Agricultural Commodity Market Summary

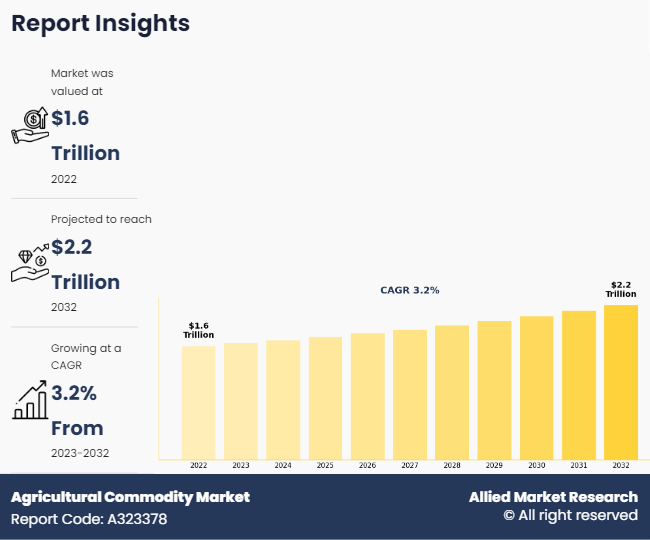

The global agricultural commodity market size was valued at $1.6 trillion in 2022, and is projected to reach $2.2 trillion by 2032, growing at a CAGR of 3.2% from 2023 to 2032.

Key Market Trends and Insights

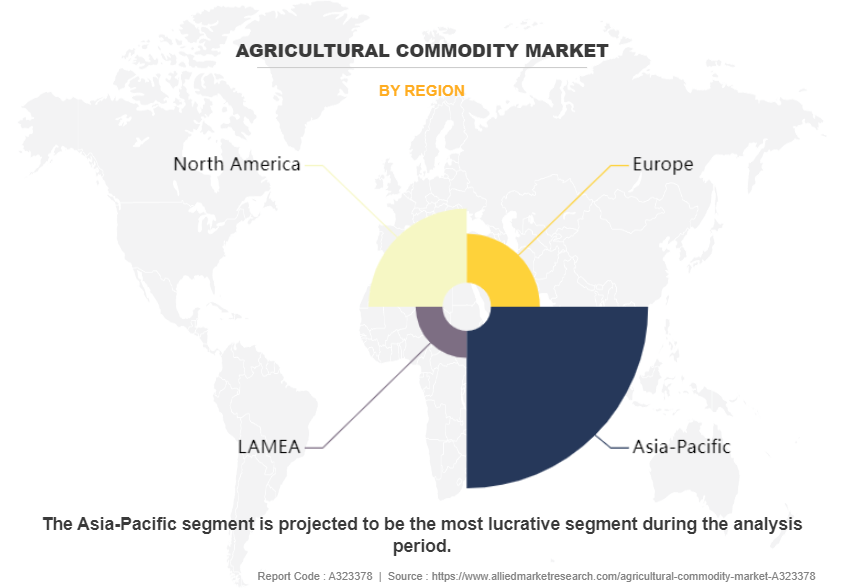

Region wise, Asia-Pacific generated the highest revenue in 2022.

