Aerospace Sealants Market Research, 2033

The global aerospace sealants market was valued at $915.8 million in 2023, and is projected to reach $1570.1 million by 2033, growing at a CAGR of 5.6% from 2024 to 2033. Innovations in next-generation aircraft, including electric and hybrid models, provide opportunities for sealants designed to meet the unique requirements of these aircraft, such as increased heat resistance or electrical insulation.

Introduction

Aerospace sealants are specialized materials used in the aerospace industry to seal various components and structures of aircraft and spacecraft. Their primary purpose is to ensure air and fluid-tight seals, preventing the ingress of water, fuel, hydraulic fluids, air, and other potentially harmful substances into critical parts of an aircraft or spacecraft. These sealants play a vital role in maintaining the structural integrity, safety, and performance of aerospace vehicles by protecting them from extreme environmental conditions, such as high altitudes, temperature fluctuations, UV exposure, and the corrosive effects of aviation fuels.

Aerospace sealants are formulated to meet the stringent requirements of the aerospace industry, including high strength, flexibility, resistance to a wide range of chemicals, and the ability to endure severe mechanical stresses. They are used in a variety of applications, such as sealing joints, seams, fasteners, windows, doors, and access panels. Additionally, aerospace sealants must adhere to rigorous safety and performance standards established by aviation regulatory bodies, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), to ensure the highest levels of reliability and safety in flight.

Aerospace sealants play an essential role in the construction and maintenance of aircraft structures, such as the fuselage, wings, and tail sections. These sealants are used to create airtight and watertight seals between panels, preventing water and air from entering the aircraft. This is particularly important in maintaining cabin pressure at high altitudes and preventing corrosion due to moisture. Fuel tanks and fuel systems in aircraft are subjected to significant stress due to changes in pressure, temperature, and the presence of volatile fuels. Aerospace sealants are used extensively in fuel tanks to prevent fuel leaks, which can pose a significant safety risk. These sealants must be resistant to aviation fuel, hydraulic fluids, and other chemicals found in fuel systems. Integral fuel tank sealants are applied to the internal surfaces of the tank, sealing seams and rivets to prevent fuel from leaking. These sealants must maintain their flexibility and sealing properties even after prolonged exposure to fuel and temperature fluctuations. Additionally, aerospace sealants are used in fuel lines, pumps, and other components of the fuel system to ensure airtight and leak-proof connections.

Key Takeaways

- The global aerospace sealants market has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of application, end-use industry, 4 major regions, and more than 15 countries.

- The global aerospace sealants market report includes a detailed study covering underlying factors influencing the industry opportunities and trends. The key players in the aerospace sealants market are PPG Industries, Inc., 3M, Solvay, H.B. Fuller Company, Henkel Corporation, Flamemaster Corporation, W. L. Gore & Associates, Inc., Bostik SA, Master Bond Inc., and Hernon Manufacturing, Inc.

- The report facilitates strategy planning and industry dynamics to enhance decision-making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global aerospace sealants market.

Market Dynamics

Surge in demand for maintenance, repair, and overhaul (MRO) activities is expected to drive the growth of aerospace sealants market during the forecast period. The aerospace industry relies heavily on maintenance, repair, and overhaul (MRO) activities to ensure aircraft safety, efficiency, and longevity. As global air travel expands and fleets age, the demand for reliable MRO services has intensified, particularly for aerospace sealants. The growing number of aircraft in service, along with an increasing proportion of aging planes, necessitates regular and extensive maintenance. Aircraft experience extreme conditions during flights, such as significant pressure changes, temperature fluctuations, and exposure to various chemicals, leading to wear and tear on critical components.

However, the limited product lifespan of aerospace sealants is expected to hinder the growth of aerospace sealants market during the forecast period. These specialized sealant materials often have a defined shelf life that affected by various environmental conditions, including temperature fluctuations and humidity levels. Exposure to extreme temperatures degrades the chemical properties of sealants, making them less effective over time. This degradation leads to diminished performance when the sealant is eventually applied, potentially compromising the safety and integrity of aircraft structures.

