Agricultural Insurance Market Research, 2032

The global agricultural insurance market size was valued at $38.5 billion in 2022 and is projected to reach $67.4 billion by 2032, growing at a CAGR of 5.8% from 2023 to 2032. Insurance is a system in which a collective of individuals, sharing similar risks, contribute small amounts to a common fund. This fund is subsequently utilized to provide compensation to those who experience losses. Crop insurance provides cultivators with financial protection against expected crop losses caused by uncontrollable natural factors like fire, weather, floods, pests, and diseases. The insurance coverage can be based on the total expenditure, a multiple of it, or a proportion of the expected crop income for which premiums are paid. A compensation that is claimable payment is provided based on the difference between the guaranteed yield (threshold yield) and the actual yield. Claims are paid after the actual loss in crop yield is determined. With agricultural insurance services, the insured party (the farmer) pays a premium to an insurer to guarantee against losses (of crops, assets, property, livestock, or income) over a certain time period.

The agricultural insurance is witnessing a significant surge in demand driven by the frequent incidence of plant diseases, posing a substantial challenge to farmers. Extreme weather and climate-related events have become more frequent and intense in recent decades, posing a significant threat to agricultural systems. The agricultural insurance sector is especially vulnerable to natural disasters due to its reliance on weather and environment. Disasters can have serious repercussions for crop development, livestock health, fisheries and aquaculture productivity, and ecosystems, ranging from extreme weather events to outbreaks of transboundary animal and plant pests and illnesses. Data from Post-Disaster Needs Assessments (PDNA) spanning 2008 to 2018 reveal agriculture's essential involvement in disaster effects.

Agriculture, which includes crops, livestock, forestry, fisheries, and aquaculture, absorbed 26% of the overall impact of medium- to large-scale calamities in low- and lower-middle-income nations over this time period. In comparison to other sectors such as industrial, commerce, and tourism, agriculture bears a disproportionate percentage of the damage and loss caused by calamities, accounting for 63% of total damage and loss. This data emphasizes the critical role of agricultural insurance in providing a safety shield for farmers and agricultural stakeholders, assisting them in mitigating the financial impact of these increasingly frequent and severe disasters and promoting resilience in the face of evolving climate risks.

The agricultural insurance market faces significant constraints due to several factors that contribute to the high cost of premiums. Despite efforts to make these insurance products more affordable, many are still prohibitively expensive, particularly for smallholder farmers, who make up the majority of the agricultural insurance market. Furthermore, the sophisticated risk assessment techniques inherent in agricultural insurance increase these cost-related issues. Administrative expenses linked to the distribution of insurance payouts and the registration of farmers further add to the financial burden, posing a threat to the long-term viability of the industry.

The application of the Internet of Things (IoT) has the potential to revolutionize the agricultural insurance market. IoT involves a network of interconnected devices and everyday devices such as smartphones and others that can transmit and receive data. While its development is in its early stages, particularly in low- and middle-income countries (LMICs), IoT holds significant promise for transforming the landscape of agricultural insurance. Currently, IoT data streams are primarily leveraged to streamline insurance processes, including underwriting and claims handling.

Moreover, these data streams facilitate more efficient interactions with customers. As the collection of data becomes increasingly automated, interconnected tools such as tractors can gather information like crop height, soil moisture, and crop sturdiness. This data can then be transmitted to insurance companies. In response, insurers can provide specific farming recommendations directly to insured farmers. This innovation has the potential to create a mutually beneficial scenario. By preventing crop losses through timely interventions, both the insured farmer's yield is safeguarded, and the cost of insurance is potentially reduced. These factors are anticipated to boost the agricultural insurance market opportunity.

The agricultural insurance market forecast key players profiled in this report include Great American Insurance Company Agriculture Insurance Company of India Limited (AIC), Allianz SE Reinsurance, Munich Re Group, Chubb, Sompo International Holdings Ltd, Zurich, AXA, People's Insurance Company (Group) of China Limited, and QBE Insurance Ltd. The agricultural insurance market players are continuously striving to achieve a dominant position in this competitive market using strategies such as collaborations and acquisitions. For instance, in July 2023, Agi3 Risk Services (ARS) partnered with Definity Financial Corporation to offer AgriEnhance, an AI-powered crop insurance solution. The new crop insurance offering is the first on ARS' Agi3 platform targeted at assisting farmers in finding novel ways to protect their crops.

