Actuators And Valves Market Research, 2032

The Global Actuators and Valves Market was valued at $104.2 billion in 2022 and is projected to reach $221.3 billion by 2032, growing at a CAGR of 8.1% from 2023 to 2032. An actuator is a device that converts energy into mechanical motion. It can be controlled by a signal from a control system and is commonly used to open or close valves, operate dampers, or move mechanical parts in industrial or manufacturing settings. Actuators can be powered by a variety of sources, including electricity, pneumatic pressure, or hydraulic fluid. Actuators are used in a wide range of applications, including aerospace, automotive, construction, and robotics.

They can be classified into different types based on the type of energy they use, such as electric actuators, pneumatic actuators, and hydraulic actuators. Electric actuators use an electric motor to generate motion, pneumatic actuators use compressed air, and hydraulic actuators use pressurized fluid. A valve is a mechanical device that controls the flow of liquids, gases, or other fluid substances. It regulates the pressure, direction, and flow rate of the fluid. Valves are commonly found in plumbing, heating, and cooling systems, as well as in industrial and manufacturing settings.

Actuators can also be classified based on the type of motion they generate, such as linear actuators, which produce linear motion, and rotary actuators, which produce rotary motion. Linear actuators are commonly used in applications such as moving machine parts, opening and closing valves, and adjusting the position of mirrors, while rotary actuators are used in applications such as turning gears and wheels. Actuators can also be classified based on the type of control system used to operate them. For example, some actuators may use a simple on/off control system, while others may use a more advanced system that allows for precise control of the motion of the actuator.

There are several types of valves, each designed to perform a specific function. Some of the most common types of valves include:

- Ball valves have a ball inside the valve that rotates to control the flow of fluid.

- Gate valves have a gate inside the valve that moves up and down to control the flow of fluid.

- Globe valves have a disk inside the valve that moves up and down to control the flow of fluid.

- Butterfly valves have a disc inside the valve that rotates to control the flow of fluid.

- Check valves allow fluid to flow in one direction but prevent it from flowing in the opposite direction.

- Diaphragm valves have a flexible diaphragm that moves to control the flow of fluid.

Valves can be operated manually, by turning a handle or knob, or they can be controlled automatically by actuators. Some valves can also be controlled remotely by a control system. The market is expected to witness notable growth during the forecast period, owing to growth in the water and wastewater treatment industry, an increase in safety measurements in industries, and technologically advanced processing methods. Moreover, the increase in the adoption of robotics in the market is expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, the lack of product differentiation is one of the restraints for actuators and valves market growth during the forecast period.

Segment Overview

The market is segmented based on application, type, and region.

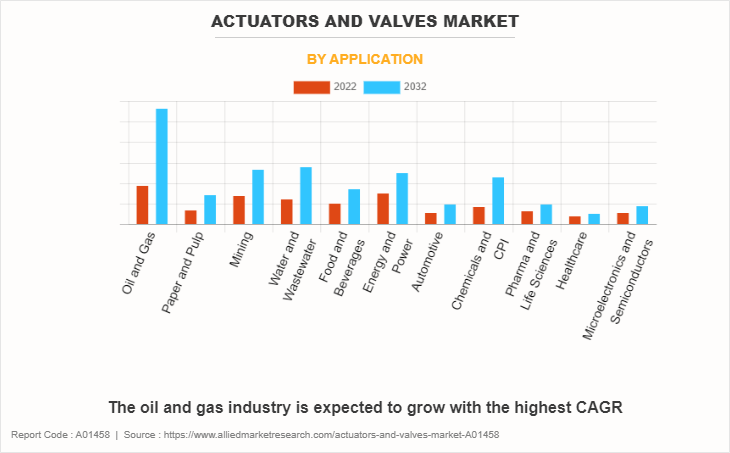

Based on application, the market is divided into oil and gas, paper and pulp, mining, water and wastewater, food and beverages, energy and power, automotive, Chemicals and CPI, pharma and life sciences, healthcare, and microelectronics and semiconductors.

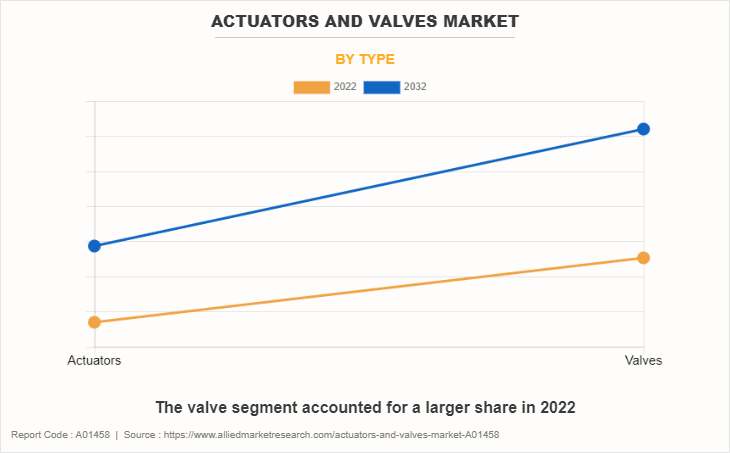

Based on type, the market is divided into actuators and valves.

Region-wise, the market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competitive Analysis

Competitive analysis and profiles of the major global actuators and valves industry players that have been provided in the report include Crane Holdings, Co., Emerson Electric Co. (PENTAIR VALVES), Flowserve Corporation, General Electric Company, IMI plc, KITZ CORPORATION, METSO OYJ (NELES OYJ), PARKER-HANNIFIN CORPORATION, Rotork plc, and SLB.

