Adaptive Cruise Control (ACC) System Market Research, 2034

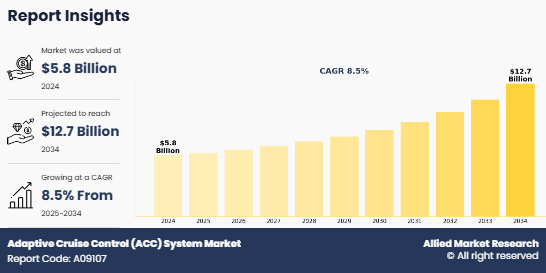

The global Adaptive Cruise Control System Market Size was valued at $5.8 billion in 2024, and is projected to reach $12.7 billion by 2034, growing at a CAGR of 8.5% from 2025 to 2034.

The Adaptive Cruise Control System Market involves the development and integration of advanced driver assistance systems that automatically adjust a vehicle’s speed to maintain a safe distance from vehicles ahead. These systems use sensors such as radar, lidar, and cameras, along with electronic control units and software, to enhance driving safety and comfort. The market is driven by increasing demand for vehicle safety features, the rising adoption of ADAS in modern vehicles, and growing government regulations promoting road safety. ACC systems are widely used in both passenger and commercial vehicles, particularly in premium and electric models. Technological advancements, including AI-based decision-making and integration with autonomous driving platforms, are transforming the market landscape.

Key Takeaways

- The Adaptive Cruise Control System Market Size covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value Adaptive Cruise Control System Market Insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

The rising emphasis on road safety and automation is driving the global adoption of Advanced Driver Assistance Systems (ADAS), including Adaptive Cruise Control (ACC). According to the European Commission, over 90% of road accidents are caused by human error, prompting regulatory bodies and consumers to favor intelligent driving systems. ACC, which automatically adjusts a vehicle’s speed based on traffic flow, has become a standard feature in many mid-to-high-end vehicles. As of 2023, over 75% of new cars sold in Europe were equipped with at least one ADAS feature, with ACC adoption steadily increasing. In the U.S., the National Highway Traffic Safety Administration (NHTSA) reported that vehicles with ADAS features reduce rear-end collisions by nearly 50%. This strong safety performance, coupled with driver convenience, is making ACC a preferred feature among buyers and prompting automakers to expand its integration across broader vehicle segments.

Furthermore, stringent government regulations aimed at reducing road accidents and enhancing vehicular safety are a major driver for the adoption of Adaptive Cruise Control (ACC) systems. Regulatory bodies across regions are mandating the inclusion of ADAS features, including ACC, in new vehicles. The European Union’s General Safety Regulation (GSR), implemented in July 2022, requires all new vehicles sold in the EU to include advanced safety technologies such as intelligent speed assistance, lane-keeping systems, and adaptive cruise control. Similarly, in the United States, the NHTSA’s New Car Assessment Program (NCAP) includes ACC in its recommended ADAS technologies. In Japan, over 90% of new passenger cars come equipped with automatic braking and adaptive cruise systems, largely due to government safety campaigns. These regulatory frameworks are compelling automakers to integrate ACC as a standard or optional feature, thus accelerating market growth and ensuring higher safety standards across global ACC System Market.

Also, technological progress in sensors, software, and computing power is significantly enhancing the accuracy and efficiency of Adaptive Cruise Control (ACC) systems. ACC now leverages a combination of radar, lidar, and camera-based sensors, supported by real-time AI algorithms, to make complex driving decisions such as stop-and-go traffic management and predictive braking. The development of SAE Level 2 and Level 3 autonomous vehicles heavily relies on ACC as a foundational technology. For instance, Tesla’s Autopilot and GM’s Super Cruise systems integrate adaptive cruise with lane centering for semi-autonomous driving. According to Intel, an average autonomous vehicle generates 4 terabytes of data per day, requiring advanced ACC systems capable of processing inputs instantly. Additionally, sensor costs have decreased—automotive radar unit prices dropped by over 30% between 2018 and 2023, making it more feasible to integrate ACC into mid-range vehicles. These advancements are making ACC smarter, faster, and more scalable for mass adoption.

