Aerostructures Market Summary

The global aerostructures market size was valued at $62 billion in 2022, and is projected to reach $114.8 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032. Stringent environmental regulations, increasing demands to save and optimize operating costs, increasing awareness and concerns about environmental issues are factors driving the aerostructures market.

Key Market Trends and Insights

Region wise, Asia-Pacific generated the highest revenue in 2022.

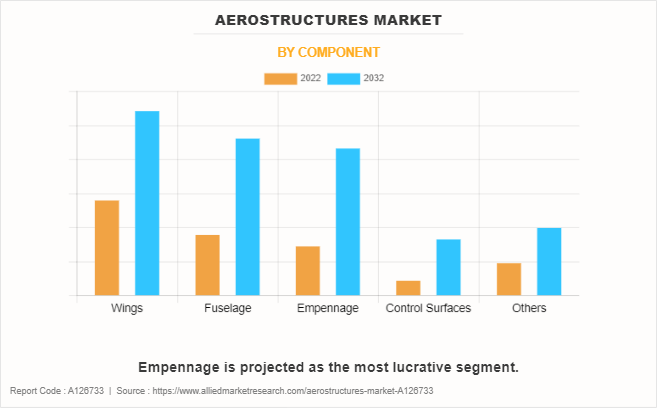

The global aerostructures market share was dominated by the wings segment in 2022 and is expected to maintain its dominance in the upcoming years

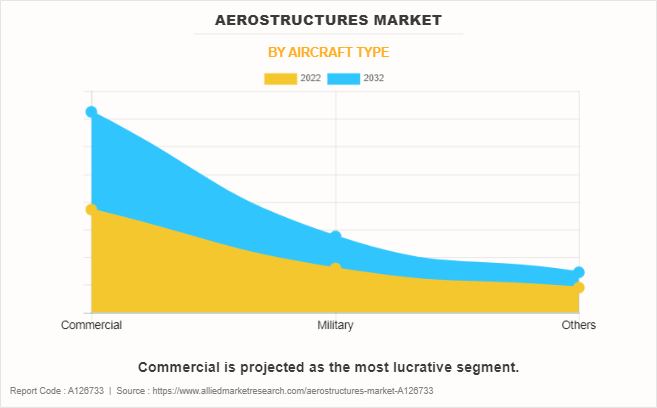

The commercial segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2022 Market Size: USD 62 Billion

- 2032 Projected Market Size: USD 114.8 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 6.6%

- Asia-Pacific: Generated the highest revenue in 2022

Report Key Highlighters:

- The aerostructures market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($ million) available over the forecast period 2022-2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global aerostructures market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The aerostructures market share is marginally fragmented, with players such as Airbus SE, ELBIT SYSTEMS LTD., Saab AB, Spirit AeroSystems, Inc., Leonardo S.p.A., Triumph Group, Inc., AAR Corporation, GKN Aerospace Services Limited., Boeing, and FACC AG. Major strategies such as contracts, agreements, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored

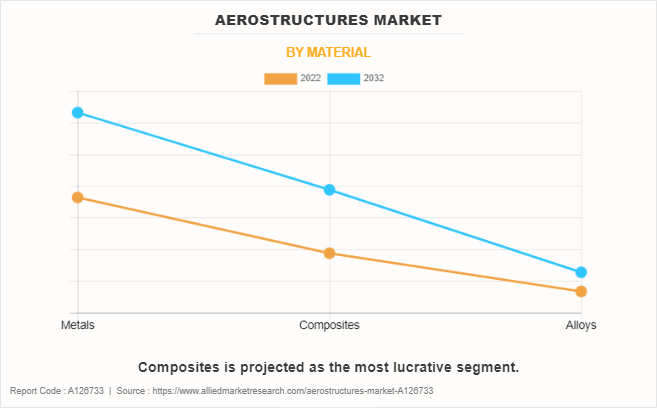

An aerostructure refers to airframe of aircraft that incldues fuselage, wings, or control surfaces, and other parts. Aerostructure improves the accuracy, performance, and efficiency of an airplane system. Aerostructure plays an important role in aircraft design. This covers the empennage, control surface, wings, fuselage, and so forth. Aerostructures are typically built from strong, lightweight materials like aluminium or composites to improve the overall efficiency and performance of the aircraft.

In addition, various companies form strategies to design and build aerostructure components for aircrafts. For example, in June 2023 Supernull LLC (Company) and GKN Aerospace large aerostructures announced a partnership to design and manufacture aerostructures and interconnection system (EWIS) for electric vertical takeoff and landing (eVTOL) vehicle. Such developments generate demand for aircraft aerostructures, which is expected to fuel the growth of the aerostructures market forecast.

The market is growing but high start-up costs and difficulties in technology adoption and integration hinder the growth of the aerostructures market. Furthermore, the increasing trend towards automation and application of business intelligence solutions, coupled with technological advancements, provides remarkable growth opportunities for the players operating in the market.

