Adiabatic Cooler Market Research: 2032

The Global Adiabatic Cooler Market Size was valued at $626.8 million in 2022, and is projected to reach $1 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032. Adiabatic cooling systems use evaporation as a means of cooling the entering air passing through a finned heat exchanger. In a properly designed and operated system, the finned heat exchanger stays dry, protecting the surfaces from scale and corrosion. The adiabatic air cooling can be accomplished by spraying water into the airstream or by using wetted pads that provide a surface for water and air to interface.

Market Dynamics

The increasing demand for adiabatic coolers can largely be attributed to the increasing adoption of adiabatic coolers in various sectors. The adiabatic cooler market is experiencing a surge owing to the growth in population and increase in the consumption of packaged food, beverages, meat products, dairy, and others, included in the food & beverage industry. In addition, upgradation of existing cold storages in developing countries is also driving the market. Moreover, the adoption of eco-friendly and energy-efficient adiabatic coolers is a major factor driving the market. However, high initial costs act as restraints to the market. Contrarily, the technological developments in the adiabatic cooler are expected to provide lucrative growth opportunities to the market players in the coming years.

In addition, the adiabatic cooler is an important equipment used to reduce the heat in the surrounding atmosphere. In an adiabatic cooler, volume expansion causes a change in air pressure, which is responsible for the reduction of heat. The adiabatic cooler is used at many commercial places to reduce the heat generated in that place. Data generation centers also use adiabatic coolers to cool the servers. Adiabatic coolers offer a wide range of applications in different sectors, such as food and beverages, chemical and petrochemical, and industrial manufacturing, where temperature reduction is very important and is expected to boost the adiabatic cooler market growth.

Segmental Overview

The adiabatic cooler market is segmented on the basis of product type, orientation, end user industry, and region. By product type, the market is categorized into dry air coolers and liquid coolers. On the basis of orientation, it is bifurcated into V-type, and horizontal. And on the basis of end-user industry, the market is categorized into oil and gas, industrial manufacturing, chemical and petrochemical, food and beverage and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

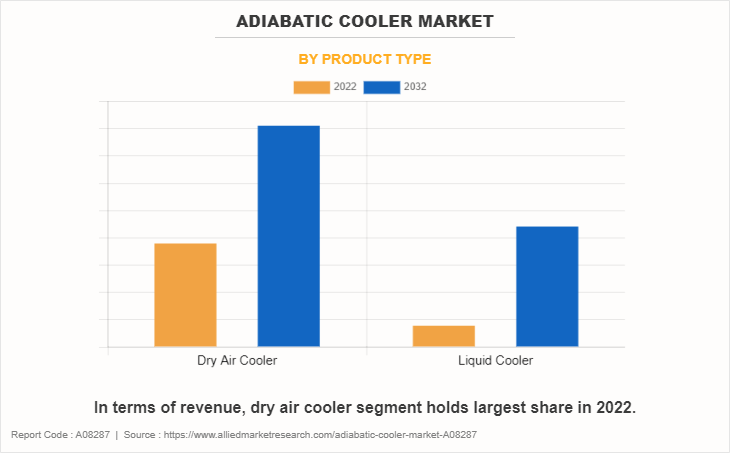

By Product Type

In terms of revenue, dry air cooler segment holds largest share in 2022. In 2022, the dry air cooler segment dominated the adiabatic cooler Industry, in terms of revenue, and liquid cooler is expected to grow at the highest CAGR during the forecast period. Dry air coolers are frequently used in situations where water resources are limited or where environmental concerns call for water conservation is expected to boost the growth of the market. The Adiabatic Cooler is used in various industrial processes, power plants, and HVAC systems to maintain ideal operating temperatures.

For example, dry air coolers are used including cooling the lubricating oil in a gas turbine power facility, cooling process water in a chemical manufacturing plant, or regulating the temperature of server racks in data centers. In addition, a liquid cooler uses liquid such as water or refrigerant for applications in various industries and machinery. It operates by leveraging adiabatic cooling, a process where the fluid's temperature is lowered through the evaporation of water, without relying on external heat sources or additional energy input. In addition, an adiabatic liquid cooler incorporates a wet medium or surface where water is introduced, and as air moves across this damp surface, it leads to the evaporation of water, consequently decreasing the fluid's temperature.

