Aerospace Avionics Market Summary

The global aerospace avionics market size was valued at $48.7 billion in 2022, and is projected to reach $111.6 billion by 2032, growing at a CAGR of 8.9% from 2023 to 2032. The global market size of aerospace avionics system is expected to witness notable growth, owing to a rise in production of aircraft. Enhanced connectivity solutions create lucrative growth opportunities. On the other hand, High initial costs are projected to hinder the market growth.

Key Market Trends and Insights

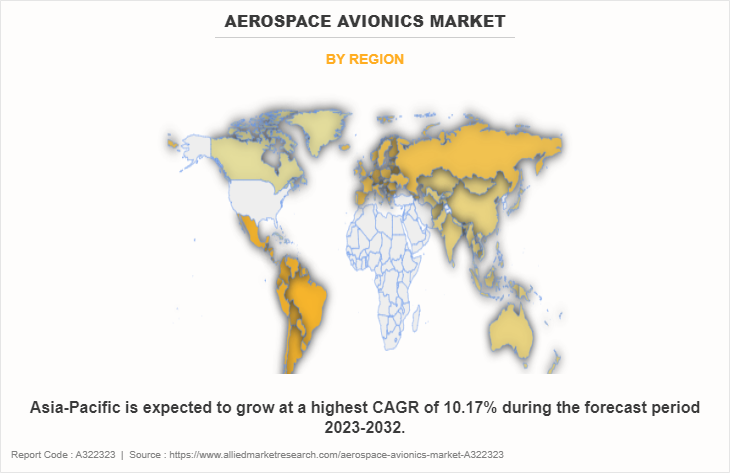

Region wise, North America generated the highest revenue in 2022.

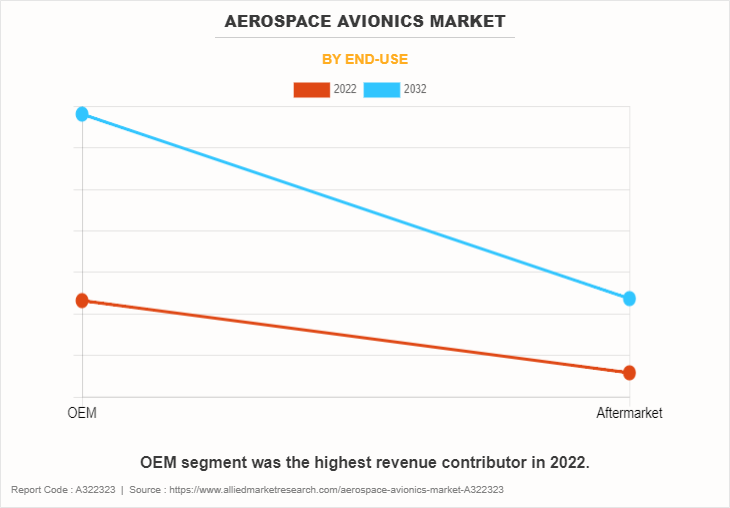

The global aerospace avionics market share was dominated by the OEM segment in 2022 and is expected to maintain its dominance in the upcoming years

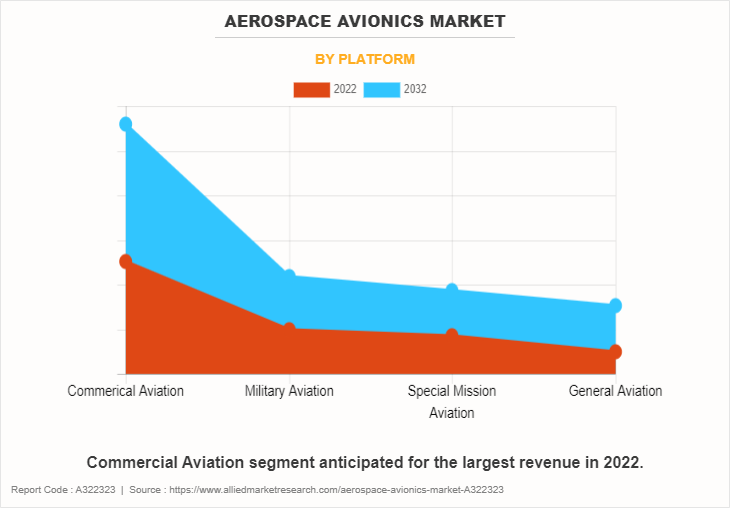

The commercial aviation segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2022 Market Size: USD 48.7 Billion

