Aerostat Systems Market Research, 2033

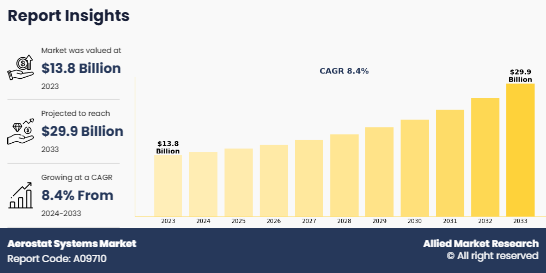

The global Aerostats Systems Market Size was valued at $13.8 billion in 2023, and is projected to reach $29.9 billion by 2033, growing at a CAGR of 8.4% from 2024 to 2033.

The aerostat system market encompasses the development, production, and deployment of lighter-than-air platforms, including tethered balloons and airships, used for surveillance, communication, and reconnaissance. These systems are equipped with sensors, cameras, and radar to provide real-time data and are valued for their cost efficiency, extended operational duration, and adaptability in military, commercial, and scientific applications. Increasing demand for border security, disaster management, and environmental monitoring drives market growth. Key advancements include enhanced payload capacity and integration with advanced technologies like AI and IoT. The market spans sectors such as defense, telecommunications, and weather forecasting, with expanding applications worldwide.

Key Takeaways

- The Aerostats Systems Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global single coated adhesive tapes markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

Aerostats, with their ability to provide continuous, long-duration observation at a fraction of the cost of manned aircraft or satellites, are increasingly preferred for border security and surveillance missions. According to a report by the Stockholm International Peace Research Institute (SIPRI), global military spending reached $2.24 trillion in 2024, marking a 3.5% increase from the previous year, indicating robust investments in defense infrastructure, including surveillance systems. Moreover, the rise in geopolitical tensions and transnational threats has propelled nations to bolster their situational awareness capabilities. For instance, the U.S. Customs and Border Protection agency utilizes aerostat systems for monitoring the southern border, significantly aiding in the interdiction of illegal activities. Additionally, advancements in sensor technologies, including high-resolution cameras and radar systems, enhance the operational effectiveness of aerostats, broadening their appeal. The integration of artificial intelligence (AI) and machine learning (ML) for automated threat detection further underscores their strategic importance. With global security concerns on the rise, the deployment of aerostat systems is poised to grow, driven by their versatility and cost-efficiency.

Aerostats, being lighter-than-air platforms, are highly susceptible to high winds, thunderstorms, and extreme temperatures, which can cause instability or structural damage. For instance, studies show that wind speeds exceeding 50 knots can render many aerostat systems inoperable. Additionally, the material used for aerostats, such as high-strength fabrics, is prone to wear and tear over time, particularly in harsh environments, leading to increased maintenance costs.

Another significant challenge is the risk of accidental or deliberate damage. Aerostats, typically tethered to the ground, can be targeted by small arms fire, drones, or other hostile actions, especially in military or conflict zones. Furthermore, the tethers themselves can pose operational risks, as they may obstruct air traffic or experience mechanical failure. Regulatory challenges also impact Aerostats Systems Market Growth, as aviation authorities impose stringent safety standards and restrictions on deploying aerostats near urban areas or sensitive airspace. These operational limitations, coupled with high initial investment costs for advanced aerostat systems and maintenance, hinder their adoption across various industries, thereby restraining market expansion despite growing demand.

The aerostat system market presents significant opportunities driven by growing demand for cost-effective surveillance and communication solutions across defense and commercial sectors. With the increasing emphasis on border security, aerostat systems are being deployed for real-time monitoring and threat detection. For instance, tethered aerostats equipped with radar and electro-optical systems are extensively used for counter-drone operations, offering superior coverage at a fraction of the operational cost of UAVs. Additionally, the rising number of natural disasters has created opportunities for aerostats in disaster management, as they provide real-time data to aid in rescue operations.

The integration of advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT) further enhances aerostat capabilities. Smart aerostats can now process and transmit data faster, improving situational awareness. According to industry reports, the adoption of advanced sensors and lighter materials has increased operational efficiency by up to 30%. Furthermore, commercial applications, including telecommunication and remote connectivity in remote areas, have grown significantly. For example, aerostats can provide stable internet connectivity in rural regions, addressing the global digital divide. The market also benefits from reduced helium costs and government investments in surveillance programs, making aerostat systems a vital component of modern security and communication networks.

