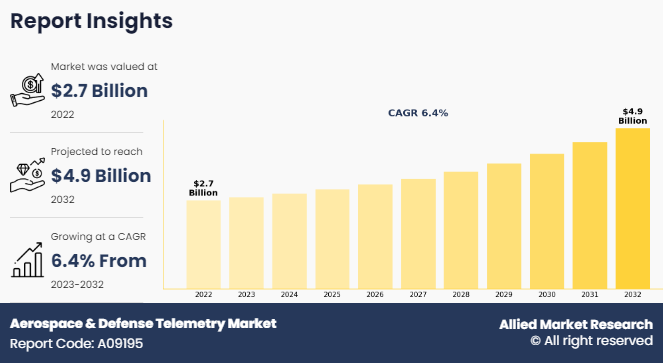

The global aerospace & defense telemetry market was valued at $2.7 billion in 2022, and is projected to reach $4.9 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032.

Aerospace and defense telemetry is a critical technology utilized in the aerospace and defense industries for data acquisition and transmission from remote objects, such as aircraft, missiles, satellites, and unmanned vehicles, to ground stations or control centers. The objective of the telemetry systems is to collect a range of real-time data, including environmental variables, flight characteristics, performance indicators, and mission-critical data. The performance and safety of aerospace and defense systems are monitored and analyzed with the help of this telemetry data, which helps engineers and operators make well-informed decisions during missions or operations. Telemetry data helps assess how assets, such as airplanes, behave in a variety of operational environments. This information may be used to spot possible problems, improve performance, and raise overall effectiveness.

Key Takeaways

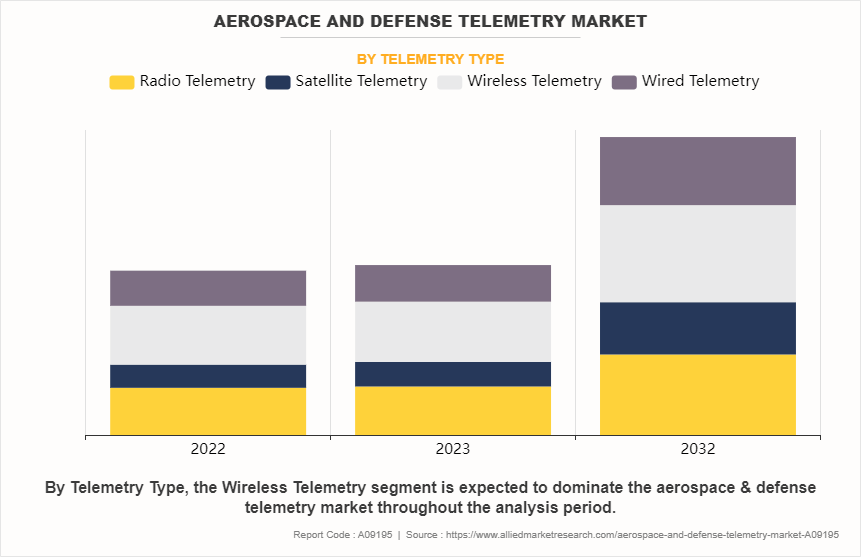

On the basis of telemetry type, the wireless telemetry segment held the largest share in the aerospace and defense telemetry market in 2022.

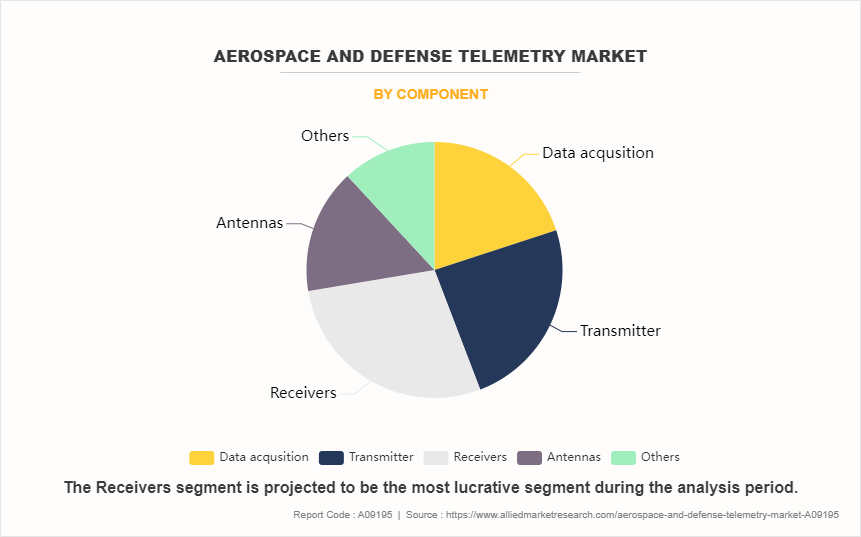

By component, the receivers unit segment held the largest share in the market in 2022.

