Africa Condom Market Research, 2035

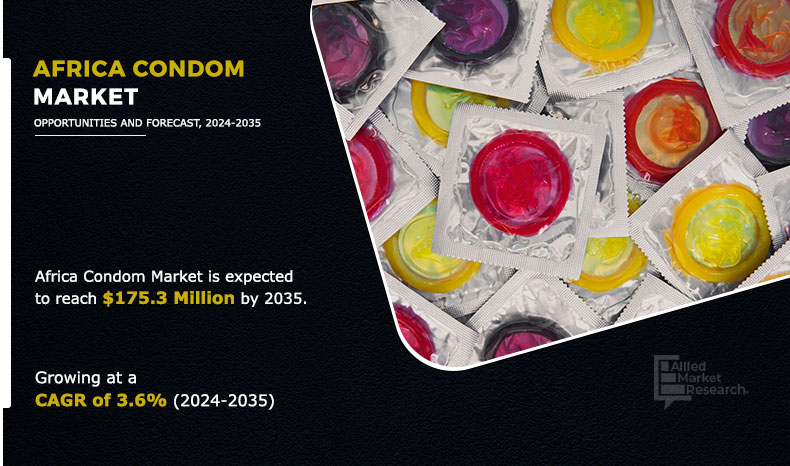

The Africa condom market size was valued at $115.6 million in 2023 and is projected to reach $175.3 million by 2035, registering a CAGR of 3.6% from 2024 to 2035. The growth of the Africa condom market is primarily driven by increase in awareness regarding HIV/AIDS prevention and sexual health education programs. Moreover, rise in population, urbanization, and government initiatives promote safe sexual practices that contribute to market expansion. In addition, the emergence of innovative condom designs and materials, coupled with efforts to reduce stigma surrounding contraception, has further fueled market growth.

A condom is a thin sheath, typically made of latex or polyurethane, which is worn over the penis during sexual activity to prevent pregnancy and reduce the risk of sexually transmitted infections (STIs). These condoms act as a barrier, trapping semen and preventing the exchange of bodily fluids between partners. Condoms are one of the most effective methods of birth control and are widely available over-the-counter. Proper use, which requires following the instructions and checking for damage, is essential for their effectiveness.

Market Dynamics

Rise in prevalence of sexually transmitted infections (STIs) significantly boosts the demand for condoms in the African market. With STIs posing a substantial public health challenge across the region, including high rates of HIV/AIDS, gonorrhea, syphilis, and chlamydia, there is an increased awareness of the importance of safe sexual practices. According to the World Health Organization, in Africa, an estimated 25.6 million people were living with HIV in 2022, of which 90% knew their status, 82% were receiving treatment, and 76% of them had suppressed viral loads. In addition, an estimated 20.9 million people received antiretroviral therapy in 2022. Moreover, 760,000 people in Africa got newly infected with HIV in 2022, which highlights the ongoing challenges in controlling the spread of the virus and the urgent need for effective prevention measures. Thus, condoms are recognized as an effective barrier method to prevent the transmission of STIs during sexual activity, which makes them a crucial sexual wellness product in combating the spread of infections.

As the incidence of STIs continues to increase, individuals are increasingly seeking ways to protect themselves and their partners. The increased awareness of the risks associated with unprotected sex drives the demand for condoms, leading to greater accessibility and utilization of condoms in Africa condom market. Moreover, public health campaigns and initiatives aimed at promoting safe sexual practices further contribute to surge in demand for condoms in the Africa condom market. As a result, manufacturers, NGOs, and healthcare organizations have scaled up efforts to ensure the availability and affordability of condoms to meet the growing needs of the population, which is expected to play a vital role in reducing the prevalence of STIs and improving sexual health outcomes is expected to create more Africa condom market opportunities in the coming years.

Even though the market has experienced rapid growth, there are certain factors that hinder the Africa condom market demand. Stringent rules and regulations for condoms present a formidable barrier to market demand for condoms in the region. Requirements for certification and adherence to national standards, as mandated by regulatory bodies such as the South African Bureau of Standards (SABS), result in prolonged approval processes for condom manufacturers. These bureaucratic obstacles delay the introduction of new products into the market, prolonging the time and resources necessary for manufacturers to navigate regulatory frameworks. Consequently, the pace of innovation in condom technology and design is hampered, limiting the availability of advanced products that could better align with consumer needs and preferences.