The rapid expansion of premium and electric vehicle (EV) segments is significantly driving the adoption of Adaptive Cruise Control (ACC) systems. High-end vehicles often come equipped with advanced safety and comfort technologies, including ACC, as standard features. According to the International Energy Agency (IEA), global EV sales exceeded 14 million units in 2023, accounting for 18% of all car sales, a sharp increase from just 4% in 2020. Leading EV manufacturers like Tesla, BMW, and Mercedes-Benz offer ACC as part of their advanced driver-assist suites. Additionally, over 85% of new luxury cars sold globally in 2023 were equipped with ACC or similar semi-autonomous features. As consumer expectations rise in terms of technology and safety, automakers are integrating these features to differentiate their offerings and meet demand. The premium and EV segments, due to their tech-oriented positioning, serve as key platforms for ACC adoption and innovation.

One of the major barriers to the widespread adoption of Adaptive Cruise Control (ACC) systems is their high implementation cost, especially in developing markets. Advanced ACC relies on a combination of radar, lidar, cameras, and high-performance processors—all of which contribute significantly to the overall cost of a vehicle. For instance, a single automotive-grade radar sensor can cost between $50 and $200, while a lidar unit may range from $500 to over $1,000, depending on resolution and range. Integrating these components with control units and safety-certified software adds to development and validation costs for automakers. This is particularly restrictive for price-sensitive markets like India or Southeast Asia, where a large percentage of vehicles sold are in the entry-level or budget segment. As a result, OEMs may choose to limit ACC offerings to premium models, slowing overall market penetration despite growing interest in vehicle safety.

Furthermore, the performance of Adaptive Cruise Control (ACC) systems is highly dependent on the quality of road infrastructure and sensor reliability, which can limit adoption, especially in emerging markets. ACC systems rely on clear lane markings, accurate traffic signs, and consistent road conditions to function optimally. However, in many developing countries, poor or inconsistent infrastructure—such as faded lane lines, potholes, and irregular traffic patterns—can degrade system accuracy and safety. Additionally, sensors like radar and lidar face challenges in adverse weather conditions; for example, fog, heavy rain, and snow can reduce sensor effectiveness by up to 30-50%, according to automotive sensor studies. Dust and dirt buildup on sensors can further impair detection. These limitations create uncertainty around system reliability, leading some consumers and manufacturers to hesitate in adopting ACC technologies widely, particularly in regions where road maintenance and environmental factors are less controlled.

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer substantial growth opportunities for Adaptive Cruise Control (ACC) systems. Rapid urbanization and increasing vehicle ownership rates are driving demand for safer, smarter vehicles in countries like India, Brazil, and Indonesia. According to the International Organization of Motor Vehicle Manufacturers (OICA), India’s vehicle production increased by 7.5% in 2023, indicating growing automotive activity. Although ACC penetration is currently low in these markets due to cost sensitivity, improving consumer awareness about vehicle safety and favorable government initiatives supporting safer mobility are paving the way for wider adoption. Automakers are responding by launching more affordable vehicle models equipped with ADAS features tailored for these regions. Furthermore, infrastructure improvements and digital connectivity expansion support the integration of ACC systems, making emerging markets a critical focus area for growth and OEM partnerships.

The aftermarket segment presents a significant Adaptive Cruise Control System Market Opportunity adoption, especially in regions with long vehicle replacement cycles. In many developing countries, the average age of vehicles on the road exceeds 8-10 years, with a substantial share of used cars lacking modern safety features. According to the International Transport Forum, retrofitting vehicles with ADAS technologies, including ACC, could reduce accidents by up to 30% in these Global Adaptive Cruise Control System Market. Third-party suppliers and automotive workshops are increasingly offering retrofit ACC kits compatible with older models, allowing consumers to upgrade safety features without purchasing new vehicles. This segment is especially promising in North America and Europe, where vehicle owners show growing interest in enhancing vehicle safety post-purchase. As retrofit technologies become more affordable and user-friendly, they are expected to drive secondary growth and broaden ACC’s reach beyond new car sales.

The evolution of connected vehicles and smart mobility ecosystems presents a major growth opportunity for Adaptive Cruise Control (ACC) systems. ACC integrated with Vehicle-to-Everything (V2X) communication can leverage real-time traffic data, GPS, and cloud-based analytics to predict road conditions and dynamically adjust driving behavior. According to a study by McKinsey, connected vehicle technologies could reduce traffic accidents by up to 80% by 2030, with ACC playing a critical role in this transformation. The rise of 5G networks enables faster, more reliable communication between vehicles and infrastructure, enhancing ACC responsiveness and safety. Moreover, integration with advanced driver-assistance systems and autonomous driving software allows for seamless transitions between manual and automated driving. Automakers and technology providers are actively investing in these integrated solutions, positioning ACC as a foundational technology in future smart transportation systems.

