Aerospace Maintenance Chemical Market Outlook - 2030

The global aerospace maintenance chemical market size was valued at $7.8 billion in 2021, and is projected to reach $13.7 billion by 2030, growing at a CAGR of 6.24% from 2022 to 2030.

Aerospace maintenance chemicals are cleaners that are used for the operational proficiency of the aircraft. They are used as cleaning materials, paint removers, paint strippers, degreasers, and aircraft washers & polishers. The cleaners are used to keep all commercial aircrafts corrosion free and maintain hygienic conditions inside & outside.

Rise in demand for the maintenance of aircraft surface in order to deal with extreme surrounding temperature or climatic conditions fuels the demand for aircraft maintenance chemicals. In addition, increase in air passenger traffic due to rise in disposable income of the middle class population tends to increase the flight frequency. This, in turn, increases the maintenance, repair, and overhaul (MRO) activities of the aircraft, which further fuels the growth of the aerospace maintenance chemical market share.

However, stringent government regulations regarding the use of harmful chemicals for airplane maintenance, high maintenance costs of airplanes, time constraints, limited market players, and lack of skilled expertise are expected to restrain the aerospace maintenance chemical market growth.

The gap in demand and supply in the aviation industry has been witnessed over the past few years that has led to an increase in the production of aircraft, which will further increase the MRO activities, creating lucrative opportunities for the expansion of the aerospace maintenance chemical market.

Segments Overview

The aerospace maintenance chemical market is segmented into Nature, Product Type and Type of Aircraft.

The global aerospace maintenance chemical market is sub-segmented on the basis of nature, product type, type of aircraft, and region. By nature, the market is classified as organic and inorganic. By product type, the market is sub-segmented as cleaners, deicing fluids, adhesives, and others. By type of aircraft, the market is sub-segmented into commercial, business, defence, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

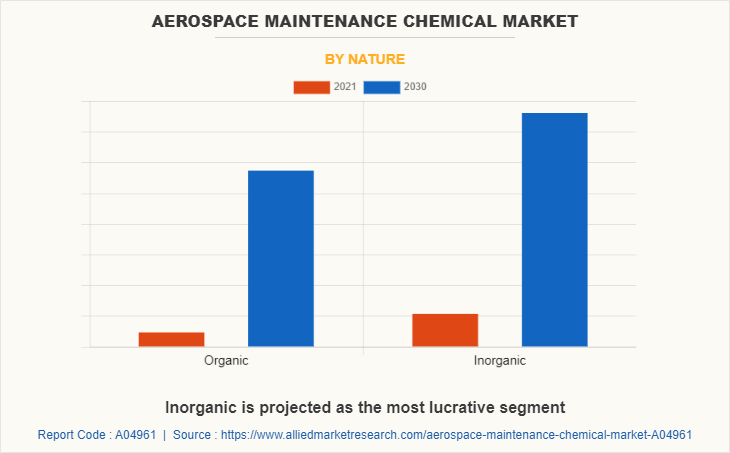

Aerospace Maintenance Chemical Market By Nature

By nature, the inorganic sub-segment dominated the global aerospace maintenance chemical market in 2021 and is projected to remain the fastest-growing sub-segment during the forecast period. Inorganic chemicals are made by combining many different chemicals and are most effective for cleaning surfaces with less effort requirements. Also, they can be prepared in abundance and according to the amount to be used.

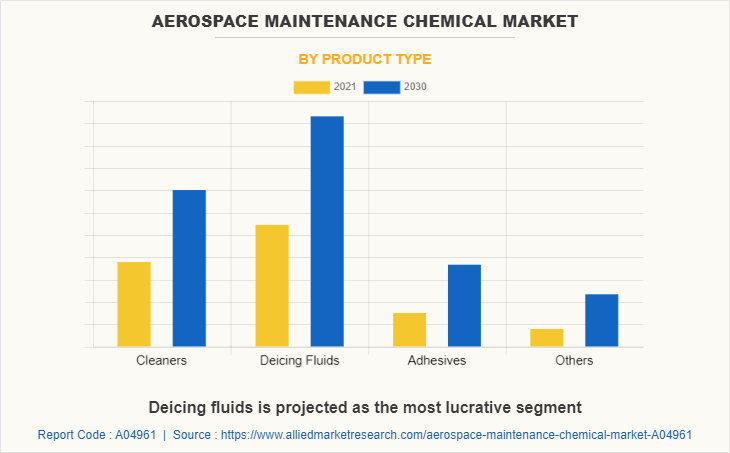

Aerospace Maintenance Chemical Market By Product Type

By product type, the deicing fluids sub-segment dominated the global aerospace maintenance chemical market in 2021. The growth of deicing fluids sub-segment is attributed to the extensive use of deicing fluids for polishing the outer surfaces of aircrafts. Deicing fluids help in preventing snow deposit on aircraft surface when it travels in cold areas.