Segmentation

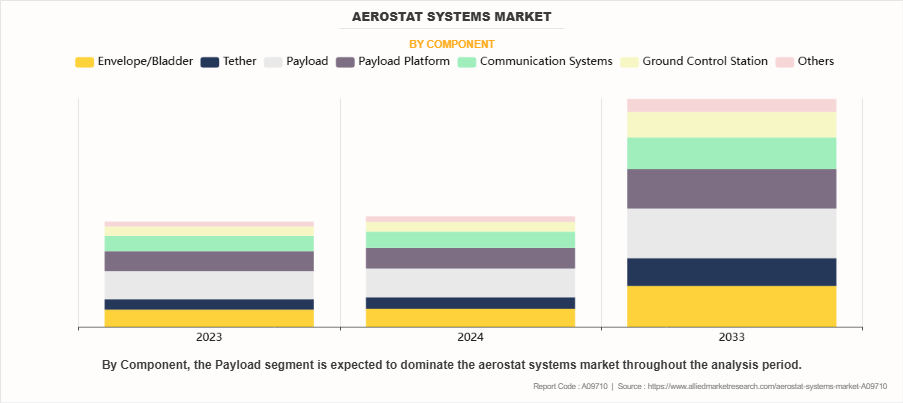

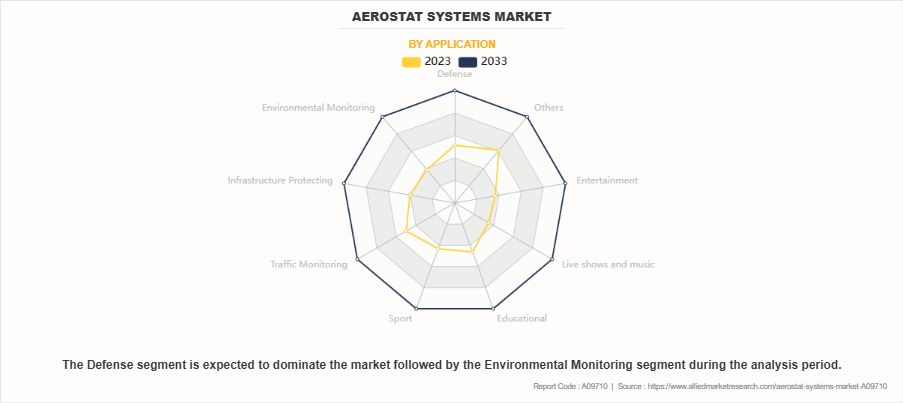

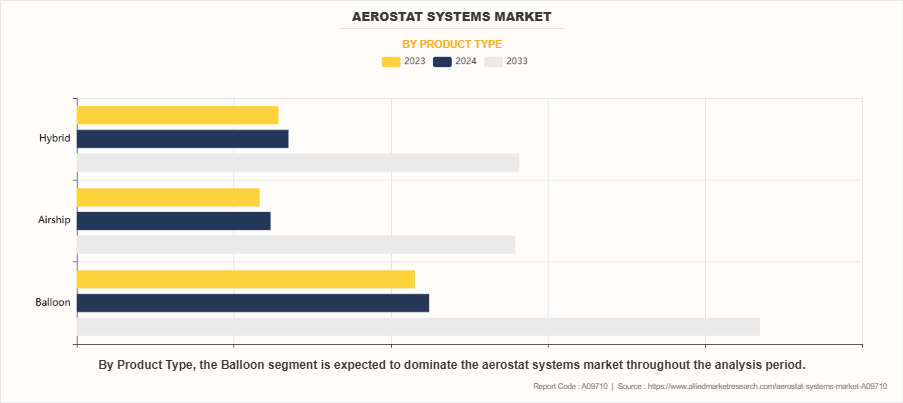

The aerostat system market is segmented into components, application, product type, class, and region. By component, the market is divided into envelope/bladder, tether, payload, payload platform, communication systems, ground control station, and others. As per application, the market is segregated into defense, environmental monitoring, infrastructure protecting, traffic monitoring, sport, educational, live shows and music, entertainment, and others. On the basis of product type, the market is classified into balloon, airship, and hybrid. By class, the market is categorized into large, medium, and compact. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Component

Based on components, the payload segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the increasing Aerostats Systems Market Demand for advanced sensors, cameras, and communication equipment that enhance situational awareness and operational capabilities. Payloads are critical for surveillance, intelligence gathering, and reconnaissance, particularly in defense and disaster management. The adoption of multi-mission payloads capable of performing diverse tasks, coupled with advancements in lightweight materials and miniaturization, has further driven their dominance. Their ability to integrate with cutting-edge technologies like AI and IoT strengthens their importance in the market.

Application

Based on application, the defense segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the rising need for enhanced border security, surveillance, and counter-drone operations. Defense applications require persistent monitoring and intelligence gathering, which aerostats provide cost-effectively over extended periods. Governments worldwide are increasingly investing in aerostat systems for missile detection, maritime surveillance, and battlefield reconnaissance. Their capability to operate in remote or hostile environments without risking human life has made them indispensable in modern defense strategies.