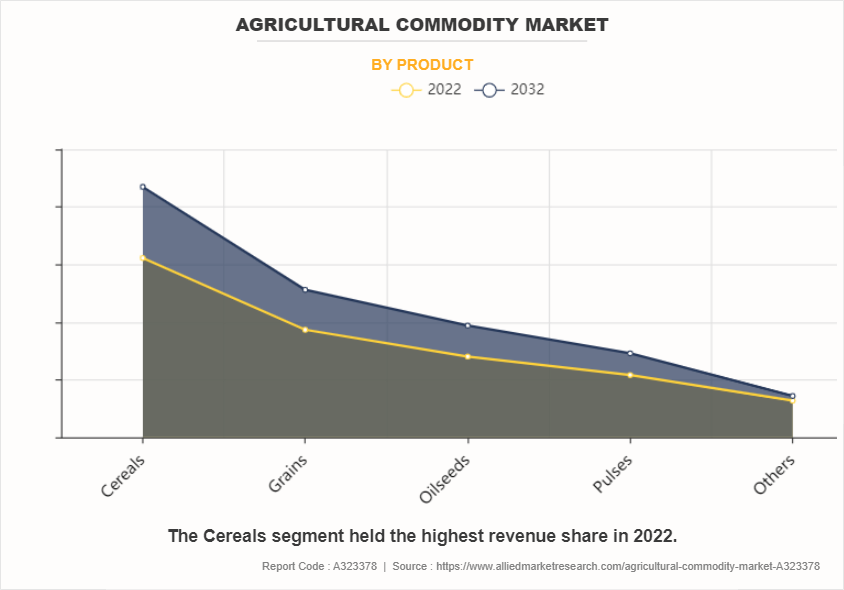

The global agricultural commodity market share was dominated by the cereals segment in 2022 and is expected to maintain its dominance in the upcoming years

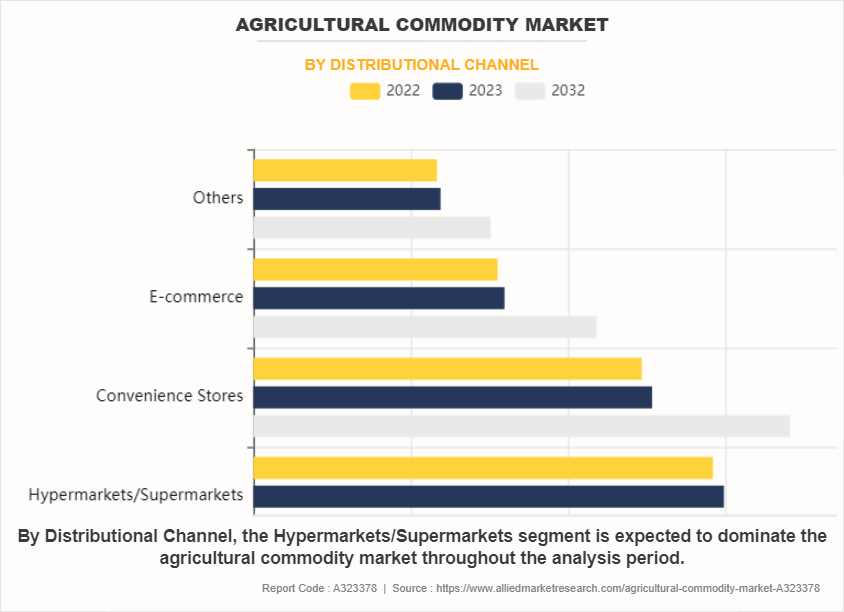

The hypermarkets/supermarkets segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2022 Market Size: USD 1.6 Trillion

- 2032 Projected Market Size: USD 2.2 Trillion

- Compound Annual Growth Rate (CAGR) (2023-2032): 3.2%

- Asia-Pacific: Generated the highest revenue in 2022

Market Dynamics

Agricultural commodities are raw materials that are cultivated, harvested, and traded for various purposes, including food, feed, fuel, and fiber. These commodities are derived from agricultural processes, such as crop cultivation, animal husbandry, and forestry. Examples of agricultural commodities include grains, oilseeds, livestock, dairy products, fruits, vegetables, and fibers. Agricultural commodities are essential components of global supply chains, serving as the foundation for food security, economic development, and industrial production across the world.

Growing awareness regarding environmental degradation, soil health deterioration, water scarcity, and biodiversity loss is driving a shift towards sustainable farming practices and organic production methods. Consumers are becoming more conscious of the ecological footprint of their food choices, driving demand for sustainably sourced agricultural commodities. Consequently, market preferences are evolving, favoring products with eco-friendly certifications and transparent supply chains. Furthermore, regulatory bodies are implementing policies to promote sustainable agricultural practices and enforce environmental standards, resulting in a more significant market dynamics. Farmers and producers are adapting to these changes by adopting practices that minimize environmental impact, such as precision farming, crop rotation, and agroforestry. Overall, the increasing awareness regarding environmental sustainability is becoming a significant driver in the agricultural commodity market, influencing production methods, consumer preferences, and regulatory.