- 2032 Projected Market Size: USD 111.6 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 8.9%

- North America: Generated the highest revenue in 2022

Report Key Highlighters

- The aerospace avionics market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The aerospace avionics market share is marginally fragmented, with players such as Raytheon Technologies Corporation; Honeywell International Inc.; L3 Harris Technologies; BAE Systems; Thales Group; Curtis Wright Corporation; Northrop Grumman; Safran SA; Leonardo S.P.A, Elbit Systems Ltd. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Rise in Production of Aircraft is Boosting the Market Growth

The increasing production of aircraft is driving advancements in avionics systems. This growth in aircraft manufacturing is fueling the demand for advanced avionics technologies, including precise navigation systems, enhanced communication systems, and overall performance upgrades.

The growing aircraft production and avionics development is shaping a dynamic business environment. For instance, in 2023, Boeing and Airbus collectively delivered 528 and 735 aircraft, respectively, surpassing their 2022 figures of 480 and 661 deliveries. Airbus reported record annual jet orders and confirmed an 11% increase in 2023 deliveries. Avionics innovators are continuously striving to introduce state-of-the-art solutions that meet the evolving needs of the modern aviation industry. This collaborative effort not only addresses current demands but also promotes ongoing enhancement and adaptation to emerging trends in the aerospace sector.

The anticipated surge in aircraft deliveries in the forthcoming years, as manufacturers increase production rates and the international aviation sector continues its recovery from the pandemic, underscores the significance of this aerospace avionics market. For instance, in June 2023 the Boeing official production rate of aircraft was 31 aircraft per month. The International Air Transport Association (IATA) forecasts that the number of air passengers will reach $4.7 billion in 2024, exceeding the 4.5 billion passengers in 2019, indicating a demand for new aircraft in the years ahead.

High Initial Costs are Restricting the Market Growth

The aerospace avionics sector faces challenges to its avionics, with high implementation and maintenance costs posing barriers to aerospace avionics market growth. The difficulties of managing the value chain are compounded by the low profit margins associated with installing expensive avionics systems. Additionally, the aerospace industry is fighting with the rising prices of fuel, further straining profitability and hindering investment in advanced avionics technologies.

In the aerospace sector, the initial cost of implementing networking technologies and connectivity hardware is particularly expensive. For instance, the deployment of satellite technology can cost upwards of $400,000 per aircraft, significantly impacting the adoption rates of connectivity hardware and services, especially among airlines operating in developing regions such as Asia-Pacific and Latin America. This financial burden limits the ability of aerospace companies to modernize their avionics systems and keep pace with technological advancements.

Enhanced Connectivity Solutions will Create Lucrative Growth Opportunities

The pursuit of cutting-edge connectivity solutions in avionics systems presents a strategic opportunity to meet the increasing demand for enhanced connectivity options in the aviation sector. This opportunity revolves around the implementation of state-of-the-art communication technologies, particularly high-speed satellite connectivity and the integration of 5G networks into avionics infrastructure.

For instance, in December 2022, United Airlines launched its largest widebody aircraft order by a U.S. carrier in commercial aviation history, for 100 new 787 Dreamliners plus options to add 100 more. With this order, the airline is now expecting new deliveries of 700 new narrowbody and widebody aircraft by 2032, on an average of 2 aircraft per week in 2023 and 3 aircraft per week in 2024. Such developments render a positive outlook for the aerospace avionics market in North America during the forecast period.

Embracing these advanced connectivity solutions enables avionics systems to facilitate seamless data exchange between aircraft, ground systems, and other airborne platforms. This enhances real-time monitoring capabilities and contributes to improved air traffic management, enhancing operational efficiency and safety. The integration of high-speed satellite connectivity ensures uninterrupted and reliable communication, even in remote or challenging airspace, promoting effective coordination and data sharing.

In addition, in June 2023, at the Paris Air Show, Embraer Services & Support launched the next-generation version of its aircraft health analysis and diagnosis (AHEAD) system for its E-Jets. This AHEAD system will integrate and analyze trends from several systems, such as landing gear, navigation, pneumatics, etc., and can detect anomalies and identify potential issues before they become critical.

