Aerospace Raw Materials Market Research, 2033

The global aerospace raw materials market size was valued at $38.2 billion in 2023, and is projected to reach $75.6 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033. The aerospace raw materials industry includes the acquisition and use of basic materials needed to produce aircraft components and assemblies. This industry is essential for obtaining metals such as titanium and aluminum, as well as sophisticated composites, alloys, and thermoplastics, which are needed to make airframes, engines, and interior fixtures. In addition, the aircraft industry's constant development leads to rise in the need for these raw materials. The growth in air travel is driving increased demand for lightweight and durable materials, defense spending, and advancements in lightweight material technology are the primary drivers of this rapidly evolving raw materials in aerospace sector.

Manufacturers are moving towards lightweight materials owing to the aircraft industry's ongoing efforts to reduce carbon emissions and increase fuel economy. For instance, in December 2021, United Airlines operated the worlds first passenger flight using 100% SAF in one engine of a Boeing 737 MAX. The flight was from Chicago O'Hare International Airport to Washington, D.C. SAF is an alternative fuel derived from renewable sources such as waste oils, agricultural residues, and other bio-based materials. They have the ability to reduce lifecycle carbon emissions by up to 80% as compared to traditional jet fuel.

The need for lighter and more fuel-efficient aircraft is one of the major factors driving the growth of the aerospace raw materials market. As the aircraft is lighter, the journey's operational costs are significantly reduced, and the aircraft operator benefits from the increased fuel efficiency.

Key Developments/Strategies in Aerospace Raw Materials

- In June 2023, Constellium partnered with TARMAC Aerosave for development of technologies and processes to recover aluminium from end-of-life aircraft, and reutilize it within the aerospace value chain, while maintaining material properties and performance.

- In May 2023, Hexcel Corporation opened its engineered core operations plant in Morocco to meet the growing demand for lightweight advanced composite materials for the aerospace industry. The 13,000-square-meter expansion in the Midparc Free Trade Zone in Casablanca has doubled the size of the plant to 24,000-square meters.

- In May 2024, DuPont developed Tedlar material for the aerospace and amp, aircraft industry. It is an extremely lightweight and long-lasting protective material. It plays a critical role in enhancing aircraft performance by enabling paneling systems to increase aircraft efficiency and reduce waste.

- In July 2023, TORAY INDUSTRIES, INC. through its subsidiary Toray Composite Materials America, Inc. expanded its carbon fiber facility in Spartanburg, South Carolina. This strategy helps to meet the growing demand for clean energy solutions. The 30,000 square foot facility expansion is expected to increase Toray's carbon fiber capacity by 3,000 metric tons annually starting in 2025. The expansion adds flexibility and capability, enabling it to serve customers in aerospace and defense, industrial, sports and recreation, and automotive markets.

Top Impacting Factors

The global aerospace raw materials market is expected to witness notable growth registering a CAGR of 7.5%, surge in need for lightweight materials. Moreover, the increase in demand for aeronautics is expected to provide a lucrative opportunity for the growth of the market during the forecast period. On the contrary, technological issues are anticipated to hinder market growth.

Market Overview

Rising Demand for Composites in Several Applications

Composites were limited to a few secondary structures, but now technological advancements have led to a substantial rise in their application within the aerospace industry. Composites are used in many primary structures, including wings and fuselages.

The aerospace sector employs a diverse range of material matrix composites, such as fiber-reinforced and metal-particle-reinforced composites. Despite the complexities of the supply chain for manufacturing aerospace composite components, manufacturers ensure a steady supply of these materials globally, overcoming various challenges. The adoption of aerospace composites is rapidly increasing, with aircraft manufacturers incorporating them into innovative components like engine blades, which benefit from design flexibility, enhanced strength, and reduced weight. A notable example is the engine blades used in the LEAP (Leading Edge Aviation Propulsion) system for the Airbus A320neo.

Technological Issues May Hinder the Market Growth

The aerospace raw materials market growth may encounter certain technological challenges; however, these are not expected to significantly hinder its overall growth trajectory. The aerospace sector consistently seeks to advance material science to meet the increasingly rigorous performance standards for both aircraft and spacecraft. This pursuit of innovation may lead to temporary obstacles as new materials and manufacturing processes are developed and refined.

The NASA Aeronautics Research Mission Directorate has determined several key areas for material enhancement, such as high-temperature materials for hypersonic travel, lightweight composites aimed at improving fuel efficiency, and self-healing materials designed to enhance durability. Although the development of these advanced materials poses technical difficulties, it also drives innovation and creates new business opportunities. For instance, the European Space Agency (ESA) has noted that advancements in ceramics and metal matrix composites have led to enhancements in thermal protection systems for spacecraft, thereby paving the way for new possibilities in space exploration and satellite technology.

Increasing Demand for Aeronautics

The Aluminum Association emphasizes that aluminum alloys are the preferred materials for both military and commercial aircraft. In addition, aluminum plays a vital role in space exploration, being essential for NASA's spacecraft, space shuttles, and the International Space Station.