Climate change and environmental risks pose significant challenges to the agricultural commodity market growth. The rising frequency of extreme weather issues, including droughts, floods, and heatwaves, disrupts crop yields and livestock production, resulting in supply shortages and price instability. Farmers face numerous challenges in adapting to these unpredictable conditions, leading to decreased agricultural productivity and increased production costs. In addition, environmental degradation, such as soil erosion and water scarcity, further constrains farming activities, limiting the availability of arable land and diminishing overall output. These factors collectively hinder the sustainable growth and resilience of the agricultural commodity market, causing uncertainties for investors. All these factors are projected to restrain the market growth during the forecast period.

The rising demand for sustainable and organic products is projected to create several growth opportunities in the market. As consumers become increasingly conscious of health and environmental issues, there is a growing preference for agricultural commodities produced using sustainable practices and without the use of synthetic chemicals or genetically modified organisms (GMOs). This trend is driven by concerns about food safety, environmental sustainability, and animal welfare. Producers adopt sustainable farming methods such as organic farming, regenerative agriculture, and agroecology stand to benefit from this shift in consumer preferences. By focusing on soil quality, biodiversity conservation, and minimizing chemical inputs, these practices are not only referring to environmental concerns but also often lead to higher-quality products with superior nutritional profiles. Overall, the rising demand for sustainable and organic agricultural commodities represents a significant opportunity for farmers and producers to align with evolving consumer preferences, improve environmental stewardship, and capture value in the market. These are among the major factors that are projected to create growth opportunities for the key players operating in the market during the forecast period.

Competitive Landscape:

The key players profiled in agricultural commodity industry include Louis Dreyfus, Cofco, Olam International, Cargill Incorporated, Ag Processing Inc, Marubeni Corporation, Wilmar International Limited, Archer Daniels Midland, Glencore Agriculture, and Bunge Limited. Investment and agreement are common strategies followed by major market players. For instance, in March 2024, BASF announced the development of advanced fermentation plant in Ludwigshafen, signaling a significant step forward in producing biological and biotechnology-driven crop protection solutions. This facility highlights BASF's commitment toward innovative, sustainable agriculture practices and further increase company’s growth in the field of agri commodity.

Segment Analysis:

The agricultural commodity market forecast is segmented on the basis of product, nature, distribution channel, and region. By product, the market is divided into, cereals, grains, oilseeds, pulses, and others. By organic, the market is classified into natural and conventional. By distribution channel, the market is classified into hypermarkets/supermarkets, convenience stores, e-commerce, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product, the cereals sub-segment dominated the market in 2022, due to rapid population growth, dietary shifts, and global trade dynamics. Population expansion boosts demand for staple grains like wheat, rice, and maize, as these form the foundation of many diets worldwide. Dietary shifts towards convenience and processed foods also contribute to increased cereal consumption. Moreover, global trade agreements and geopolitical factors influence production and distribution patterns, impacting market prices. In addition, weather conditions and climate variability affect cereal yields, posing both challenges and opportunities for producers. Overall, a combination of demographic, dietary, and trade factors drives the cereals segment growth of the agricultural commodity market. These are predicted to be the major factors driving the market growth during the forecast period too.