Segmental Analysis

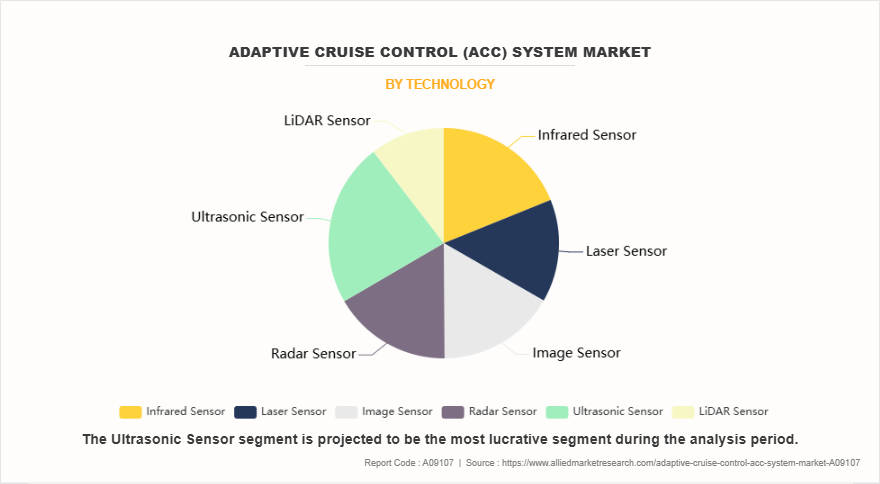

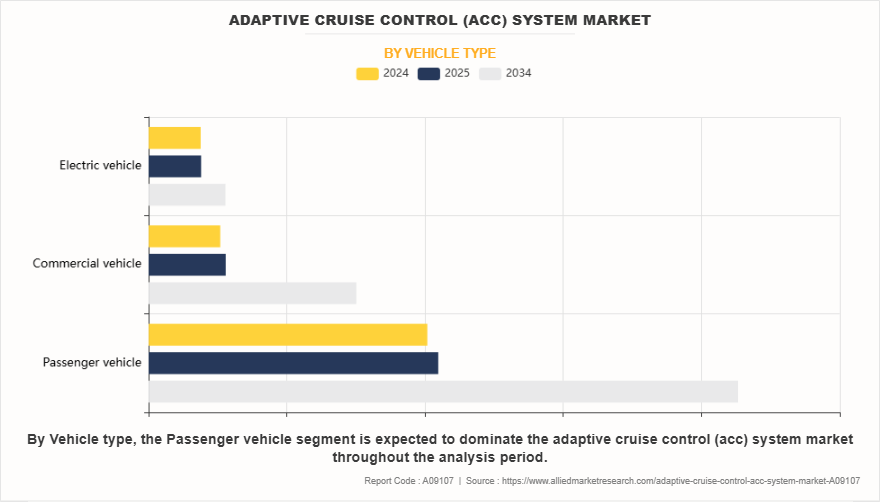

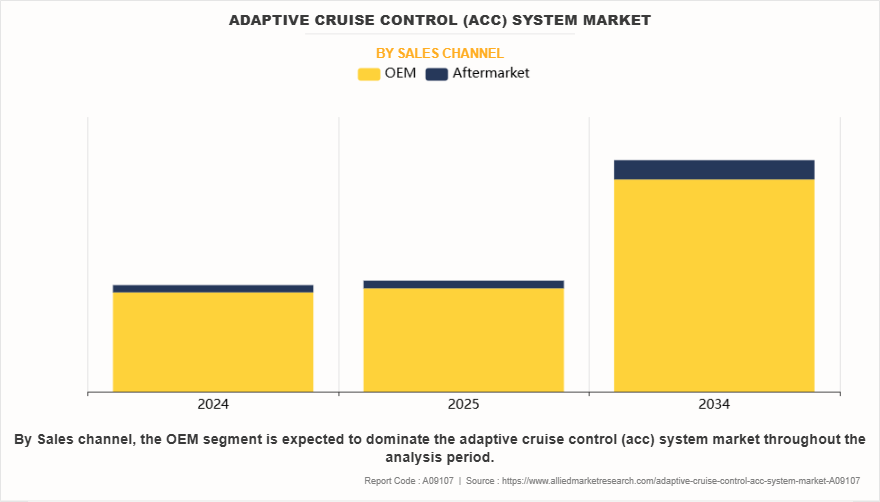

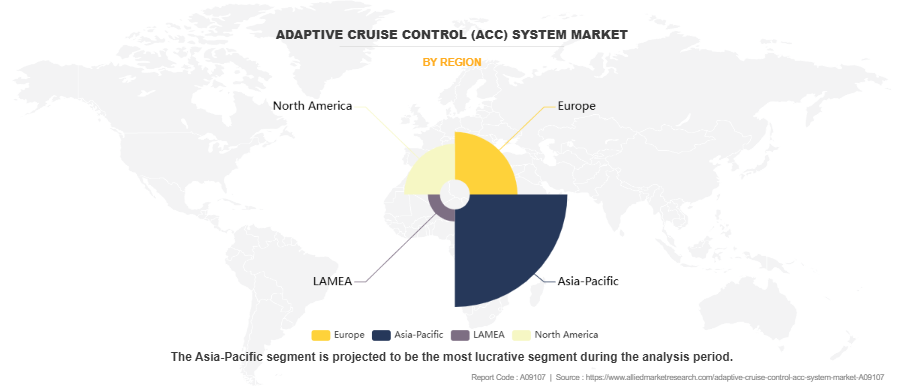

The adaptive cruise control market is segmented on the basis of technology, vehicle type, sales channel and region. By Technology, the Adaptive Cruise Control System Industryis categorized into Infrared Sensor, Laser Sensor, Image Sensor, Radar Sensor, Ultrasonic Sensor, LiDAR Sensor. By Vehicle Type, the market is further divided into Passenger Vehicle, Commercial Vehicle, Electric Vehicle. By Sales Channel, the Global Adaptive Cruise Control System Market is bifurcated into OEM, Aftermarket Region wise, the market is sub-divided into North America, Europe, Asia-Pacific, and LAMEA.

By technology

By technology, the Ultrasonic Sensor segment dominated the global market in the year 2024 and is likely to remain dominant during the forecast period. Ultrasonic sensors play a vital role in short-range object detection, especially in low-speed scenarios, making them ideal for ACC systems that require precise proximity sensing. These sensors offer advantages such as cost-effectiveness, reliability, and easy integration with other sensor technologies, enhancing their adoption across various vehicle types. Ultrasonic sensors are particularly effective in parking and stop-and-go traffic, where accurate distance monitoring and collision avoidance are critical. As the demand for more efficient, cost-effective ACC systems grows, the reliance on ultrasonic sensors is expected to increase. The growing need for safety features in vehicles and the integration of ACC systems into mass-market models further drive the growth of the ultrasonic sensor segment.

By vehicle type