Moreover, increase in demand for electric and hybrid aircraft is expected to provide lucrative opportunities in the market. Electric and hybrid aircraft operate under different conditions than traditional jet-fueled aircraft, often experiencing unique thermal and environmental challenges. This necessitates the use of specialized sealants that can withstand a wide range of operating conditions, including higher temperatures, moisture levels, and vibrations. Sealants designed for electric and hybrid applications must exhibit excellent adhesion to lightweight composite materials commonly used in their construction. Furthermore, these sealants need to ensure effective sealing against fuel and battery leaks, protecting the integrity of the aircraft and enhancing safety. In June 2023, Airbus introduced the Eco Pulse hybrid-electric aircraft during the Paris Air Show. This new aircraft is based on the Daher TBM light aircraft, featuring a hybrid-electric powertrain and six electrically driven propellers for enhanced performance.

Segments Overview

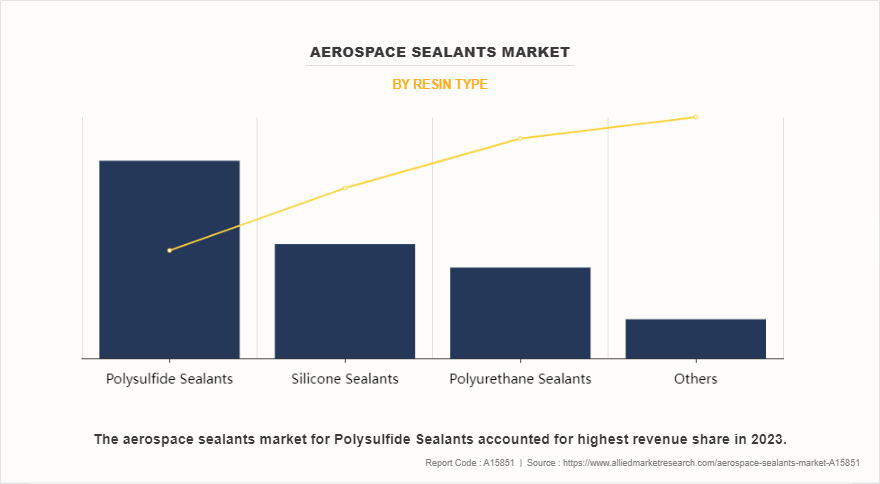

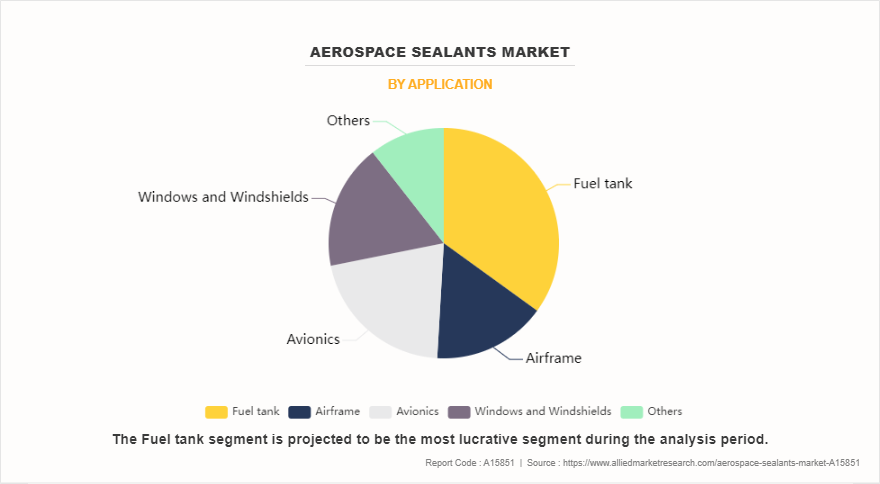

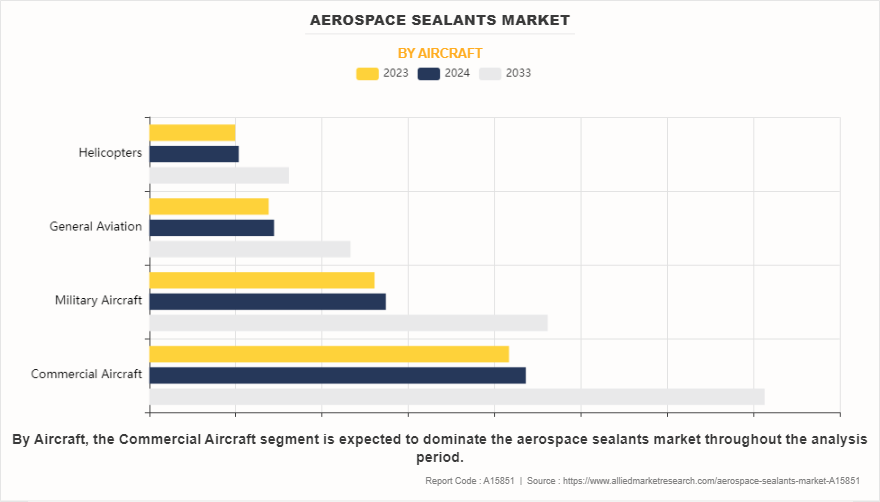

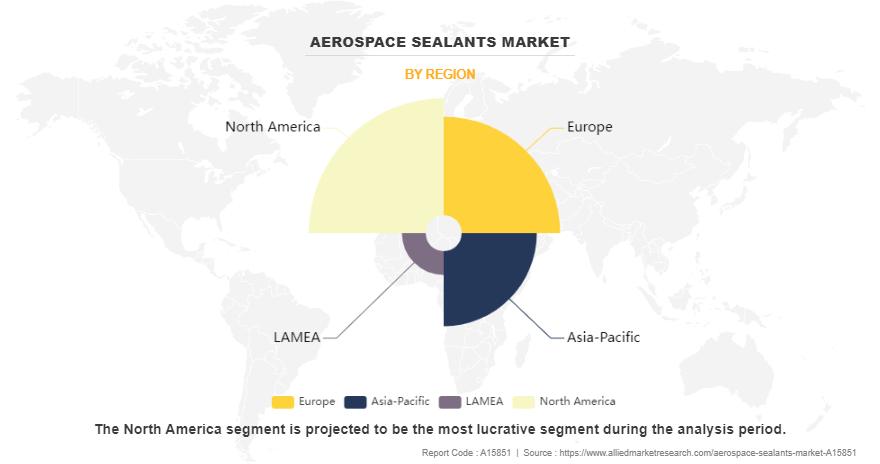

The aerospace sealants market is segmented into resin type, application, aircraft, and region. On the basis of resin type, the market is classified into polysulfide sealants, silicone sealants, polyurethane sealants, and others. On the basis of application, the market is divided into fuel tank, airframe, avionics, windows & windshields, and others. On the basis of aircraft, the market is categorized into commercial aircraft, military aircraft, general aviation, and helicopters. Based on region the market is divided into North America, Europe, Asia-Pacific, and LAMEA.

On the basis of resin type, the polysulfide sealants segment is the dominated the market representing the CAGR of 5.5% during the forecast period. Polysulfide sealants are typically used for sealing joints, gaps, and other critical areas in aircraft structures where exposure to fuels, oils, hydraulic fluids, and other chemicals is frequent. One of their most important functions is fuel tank sealing, as they offer exceptional resistance to jet fuel and prevent leakage in the demanding conditions of aerospace environments. Their ability to remain flexible even under extreme temperature fluctuations ensures that the seal remains intact despite the constant expansion and contraction of materials during flight.

On the basis of application, the fuel tank segment is the dominated the market representing the CAGR of 5.3% during the forecast period. Aerospace sealants play a critical role in fuel tank applications, where they are essential for preventing leaks, maintaining the integrity of fuel systems, and ensuring the safety and reliability of aircraft. These sealants are formulated to withstand extreme environmental conditions, including high pressures, temperature variations, and exposure to chemicals such as aviation fuel. In fuel tank applications, sealants are primarily used to create airtight and fuel-resistant barriers that prevent fuel leakage, which is crucial for both performance and safety.

