Aerospace Bearings Market Research, 2030

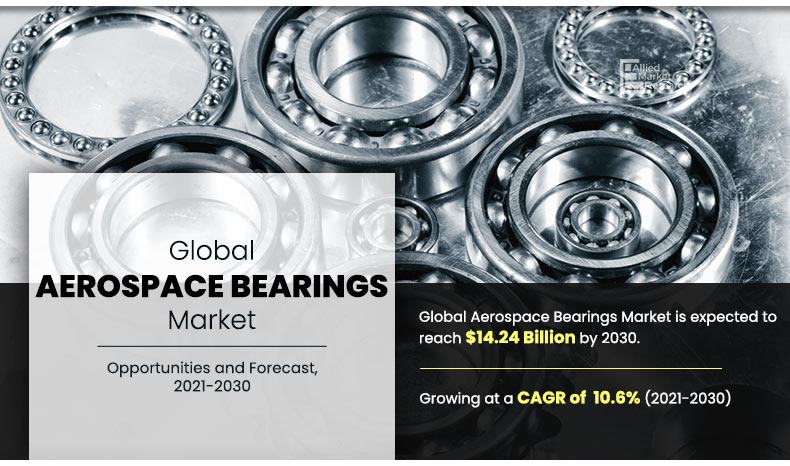

The global aerospace bearings market size was valued at $5.24 billion in 2020, and is projected to reach $14.24 billion by 2030, registering a CAGR of 10.6% from 2021 to 2030. Bearing is a type of machine element that is used to support relative motion and helps to reduce friction that is caused between moving parts. Bearing find their applications in various industries such as automobile, aerospace, wind turbines, construction & mining machinery, agricultural equipment, machine tools, and others. It is used in aircrafts to ensure smooth running of engines, shafts, propellers and other type of parts reed for aviation.

Global aerospace bearings market is gaining more importance owing to rising utilization of bearing products in various end-use industries, rolling mills, and aircrafts. Technological developments have improved the overall efficiency of bearing products in the aviation sector and have enhanced the shelf life of products. For instance, NSK has developed gearbox bearing that offers low maintenance and enhanced reliability in heavy duty engines.

In addition, the factors such as increase in focus toward reduction of vehicle weight, growth of global space sector & technological innovations and focus on green aerospace sector & its impact on bearing supply chain supplements the growth of the aerospace bearings market across the globe. However, factors such as high cost of raw materials, increase in operational costs followed by seasonal serviceability and delay in obtaining accreditations hampers the growth of the market across the globe.

Moreover, the factors such as growth in urban air mobility (UAM) platform, emergence of sensor bearing units and increase in development of additive manufacturing technologies & materials to manufacture bearing creates ample opportunities for the growth of the market during the forecast period.

By Bearing Type

Others is projected as the most lucrative segments

The aerospace bearings market has been segmented into bearing type, aircraft type, application and region. By bearing type, the global market has been segmented into plain bearing, roller bearing, ball bearing and others. By aircraft type, the global market has been segmented into fixed wings, rotorcraft and others. By application, the global market has been segmented into commercial aviation, military aviation, business & general aviation and unmanned aerial vehicle. By region, the aerospace bearings market has been studied across North America, Europe, Asia-Pacific and LAMEA.

The key players profiled in the global aerospace bearings market are GGB, JTEKT Corporation, Kaman Corporation, NSK Ltd., NTN Corporation, RBC Bearings Inc., Schaeffler AG, SKF, THK CO. LTD. and Timken.

By Aircraft Type

Others is projected as the most lucrative segments

Increasing Focus Toward Reduction Of Vehicle Weight

Aircraft manufacturers across the world are focusing on reducing the overall weight of the aircraft, owing to improvement in fuel efficiency and reduction in carbon dioxide emissions. In addition, bearings add significant weight in vehicle, and therefore integration of lightweight bearings will reduce the overall weight of vehicles. For this purpose, bearings makers are focusing on using low tolerance and enhanced forging techniques in production, in a bid to remain competitive and to comply with the changing norms.

For instance, in March 2020, NSK, a leading bearing manufacturer, developed a new ultrahigh-speed, lightweight and thinner bearing for electric vehicles, including electric, hybrid, and other new energy vehicles. In addition, SKF, a bearing and seal manufacturing company, is developing compact and lightweight bearings, which have been designed to run at extremely high speeds, with enhanced stiffness, superior load carrying capability, and prolonged operating life.

Moreover, modern aircrafts have strong demand for lightweight bearings for better durability, stiffness, and weightlessness. Therefore, increase in focus on vehicle weight reduction fuel the overall growth of the aerospace bearings market.

Growth Of Global Space Sector And Technological Innovations

With increasing funding and a decline in costs, the space industry is expected to witness increased opportunities, primarily in satellite broadband internet access. In 2020, space investments stayed resilient at $25.6 billion, and the impetus for investments is expected to continue solid in 2021 as well.

Space launch facilities are expected to record strong progress in 2021 owing to the increased investment in space & aviation sector. Space exploration is also anticipated to continue to evolve and flourish in 2021 due to diminishing launch costs and innovations in technology. Over the long term, costs are expected to continue dropping with companies in the space ecosystem deploying a greater number of satellites. For instance, more than 1,000 Starlink satellites have been launched into orbit by SpaceX, and the company aims to further launch 4,425 satellites in orbit by 2024 as its launch costs decline due to the use of reusable rockets and the mass production of satellites.