Impact of Russia-Ukraine War on Aerospace Avionics Industry

The Russia-Ukraine conflict has the potential to significantly impact the aerospace avionics market due to several interconnected factors. Firstly, disruptions in the supply chain of critical components and technologies could occur, as both Russia and Ukraine are important players in the aerospace manufacturing sector. Any disruption in the supply chain could lead to delays in production of raw materials and delivery of avionics systems, affecting manufacturers and airlines globally.

Agreements imposed by the U.S. and France have directly affected the Russian aviation sector, leading to two major aircraft original equipment manufacturers (OEMs), Boeing and Airbus, refusing to provide spare parts and accessories for their aircraft used by Russian airlines. The analysis indicates that nearly 75% of Russian carriers rely on Airbus and Boeing aircraft. The consequences of these sanctions on parts and accessories for these aircraft are anticipated to significantly restrict the operations of these carriers.

Moreover, the conflict has increased geopolitical tensions, resulting in increased uncertainty within the aerospace industry. This uncertainty can influence investment decisions and market dynamics, potentially leading to delays or cancellations of avionics system upgrades or new projects. Stakeholders in the industry may adopt a cautious approach as they assess the risks and potential implications of the ongoing conflict.

In addition, the economic impact of the Russia-Ukraine conflict can affect throughout the aerospace avionics market. Fluctuations in currency values, trade restrictions, and geopolitical instability can disrupt financial markets and impact the overall economic outlook. Such economic uncertainties can affect demand for avionics systems and influence purchasing decisions by airlines and aircraft manufacturers.

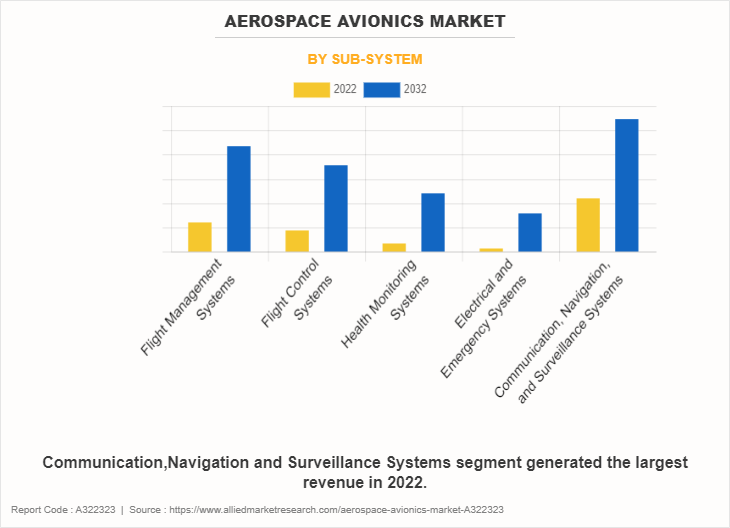

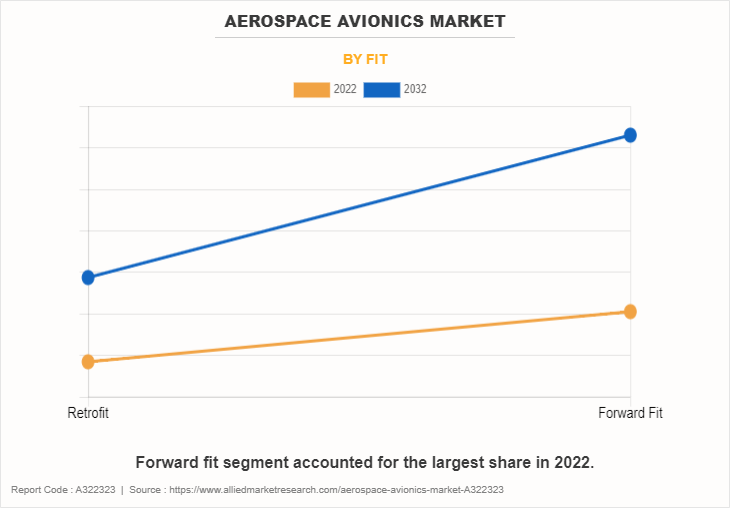

Segments Overview

The aerospace avionics market size is segmented into Sub-System, Fit, Platform and End-Use. On the basis of subsystem, the market is bifurcated into flight management systems, flight control systems, health monitoring systems, electrical & emergency systems and communication, navigation, and surveillance systems. On the basis of fit, the market is classified into retrofit and forward fit. On the basis of platform, the market is divided into military aviation, commercial aviation, general aviation and special mission aviation. On the basis of end-use, it is divided into OEM and aftermarket.OEM segment generated the largest revenue in 2022, and expected to follow the same trend during the forecast period of 2022-2032.