As global air travel demand rises, aircraft manufacturers are facing an increased need for new airplanes. This surge in demand subsequently elevates the need for advanced materials, such as composite materials and aluminum alloys, which are essential for creating lightweight and fuel-efficient aircraft. For instance, on October 12, 2023, Novelis, a leading global provider of aluminum rolling and recycling and a prominent supplier of sustainable aluminum solutions, announced an extension of its agreement with Airbus. This extension reinforces Novelis's enduring partnership with Airbus and underscores the company's prominent role in delivering innovative aluminum products and services to the commercial aviation industry.

On October 29, 2023, Toray Industries, Inc. unveiled TORAYCATM T1200, one of the strongest carbon fibers in the world, boasting a strength of 1,160 kilopounds per square inch (Ksi). This groundbreaking product, which enhances the lightweight properties of carbon-fiber-reinforced plastic products, aims to reduce environmental impact. Furthermore, it opens new performance possibilities for strength-driven applications across various sectors, including aerostructures, defense, alternative energy, and consumer goods. Such factors will create lucrative aerospace raw materials market opportunity.

Impact of Russia-Ukraine War on Aerospace Raw Materials Market

The Russia-Ukraine war had an indirect impact on the aerospace raw materials sector. Owing to its wider effects on the aerospace industry and the geopolitical landscape globally. The interruption of supply chains, particularly for critical materials like titanium, aluminum, and rare earth elements, caused disruptions in production and procurement. Both Ukraine and Russia are significant producers of these materials, with Russia being one of the largest global suppliers of titanium, crucial for aerospace manufacturing.

In addition, agreements on Russia and the resulting shifts in global trade dynamics led to increased costs and delays in sourcing raw materials, affecting the aerospace sector's manufacturing timelines, costs, and overall growth projections. This geopolitical tension also spurred many countries to re-evaluate their supply chain dependencies and seek alternatives, further reshaping the raw materials market for aerospace applications.

Historical Data & Information

The global aerospace raw materials market is consolidated, owing to the strong presence of existing vendors. Vendors of the global aerospace raw materials market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Segmental Analysis

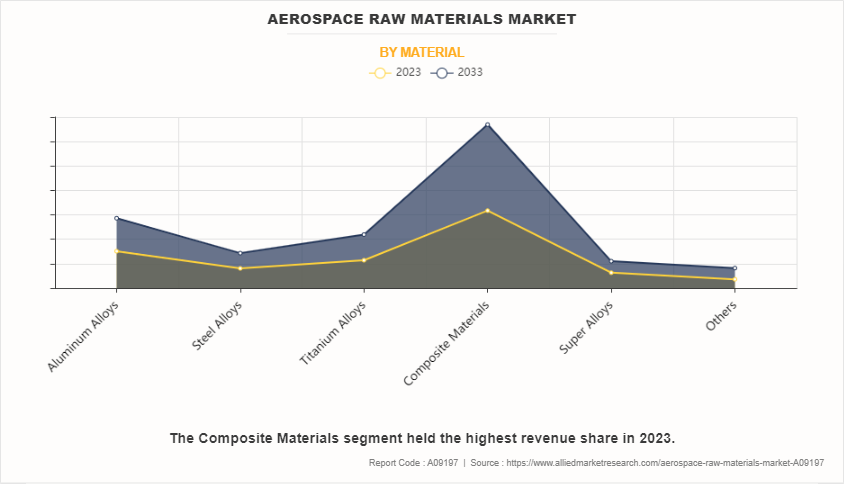

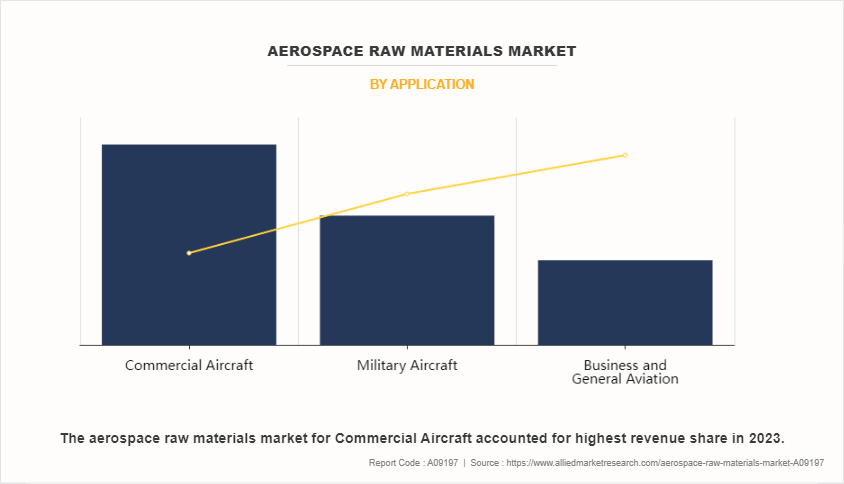

The aerospace raw materials market is segmented into Application and Material.On the basis of material type, the market is divided into composites, aluminum alloys, titanium alloys, steel alloys, super alloys, and others. On the basis of application, the market is divided into commercial aircraft, business and general aviation, and military aircraft.

