The global aerospace cyber security market size was valued at $26.3 billion in 2022, and is projected to reach $58.9 billion by 2032, growing at a CAGR of 8.4% from 2022 to 2032.

Report Key Highlighters

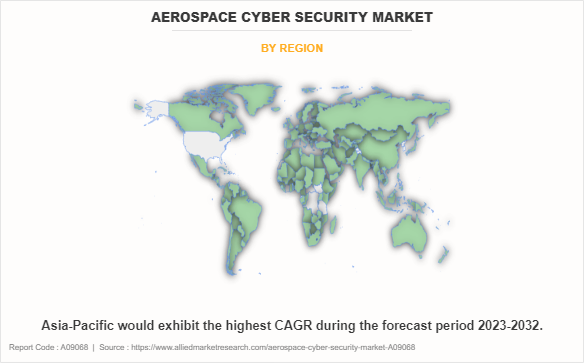

- The aerospace cyber security market studies more than 15 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The aerospace cyber security market share is marginally fragmented, with players such as Astronautics Corporation of America, BAE Systems, DXC Technology Company, Eurocontrol, Honeywell International Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing, Thales Group, and The Aerospace Corporation. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Aerospace cyber security encompasses a collection of methodologies, technologies, and strategies employed to safeguard the digital infrastructure, networks, and data within the aerospace sector against potential cyber threats and attacks. In recent years, the aviation industry, much like other sectors, has undergone significant digitization. The development of modern aviation systems incorporates various technological advancements such as augmented reality, 3D printing, machine learning, cloud technology, and notably, the Internet of Things (IoT).

As aircraft and aviation systems embrace increased digitalization and connectivity, the security and integrity of data face heightened vulnerabilities. A system that is computer-controlled could potentially be susceptible to hacking. The more connections a system has, the more exposed it becomes to potential threats. While the interconnectedness of aviation systems allows for the integration of innovative technologies, it simultaneously creates an environment where unauthorized access becomes a concern.

Increase in cyber threats, rise in digitization and connectivity, and integration of advanced technologies in the aerospace sector are the key factors driving the growth of the global aerospace cyber security market. However, the market is hampered by high installation & operational costs and regulatory challenges. On the contrary, technological advancements and innovation, coupled with strengthening of cyber regulations in the aerospace industry, are expected to provide remarkable growth opportunities for the players operating in the market.

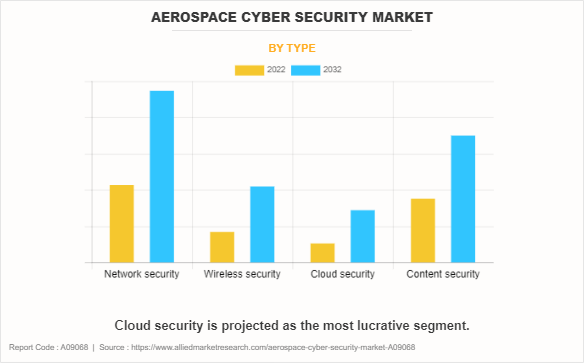

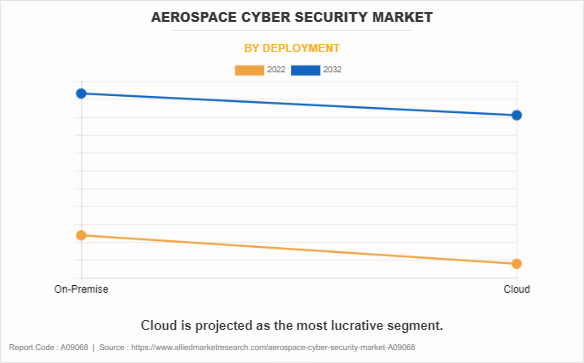

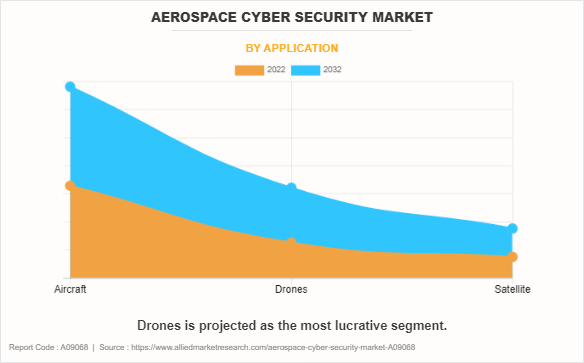

The global aerospace cyber security market is segmented into type, deployment, application, component, and region. By type, the market is fragmented into network security, wireless security, cloud security, and content security. According to deployment, it is classified into on-premises and cloud. Depending on component, it is segregated into less aircraft, drones, and satellites. On the basis of type, it is categorized into services and solutions. Region wise, the market is analyzed in North America, Europe, Asia-Pacific, and LAMEA.