In addition, according to the Health System Trust’s District Health Barometer (DHB) stats, there is a substantial decline in the distribution of male condoms, by over 300 million from 728 million in 2018 to 403 million in the financial year 2022-2023. The decline in this number indicates the negative impact of regulatory constraints on Africa condom market dynamics. While female condom supply also decreased over this period, the decline was comparatively less severe. Furthermore, strict regulations governing advertising and distribution are further anticipated to hinder market demand. Advertising content and placement restrictions, coupled with limitations on where and how condoms are sold, impede efforts to raise awareness about safe sex practices and promote condom use. As a result, these regulatory barriers and strict policies on condom manufacturing and sales are expected to slow the market growth in the coming years.

Furthermore, the establishment of mobile clinics for condom distribution in rural areas presents significant opportunities for key players in the Africa condom market. By reaching underserved population in remote regions where access to healthcare facilities is limited, mobile clinics play a crucial role in increasing awareness about sexual health and promoting condom usage, which is expected to drive the Africa condom market growth.

Partnering with mobile clinics provides an effective distribution channel for condom manufacturers and distributors, to penetrate untapped markets and expand their consumer base. By strategically positioning their products within these clinics, companies capitalize on the opportunity to reach a wider audience and enhance brand visibility. In addition, collaboration with mobile clinics allows key players to engage directly with local communities, gain insights into their preferences & behaviors, and tailor their marketing strategies accordingly.

Segmental Overview

The Africa condoms market is segmented into type, end user, distribution channel, and country. On the basis of type, the market is categorized into latex and non-latex. By end user, it is bifurcated into men and women. Depending on distribution channel, it is divided into offline and online. Country-wise, it is analyzed across South Africa, Nigeria, Kenya, Ghana, Angola, Ivory Coast, Tanzania, and rest of Africa.

By Type

By type, the latex segment dominated the market in 2023 and is anticipated to continue the same Africa condom market trends during the forecast period. Latex is a highly effective material for prevention of pregnancy and sexually transmitted infections (STIs), providing a reliable barrier during sexual activity. These condoms are widely available and tend to be more affordable than non-latex options, which makes them accessible to a larger population. As a result, latex condom segment has experienced tremendous growth in recent years among African population. In addition, latex is a stretchable material that fits well to different body shapes, enhancing comfort and reducing the risk of breakage during use.

By Type

Non-Latex segment would exhibit the highest CAGR of 4.7% during 2024-2035.

Latex condoms have gained popularity among African consumers owing to the increased awareness campaigns regarding HIV/AIDS and sexually transmitted infections (STIs) prevention. Moreover, there are many government and non-governmental organizations in Africa that promote safe sex practices, making condoms more accessible and affordable. Furthermore, cultural shift toward more open discussions about sexual health has reduced the stigma surrounding condom use, thus driving the growth during the Africa condom market forecast.

By Gender

By end user, the men segment held the major Africa condom market share in 2023. Men’s condoms are more widely available and distributed through various health programs, which makes them more accessible to both urban and rural populations. Men’s condoms are often more affordable and familiar to users, as they have been promoted extensively in public health campaigns. In addition, cultural norms and gender dynamics in many African societies contribute to a preference for men's condoms, with men often being responsible for contraception decisions. Some users perceive men's condoms as easier to use and more effective in preventing both unintended pregnancies and sexually transmitted infections.

By Gender

WoMen segMent would exhibit the highest CAGR of 4.6% during 2024-2035.

Moreover, the awareness campaigns promoting safe sex practices have significantly increased, focusing on preventing STIs and unintended pregnancies, which has helped drive the demand for condoms among men. The rise in population in Africa has further increased the demand for contraceptives, particularly condoms, further boosting its popularity in the Africa condom industry.

By Distribution Channel

By distribution channel, the chemist shops segment registered the highest growth in 2023 and is anticipated to maintain its dominance during the forecast period. Chemist shops are accessible and trusted outlets for individuals seeking contraceptive options and sexual health products. The widespread presence of chemist shops in both urban and rural areas ensures that condoms are readily available to a diverse population.

By Distribution Channel

E-commerce Website segment would exhibit the highest CAGR of 6.6% during 2024-2035.

These shops often provide a private environment for customers to purchase condoms, which addresses the cultural sensitivities and stigmas surrounding discussions of sexual health. In addition, chemist shops frequently offer a variety of condom brands, sizes, and types, catering to diverse preferences and needs.

Moreover, the pharmacists and healthcare professionals working in chemist shops provide valuable information and guidance on condom use, helping to promote safe sex practices, and address concerns & misconceptions. Furthermore, the affordability of condoms sold in chemist shops, often subsidized by government initiatives or non-profit organizations, makes them accessible to low-income individuals. Thus, the combination of accessibility, privacy, variety, professional guidance, and affordability has contributed to the significant sales of condoms in chemist shops across the Africa condom market.