By Material

The increasing rate of replacing aging aircraft has resulted in increasing demand to produce new aircraft, which is driving the need for aerospace raw materials. The market is anticipated to experience a growing demand for lightweight materials aimed at enhancing the cost-effectiveness and environmental performance of aircraft. Furthermore, high-strength, lightweight fiber-reinforced composites are becoming increasingly in aircraft manufacturing, as they contribute to improved fuel efficiency, reduced emissions, and minimized material usage, thus facilitating the incorporation of new functionalities.

By Application

The growing demand for air travel from developing nations and low-cost carriers is anticipated to influence the aerospace materials sector. As emerging economies experience robust economic growth and a burgeoning middle class, the need for air travel escalates. Countries such as China, India, and Brazil are witnessing substantial increases in both domestic and international aviation traffic. The International Air Transport Association (IATA) projects that the Asia-Pacific region will see the most considerable rise in air passengers, expected to reach 3.9 billion by 2037, thereby accounting for over half of global air travel. This growth is driving the need for new aircraft, which in turn propels the demand for aerospace raw materials market share.

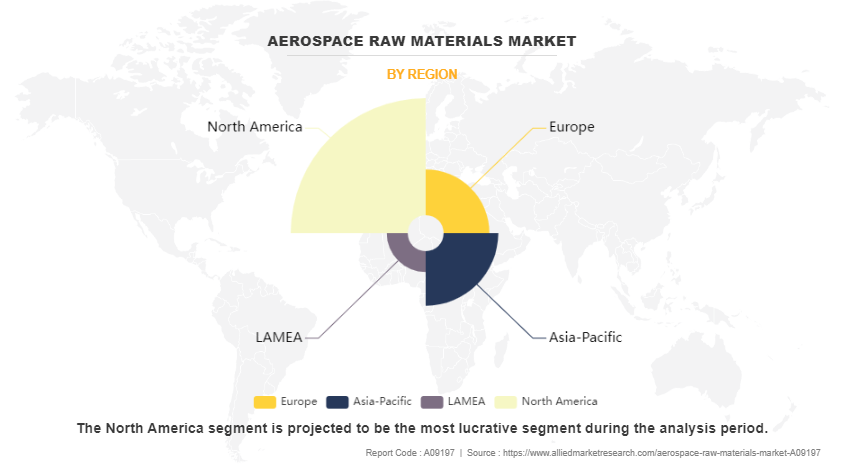

By Region

Region-wise, the aerospace raw materials market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).In addition, some manufacturers have integrated composites into seating materials to achieve lighter and more durable products. For instance, a seat developed by the French company Explicit weighs just 4 kg, utilizing composite and titanium materials. This seat is the lightest to successfully pass crash tests and contributes to annual fuel savings of approximately USD 400,000 for both the B737 and A320 aircraft.

Competitive Analysis

Competitive analysis and profiles of the major global aerospace raw materials market players that have been provided in the report include include Toray Industries, Inc., Arconic (Alcoa Corporation), ATI (Allegheny Technologies), Synesco, Constellium SE, AMG N.V., Hexcel, Materion, Dupoint, and Kobe Steel Ltd. The key strategies adopted by the major players of the global market are product launch and mergers & acquisitions.

Report Key Highlighters

- The aerospace raw materials industry studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The aerospace raw materials market share is marginally fragmented, with players such as include Toray Industries, Inc., Arconic (Alcoa Corporation), ATI (Allegheny Technologies), Synesco, Constellium SE, AMG N.V., Hexcel, Materion, Dupoint, and Kobe Steel Ltd. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Key Benefits of Stakeholders

- This study comprises analytical depiction of the global aerospace raw materials market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global aerospace raw materials market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2022 to 2033 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in aerospace raw materials.

- The report includes the market share of key vendors and the aerospace raw materials market forecast.

Aerospace Raw Materials Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 75.6 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 278 |

| By Application |

|

| By Material |

|

| By Region |

|

| Key Market Players | Constellium, DuPont, Materion Corporation, Hexcel Corporation, TORAY INDUSTRIES, INC., Kobe Steel Ltd., ATI, Syensqo, Arconic, AMG |

Military Aircraft is the leading application of aerospace raw materials market.

The upcoming trends of aerospace Raw Materials Market include surge in need for lightweight materials. And the increase in demand for aeronautics.

North America is the largest regional market for aerospace raw materials.

The global aerospace raw materials market was valued at $38.2 Billion in 2023.

Toray Industries, Inc., Arconic (Alcoa Corporation), ATI (Allegheny Technologies), Synesco, Constellium SE are the top companies to hold the market share in aerospace raw materials.

Loading Table Of Content...

Loading Research Methodology...