Space systems play a crucial role for various government and commercial entities, offering unique global capabilities within the space domain. In times of conflict, adversaries aim to disrupt, deny, degrade, deceive, or destroy these capabilities. Cyberattacks, recognized as a complex yet effective threat, are increasingly prevalent in the space domain. Consequently, the intersection of cyber security and space operations has become vital to counter these cyber threats.

Traditionally, spacecraft were considered relatively secure from cyber threats, and vulnerabilities in space systems were often overlooked in the evaluation of critical infrastructure. However, with the emergence of space cyber threats from nation-state actors, government and industry stakeholders have acknowledged the need for additional defenses. Unfortunately, the development of space-centric cyber security standards and governance has been slow, lagging behind the rapid growth of cyber threats. To address this gap, comprehensive defense-in-depth techniques for protecting space systems must be embraced across government, industry, and the international community, ensuring resilience against cyber compromises.

Increase in Cyber Threats

The risk of cyber threats targeting critical infrastructure in the aerospace industry has increased significantly. The aerospace cyber security market trends highlights the increase in launch of cyber security solutions and intellligence services for the rise in the cyber threats in the aerospace market, For instance, Eurocontrol, the European organization that helps the aviation industry, reported 52 cyber-attacks in 2020, 48 attacks in 2021, 78 attacks in 2022, and 27 attacks up to May 2023. According to the European Air Traffic Management Computer Emergency Response Team (EATM-CERT) Aviation Cyber Event Map, 52 attacks were reported in 2020, 48 attacks were reported in 2021, and 50 attacks were reported till the end of August 2022. Thus, the cyber incidents in 2022 have reached the average of 2020 and 2021 in just eight months.

This elevated threat landscape encompasses potential attacks on various components, including aircraft, satellites, communication networks, and interconnected systems. In 2022, a low-cost airline in India experienced a ransomware attack, resulting in delayed departures for several flights. Although the airline managed to contain and resolve the situation, leading to the resumption of operations within a few hours, the incident left numerous passengers stranded at different airports.

The sophistication of cyber threats has evolved over time, with attackers utilizing advanced techniques such as malware, ransomware, and targeted attacks. Aerospace systems, if not adequately safeguarded, are susceptible to these evolving cyber threats, highlighting the need for advanced cyber security measures. In April 2022, a Canadian airline encountered a cyberattack that led to flight delays and operational disruptions lasting for five days. The attack was attributed to a data breach at the airline's third-party service provider, responsible for passenger management software solutions such as check-in and boarding systems. To address these challenges, the aerospace industry understands the use of robust cyber security measures which are expected to drive the growth of the market.

Rise in the Digitization and Connectivity

As the aerospace industry embraces more digital technologies and systems that connect everything, the chances of cyber threats are expected to rise, which, in turn, fuels the need for strong cyber security measures for enhanced safety. Furthermore, the planes, satellites, communication networks, and all the other systems in aviation are heavily dependent on digitalization and are being connected to each other. This leads to more cyber threats to cause trouble, so it is important to have solid cyber security in place to protect against any potential problems.

Presently, most systems in aviation sector are connected. This not only streamlines the processes but also brings new challenges, especially when it comes to safeguarding everything from cyber threats. Therefore, the demand for cyber security solutions has been witnessed to increase that can handle and mitigate threats across all the connected systems, which, in turn, significantly contributes toward the market growth. Important systems in the aviation sector such as reservation systems, air traffic controls, in-flight entertainment devices, devices used by cabin crews, cockpit instruments, and cargo handling, are all at risk of getting attacked, which is anticipated to boost the demand for aerospace cyber security systems.

Moreover, airlines are trying to save money and work better by using advanced technologies in every part of their operations. They often get help from outside IT companies for outsourcing, and they use ready-made software such as commercial off-the-shelf (COTS) software. However, these outside systems and software might not always be safe, making them more likely to get attacked. Therefore, there is a growing demand for robust cyber security solutions to safeguard these vulnerable areas, which boosts the aerospace cyber security market growth.

