Aerospace Nanotechnology Market Research, 2034

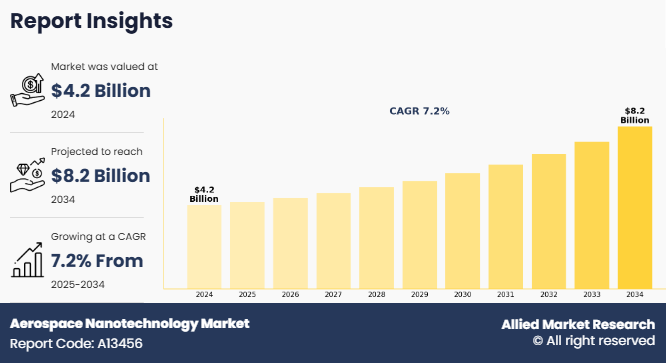

The global aerospace nanotechnology market size was valued at $4.2 billion in 2024, and is projected to reach $8.2 billion by 2034, growing at a CAGR of 7.2% from 2025 to 2034.

Report Key Highlighters:

- The aerospace nanotechnology industry study covers 14 countries. The research includes regional and segment analysis of each country for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the aerospace nanotechnology industry are Airbus SE, Boeing, Lockheed Martin Corporation, Glonatech SA, Zyvex Technologies, Veelo Technologies, Meta Materials Inc., Nanocyl S.A., ToughGuard, LLC, and BAE Systems. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Aerospace nanotechnology refers to the application of nanoscale materials and technologies in the design, manufacturing, and operation of aircraft, spacecraft, and related systems. This field involves manipulating matter at the atomic or molecular level to create materials and devices with enhanced properties that improve aerospace performance. Nanotechnology enables the development of lightweight yet strong nanocomposites for airframes, advanced nanocoatings for corrosion and thermal protection, and highly sensitive nano-sensors for structural health monitoring.

Moreover, it contributes to more efficient propulsion systems through thermal barrier coatings and nano-enhanced fuels. In space applications, nanotechnology provides solutions for radiation shielding, self-healing materials, and miniaturized satellite components.

Moreover, space agencies are increasingly relying on nanotechnology to improve satellite performance and the durability of spacecraft. Space missions require components that can endure harsh radiation, high temperatures, and the vacuum of space. Nanotechnology offers solutions such as radiation-resistant materials and energy-efficient propulsion systems. For example, nanostructured coatings are being used to prevent the overheating of spacecraft and to enhance the lifespan of solar panels. In addition, as space exploration extends to Mars and beyond, the demand for more reliable and lightweight materials has never been higher. Agencies such as NASA, ESA, and ISRO are actively funding research in nanomaterials for use in long-term missions and planetary exploration. Private space companies are following suit, adopting nanotech in launch vehicles and payload systems.

Aerospace nanotechnology refers to the application of nanoscale materials and technologies in the design, manufacturing, and operation of aircraft, spacecraft, and related systems. This field involves manipulating matter at the atomic or molecular level to create materials and devices with enhanced properties that improve aerospace performance. Nanotechnology enables the development of lightweight yet strong nanocomposites for airframes, advanced nano-coatings for corrosion and thermal protection, and highly sensitive nano-sensors for structural health monitoring.

Moreover, it contributes to more efficient propulsion systems through thermal barrier coatings and nano-enhanced fuels. In space applications, nanotechnology provides solutions for radiation shielding, self healing materials, and miniaturized satellite components. Moreover, UK-based universities and research centers are engaged in projects funded by the government and the EU to explore nano-enabled coatings, sensors, and smart systems.

In addition, partnerships between aerospace giants such as Rolls-Royce and BAE Systems with research institutes are pushing nanotechnology adoption forward in propulsion systems and structural design. For instance, in July 2024, British aerospace company BAE Systems announced that it is building a piloted supersonic demonstrator aircraft to support the Global Combat Air Programme (GCAP), which aims to develop a sixth generation fighter jet by 2035. GCAP combines efforts from Japan, the UK, and Italy, with BAE leading the project alongside Leonardo and Mitsubishi Heavy Industries. The demonstrator is being largely built in the UK using additive manufacturing for key structural components. Such developments further propel market growth.

The aerospace nanotechnology market growth is driven by the rise in demand for lightweight and fuel-efficient aircraft, increased R&D investments by governments and private players, and growth in military and space applications. However, high production and certification costs along with supply chain complexities for advanced nanomaterials may restrain market expansion. Moreover, the expansion of electric and hybrid-electric aircraft and the rise of autonomous UAVs and drones are expected to create significant growth opportunities in the coming years.

