The Africa unsecured business loans market is anticipated to witness substantial growth during the forecast period This is attributed due to the increase in relentless demand for funds compelling businesses to seek unsecured loans as a lifeline for expansion and necessities for livelihood. In addition, emerging entities such as startups and innovative ventures often lack collateral and assets to secure traditional loans, making unsecured loans their primary choice which fuels the growth of the market. Furthermore. the allure of fast and hassle-free access to capital, typically associated with unsecured loans contribute toward the growth of the market.

However, the unsecured nature of these loans makes them riskier for lenders, resulting in higher interest rates and stricter terms which restricts the market growth. In addition, the unpredictability of economic conditions restrains the growth of the market.

On the other hand, the Africa unsecured business loans market is expected to offer several opportunities for new players in the market. The unexplored segments within the market, the latent potential of new product development, and the prospect of catering to the evolving needs and perceptions of consumers offer remunerative opportunities for the growth of the market.

The Africa unsecured business loans market is expected to witness a multitude of future trends. Rise in the importance of technology in streamlining the loan application and approval processes is the current trend in the market. Another trend is the shift in focus toward sustainability and social responsibility as businesses are increasingly considering their environmental and social impact. The lenders may respond by offering loans with favorable terms to those who adhere to responsible business practices

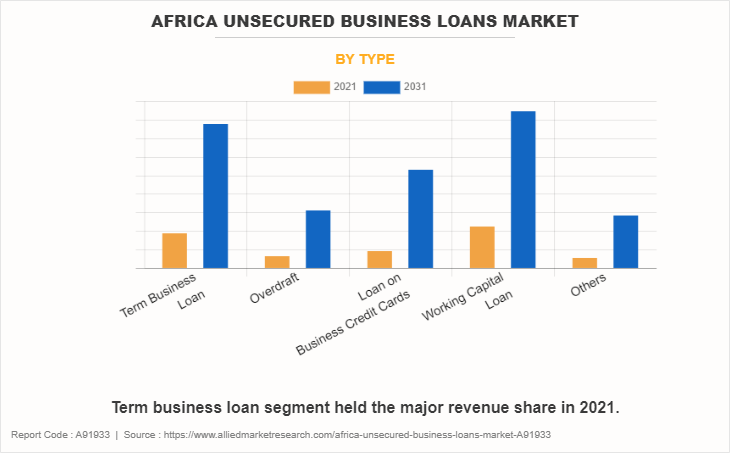

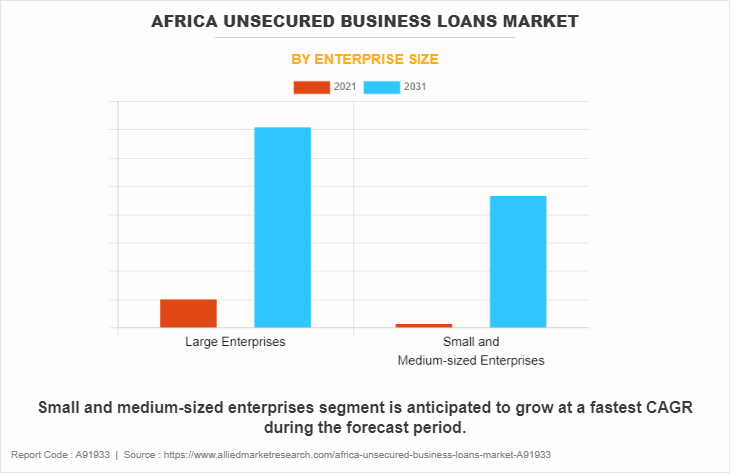

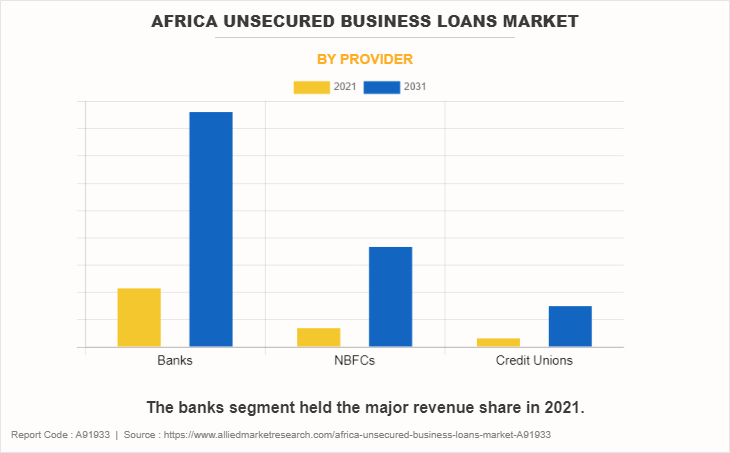

The Africa unsecured business loans market is segmented into type, enterprise size, and provider. On the basis of type, the market is segregated into term business loan, overdraft, loan on business credit cards, working capital loan, and others. By enterprise size, the market is divided into large enterprises and small & medium-sized enterprises. Depending on the provider, the market is classified into banks, NBFCs, and credit unions.