Type

Based on type, the balloon segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to their versatility, low operating cost, and ease of deployment. Balloons are widely used for surveillance, communication, and meteorological applications due to their ability to maintain a stable position for prolonged periods. Innovations in materials and design have improved their durability and payload capacity, enhancing their performance. Their scalability for both commercial and military uses, combined with their cost efficiency compared to other aerial platforms, has solidified their dominance in the market.

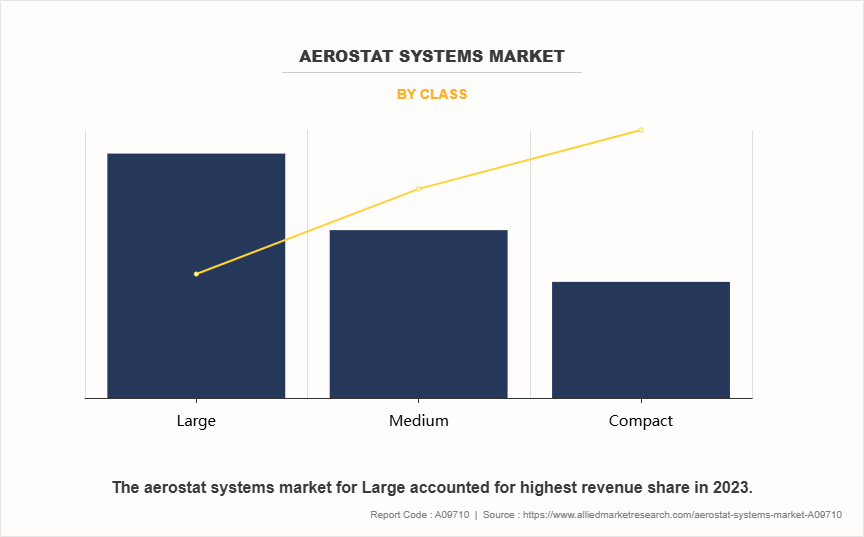

Class

Based on class, the large segment had thedominating Aerostats Systems Market Share in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to their superior payload capacity, longer endurance, and ability to operate at higher altitudes. Large aerostats are extensively used for military and large-scale surveillance projects, where comprehensive coverage is required. These systems are ideal for integrating advanced technologies such as radar, high-resolution cameras, and communication relays. Their effectiveness in long-term operations, combined with growing defense budgets and government investments in large-scale aerostat programs, drives their prominence in the market.

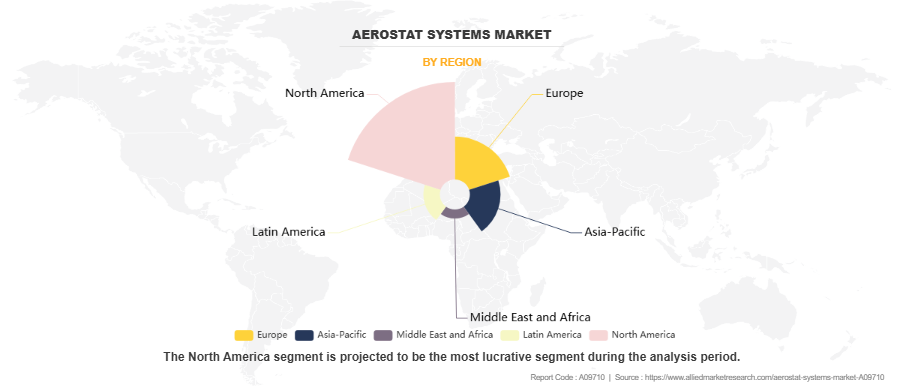

Region

Based on region, the North America region dominated the global Aerostats Systems Industry in the year 2023 and is likely to remain dominant during the Aerostats Systems Market Forecast period. This is attributed to the presence of major aerostat manufacturers, high defense spending, and increasing investments in advanced surveillance systems by the U.S. government. North America’s focus on border security, disaster management, and counter-drone technologies has accelerated the adoption of aerostats. Additionally, the region’s strong technological infrastructure supports the integration of advanced components like AI-powered payloads and IoT systems. Ongoing R&D initiatives and collaborations with military organizations further bolster North America’s market leadership.

Competitor Analysis

The Aerostats Systems Market Analysis includes top companies operating in the market, such as Aeronord Sas, ALLSOPP HELIKITES LTD, Altaeros, A-NSE, Carolina Unmanned Vehicles Inc., CNIM, HEMERIA, ILC Dover LP, TCOM, L.P., and Raven Industries, Inc. These players have adopted various strategies to increase their Aerostats Systems Industrypenetration and strengthen their position in the aerostat system industry.