Competitive Analysis

The key players in the Africa condom market analysis include Reckitt Benckiser Group Plc, Church and Dwight Co. Inc, HLL Lifecare Limited, Ansell Ltd., Gemilatex (Pty) Ltd., DKT International, Inc., Karex Berhad, Thai Nippon Rubber Industry Public Company Limited, Cupid Limited, and Okamoto Industries, Inc.

Several upcoming brands are vying for market dominance in the expanding Africa condom industry. Smaller, niche firms are more well-known for catering to consumer demands and needs. Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they have different recognition or range of products than well-known companies.

Some Developments in the Africa Condom Market

- In June 2023, Durex launched Durex Mutual Climax condoms in Nigeria to strengthen its product portfolio in Africa. The product is available across all registered pharmacies & drug stores, supermarkets, top groceries, and channels across Nigeria.

Key benefits for stakeholders

- This report provides a quantitative analysis of the current trends, estimations, and dynamics of the Africa condom market size from 2023 to 2032 to identify the prevailing opportunities in the market.

- A comprehensive analysis of the factors that drive and restrict market growth is provided.

- An in-depth analysis of the Africa condom market helps to determine the prevailing market opportunities.

- The report includes details of the analysis of the country market, key players, market segments, application areas, and growth strategies.

Africa Condom Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Gender |

|

| By Distribution Channel |

|

| By Country |

|

| Key Market Players | Gemilatex (Pty) Ltd., HLL Lifecare Limited, Okamoto Industries, Inc., DKT International, Inc., Thai Nippon Rubber Industry Public Company Limited, Cupid Limited, Church and Dwight Co. Inc, Ansell Ltd., Reckitt Benckiser Group Plc, Karex Berhad |

Analyst Review

As per the perspective of top-level CXOs, the Africa condom market is expected to unleash attractive business opportunities in developing economies, however, is dealing with challenges simultaneously. Moreover, there is a rise in demand for sexual wellness products, including condoms in Africa owing to increased awareness among the individuals, which is expected to drive significant growth in this sector. The CXOs have stated that the prevalence of sexually transmitted diseases and sexually transmitted infections in Africa highlights the critical need for accessible and affordable sexual health products such as condoms. As the continent experiences demographic shifts and urbanization, there is a simultaneous increase in interest and awareness among consumers regarding the importance of safe sex practices. However, CXOs believe that penetrating the African condom market requires a sensitive approach. Cultural sensitivities, religious beliefs, and socio-economic factors all play a role in shaping consumer attitudes toward condom products. Moreover, logistical challenges such as distribution networks and infrastructure limitations hinder market penetration efforts.

Innovations in condom technology, such as ultra-thin materials, textured surfaces, and novel packaging designs, are anticipated to drive market growth in Africa. By addressing concerns related to pleasure, comfort, and reliability, manufacturers appeal to diverse consumer preferences and effectively differentiate their products in a competitive landscape. CXOs have further highlighted that the key players in the Africa condom industry should consider strategic partnerships, localized marketing campaigns, and community outreach initiatives to establish a strong foothold in the African market. Moreover, investing in R&D tailored to the unique needs and preferences of African consumers drive product innovation and enhance market relevance in Africa. Furthermore, the Africa condom market offers a great opportunity for companies to grow and expand. Thus, clear understanding of the market challenges in Africa condom market and adjusting their approaches to fit African consumers' needs, key players have tapped into the rapidly expanding market.

The Africa condom market was valued at $115.6 million in 2023 and is projected to reach $175.3 million by 2035, registering a CAGR of 3.6% from 2024 to 2035.

The Africa condom market registered a CAGR of 3.6% from 2024 to 2035.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the Africa condom market report is from 2024 to 2035.

The top companies that hold the market share in the Africa condom market include Reckitt Benckiser Group Plc, Church and Dwight Co. Inc, HLL Lifecare Limited, Ansell Ltd., Gemilatex (Pty) Ltd., DKT International, Inc., Karex Berhad, Thai Nippon Rubber Industry Public Company Limited, Cupid Limited, and Okamoto Industries, Inc.

The Africa condom market report has 3 segments. The segments are type, end user, distribution channel.

By type, the non-latex segment in the Africa condom market has the highest growth rate at a CAGR of 4.7% from 2024 to 2035.

Loading Table Of Content...