By vehicle type, passenger vehicles segment dominated the global Adaptive Cruise Control System Industry in the year 2024 and is likely to remain dominant during the forecast period. Passenger vehicles, comprising a large portion of the global automobile market, have seen increasing demand for advanced driver-assistance systems (ADAS) like ACC to improve safety and driving comfort. As more consumers prioritize safety features and convenience, automakers have incorporated ACC into mid-range and high-end passenger models. The rising focus on reducing road accidents and enhancing driving experiences, especially in congested urban environments, contributes to the growing demand for ACC systems in passenger vehicles. Moreover, the integration of ACC with other autonomous features, such as lane-keeping assist and automatic braking, is becoming increasingly common in new vehicle models. This trend ensures the continued dominance of the passenger vehicle segment in the global ACC system market.

By sales channel

By sales channel, the OEM sales channel segment dominated the global market in the year 2024 and is likely to remain dominant during the forecast period. Original Equipment Manufacturers (OEMs) play a crucial role in the integration of ACC systems into vehicles at the time of production. As automakers increasingly prioritize the inclusion of safety technologies like ACC in their vehicle models to meet regulatory standards and consumer demand, OEMs are at the forefront of market growth. Additionally, OEMs benefit from economies of scale, ensuring the production and integration of ACC systems are both cost-effective and widespread across various vehicle models. As ACC becomes a standard feature in mid-range and luxury vehicles, the OEM channel is projected to continue to capture the largest Adaptive Cruise Control System Market Share. Furthermore, collaboration between automakers and suppliers of ACC components will strengthen OEM market dominance.