Top Impacting Factors

Growth in the water & wastewater industry, increase in safety measurements in industries, technological advancements in processing methods, and changing environmental regulations are the major factors that propel the actuators and valves market outlook. However, the lack of product differentiation is expected to hinder the market growth. Conversely, the surge in demand for robotics is projected to offer remunerative opportunities for the actuators and valves market analysis.

Historical Data & Information

The global actuators and valves market is highly competitive, owing to the strong presence of existing vendors. Vendors of actuators and valves market forecast with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to the actuators and valves market demand. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Top market players have adopted various strategies, such as product development, acquisition, innovation, partnership, and others, to expand their foothold in the actuators and valves market.

- In July 2023, the introduction of PFA-Lined Weir Type Diaphragm Valves was announced by KITZ Corporation. A range of diaphragm valves is now available in the PFA-lined valve series for pipe systems that demand chemical and corrosion resistance. A variety of PFA-lined products, such as butterfly valves, ball valves, plug valves, and check valves, are included in the PFA-lined valve series.

- In March 2023, in a Hong Kong wastewater pumping plant, Rotork IQ actuators were installed. The old manual valves were replaced with electronic actuators with built-in intelligence, which are more modern and efficient.

- In December 2022, Parker Hannifin launched next-generation pre-compensated load-sensing valves with VA Series branding. The VA Series mobile directional control valves are designed to meet future demands within a range of challenging mobile machinery industries, such as forestry, construction, mining, and material handling.

- In September 2022, Crane India, as part of Crane Holdings, Co., developed a new engineered check valve factory in Satara, Maharashtra. It is an approximately 110,000-square-foot manufacturing facility featuring automated welding technology to manufacture a full range of Noz-Chek and Duo-Chek valves in sizes up to 84". The plant meets the stringent quality and product approvals and is capable of in-house machining for all offered size ranges. The facility offers in-house high-pressure gas and cryogenic testing for valves up to 72".

- In June 2022, Emerson launched the AVENTICSTM Series Servo Profile Advanced (SPRA) Electric Actuators, a line of precise and highly repeatable rod-style cylinders. While only one type of electric actuator screw is typically available on the actuators and valves market, the SPRA actuators offer three screw technologies. These include a precision ball screw, which provides exceptional durability and accuracy for applications that need optimal quality or throughput; a cost-effective lead screw option; and roller screws for precision, speed, and heavy loads.

- In October 2022, Schlumberger launched an electric surface actuator. It lowers the OPEX by up to 30% via reliable, long-term remote control of surface valves as well as condition-based monitoring and money-saving predictive maintenance. By eliminating unnecessary site visits and personnel on location, these actuators enable you to rethink platform design, potentially removing costly structures such as helidecks, living quarters, and control rooms. Reducing maintenance visits also decreases CO2 emissions. Asset field crews can run leaner because technicians are better informed about the maintenance required.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the actuators and valves market segments, current trends, estimations, and dynamics of the actuators and valves industry analysis from 2022 to 2032 to identify the prevailing actuators and valves market opportunity.

- The actuators and valves market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the actuators and valves industry segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the actuators and valves market players.

- The report includes an analysis of the regional as well as global actuators and valves market trends, key players, market segments, application areas, and market growth strategies.

Actuators And Valves Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 221.3 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 359 |

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | SLB, Rotork plc, Crane Holdings, Co., General Electric Company, KITZ CORPORATION, Parker-Hannifin Corporation, Emerson Electric Co. (PENTAIR VALVES), IMI plc, Metso Oyj (Neles Oyj), Flowserve Corporation |

Analyst Review

According to the perspectives of CXOs of a leading actuator and valve solution company, the global actuators and valves market is expected to witness significant growth due to increase in demand for ball valve and butterfly valves for sectors such as oil and gas, pulp and paper, food and beverages, and others.?

During the forecast period, it is anticipated that the growth in the water and wastewater treatment industry and technologically advanced processing methods, would propel the worldwide actuators and valves market's expansion. However, during the forecast period, the basic design and structure of various actuators & valves has not changed in the past few years and is expected to restrain market expansion.??

Furthermore, actuators and valves are crucial components in many industrial and technological systems, including manufacturing, power generation, and water treatment plants. In recent years, there has been significant growth in the demand for actuators and valves, driven by the need for more efficient and automated systems in these industries. Advances in materials science and technology have also led to the development of new and improved actuator and valve designs, which are more durable, reliable, and cost-effective. Additionally, the growth of renewable energy sources such as wind and solar power has also increased the demand for actuators and valves in these industries. Overall, the market for actuators and valves is expected to continue growing in the coming years as industries continue to adopt more advanced technologies and automation.

Growth in water and wastewater treatment industry and increase in safety measurements in industries are the upcoming trends in the actuators and valves market.

Oil and gas is the leading application of actuators and valves market

Asia-Pacific is the largest regional market for actuators and valves market

The actuators and valves market is estimated to reach $221.2 billion by 2032

Crane Holdings, Co., Emerson Electric Co. (PENTAIR VALVES), Flowserve Corporation, General Electric Company, IMI plc, KITZ CORPORATION, METSO OYJ (NELES OYJ), PARKER-HANNIFIN CORPORATION, Rotork plc, and SLB are the top companies holding a prime share in the actuators and valves market

Loading Table Of Content...

Loading Research Methodology...