High Acquisition and Operational Cost

Establishing strong cyber security measures in the aerospace sector requires substantial upfront investment. This encompasses the acquisition and deployment of advanced cyber security technologies, thorough assessments, and the establishment of secure protocols. The intricate nature of aerospace systems, coupled with the demand for specialized solutions, adds to the initial costs associated with implementing effective cyber security. The development and integration of cyber security solutions tailored to the distinct needs of the aerospace industry are also costly endeavors, which hamper the market growth. These solutions must address specific challenges related to aircraft, satellites, communication networks, and ground infrastructure, leading to extensive research, development, and integration efforts and, consequently, elevated overall expenses.

Regulatory Challenges

The trends in aerospace cyber security regulatory involves landscape governing cyber security which is characterized by constant evolution. Aerospace companies are confronted with the intricate challenge of navigating a complex framework comprising national and international regulations, standards, and guidelines. Ensuring compliance with these diverse and regularly updated requirements necessitates significant resources and meticulous attention to detail.

Within the aerospace industry, distinct cyber security standards and regulations, set apart from those in other sectors, contribute to the complexity. Adhering to these industry-specific standards requires a profound understanding of aviation systems, presenting a challenge for companies lacking dedicated expertise in cyber security. The necessity to align with these standards introduces an additional layer of intricacy to cyber security initiatives. Given the global scale of operations in the aerospace sector, often involving collaborations with entities in various countries, achieving and maintaining compliance across different regulatory frameworks becomes a sophisticated task.

Impact of Russia Ukraine War on Aerospace Cyber Security Industry

On February 24, 2022, Russia invaded Ukraine, leading to the Russia Ukrainian war that began in 2014. Due to geopolitical conflicts, there is an emergence of global economic uncertainties. In times of economic unpredictability, aviation companies or airports budgets can be affected, potentially influencing the allocation of funds for aerospace cyber security. This, in turn, could impact the adoption and integration of aerospace cyber security products or ability to invest in cyber security services. Furthermore, in times of conflict, governments might have to redirect their resources to deal with urgent security and humanitarian needs. This could mean changing their budget priorities, which might result in less money allocation for the investment in cyber security.

Recent Developments in the Aerospace Cyber Security Industry

In January 2023, The Aerospace Corporation created the Space Attack Research and Tactic Analysis (SPARTA) framework to pinpoint the unique risks that hackers could pose to space systems.

In July 2023, Honeywell International confirmed its plans to acquire SCADAfence, a prominent provider of cyber security solutions for operational technology (OT) and Internet of Things (IoT) in monitoring extensive networks.

In March 2022, Northrop Grumman Corporation announced that it has established the 100th U.S. Air Force training site on the company's distributed mission operations network (DMON), enabling combat air force (CAF) crews around the world to securely connect with other sites in virtual training and exercises.

In April 2022, Thales launched its sixth cyber security center in the African continent, based in Morocco.

In November 2021, Honeywell International, Inc. launched new software Honeywell NAVITAS. This software uses artificial intelligence (AI), big data, machine learning, cyber security, and human-centered design principles.

In May 2021, Air Force Life Cycle Management Center (AFLCMC) partnered with Lockheed Martin in establishing the rogue blue software factory. This software development factory produces mission planning and command and control applications for the U.S. Strategic Command. This also expanded the capability of the system to ensure it would provide needed legacy capability while complying with the newest technical and cyber security standards.

In February 2021, Lockheed Martin Corporation received basic ordering agreement (BOA) from the U.S. Air Force for Platform One software DevSecOps services to support DevSecOps engineering, software development, cyber security and operations, and IT support.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerospace cyber security market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Aerospace Cyber Security Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 58.9 billion |

| Growth Rate | CAGR of 8.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Deployment |

|

| By Application |

|

| By Component |

|

| By Region |

|

| Key Market Players | EUROCONTROL, DXC Technology Company, Raytheon Technologies Corporation, Honeywell International, Inc., Lockheed Martin Corporation, Astronautics Corporation of America, Northrop Grumman Corporation, BAE Systems, Thales Group, The Aerospace Corporation |

The global aerospace cyber security market was valued at $26,333.7 million in 2022, and is projected to reach $58,850.6 million by 2032, registering a CAGR of 8.4% from 2022 to 2032

The largest regional market for aerospace cyber security is North America.

The top companies to hold the market share in aerospace cyber security are Astronautics Corporation of America, BAE Systems, DXC Technology Company, Eurocontrol, Honeywell International Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing, Thales Group, and The Aerospace Corporation.

The leading application of aerospace cyber security market is aircraft.

The upcoming trends of aerospace cyber security market in the world are technological advancements and innovation, and strengthening of cyber regulations in the aerospace industry.

Loading Table Of Content...

Loading Research Methodology...