By Region

By Region, Asia-Pacific region dominated the global market in the year 2024 and is likely to remain dominant during the Adaptive Cruise Control System Market Forecast period. This dominance can be attributed to the rapid automotive industry growth in countries like China, Japan, South Korea, and India, which are key markets for vehicle production and adoption of advanced technologies. The region’s growing demand for passenger and commercial vehicles, coupled with the government's focus on improving road safety, has created a conducive environment for ACC system adoption. Additionally, the rise of electric vehicles (EVs) in the region, combined with advancements in autonomous driving technology, has further boosted the Adaptive Cruise Control System Market Demand for ACC systems. As Asia-Pacific continues to lead in vehicle production and sales, the implementation of ADAS technologies, including ACC, is expected to grow significantly, ensuring that the region remains a dominant force in the global market.

Competition Analysis

Key Players included in the Adaptive Cruise Control System Market Analysis are DENSO Corporation, Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, VALEO SA, Magna International Inc., Hyundai Mobis Co Ltd., Ford Motor Company, Velodyne Lidar, Inc., Aisin Seiki Co., Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current Adaptive Cruise Control System Market Trends, estimations, and dynamics of the adaptive cruise control (acc) system market analysis from 2024 to 2034 to identify the prevailing adaptive cruise control (acc) system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the adaptive cruise control (acc) system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global adaptive cruise control (acc) system market trends, key players, market segments, application areas, and Adaptive Cruise Control System Market Growth strategies.

Adaptive Cruise Control (ACC) System Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 12.7 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 250 |

| By Technology |

|

| By Sales channel |

|

| By Vehicle type |

|

| By Region |

|

| Key Market Players | Robert Bosch GmbH, Hyundai Mobis Co Ltd., Magna International Inc., Velodyne Lidar, Inc., Ford Motor Company, DENSO Corporation, ZF Friedrichshafen AG, VALEO SA, Continental AG, Aisin Seiki Co., Ltd. |

Analyst Review

The Adaptive Cruise Control (ACC) System Market is rapidly evolving, driven by the broader transformation of the global automotive landscape toward automation, safety, and connected mobility. As one of the most mature and widely adopted advanced driver-assistance systems (ADAS), ACC has transitioned from being a luxury feature to a core safety component in mainstream passenger vehicles. This shift is being strongly supported by regulatory frameworks, rising consumer safety expectations, and advancements in sensor technology.

the market is in a strong growth phase, particularly due to the increasing standardization of ACC in new vehicle models across key markets such as Europe, North America, China, and Japan. Regulatory mandates like the European Union’s General Safety Regulation (GSR), effective from 2024, have compelled automakers to integrate ACC systems in all new vehicles, accelerating adoption across both premium and mid-range segments. Moreover, emerging economies in Asia-Pacific are witnessing strong demand for vehicles equipped with ACC, primarily fueled by rising disposable incomes and growing awareness about road safety.

Technological evolution is a critical growth enabler. The convergence of radar, lidar, camera, and ultrasonic sensors has significantly enhanced the accuracy and reliability of ACC systems. Furthermore, the integration of artificial intelligence and machine learning into these systems allows for more adaptive behavior based on driving patterns and real-time road conditions. Leading players such as Bosch, Continental, and Denso are heavily investing in AI-enabled adaptive cruise control solutions, enhancing not only safety but also vehicle efficiency and driver comfort.

However, challenges persist—particularly related to cost and system complexity. High sensor costs, coupled with the technical demands of sensor fusion and calibration, continue to restrict adoption in budget vehicle segments and in price-sensitive markets like Southeast Asia and Africa. Additionally, the variability of driving conditions—ranging from traffic congestion to inclement weather—requires continuous refinement of algorithms to ensure consistent system performance. These issues underscore the need for scalable, cost-effective ACC solutions that can be integrated across all vehicle classes.

A particularly promising development is the emergence of V2X (Vehicle-to-Everything) communication technologies, which are expected to reshape how ACC systems interact with their environment. By enabling vehicles to communicate with traffic signals, other vehicles, and road infrastructure, V2X integration can significantly improve ACC responsiveness and safety. This evolution aligns well with the automotive industry's vision for fully autonomous driving, where ACC will serve as a foundational element.

The global adaptive cruise control ACC system market was valued at $5,821.7 million in 2024, and is projected to reach $12,649.1 million by 2034, registering a CAGR of 8.5%.

From 2024-2034 would be forecast period in the market report.

$5,821.7 million is the market value of ACC Market in 2025.

2024 is base year calculated in the ACC Market report.

Analog Devices, Inc., BorgWarner Inc., Continental AG, DENSO Corporation, NXP Semiconductors, Robert Bosch GmbH are the top companies hold the market share in ACC Market.

Loading Table Of Content...

Loading Research Methodology...