Further, the U.S. Space Command, which supervises space operations using personnel and assets managed by the Space Force, is expected to support A&D companies in fast-tracking investments in innovative technologies and capabilities. China and Russia are similarly focusing on strengthening their military facilities in space, which also creates ample opportunities for the growth of the market across the globe.

By Application

Unmanned Aerial Vehicle is projected as the most lucrative segments

High Cost Of Raw Materials

The cost of raw materials continues as the top interest for manufacturers. As high-grade steel is an essential component used for manufacturing bearings, the prices of bearings are interrelated with the global steel price movement. The variation of raw material price generates challenges for the bearing manufacturers to deliver bearings at a reasonable price and elevated quality. In addition, fluctuating supply and demand scenario is hindering the growth of the bearing industry.

The difference in trade strategies, discrepancies in supply and demand, variations in foreign exchange rates, intensified geopolitical risks across various countries, create a potential impact on the pricing of steel and aluminum bearing materials. Besides, the bearing components comprise seals, cages, and others, which require lubrication at frequent intervals to ensure smooth functioning; thus, requiring additional expenses.

Emergence Of Sensor Bearing Units

With the goal of improving performance, the latest trend among vendors in the aviation industry is the incorporation of sensor units in bearing. The most popular sensor bearing are found in wheel applications and transmission units. Most aircraft control unit bearing commonly include speed sensors that send wheel speed data to the safety system and traction control units of aircrafts.

In addition, sensor-bearing units also assist in the digital monitoring of rotation speed, axial movement, deceleration, acceleration and load carrying capacity in passenger and commercial aircrafts. Moreover, sensor ball bearing are being used in other aircrafts such as helicopters, drones, space shuttles, UAVs & others. Furthermore, the advantages such as compact, robust, easy-to-mount and cost saving with wide scope of application will open the opportunities for the market in near future.

By Region

LAMEA would exhibit the highest CAGR of 12.1% during 2021-2030.

Key Benefits For Stakeholders

This study presents analytical depiction of the global aerospace bearings market analysis along with current trends and future estimations to depict imminent investment pockets.

The overall market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global market with a detailed impact analysis.

- The current market is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Aerospace Bearings Market Report Highlights

| Aspects | Details |

| By Bearing Type |

|

| By Aircraft Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | NSK Ltd., Schaeffler AG, GGB, THK CO. LTD., Timken, SKF, NTN Corporation, Kaman Corporation, RBC Bearings Inc., JTEKT Corporation |

Analyst Review

The global aerospace bearing market is projected to witness considerable growth, especially in the Asia-Pacific region, owing to growth in population along with increase in industrialization and rise in purchasing power & aircraft services over the globe. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative feature offerings.

The global aerospace bearing market has been supplemented by factors such as rising utilization of bearing in aircrafts, helicopters and UAVs followed by rising utilization of bearing in motor, propellers, shafts, gears & others, which has enhanced the demand of bearing across aviation industry.

In addition, the presence of numerous companies operating in the global aviation component industry has been continuously developing advanced products & components to be used across aircrafts & UAVs, which creates a wider scope for the growth of the market across the globe. For instance, in September 2021, NSK developed world's first bioplastic cage for rolling bearings, which helps in CO2 reduction by up to 91% when used in machine. Such developments carried out by different companies supplement the growth of the market across the globe.

Factors such as increasing focus toward reduction of vehicle weight, growth of global space sector & technological innovations and focus on green aerospace sector & its impact on bearing supply chain supplements the growth of the market across the globe. However, factors such as high cost of raw materials, increase in operational costs followed by seasonal serviceability and delay in obtaining accreditations hampers the growth of the market across the globe. Moreover, the factors such as growth in urban air mobility (UAM) platform, emergence of sensor bearing units and increasing development of additive manufacturing technologies & materials to manufacture bearing creates ample opportunities for the growth of the market during the forecast period.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by North America, Europe, and LAMEA. On the basis of forecast analysis, LAMEA is expected to maintain its lead during the forecast period, owing to increase in establishment of production facilities across the region.

Plain Bearing, ball bearing, roller bearing are different types of bearings used in aerospace industry

The global aerospace bearings market was valued at $5,238.80 million in 2020, and is projected to reach $14,243.90 million by 2030, registering a CAGR of 10.6% from 2021 to 2030

The sample for global aerospace bearings market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report

Introduction of sensor based bearings & self lubricating bearings are the upcoming trends in aerospace bearings market

The aerospace bearings market has witnessed significant growth in past few years. However, increase integration of advanced technology in aircrafts is bolstering the demand for bearings in aviation sector.

The company profiles of the top market players of aerospace bearings market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the aerospace bearings market.

The aerospace bearings makret holds a considerable market share of $5.24 billion in the global aviation industry

Numerous companies have been operating in aerospace bearings market which holds a comparative market share in the global market. The detailed information pertaining to the same can be obtained on demand from AMR website.

China, Japan, U.S., Germany, France are the key matured markets growing in the aerospace bearings industry

Increased aircraft production followed by the demand for safer aviation medium leads to the growth of the market across the globe.

Loading Table Of Content...