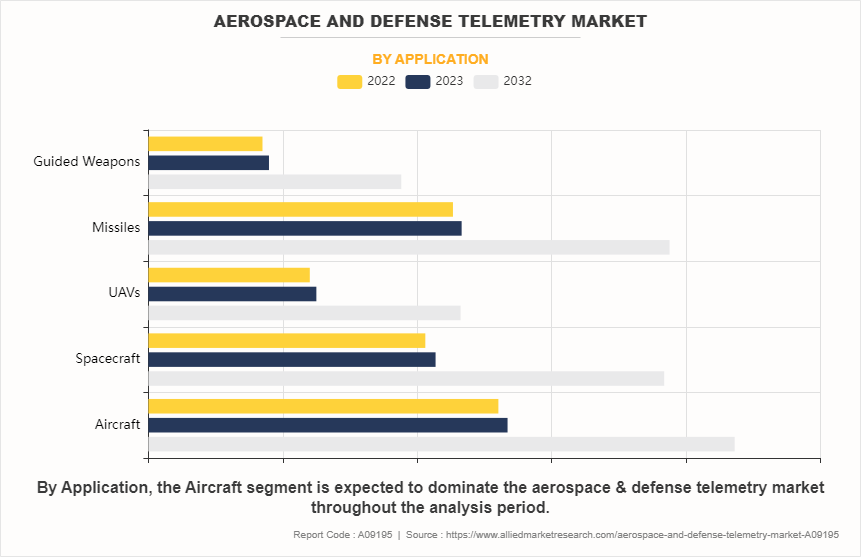

On the basis of application, the aircraft segment held the largest market share in 2022.

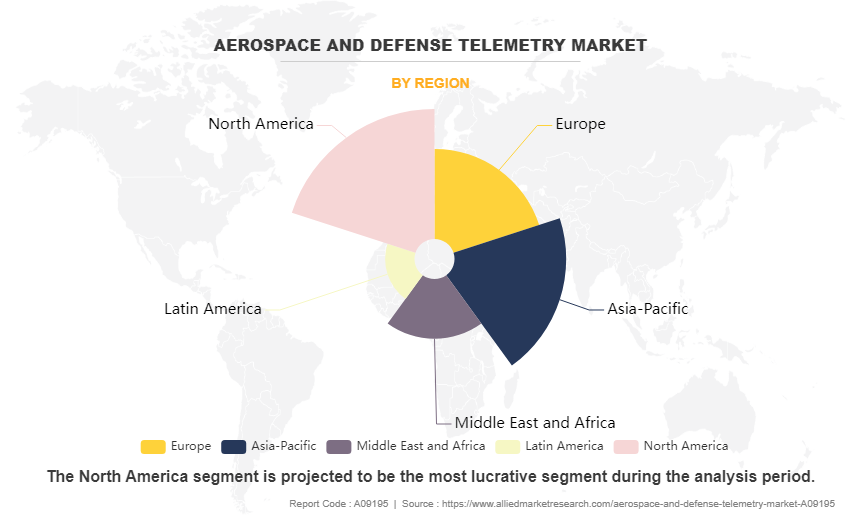

On the basis of region, North America held the largest market share in 2022.

Advanced communication technologies are utilized by defense and aerospace telemetry systems to guarantee secure and dependable data transfer over extended distances and in difficult conditions. Since the data being communicated frequently contains sensitive and classified information, these systems are subject to strict security requirements. Telemetry solutions are become more complex as technology advances, providing increased data rates, better accuracy, and stronger encryption to satisfy the aerospace and defense industries' rising needs.

For instance, in February 2022, Smiths interconnect has announced a manufacturing contract from Lockheed Martin to manufacture high gain high sensitivity (HGHS) antenna systems to protect the U.S. navy ships from threats during mission critical operations. The high gain high sensitivity (HGHS) antenna is enabled by Smiths Interconnect’s 30-year heritage of antennas and sofware capabilities to provide enhanced frontline situational awareness and ship protection from inbound threats. The contract includes manufacture and test of the high gain high sensitivity antenna systems along with embedded control and interface software.