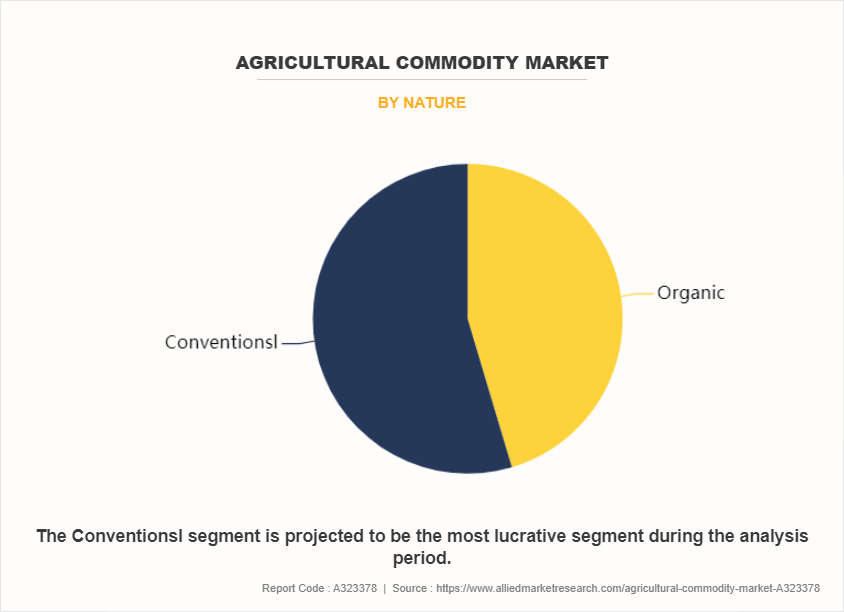

By nature, the conventional sub-segment dominated the global agricultural commodity market share in 2022. Conventional farming practices utilize various techniques to expedite the growth of agricultural commodities. These methods often involve the use of synthetic fertilizers to enhance soil fertility and promote rapid plant growth. In addition, pesticides and herbicides are commonly employed to control pests and weeds, reducing competition for resources, and allowing crops to thrive. Furthermore, irrigation systems ensure consistent water supply, vital for sustained growth. Mechanization plays a major role, with machinery facilitating tasks like planting, harvesting, and processing, thus increasing efficiency. The market demand for staple crops also enables farmers to prioritize high-yield varieties to meet consumer needs and achieve profitability in the competitive agricultural industry.

By distribution channel, the hypermarkets/supermarkets sub-segment dominated the global market share in 2022. Consumer preferences for convenience and variety compel these retailers to offer a diverse range of fresh produce, driving demand for agricultural commodities. Efficient supply chain management and logistics are critical, ensuring timely delivery of perishable goods to meet consumer demand. In addition, competitive pricing strategies and promotional activities influence purchasing decisions, impacting the sourcing patterns of hypermarkets/supermarkets. Moreover, stringent quality standards and certifications drive suppliers to maintain high-quality products, fostering trust and loyalty among consumers. Overall, these factors shape the dynamics of the agricultural commodity market within the hypermarkets/supermarkets distribution channel segment.

By region, Asia-Pacific dominated the global market in 2022. The Asia-Pacific market growth is driven by several factors including population growth, urbanization, and shifting dietary preferences towards higher-value products. Environmental challenges such as climate change and water scarcity also influence market dynamics. Government policies, trade agreements, and technological advancements play pivotal roles in shaping production, distribution, and pricing of agricultural commodities. In addition, increasing demand for sustainable and organic products reflects evolving consumer preferences, offering premium pricing opportunities. The Asia-Pacific agricultural commodity market has a complex interplay of demographic changes, environmental constraints, policy interventions, and consumer behavior.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the agricultural commodity market analysis from 2022 to 2032 to identify the prevailing agricultural commodity market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the agricultural commodity market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global agricultural commodity market trends, key players, market segments, application areas, and market growth strategies.

Agricultural Commodity Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.2 trillion |

| Growth Rate | CAGR of 3.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 315 |

| By Product |

|

| By Nature |

|

| By Distributional Channel |

|

| By Region |

|

| Key Market Players | Wilmar International Limited, Cargill Incorporated, Glencore Agriculture, Archer Daniels Midland, Bunge Limited, Louis Dreyfus, Marubeni Corporation, Ag Processing Inc., Olam International, Cofco |

The global agricultural commodity market size was valued at USD 1.6 trillion in 2022, and is projected to reach USD 2.2 Trillion by 2032

The global agricultural commodity market is projected to grow at a compound annual growth rate of 3.2% from 2023-2032 to reach USD 2.2 Trillion by 2032

The key players profiled in the reports includes Louis Dreyfus, Cofco, Olam International, Cargill Incorporated, Ag Processing Inc, Marubeni Corporation, Wilmar International Limited, Archer Daniels Midland, Glencore Agriculture, and Bunge Limited.

Asia-Pacific dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

Increasing demand for sustainable and traceable products, adoption of precision agriculture technologies, climate change impacts, evolving trade policies, and shifts in consumer preferences towards plant-based alternatives.

Loading Table Of Content...

Loading Research Methodology...