was announced by 3M. This end-to-end bonding solution allows for usage on any scale by combining the advantages of liquid adhesives with the convenience of 3M VHB Tapes in a single, contained footprint.

- In February 2022, the Performance Adhesives division of Ashland was fully acquired by Arkema Group. In the world of high-performance adhesives, Ashland is a U.S. leader.

- In February 2022, the acquisition of Fourny NV was announced by H.B. Fuller as a way to bolster its Construction Adhesives division in Europe.

- In January 2021, for pressure-sensitive adhesives used in paper and film labels, Dow introduced Acrylic Adhesives. Dow's new technologies are expected to help label stock makers, converters, and brand owners satisfy new and changing industry expectations.

Regional Industry Outlook

Asia-Pacific is experiencing robust economic growth. The demand for acrylic adhesives in the Asia-Pacific region is driven by rapid industrialization, increase in construction activities, and growth in the automotive and electronics sectors. Rise in urbanization and infrastructure development further boost the market growth. In addition, the shift towards sustainable and high-performance adhesive solutions, along with technological advancements and expanding manufacturing capacities, contribute to the increasing demand for acrylic adhesives in this region.

- As a part of the Sagarmala Program, over 610 projects valued at $10.5 million will be undertaken from 2015 to 2035. These initiatives aim to modernize and construct new ports, enhance port connectivity, promote port-linked industrialization, and develop coastal communities.

- The Bharatmala Pariyojana is a comprehensive highway program designed to improve freight and passenger movement efficiency nationwide. This will be achieved by addressing critical infrastructure gaps through the development of Economic Corridors, Inter Corridors and Feeder Routes, National Corridor Efficiency Improvement, Border and International Connectivity Roads, Coastal and Port Connectivity Roads, and new expressways.

- In 2022-2023, the PM Gati Shakti Master Plan for Expressways will be implemented to enable faster transit. The National Highway network will expand by 25, 000 kilometers in 2022-2023, costing $2.42 billion (INR 20, 000 crore) .

- India's road sector witnessed significant growth in 2022, with new stretches of national highways constructed, numerous projects approved and completed, and substantial fundraising efforts. This progress aims to create an integrated, multi-modal national transportation and logistics network, improve connectivity in isolated and challenging terrains, and reduce congestion in key areas of the road network.

- In January 2022, the government approved the development of 21 greenfield airports across the country, with the largest to be built in the Gautam Buddha Nagar area of Uttar Pradesh. The Ministry of Civil Aviation plans to establish 21 additional airports in the coming years.

- Over the next four to five years, the Airports Authority of India (AAI) plans to create new airports and upgrade many existing ones at a cost of $ 338 million. This includes expanding and renovating existing terminals, constructing new terminals, and enhancing runways, technical blocks, aprons, and control towers. In addition, by 2025, three Public-Private Partnership (PPP) airports in Delhi, Bengaluru, and Hyderabad will invest INR 30, 000 crore in expansion plans.

- The demand for acrylic adhesives is rising with the increase in infrastructure and construction industry in this region. Thus, the acrylic adhesives industry is growing rapidly, with flourishing demand in infrastructure and construction.

Industry Trends

- Acrylic adhesives are used in architecture and construction to adhere panels, insulating boards, and ceiling tiles. They come in the form of thick mastic or putty. The growth of residential housing plans, architectural locations, and rising investment and urbanization are all contributing factors to the building and construction industry's success.

- For instance, the seasonally adjusted annual rate of building in the U.S. increased from US$1, 553, 547 in April 2021 to US$1, 744, 801 in April 2022, according to the U.S. Census Bureau.

- The demand for acrylic adhesives is expected to increase in tandem with the growth in building and construction projects around the world, which is projected to fuel market expansion in the building and construction sector during the forecast period.

Key Sources Referred

- gitnux.org

- The Ministry of Civil Aviation

- Airports Authority of India (AAI)

- Invest India

- India Energy Storage Alliance

- International Organization of Motor Vehicle Manufacturers (OICA)

- Federation of Automobile Dealers' Association (FADA) .

- National Electric Mobility Mission Plan (NEMMP)

- Chinese Association of Automotive Manufacturers

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the acrylic adhesives market analysis from 2024 to 2033 to identify the prevailing acrylic adhesives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the acrylic adhesives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global acrylic adhesives market trends, key players, market segments, application areas, and market growth strategies.

Acrylic Adhesives Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 13.1 Billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Technology |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | MAPEI S.P.A., Dow Inc., Sika AG, H.B. Fuller Company, Arkema Group, Avery Dennison Corporation, Huntsman International LLC, Henkel Corporation, Pidilite Industries Ltd., 3M |

Loading Table Of Content...