Qualitative insights represent about remarkable developments in the Africa unsecured business loans market. These insights encompass new product development, research and development efforts, consumer/end-user perceptions, and pricing strategies. Lenders are focusing on new product development and constantly devising novel loan products tailored to the specific needs of businesses in Africa. Lenders are investing heavily in R&D to provide cutting-edge technologies to assess creditworthiness and risk. Understanding end-user perceptions is pivotal for lenders to meet the expectations and preferences of the businesses. Lenders are adopting pricing strategies to maintain a balance between competitiveness and profitability.

The Porter’s five forces analysis is a model, which analyzes the competitive scenario of the industry and role of each stakeholder. The five forces include the bargaining power of buyers, the bargaining power of suppliers, the threat of new entrants, the threat of substitutes, and the level of competitive rivalry. The rivalry among existing lenders is intense, particularly in the Small and Medium-sized Enterprises (SME) segment as the banks, NBFCs, and credit unions compete for market share, leading to competitive interest rates and product offerings. The bargaining power of suppliers is significant due to the limited options for borrowers seeking unsecured loans, especially if they lack collateral. However, the rise of fintech and alternative lending platforms is gradually shifting the power toward borrowers. The bargaining power of buyers, the businesses seeking loans, can be influenced by their creditworthiness and the strength of their financial statements. Borrowers with robust financials can negotiate better terms, while those with weaker financials may have limited options. The threat of new entrants is moderate due to the complex regulatory environment and the need for substantial capital to enter the market. However, innovative fintech startups continue to challenge traditional lenders, gradually eroding barriers to entry. The threat of substitutes is low, as unsecured loans remain a primary source of funding for businesses. Other financing options may have their limitations, making unsecured loans a preferred choice for many.

A SWOT analysis provides an overview of the Africa unsecured business loans market. It includes its internal strength, weakness, opportunities and threats. The strengths include the strong demand for unsecured loans, particularly among SMEs, which drives the market growth. The market caters to businesses that lack collateral, offering access to capital for a wide range of enterprises. Evolving fintech solutions are enhancing the efficiency of loan processes. The weaknesses include the unsecured nature of loans leads to higher interest rates and stricter terms, which can deter potential borrowers. Regulatory complexities and variations across African countries create challenges for lenders. Economic and political instability in some regions can affect market stability. The opportunities include the future trends point to increased technological integration and a focus on sustainability and social responsibility. New product development and innovative lending solutions can tap into underserved segments of the market. Consumer perceptions are evolving, offering opportunities for education and awareness campaigns. The threat includes the intense competition among lenders in the SME segment that may squeeze profit margins. The rise of fintech startups and alternative lending platforms poses a competitive threat to traditional lenders. Economic uncertainties and external factors can impact the market's stability.

The key players operating in the Africa unsecured business loans market Wells Fargo, JPMorgan Chase & Co., Bank of America, Kabbage (now part of American Express), OnDeck (now part of Enova International), Funding Circle, LendingClub, BlueVine, Fundera (now part of NerdWallet), and Fundbox.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Africa unsecured business loans market.

- Assess and rank the top factors that are expected to affect the growth of Africa unsecured business loans market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Africa unsecured business loans market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Africa Unsecured Business Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2021 - 2031 |

| Report Pages | 82 |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| Key Market Players | BlueVine, Bank of America, JPMorgan Chase & Co., OnDeck (now part of Enova International), Funding Circle, Wells Fargo, Kabbage (now part of American Express), Fundera (now part of NerdWallet), Fundbox, LendingClub |

The Africa unsecured business loans market is estimated to reach $137.1 billion by 2031

Wells Fargo, JPMorgan Chase & Co., Bank of America, Kabbage (now part of American Express), OnDeck (now part of Enova International), Funding Circle, LendingClub, BlueVine, Fundera (now part of NerdWallet), and Fundbox are the leading players in Africa unsecured business loans market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in africa unsecured business loans market.

3. Assess and rank the top factors that are expected to affect the growth of africa unsecured business loans market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the africa unsecured business loans market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Africa unsecured usiness loans market is classified as by type, by enterprise size, by provider

Loading Table Of Content...

Loading Research Methodology...