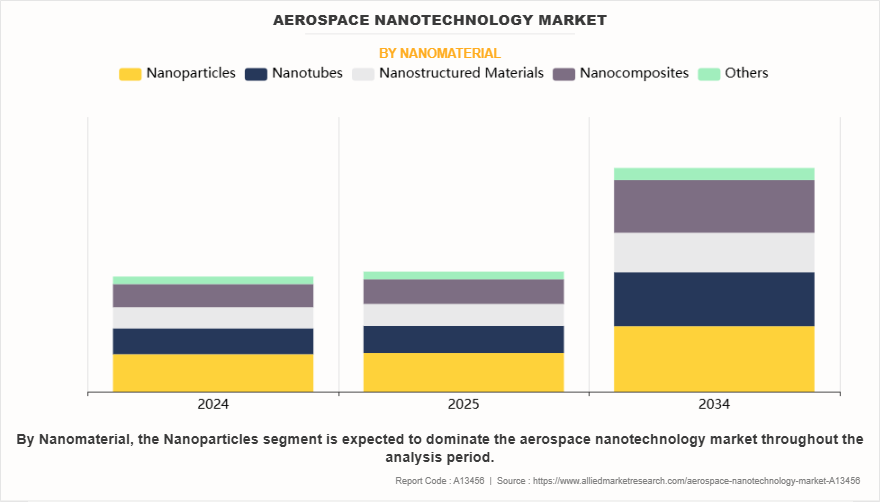

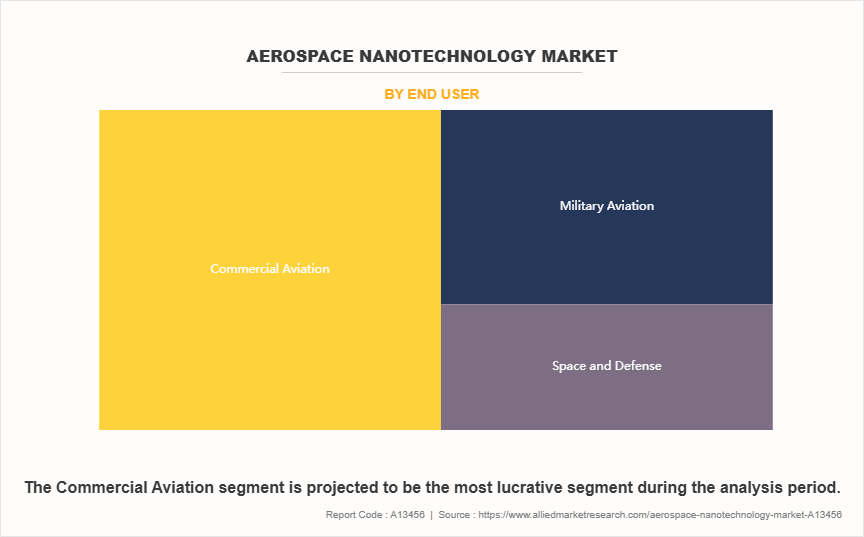

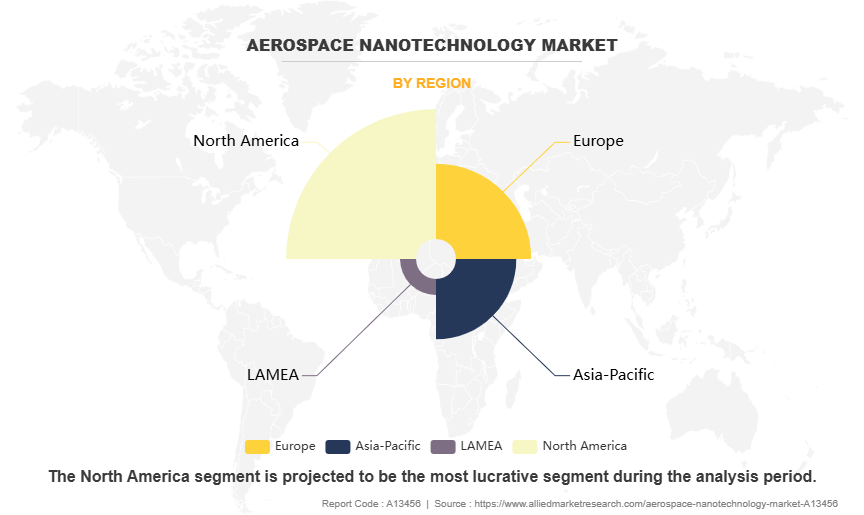

The aerospace nanotechnology market is segmented into nanomaterial, end-user, type, and region. On the basis of nanomaterial, the market is divided into nanoparticles, nanotubes, nanostructured materials, nanocomposites, and others. As per end-user, the market is segregated into commercial aviation, military aviation, and space and defense. On the basis of type, the market is bifurcated into nano devices and nano sensors. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Leading players and their key business strategies have been analyzed in the report to gain a competitive insight into the market. Key players covered in the report include Airbus SE, Boeing, Lockheed Martin Corporation, Glonatech SA, Zyvex Technologies, Veelo Technologies, Meta Materials Inc., Nanocyl S.A., ToughGuard, LLC, and BAE Systems.