For instance, in April 2022, L3Harris Technologies was one of two vendors awarded a $6 billion-ceiling IDIQ contract to deliver advanced tactical radios under the U.S. Army’s Combat Net Radio (CNR) modernization program. The contract includes a five-year base and an additional five-year option. L3Harris received an initial delivery order of $20 million.

Rise in demand for unmanned systems is a significant driver of the growth of the aerospace and defense telemetry industry. Unmanned systems are used in many different types of operations, such as target acquisition, cargo delivery, and reconnaissance and surveillance. For gathering data in real time regarding the operation, status, and surroundings of such unmanned platforms while on missions, telemetry systems are important. This information is essential for evaluating operational efficacy, keeping an eye on system health, and guaranteeing mission accomplishment. Furthermore, technological advancements in sensors and communication have driven the demand for the aerospace and defense telemetry industry.

However, budgetary constraints and defense spending has hampered the growth of the aerospace and defense telemetry market. Tight defense budgets can cause delays in telemetry system project financing and procurement decisions. Spending on vital military initiatives or other operational necessities may take precedence over investments in telemetry technology extensions or upgrades for government agencies and defense groups. Moreover, stringent regulatory requirements are major factors that hamper the growth of the aerospace and defense telemetry industry.

On the contrary, integration of telemetry with artificial intelligence (AI) is a lucrative opportunity for the growth of the market. Large amounts of real-time data gathered from aerospace and defense platforms, such as airplanes, unmanned aerial vehicles (UAVs), satellites, and missiles, can be processed by AI-driven telemetry systems. Artificial intelligence (AI) may find patterns, defects, and insights in telemetry data that human operators might miss by using machine learning algorithms. This makes it possible to optimize mission-critical operations, do predictive maintenance, and make better informed decisions.

Segment Review

The aerospace and defense telemetry market are segmented on the basis of telemetry type, component, application, and region. On the basis of telemetry type, the market is divided into radio telemetry, satellite telemetry, wireless telemetry, and wired telemetry. By component, it is divided into data acquisition unit, transmitters, receivers, antennas, and others. On the basis application, it is classified into aircraft, spacecraft, UAVs, missiles, and guided weapons. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Telemetry Type

On the basis of telemetry type, the wireless telemetry segment attained the highest market share in 2022 in the aerospace and defense telemetry market. This is attributed to the fact that wireless telemetry removes the need for physical connections or cables by allowing the real-time transfer of vital data from defense and aerospace systems to ground stations or control centers. This capacity is necessary to provide quick decision-making, keep an eye on mission-critical parameters, and improve situational awareness. Meanwhile, the satellite telemetry segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that satellite telemetry offers global coverage, enabling communication and data transfer from anywhere on earth and beyond. This capability is essential for defense and aerospace applications that require real-time monitoring and control of assets in remote or inaccessible locations, such as oceans, deserts, and polar regions.

By Component

On the basis of component, the receivers segment attained the highest market share in 2022 in the aerospace and defense telemetry market. This is attributed to the fact that receivers are essential components of telemetry systems used in aerospace and defense applications. They are responsible for capturing and demodulating telemetry signals transmitted by sensors, instruments, or data sources. Meanwhile, the antennas segment is projected to be the fastest-growing segment during the forecast period as antennas are essential components of telemetry systems used for receiving and transmitting signals. In aerospace and defense applications, antennas play a crucial role in capturing telemetry data from aircraft, satellites, missiles, drones, and other platforms.

By Application

On the basis of application, the aircraft segment attained the highest market share in 2022 in the aerospace and defense telemetry market. This was due to telemetry systems are required to monitor and optimize an aircraft's performance, safety, and operational efficiency for a range of uses, including flight testing, commercial aviation, military operations, and research and development. To maintain airworthiness and guarantee mission success, telemetry data gathered from aircraft systems, engines, and flight controls is essential. However, this was due to the fact that guided missiles represent some of the most advanced and complex systems in the aerospace and defense industry. These systems require highly sophisticated telemetry solutions to monitor and control their flight, guidance, and performance parameters. The need for cutting-edge telemetry technology to support guided missiles drives innovation and investment in this segment.

By Region

On the basis of region, North America attained the highest market share in 2022 and emerged as the leading region in the aerospace and defense telemetry market. This is attributed to major defense expenditures being allotted by the U.S, in North America, to support efforts for military modernization and national security. The need for telemetry solutions across an array of defense initiatives, including unmanned systems, aviation, missile defense, and space exploration, is fueled by substantial government investments in defense technology and aerospace research.