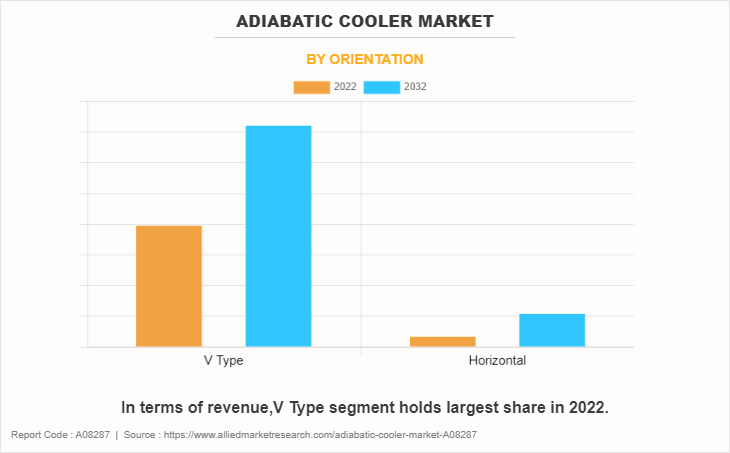

By Orientation

In terms of revenue,V Type segment holds largest share in 2022. the V-type segment dominated the adiabatic cooler Industry, in terms of revenue, and horizontal is expected to grow at the highest CAGR during the forecast period. V-type adiabatic coolers, also known as V-coolers, come with numerous benefits and are expected to boost the growth of the market. These coolers sport a V-shaped design with moistened pads or surfaces for adiabatic cooling. It offers various advantages such as energy efficiency, water conservation, and improved cooling performance.

V-type adiabatic coolers are designed to effectively lower the temperature of the air entering HVAC systems or industrial processes. In addition, the adoption of V-shaped adiabatic coolers in various industries is expected to boost the growth of the market. In the steel industry, it is used for electrical arc furnaces and induction furnace cooling. It is also used in various industries such as refinery and petrochemicals, rubber, poly film, plastic, refrigeration, and air conditioning, and in the power, industry is used for turbine lube oil coolers.

These coolers can be used in existing HVAC systems, data centers, or industrial processes, providing effective cooling solutions in various settings. Furthermore, the reduced reliance on mechanical cooling systems and the associated energy consumption is a significant driver for the adoption of V-coolers, as they align with contemporary objectives of energy efficiency and environmental responsibility in industrial and commercial sectors.

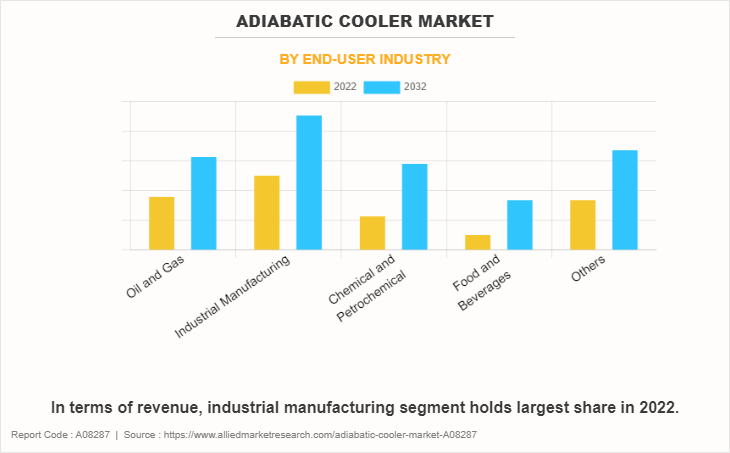

By End-User Industry

In terms of revenue, industrial manufacturing segment holds largest share in 2022. The adiabatic cooler market is categorized into oil and gas, industrial manufacturing, chemical and petrochemical, food and beverage, and others. In 2022, the industrial manufacturing segment dominated the market, in terms of revenue, and chemical and petrochemical is expected to grow at the highest CAGR during the forecast period. The chemical processing facilities perform a wide range of exothermic processes.

The removal of heat from these exothermic processes is important for process control and the safety of the manufacturing facility. This creates a demand for efficient adiabatic coolers to maintain a safe temperature in chemical processing and storage facilities. Furthermore, chemical industries require adiabatic coolers to maintain safe temperature during processing and storage of volatile organic compounds such as benzene. Chemical industries further consist of reactors, and the productivity of the chemical plants is related to the cooling time of these reactors.

The increase in population has fostered the demand for various home care, personal care, and agricultural products. The chemical industry is a supplier of raw materials to manufacturers of products such as paint, detergent, personal care products, paper, and pesticides; thus, expansion of the chemical industry is anticipated to boost the demand for adiabatic coolers, thereby augmenting the growth of the global market. Petrochemical industries are witnessing a surge owing to the rise in demand for fuel by automotive users, shippers, and transporters, and the energy industry is expected to boost the demand for the adiabatic cooler market.

By Region:

The adiabatic cooler market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, Asia-Pacific had the highest share in the adiabatic cooler market share and is anticipated to secure the leading position during the forecast period, due to extensive demand in the industrial manufacturing segment. Factors such as availability of workforce and low-cost manufacturing have propelled the manufacturing sector in Asia Pacific. The food processing and manufacturing industries are the major contributors to the GDP of countries such as Japan, South Korea, and Australia.

Furthermore, China is one of the largest providers of activated pharmaceutical ingredients, and the Indian pharmaceutical industry is witnessing substantial growth. These factors have driven the demand for adiabatic coolers in Asia-Pacific. Furthermore, Paharpur Cooling Towers Ltd. is the major manufacturer of adiabatic coolers operating in Asia-Pacific.