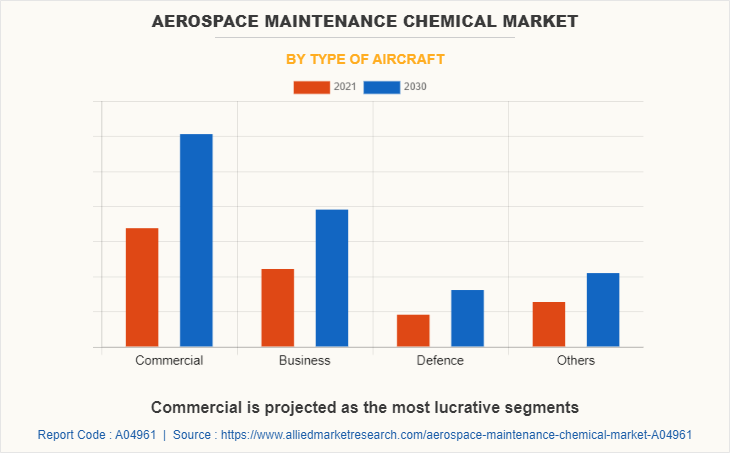

Aerospace Maintenance Chemical Market By Type of Aircraft

By type of aircraft, the commercial aircraft sub-segment dominated the global aerospace maintenance chemical market in 2021. The growth of the sub-segment is attributed to many commercial flights taking off every day, across the world. As the disposable income of people across the world has increased, the preference for air travel among them has also increased, tremendously.

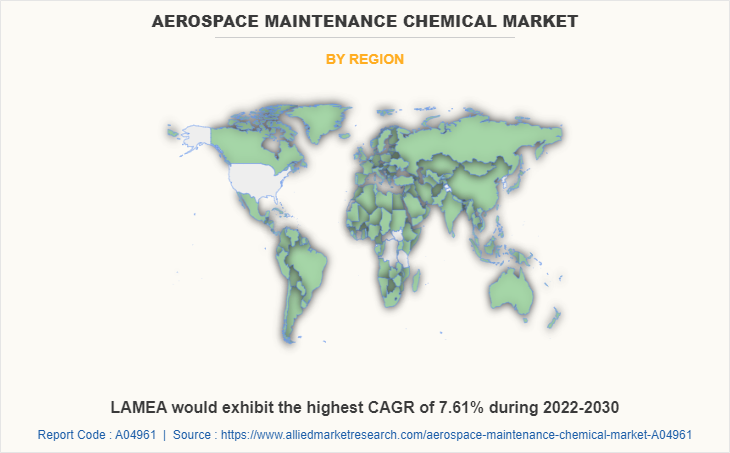

Aerospace Maintenance Chemical Market By Region

By region, North America region dominated the global aerospace maintenance chemical market in 2021. This is attributed to numerous factors such as growing air travel preference by the people in the region and high government spending on maintenance of defense aircrafts. People, in the region, have high per capita income due to which they can afford luxury travel. Owing to this, number of filghts taking off and landing in the region has increased drastically, in the past few years. Also, in defense sector, North America Defence government spends a larger amount annualy, on proper and effective maintenance, and repair of defense aircrafts. All these factors are attributed to have a positive impact on aerospace maintenance market opportunity in the forecast time period.

Competitive Analysis

The key aerospace maintenance chemical market players operating in this market include Exxon Mobil Corporation, Henkel AG & Co. KGaA, Arrow Solutions, Eastman Chemical Company, Florida Chemical, The Dow Chemical Company, Nuvite Chemical Compounds, Aircraft Spruce and Specialty Co., Nexeo Solutions, and High Performance Composites & Coatings. Companies are heavily investing in the R&D activities for maintenance methods and decreasing cost. Chemical manufacturers are collaborating with respective clients to keep up with demand & supply and research & innovation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerospace maintenance chemical market analysis from 2021 to 2030 to identify the prevailing aerospace maintenance chemical market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerospace maintenance chemical market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerospace maintenance chemical market trends, key players, market segments, application areas, and market growth strategies.

Aerospace Maintenance Chemical Market Report Highlights

| Aspects | Details |

| By Nature |

|

| By Product Type |

|

| By Type |

|

| By Region |

|

| Key Market Players | delta techops, airbus defence and space - arabia services, Boeing Company, AAR Corporation, ge aviation, nexeo solutions, llc, Henkel AG & Co. KGaA, Bombardier Inc, air france industries klm engineering & maintenance, Embraer S.A. |

Analyst Review

According to the analyst review of the leading companies, the global aerospace maintenance chemical market possesses a substantial scope for growth in the future. Continuous increase in demand for aerospace maintenance chemicals for proper cleaning & maintenance of aircrafts, owing to growing preference of people for air travel to experience luxury & save time is expected to drive the growth of aerospace maintenance chemical market. However, high cost of aerospace maintenance chemicals is a major limitation to the market growth. Growing disposable income of people and affordability of expensive travel, among people in the developing regions is likely to surge the aerospace maintenance chemical market share in the next few years. According to the analysts, LAMEA is projected to register fastest growth as compared to North America and Europe markets.

Growing demand for a clean and well maintained & equipped air travel is expected to drive the global aerospace maintenance chemical market.

Aerospace Maintenance Chemicals are largely used for proper maintenance and repair of aircrafts in aviation industry.

North America is the largest market for Aerospace Maintenance Chemical Market.

The global aerospace maintenance chemical market was valued at $7,762.8 million in 2021 and is projected to reach $13,673.3 million by 2030, growing at a CAGR of 6.24% from 2021-2030

Some of the leading aerospace maintenance chemical market players are Exxon Mobil Corporation, Henkel AG & Co. KGaA, Arrow Solutions, Eastman Chemical Company, Florida Chemical, The Dow Chemical Company, Nuvite Chemical Compounds, Aircraft Spruce and Specialty Co., Nexeo Solutions, and High Performance Composites & Coatings.

Loading Table Of Content...