However, Asia-Pacific is projected to be the fastest-growing region for the aerospace and defense telemetry market during the forecast period. This growth is attributed to the fact the aerospace sector in the Asia-Pacific area is expanding significantly, driven by rising investments in space exploration, aircraft manufacturing, and unmanned aerial systems (UAS). The demand for telemetry systems to support operational safety, aircraft performance monitoring, and flight testing in the civil and military aviation sectors is being driven by this expansion.

The report focuses on growth prospects, restraints, and trends of the aerospace and defense telemetry market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the aerospace and defense telemetry market.

Competitive Analysis

The report analysis the profiles of key players operating in the aerospace and defense telemetry market such as AstroNova, Inc., BAE Systems, CASE, Honeywell International Inc., L3Harris Technologies, Inc.,Orbit Communications Systems, Safran S.A., Mistral Solutions Pvt. Ltd., Curtiss-Wright Corporation, and Kongsberg Defence & Aerospace. These players have adopted various strategies to increase their market penetration and strengthen their position in the aerospace and defense telemetry market.

Rise in Demand for Unmanned Systems

Drones and UAVs are being used more often in a variety of industries, such as public safety, infrastructure inspection, defense, agricultural, and environmental monitoring. Reliable telemetry systems are becoming increasingly important as their applications grow, as they allow for data transmission, remote control, and mission monitoring. Furthermore, global defense organizations are allocating resources towards unmanned systems for military purposes, encompassing target acquisition, combat missions, surveillance, and reconnaissance. By giving real-time information on flight performance, sensor readings, and operational condition, telemetry systems are essential to the upkeep of these unmanned spacecraft. Moreover, the development of advanced unmanned systems with autonomous navigation, obstacle avoidance, and adaptive decision-making is being propelled by the integration of telemetry with artificial intelligence (AI) and autonomous technologies. Communication and data sharing between control centers and autonomous units are made possible by telemetry systems. Therefore, rise in demand for unmanned system drives the aerospace and defense telemetry market size.

Technological Advancements in Sensors and Communication

Sensors have become smaller as a result of technological breakthroughs that have also increased their accuracy and performance. Now that essential factors such as temperature, pressure, acceleration, vibration, and environmental conditions can be precisely measured, smaller, lighter sensors may be included into airplanes, unmanned aerial vehicles (UAVs), missiles, and other platforms. This downsizing makes telemetry applications more widely applicable and makes it easier to gather high-quality data for analysis and decision-making. Furthermore, sophisticated telemetry systems can combine data from several sensors, allowing for thorough system analysis and monitoring. Telemetry systems offer a comprehensive picture of operational situations by combining data from several sensors (such as inertial sensors, GPS receivers, radar, and vision systems), improving situational awareness and operational efficiency. In addition, telemetry systems have been completely transformed by the development of wireless communication technologies, such as radio frequency (RF), satellite communication, and mesh networking. Real-time data transfer, remote control, and connectivity across satellite, ground-based, and aircraft systems are made possible via wireless telemetry. Secure communication protocols and fast data connectivity enable mission-critical applications in demanding and changing contexts. Therefore, technological advancements in sensors and communication are driving the demand for aerospace and defense telemetry market share.

Focus on Mission Effectiveness and Safety

During missions, telemetry devices allow for the real-time monitoring of vital metrics and operational data. Telemetry systems offer vital insights into system performance, health, and mission readiness by continually gathering and delivering telemetry data from sensors on board airplanes, unmanned aerial vehicles, missiles, and other platforms. Furthermore, by giving operators fast and precise information on the state of the environment, the dynamics of the airspace, and mission-critical events, telemetry data improves situational awareness. In addition, during aerospace and defense operations, enhanced situational awareness facilitates risk mitigation, well-informed decision-making, and efficient resource allocation. Moreover, telemetry systems give real-time feedback on target tracking, vehicle dynamics, navigation accuracy, and weapon guidance to support mission planning and execution. Mission planners can more effectively and efficiently accomplish mission objectives by adjusting flight profiles, optimizing routes, and using precise telemetry data. Therefore, telemetry systems give real-time feedback on target tracking, vehicle dynamics, navigation accuracy, and weapon guidance to support mission planning and execution. Mission planners can more effectively and efficiently accomplish mission objectives by adjusting flight profiles, optimizing routes, and using precise telemetry data is driving the growth of the aerospace and defense telemetry market growth.