- October 2023, Altaeros signed a 5-year, $99 million contract from the Department of Homeland Security, U.S. Customs and Border Protection (CBP) for the delivery and support of autonomous aerostats and support services. Through this contract, Altaeros provides ST-Flex Guardian Class aerostat. It carries up to 130+ lbs (60 kg) of payload at heights up to 1,000 feet (305 m) above ground. The umbilical tether houses dedicated fiber optic cables for avionics and payloads, ensuring data is kept separated and secure.

- June 2022, Altaeros & SoftBank Corp., Japan's leading mobile carrier, completed initial testing of Altaeros' ST-Flex autonomous aerostat. ST-Flex carried SoftBank's base station system, which was equipped with its proprietary cylindrical antenna that realizes communication area footprint fixation, to a height of 816 feet (249m), where it was connected to ground equipment via optical fiber and power conductors embedded in the tethers.

- October 2021, A-NSE signed an agreement with Ivory Coast for its border with Burkina Faso to supply tethered surveillance balloons for security purpose on border area. Furthermore, A-NSE offers its customers airborne surveillance systems to protect and defend country borders and boundaries.

- September 2021, CNIM, through its subsidiary CNIM Air Space, collaborated with in-innovative navigation GmbH to deliver two airborne surveillance aerostat systems to Frontex (European border and coast guard agency). Each system is composed of a 450 m³ Eagle Owl tethered aerostat, equipped with a Hensoldt ARGOS II HD EO/IR optronic gimbal, a Diades Marine maritime radar, and an AIS receiver.

- March 2021, CNIM, through its subsidiary CNIM Air Space, inaugurated a new 55 meters long production line dedicated to the assembly of its tethered aerostats and drone airships' envelopes. Through this expansion, CNIM Air Space will produce the envelopes of its tethered aerostats systems. Those aerostats, which are linked to the ground by a tether, are deployed for 24/7 surveillance or communication missions, lasting from a few days up to several months.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current Aerostats Systems Market Trends, estimations, and dynamics of the aerostat systems market analysis from 2023 to 2033 to identify the prevailing aerostat systems market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerostat systems market segmentation assists to determine the prevailing Aerostats Systems Market Opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aerostat systems market trends, key players, market segments, application areas, and market growth strategies.

Aerostat Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 29.9 billion |

| Growth Rate | CAGR of 8.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Application |

|

| By Product Type |

|

| By Class |

|

| By Component |

|

| By Region |

|

| Key Market Players | Altaeros , TCOM, L.P., ILC Dover LP, CNIM , HEMERIA, Raven Industries, Inc., A-NSE , Aeronord Sas, ALLSOPP HELIKITES LTD, Carolina Unmanned Vehicles Inc. |

Analyst Review

The Aerostat Systems market is experiencing a notable shift toward event services applications, presenting significant opportunities for business growth and innovation.

As a CXO, the aerostat system market presents significant opportunities for growth and innovation, particularly in defense and event services. Aerostat systems have proven to be highly cost-effective and versatile, offering long-duration solutions for surveillance, monitoring, and communication. In defense, they are critical for border security, intelligence gathering, and anti-drone operations, addressing increasing global security demands. Investments in advanced technologies, such as radar, high-definition cameras, and IoT-enabled systems, are key to maintaining competitiveness in this sector.

In the event services industry, aerostats are transforming how events are organized and experienced. Their ability to provide real-time aerial monitoring, live broadcasting, and creative advertising opens new revenue streams. From sporting events to live shows and entertainment, aerostats enhance audience engagement while ensuring safety and security. Collaborating with event management companies and tapping into large-scale events offer significant growth opportunities.

However, the market also faces challenges, such as weather dependency and competition from drones. Addressing these challenges through innovative designs, improved materials, and enhanced stability features is critical. Furthermore, expanding into underserved markets, such as remote telecommunications and rural surveillance, can unlock additional growth.

Therefore, the aerostat system market aligns with the evolving needs of defense and commercial industries. By leveraging technological advancements and focusing on customer-centric applications, companies in this space can drive innovation and deliver value across diverse sectors

The global aerostat systems market was valued at $13,801.8 million in 2023, and is projected to reach $29,865.6 million by 2033, registering a CAGR of 8.4% from 2024 to 2033.

The report sample/ company profile section for Aerostat System market report can be obtained on demand from the website.

The key growth strategies adopted by the Aerostat Systems Market players includes innovations, merger, product launch, investment, joint venture, partnership and business developments with the increased RnD expenditure.

Among the analyzed geographical regions, currently North America is dominating the market with the highest revenue in the global market. However, the same region is expected to grow at a higher rate during the forecast period, predicting lucrative opportunities .

The U.S and China has are key matured markets growing in the global market

Loading Table Of Content...

Loading Research Methodology...