Key Developments

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In March 2025, Boeing and SKF Aerospace expanded their partnership, with Boeing’s distribution arm now officially authorized to distribute SKF Aerospace bearings. SKF Aerospace France is already an approved manufacturer for several Boeing standards, and this new agreement lists Boeing Distribution Services in Boeing’s D1-4426 directory as an approved distributor. The partnership meets strict quality standards and offers customers more options for high performance bearings.

- In June 2024, Airbus successfully tested a helicopter nose panel made from bio-based carbon fiber, offering the same strength as traditional carbon fiber but with much lower CO2 emissions. Unlike standard carbon fiber made from fossil fuels, this new material is made from sustainable sources, starting with capturing CO2 from the air. This is part of Airbus’s effort to use more ecofriendly materials in aircraft production.

- In January 2024, Boeing announced the acquisition of Aerospace Composites Malaysia (ACM), making it Boeing’s first fully owned manufacturing facility in Southeast Asia. Previously a joint venture with Hexcel Corp, ACM became wholly owned by Boeing in December 2023. The facility produces composite parts and subassemblies for all current Boeing commercial aircraft

Segmental analysis

The aerospace nanotechnology market is segmented into nanomaterial, end-user, type, and region. On the basis of nanomaterial, the market is divided into nanoparticles, nanotubes, nanostructured materials, nanocomposites, and others. As per end-user, the market is segregated into commercial aviation, military aviation, and space and defense. On the basis of type, the market is bifurcated into nano devices and nano sensors. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Nanomaterial

By nanomaterial, the market is divided into nanoparticles, nanotubes, nanostructured materials, nanocomposites, and others. The commercial aviation segment accounted for the largest market share in 2024, driven by the need for improved fuel efficiency, cost reduction, and passenger safety. A prominent trend is the integration of nano-enhanced materials in fuselage and wing structures to reduce aircraft weight, leading to better fuel performance.

By End User

By end-user, the market is segregated into commercial aviation, military aviation, and space and defense. The commercial aviation segment accounted for a dominant market share in 2023, driven by the need for improved fuel efficiency, cost reduction, and passenger safety. A prominent trend is the integration of nano-enhanced materials in fuselage and wing structures to reduce aircraft weight, leading to better fuel performance.

By Type

By type, the market is bifurcated into nano devices and nano sensors. The nano devices segment accounted for the largest market share in 2024, as nano devices are becoming increasingly important as aerospace systems demand more sophisticated miniaturized components. The trend towards more electric aircraft is driving development of nano-enabled power management systems.

By Region

Region wise, North America held the largest aerospace nanotechnology market share in 2023, driven by strong industrial capabilities, strategic government initiatives, and a thriving research ecosystem. The U.S. continues to dominate the regional market, driven by its significant investments in defense, space exploration, and advanced aviation technologies.

Rise in demand for lightweight and fuel-efficient aircraft

The aerospace industry is under immense pressure to reduce fuel consumption and carbon emissions due to stringent environmental regulations and rising operational costs. Nanotechnology plays a pivotal role in achieving these goals by enabling the development of ultra-lightweight yet high-strength materials. For instance, carbon nanotube (CNT)-reinforced composites are significantly lighter than traditional aluminum alloys while offering superior tensile strength. This weight reduction directly translates into major improved fuel efficiency, a critical factor for airlines facing volatile fuel prices. Major aircraft manufacturers such as Boeing and Airbus are increasingly incorporating nanocomposites in next-gen models such as the 787 Dreamliner and A350 XWB, where nanomaterials account for over 50% of the airframe. In addition, nano-coatings with hydrophobic and anti-icing properties further enhance aerodynamic efficiency, thus reducing drag and maintenance costs. With the International Air Transport Association (IATA) targeting a 50% reduction in COâ‚‚ emissions by 2050, the adoption of nanotechnology in aerospace is no longer optional but a necessity.

This driver is further amplified by the growing aerospace nanotechnology market demandfor urban air mobility (UAM) and electric vertical takeoff and landing (eVTOL) aircraft, where weight savings are even more critical due to battery limitations. As a result, the aerospace nanotechnology market is poised for sustained growth, driven by the relentless pursuit of efficiency and sustainability in aviation. The aerospace nanotechnology market forecast reflects this upward trend, highlighting strong potential in both commercial and emerging aviation segments.