Budgetary Constraints and Defense Spending

The implementation of budgetary constraints or reduction of defense expenditures by governments may result in funding cuts or delays for procurement and modernization programs. The aerospace and military industry's ability to innovate and increase its market may be impacted by reduced defense budget, which may restrict investment in innovative technology, such as telemetry systems. Furthermore, major defense procurement programs, such as the purchase of new aircraft, missiles, unmanned systems, or sensor platforms, sometimes experience delays or deferrals due to budgetary restrictions. The telemetry systems necessary for these initiatives might see a decrease in demand or a postponed rollout, which is expected to impact prospects for market expansion. Moreover, defense organizations pursue cost reduction and operational efficiency to maximize resource allocation during times of budgetary restrictions. The focus on cost reductions limits the amount of money spent on non-essential technology, which is expected to influence the purchase of telemetry systems. In addition, investments made in R&D projects to advance telemetry technologies and create next-generation capabilities may potentially be impacted by reduced defense funds. Insufficient funds for research and development impede creativity, impede technological advancements, and postpone the release of novel telemetry solutions. Therefore, budgetary constraints and defense spending are hampering the growth of aerospace and defense telemetry market trends

Stringent Regulatory Requirements

Telemetry systems that are used in defense and aerospace applications have to go through strict certification procedures to comply with industry-specific regulations and standards. It might take a long time and money to obtain approvals from regulatory bodies, defense departments, and aviation authorities. This delays the release of new products and their introduction into the market. Furthermore, strict security and encryption requirements for telemetry systems used in military and defense operations are frequently mandated by regulatory frameworks. Mission-critical security and the preservation of sensitive telemetry data depend on adherence to data protection laws, secure communication protocols, and cryptographic specifications. In addition, telemetry systems need to follow communication protocols and interoperability standards to work with the current defense and aerospace infrastructure. It is necessary to follow intricate legal requirements and technological specifications in order to achieve interoperability across many platforms, networks, and mission systems. Therefore, regulatory compliance challenges are hampering the growth of aerospace and defense telemetry market size

Integration of Telemetry with Artificial Intelligence (AI)

Large amounts of telemetry data may be processed in real-time by AI algorithms, which can also identify useful patterns and insights that human analysts would miss. AI improves data analytics capabilities by utilizing machine learning and deep learning techniques, which make predictive maintenance, anomaly detection, and performance optimization possible. Furthermore, autonomous decision-making for unmanned systems, such as autonomous cars, drones, and UAVs, is made possible by AI-driven telemetry systems. Without human assistance, autonomous navigation, obstacle avoidance, mission planning, and adaptive response to changing environments are made possible by the combination of telemetry data and AI algorithms. Moreover, artificial intelligence driven telemetry systems use telemetry data analysis to forecast equipment breakdowns and maintenance requirements. Artificial intelligence (AI)-powered systems maximize maintenance schedules, minimize downtime, and prolong the life of aerospace and defense assets by anticipating potential problems. In addition, when AI is integrated with telemetry systems, routine operations are automated, complicated data streams are analyzed and real-time actionable insights are provided, which lessens the cognitive load on operators. This increases operational effectiveness and efficiency by freeing up operators to concentrate on mission-critical tasks and strategic decision-making. Therefore, integration of telemetry with artificial intelligence (AI) is a lucrative opportunity for aerospace and defense telemetry market forecast.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerospace and defense telemetry market analysis from 2022 to 2032 to identify the prevailing aerospace and defense telemetry market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the aerospace and defense telemetry market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global aerospace and defense telemetry market trends, key players, market segments, application areas, and market growth strategies.

Aerospace & Defense Telemetry Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.9 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 485 |

| By Telemetry Type |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Curtiss-Wright Corporation, L3Harris Technologies, Inc., Orbit Communications Systems, Honeywell International Inc., AstroNova, Inc., Safran S.A., CASE, BAE Systems, Kongsberg Defence & Aerospace, Mistral Solutions Pvt. Ltd. |

Increased adoption of IoT and wireless technologies for real-time data transmission are the upcoming trends of aerospace & defense telemetry market in the world.

Aircraft is the leading application of aerospace & defense telemetry market.

North America is the largest regional market for aerospace & defense telemetry.

USD $4884.5 million is the estimated industry size of aerospace & defense telemetry.

AstroNova, Inc., BAE Systems, CASE, Honeywell International Inc., L3Harris Technologies, Inc.,Orbit Communications Systems, Safran S.A., Mistral Solutions Pvt. Ltd., Curtiss-Wright Corporation, and Kongsberg Defence & Aerospace.

Loading Table Of Content...

Loading Research Methodology...