North America includes the U.S., Canada, and Mexico. Major aerospace companies in the region including leading equipment manufacturers (OEMs) and suppliers have headquarters or large offices in. This level of influence plays a key role in fostering aerostructures market expansion in the in the aerospace industry.

North America has one of the largest aerostructure industry. The aerostructures market trends represent necessity to replace ageing aircraft and the desire for fuel-efficient aircraft are the main drivers of the aerospace industry's expansion. The need for both military and commercial aircraft grew, which in turn drove up aircraft production. The assembly of aircraft requires aerostructure components, and the increase in aircraft production directly stimulates demand for aerostructures. For instance, in October 2023, Montana Aerospace obtained a contract from Boeing to produce wing stringers for Boeing's 767s.

Surge In Global Air Passenger Traffic

Based on the annual global figures published by the International Civil Aviation Organisation (ICAO), there was a increase in air travel in 2022—an estimated 47% more than in 2021. The quick consolidation of multiple multinational airlines is the cause of this expansion. In addition, the number of passenger aircraft in service by 2022 shows a significant recovery in air travel, with current projections showing it has reached 75% of pre-pandemic levels

Internationally, statistics show that air travel has increased over the years. This increase will lead to a significant increase in the demand for new aircraft worldwide, which will require the use of aerospace adhesives to manufacture aircraft worldwide so the growing global air passenger traffic is the driving force to provide aerostructures that are widely used.

Increase in Aircraft Demand and Production

The increasing global demand for air travel is driving the airlines to scale up to meet the growing needs of passengers. This increases the need for new aircraft and consequently the demand for advanced aircraft. For intance, Airbus is expected to have significantly increased its commercial fleet, delivering 661 aircraft to 84 customers in the year 2022. This represents an 8% increase compared to the previous year. In addition, the company reported 820 net new orders, exceeding its estimate of 768 for 2019. At the end of 2022, Airbus had a backlog of 7,239 aircraft, representing the highest number since 2019. Economic internal expansion in various regions is associated with the increase in disposable income and improved business activities.

Such factors coupled with improved accessibility to air travel, trigger an increased demand for air transportation services. In response, airlines expand their fleets, creating a direct need for aerostructures to facilitate the production of new aircraft. Government initiatives and policies supporting the aerospace industry can further enhance the impact of heightened aircraft demand. Moreover, ADS Group, a UK based trade association projects that 1,190 aircraft will be delivered in total by Q1 2023. The estimate is 4% higher than that of 2022. This forecast reflects a 4% increase compared to 2022, with anticipated production rate escalations leading up to 2024. It is crucial for the aerostructure manufacturers to efficiently absorb the planned increases in production over the upcoming months. In addition, measures such as subsidies, incentives, or regulatory frameworks that encourage airlines to invest in more efficient and newer aircraft contribute significantly to the sustained growth in aircraft production and, consequently, the demand for aerostructures.

Regulatory Compliance

Aviation agencies, such as the Federal Aviation Administration (FAA) in the United States, have strict safety certification standards that the aerospace sector must achieve. The Aviation Safety Agency (EASA) of the European Union mandates that installed aircraft components be made in accordance with strict rules, documented, and put through extensive testing. Known to be time consuming and expensive, complex certification processes may not allow aerostructures products to enter the aerostructures market.

In order to take into account new developments in technology, environmental concerns, and safety, aviation laws are updated and altered periodically. To ensure that their goods stay compatible, air system manufacturers need to stay informed about these developments and keep updating their offerings. Adapting to changing regulations presents challenges and may require significant investments in research, development and refurbishment of aerostructures.

The Disruption in Supply Chain

The aerospace market is based on a global supply chain that supplies components, parts and subassemblies to multiple suppliers around the world. Problems such as natural disasters, political unrest, epidemics, or unforeseen events can disrupt the production and distribution of aerostructures. Many parts of the aerostructures have special design processes and materials. Disruption to suppliers that provide such materials can lead to temporary shortages, extended lead times, and difficulties maintaining a consistent and deliverable supply of essential products. Supply variances can disrupt operating procedures, affect the overall air conditioning process, and possibly result in penalties.

Rise in demand for maintenance, repair, and overhaul services for aging aircraft

The need for maintenance, repair and overhaul (MRO) of older aircraft is increasing. The aerospace industry is growing due to the increased need for maintenance, repair and overhaul (MRO) services for aging aircraft, as many critical aircraft are approaching or exceeding their planned lives these aircraft require continuous maintenance, repair and improvement as they age Aircraft must be manufactured to the right standards and meet safety standards.