In addition, various government initiatives have boosted the manufacturing sector in the region. For instance, make in India launched by the Indian Government, and Made in China 2025 launched by the Chinese Government have fueled the growth of the manufacturing sector. Furthermore, the exponential rise in population and rapid development of the manufacturing industries have fueled the demand for electricity, thereby increasing the number of power plants in the region. These factors are expected to provide lucrative opportunities for the growth of the adiabatic coolers market in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the adiabatic cooler market such as ALFA LAVAL, Baltimore Aircoil Company Inc., EVAPCO Inc., Guntner Group, FRIGEL FIRENZE S.p.A., ICS Cool Energy Limited, MITA Group, SPX Cooling Technologies, Thermax Limited, and Vistech Cooling Systems are provided in this report. There are some important players in the adiabatic cooler market such as EVAPCO Inc., SPX Cooling Technologies, and Gunter Group. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the adiabatic cooler market.

Some examples of product launches in the market

In September 2022, in February 2022, Baltimore Aircoil Company (BAC) announced the launch of a new TrilliumSeries Adiabatic Cooler. The adiabatic cooler is ideal for applications that demand a combination of energy efficiency and limited water use. TrilliumSeries Cooler is that it captures and reuses water, unlike once-through systems, and is optimized for adiabatic operation, a form of heat rejection that is more efficient than dry coolers and uses less water than evaporative cooling. Its innovative design maximizes both water and energy efficiency, ultimately minimizing costs.

In August 2022, Gunter Group launched the high-density adiabatic cooler (dry) and condensers. High-density adiabatic dry coolers and condensers operate in dry and evaporative mode. Dry cooling is usually sufficient at most loads and temperatures. The system contains humidification pads installed in front of the heat exchangers as well as the intelligent control modules GHM and GMMnext. They dynamically adjust the cooling water flow to provide the required level of extra cooling. The High density adiabatic dry coolers and condensers use up to 70 percent less water compared to cooling towers.

In September 2023, FRIGEL FIRENZE S.p.A. launched an adiabatic cooler equipped with pre-cooler pads, ensuring not only exceptional thermal efficiency but also safe operation. The next-generation Ecodry 4DK is a groundbreaking solution in the field of efficient cooling, particularly suited for applications where traditional open cooling towers face challenges related to water consumption, treatment, and the risk of Legionella contamination.

Partnership in the market

In September 2023, Mita Group announced the partnership with Frigofluid which offers industrial chillers, refrigeration systems, and adiabatic coolers. This aims to improve the product portfolio.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging adiabatic cooler market trends and dynamics.

- In-depth adiabatic cooler market analysis is conducted by constructing market estimations for the key market segments between 2020 and 2032.

- Extensive analysis of the adiabatic cooler market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The adiabatic cooler market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within the adiabatic cooler market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the adiabatic cooler industry.

Adiabatic Cooler Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 264 |

| By Product Type |

|

| By End-User Industry |

|

| By Orientation |

|

| By Region |

|

| Key Market Players | Vistech Cooling Systems, ALFA LAVAL, FRIGEL FIRENZE S.p.A., Baltimore Aircoil Company Inc., Guntner Group, SPX Cooling Technologies, EVAPCO, Inc., Thermax Limited, ICS Cool Energy Limited, MITA Group |

Analyst Review

The increase in industrialization and the growth of sectors such as manufacturing, power generation, and data centers drive the demand for efficient adiabatic coolers. In addition, growth in emphasis on energy-efficient environmental stability and regulatory compliances fuel adoption of adiabatic coolers in industries. However, the high initial investment cost and operational expenses associated with the adiabatic coolers pose a challenge for a smaller industry or those with limited budgets.

Moreover, the rise in demand for manufactured products across the globe, especially in developing countries such as India and China, has led to an increase in the number of manufacturing facilities; thereby, driving the demand for adiabatic coolers in the region. In 2020, Asia-Pacific accounted for the highest share in the adiabatic cooler market and LAMEA is expected to grow at a significant CAGR during the forecast period. Furthermore, the expanding demand for cooling solutions in developing nations, such as in the manufacturing of electric vehicles and renewable energy sources, has created a new market region with considerable development potential.

rRse in the oil and gas industry, growth in the chemical upcoming trends of Adiabatic Cooler Market in the world

Oil and Gas, Industrial Manufacturing, Chemical and Petrochemical, Food and Beverages are the leading end users indutry of Adiabatic Cooler Market

Asia-pacific is the largest regional market for Adiabatic Cooler

The global adiabatic cooler market was valued at $626.8 million in 2022.

ALFA LAVAL, Baltimore Aircoil Company Inc., EVAPCO, Inc., Guntner Group, FRIGEL FIRENZE S.p.A., ICS Cool Energy Limited, MITA Group, SPX Cooling Technologies, Thermax Limited, and Vistech Cooling Systems.

The global adiabatic cooler market is projected to reach $1,025.9 million by 2032

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

High purchasing cost of products is the effecting factor for market.

Loading Table Of Content...

Loading Research Methodology...