Increased R&D investments by governments and private players

One of the primary drivers of the aerospace nanotechnology market is the significant rise in research and development funding from both government agencies and private corporations. Governments worldwide recognize the strategic importance of nanotechnology for aerospace advancements, leading to substantial budget allocations. For example, the U.S. Department of Defense and NASA have consistently increased their nanotechnology R&D budgets, focusing on materials that enhance aircraft performance and durability. For instance, in March 2024, President Biden proposed $2.16 billion for National Nanotechnology Initiative (NNI) research, about $90 million (4.3%) more than the estimated funding for FY2023. In Europe, the European Space Agency (ESA) and national governments fund numerous projects aimed at developing nano-enhanced components for satellites and spacecraft. Moreover, emerging economies such as China and India are aggressively investing in nanotechnology research to strengthen their aerospace capabilities and reduce dependency on foreign technology. Thus, growing R&D investments are laying the foundation for continuous innovation and commercialization of nanotechnology in aerospace. These investments ensure a steady pipeline of advanced solutions that can meet the evolving demands of civil, military, and space aviation.

High production and certification costs

One of the major restraints in the aerospace nanotechnology market is the high cost of production and the strict certification processes required for new materials and technologies. Developing nanomaterials with aerospace-grade performance involves complex manufacturing processes, specialized equipment, and skilled labor. These factors contribute to significantly higher production costs when compared to conventional aerospace materials. For small and medium enterprises or emerging players, this financial barrier can make it difficult to enter the market or scale up operations. In the aerospace industry, safety and reliability are critical. Any new material or technology, especially one involving nanotechnology, must undergo extensive testing and certification before it can be used in actual aircraft or spacecraft. This includes mechanical testing, thermal analysis, chemical stability studies, and long-term durability assessments. These certification processes are time-consuming and expensive, often involving multiple rounds of validation by regulatory authorities such as the FAA (Federal Aviation Administration) or EASA (European Union Aviation Safety Agency). Furthermore, the lack of standardization across countries and regions creates additional obstacles for global adoption. A nanocomposite approved in one country may need to be tested again for another market, delaying commercialization. As a result, while nanotechnology offers significant performance advantages, the financial and regulatory challenges involved in bringing these materials to the aerospace sector can slow down their adoption and limit market growth in the short to medium term.

Supply chain complexities for advanced nanomaterials

Another significant restraint in the aerospace nanotechnology market is the complexity of the supply chain for advanced nanomaterials. Unlike conventional aerospace materials such as aluminum or titanium, nanomaterials require precise and controlled environments for synthesis, storage, and transportation. This creates logistical challenges, especially when scaling up from laboratory production to full-scale industrial supply. Many high-performance nanomaterials, such as carbon nanotubes or graphene-based composites, are produced in limited quantities by a small number of specialized manufacturers. This creates a dependency on a narrow supplier base, which increases the risk of shortages or delays. In some cases, these materials must be imported from other countries, which introduces additional costs and uncertainties due to trade regulations, tariffs, and geopolitical factors. Moreover, maintaining the quality and purity of nanomaterials throughout the supply chain is crucial, as even small variations can affect their performance in aerospace applications. Contamination during packaging, transport, or storage can render a batch unusable, leading to waste and cost overruns. This sensitivity makes the entire logistics process more demanding compared to standard industrial materials. Therefore, the complexity of sourcing, handling, and managing nanomaterial supplies presents a serious challenge to the wider adoption of nanotechnology in aerospace, especially as the industry moves toward larger-scale applications.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerospace nanotechnology market analysis from 2024 to 2034 to identify the prevailing aerospace nanotechnology market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerospace nanotechnology market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerospace nanotechnology market trends, key players, market segments, application areas, and market growth strategies.

Aerospace Nanotechnology Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 8.2 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2034 |

| Report Pages | 349 |

| By Nanomaterial |

|

| By End User |

|

| By Type |

|

| By Region |

|

| Key Market Players | Lockheed Martin Corporation, Boeing, Zyvex Technologies, Meta Materials Inc., Airbus SE, BAE Systems, Glonatech SA, Nanocyl S.A., Veelo Technologies, LLC, ToughGuard, LLC |

Upcoming trends of Aerospace Nanotechnology Market in the globe are the expansion of electric and hybrid-electric aircraft and the rise of autonomous UAVs and drones.

The leading type of Aerospace Nanotechnology Market is nano devices.

The largest regional market for Aerospace Nanotechnology is North America

The global aerospace nanotechnology market was valued at $4.2 billion in 2024, and is projected to reach $8.2 billion by 2034, growing at a CAGR of 7.2% from 2025 to 2034.

• The key players in the aerospace nanotechnology market are Airbus SE, Boeing, Lockheed Martin Corporation, Glonatech SA, Zyvex Technologies, Veelo Technologies, Meta Materials Inc., Nanocyl S.A., ToughGuard, LLC, and BAE Systems.

Loading Table Of Content...

Loading Research Methodology...