This aging trend provides aerostructure industry opportunities for MRO services. For instance, in May 2023, Spirit AeroSystems entered into a joint venture agreement with MAB Engineering. The agreement provides for collaboration between the two companies to provide MRO services for specific parts of the aircraft (nacelle and maintenance aircraft) for Malaysia Airlines and other operators MRO services will include maintenance, repair and maintenance of nacelles and maintenance aircraft maintenance of the function. Technological and technological advances have lengthened the life of aircraft. Older aircraft are now being kept in long-term service, especially in areas where economic considerations or regulatory frameworks make it more economically feasible to upgrade and upgrade existing aircraft than to invest in a brand-new plane.

The use of MRO services for aging aircraft presents an economically viable alternative to the one-time purchase of new aircraft. Airlines and operators may choose to allocate resources to maintain and upgrade their existing aircraft, and to address specific challenges related to obsolescence of components, systems, or systems This approach this approach allows them to maximize the value derived from their current assets.

Segments Overview

The aerostructures market size is segmented on the basis of component, material, aircraft type, and region. ivided by component into wing, fuselage, empennage, control surface and so on. The market is segmented by material into metals, composites and alloys. The market is classified into commercial aircraft, military aircraft and others according to type of aircraft. By region, the aerostructures market is analyzed in North America, Europe, Asia Pacific and LAMEA.

Competitive Analysis

Key companies mentioned in the aerostructures market report are Airbus SE, Elbit Systems Ltd., Saab AB, Spirit Aerosystems, Inc., Leonardo S.P.A., Triumph Group, Inc., AAR Corporation, GKN Aerospace Services Ltd., Boeing and FACC AG.

Impact of Russia-Ukraine war on Aerostructures Industry

On February 24, 2022, Russia invaded Ukraine, leading to the Russo-Ukrainian war that began in 2014. The Russian invasion of Ukraine and subsequent sanctions against the country pose many challenges for the airline industry. As of March 25 2022, 36 countries in the European Union, the UK and the US. has implemented closed runways for Russian airlines and therefore prohibited airlines in most of these countries from flying or boarding Russian aircraft.

In 2021, international flights between Russia and the rest of the world accounted for 5.2% of global international traffic, compared to only 1.3% of all global flights to and from Russia, while international flights to and from Russia contributed 5.7% of all European flights by 2021. Restrictions on international flights may reduce demand for new aircraft Airlines may delay new aircraft orders or cancelled, affecting aircraft manufacturers’ design programs and subsequently affecting aircraft system requirements, which is expected to affect the aerostructures market growth.

Recent Developments in the Aerostructures Industry

- In June 2023, Supernal LLC and GKN Aerospace Services Limited collaborated to research and design high-voltage, high-power electrical wiring systems and lightweight aerostructures. Under this partnership, it increases its business portfolio.

- In September 2023, Saab AB established a partnership with Boeing to develop large cargo doors, bulk cargo doors, and access doors for the Boeing 787 Dreamliner.

- In January 2023, ELBIT SYSTEMS LTD. received a contract from Boeing to supply large main deck cargo doors for Boeing 777 freighter and 777-8 Freighter.

- In June 2023, Spirit AeroSystems, Inc. signed an agreement with Honda Aircraft Company to develop a composite fuselage and a composite bonded frame for Honda Jet. Through this agreement, it expands its regional and business portfolio.

- In February 2022, Leonardo S.P.A. partnered with Vertical Aerospace for a joint development project to design, test, manufacture and deliver a carbon composite fuselage for Vertical’s VX4 electric aircraft.

- In September 2021, FACC AG expanded its partnership with Airbus to develop development of empennage components for the largely composite A220 aircraft. Through this, it helps the company's long-term growth plan.

- In February 2021, Boeing launched with its joint venture Tata Boeing Aerospace Limited (TBAL), a complex vertical fin for 737 airplanes. This production helps towards making make India self-reliant in defense manufacturing.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aerostructures market analysis from 2022 to 2032 to identify the prevailing aerostructures market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aerostructures market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global aerostructures market.

- aerostructures market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Aerostructures Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 114.8 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 276 |

| By Component |

|

| By Material |

|

| By Aircraft Type |

|

| By Region |

|

| Key Market Players | AAR Corporation, FACC AG, Spirit AeroSystems, Inc., ELBIT SYSTEMS LTD., GKN Aerospace Services Limited., Airbus SE, Triumph Group, Inc., Saab AB, Boeing, Leonardo S.p.A. |

The global aerostructures market size was valued at USD 61,950.7 million in 2022, and is projected to reach USD 114,758.7 million by 2031

The global aerostructures market is projected to grow at a compound annual growth rate of 6.6% from 2023-2032 to reach USD 114,758.7 million by 2032

The top companies to hold the market share in aerostructures are Airbus SE, Elbit Systems Ltd., Saab AB, Spirit Aerosystems, Inc., Leonardo S.P.A., Triumph Group, Inc., AAR Corporation, GKN Aerospace Services Ltd., Boeing and FACC AG.

Asia-Pacific

Surge In Global Air Passenger Traffic, Increase in Aircraft Demand and Production, Regulatory Compliance, Rise in demand for maintenance, repair, and overhaul services for aging aircraft majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...