On the basis of aircraft, commercial aircraft segment dominated the market in 2023. Aerospace sealants play a vital role in the construction and maintenance of commercial aircraft, ensuring the safety, longevity, and performance of the aircraft. These sealants are used extensively in various areas, from sealing fuel tanks to preventing corrosion and weatherproofing the aircraft. One of their primary uses is in fuel tank sealing, where they provide a leak-proof barrier to contain fuel under high pressure and in varying atmospheric conditions.

Based-on region North America dominated the Aerospace sealants market in 2023. In North America, aerospace sealants play a crucial role in ensuring the safety, durability, and efficiency of both commercial and military aircraft. In the United States and Canada, aerospace sealants are also essential in maintaining aging fleets. Many military and commercial aircraft are being kept operational well beyond their original design life, necessitating extensive use of sealants to prevent corrosion, fluid leaks, and maintain structural integrity. Sealants designed for corrosion resistance are especially critical in areas like the fuselage, where exposure to moisture can lead to long-term degradation.

Competitive Analysis

The major players operating in the aerospace sealants market include PPG Industries, Inc., 3M, Solvay, H.B. Fuller Company, Henkel Corporation, Flamemaster Corporation, W. L. Gore & Associates, Inc., Bostik SA, Master Bond Inc., and Hernon Manufacturing, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerospace sealants market analysis from 2023 to 2033 to identify the prevailing aerospace sealants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerospace sealants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerospace sealants market trends, key players, market segments, application areas, and market growth strategies.

Aerospace Sealants Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.6 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 419 |

| By Resin Type |

|

| By Application |

|

| By Aircraft |

|

| By Region |

|

| Key Market Players | Solvay, Hernon Manufacturing, Inc, PPG Industries, Inc., Bostik SA, Flamemaster Corporation, 3M, W. L. Gore & Associates, Inc., H.B. Fuller Company, Henkel Corporation, Master Bond Inc. |

Analyst Review

According to the opinions of various CXOs of leading companies, the aerospace sealants market is expected to witness due to Increase in focus on aircraft fuel efficiency. The aerospace industry is placing a greater emphasis on fuel efficiency to lower operational costs and reduce environmental impact, with aerospace sealants playing a crucial role in this effort. These sealants enable the use of lightweight composite materials in aircraft design, allowing for the creation of seamless joints that reduce overall weight. As airlines and manufacturers prioritize sustainability and cost savings, the adoption of high-performance aerospace sealants is becoming increasingly important. These sealants contribute to lightweight structures and improved aerodynamics, aligning with the industry's goals of meeting stringent emissions regulations and enhancing fuel efficiency. Consequently, the role of aerospace sealants is critical to the future of aviation technology.

However, the temperature and pressure sensitivity of aerospace sealants is expected to restraint the growth of aerospace sealants market during the forecast period. Aerospace sealants must perform reliably across a wide range of temperatures and pressures, especially in high-altitude environments where external pressure decreases, and temperature variations are significant. Sealants lacking adequate thermal stability and pressure resistance fail, leading to leaks and structural weaknesses, which pose safety risks and increase maintenance costs due to frequent inspections and repairs. Additionally, inconsistent sealant performance under varying environmental conditions restricts material choices for aircraft engineers, necessitating rigorous testing and validation for each formulation.

The global aerospace sealants market was valued at $915.8 million in 2023, and is projected to reach $1570.1 million by 2033, growing at a CAGR of 5.6% from 2024 to 2033.

North America is the largest regional market for aerospace sealants.

Fuel Tank is the leading application of aerospace sealants market.

The increase in demand for electric and hybrid aircraft are the upcoming trends of aerospace sealants market

The report covers profiles of key industry participants such as PPG Industries, Inc., 3M, Solvay, H.B. Fuller Company, Henkel Corporation, Flamemaster Corporation, W. L. Gore & Associates, Inc., Bostik SA, Master Bond Inc., and Hernon Manufacturing, Inc.

Loading Table Of Content...

Loading Research Methodology...