Region wise, the aerospace avionics market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, Spain and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and Latin America (Brazil, Argentina and Rest of Latin America) and Middle East and Africa(Saudi Arabia, UAE, Israel and Africa). On the basis of region, North America is expected to be the largest market shareholder with a CAGR of 8.07% from 2022 to2032 owing to the consistent demand for advanced avionics across aerospace avionics.

Competitive Analysis

Competitive analysis and profiles of the major global aerospace avionics market players that have been provided in the report include Raytheon Technologies Corporation; Honeywell International Inc.; L3 Harris Technologies; BAE Systems; Thales Group; Curtis Wright Corporation; Northrop Grumman; Safran SA; Leonardo S.P.A, Elbit Systems Ltd. The key strategies adopted by the major players of the global aerospace avionics market are product launch and mergers & acquisitions.

Historical Data and Information

The global aerospace avionics market analysis is highly competitive, owing to the strong presence of existing vendors. Vendors of the global market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to aerospace avionics market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/Strategies in Aerospace Avionics Industry

- In January 2024, Universal Avionics (UA) and Trimec Aviation have achieved FAA Supplemental Type Certificate (STC) for the Falcon 2000/EX equipped with the InSight Flight Display System. The upgrade replaces legacy Pro Line 4 avionics with the latest-generation displays and industry-leading synthetic vision to resolve obsolescence issues, maintenance challenges, improve operational efficiency and performance, and enhance safety.

- In June 2023, United Airlines and Panasonic Avionics Corporation signed an agreement for Panasonic's new Astrova in-flight engagement (IFE) solution, making United Airlines the first customer for this IFE in the United States. The airlines plan to install this IFE solution on the new Boeing 787 and Airbus A321XLR starting in 2025. With this agreement, the United Airlines program represents the largest-ever investment in Panasonic Avionics' IFE by any airline.

- In July 2022, Universal Avionics Systems Corporation, a subsidiary of Elbit Systems Ltd., received a contract worth $33 million from AerSale Corporation to supply Enhanced Flight Vision Systems (EFVS) for Boeing 737NG aircraft. The contract is expected to be executed through 2023.

- In January 2022, Thales Group launched the successful completion of the first test flight of its new FlytX avionics suite, which is designed to improve situational awareness and reduce pilot workload. The suite includes a touch screen cockpit display, advanced weather radar, and synthetic vision technology.

- In November 2021, Collins Aerospace announced that it signed a long-term agreement with Boeing to provide avionics systems for the Boeing 777X aircraft program. The agreement includes the supply of cockpit displays, communication, and navigation systems, and other critical avionics components.

Key Benefits for Stakeholders

- This study comprises analytical depiction of the global aerospace avionics market segmentation along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and aerospace avionics market opportunities with a detailed impact analysis.

- The current global aerospace avionics market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in aerospace avionics.

Aerospace Avionics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 111.6 billion |

| Growth Rate | CAGR of 8.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 344 |

| By Sub-System |

|

| By Fit |

|

| By Platform |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Honeywell International Inc., Raytheon Technologies Corporation, Northrop Grumman, Safran SA, Curtis Wright Corporation, Thales Group, Leonardo S.P.A, L3 Harris Technologies, BAE Systems, ELBIT SYSTEMS LTD. |

The global aerospace avionics market size was valued at USD 48.7 billion in 2022, and is projected to reach USD 111.6 billion by 2032.

The global aerospace avionics market is projected to grow at a compound annual growth rate of 8.9% from 2023-2032 to reach USD 111.6 billion by 2032.

Raytheon Technologies Corporation, Honeywell International Inc., L3 Harris Technologies, BAE Systems, Leonardo S.P.A, and Thales are the top companies to hold the market share in Aerospace Avionics.

North America is the largest regional market for aerospace avionics.

Rise in Production of Aircraft, Enhanced Connectivity Solutions majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...