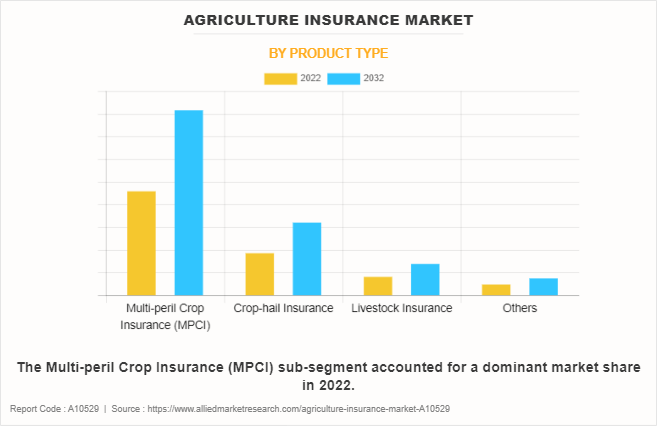

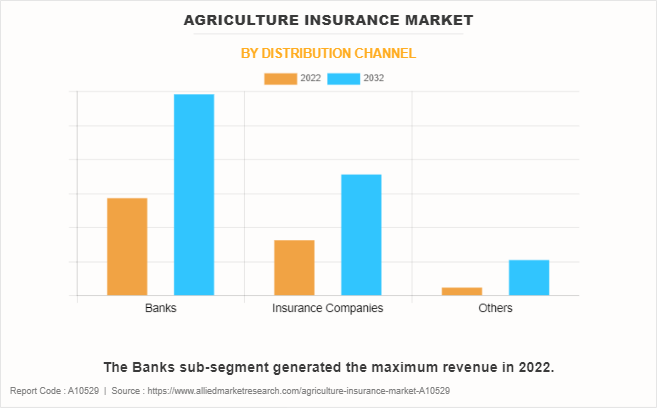

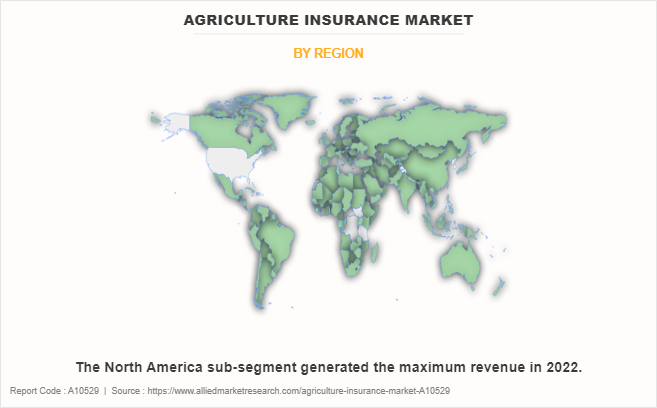

The agricultural insurance market outlook is segmented on the basis of product type, distribution channel, and region. By product type, the agricultural insurance market is divided into multi-peril crop insurance (MPCI), crop-hail insurance, livestock insurance, and others. By distribution channel, the market is classified into banks, insurance companies, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

The agricultural insurance market is segmented into Product Type and Distribution Channel.

By product type, the multi-peril crop insurance (MPCI) sub-segment dominated the agricultural insurance market in 2022. The multi-peril crop insurance, characterized by its wide range of protections against various risks and perils coverage, provides an almost full indemnity against losses, making it a prevalent option in many middle-income countries. This form of insurance safeguards farmers against a variety of risks and uncertainties that can significantly impact their agricultural endeavors.

It offers comprehensive coverage, guaranteeing that farmers are financially covered against a wide range of potential losses, including those caused by bad weather occurrences, pests, diseases, and other factors. This comprehensive insurance can give farmers more peace of mind, allowing them to focus on sustainable farming techniques rather than being burdened by unforeseeable dangers.

By distribution channel, the banks sub-segment dominated the global agricultural insurance market share in 2022. Banks play an important role as intermediaries between insurance providers and farmers in the agricultural insurance market. These financial institutions have large networks that span both rural and urban areas, putting them in a position to distribute insurance offerings to a diverse farmer base. The widespread accessibility provided by banks guarantees that even rural and underprivileged agricultural regions have access to critical insurance coverage, hence increasing the agricultural insurance market's overall inclusivity.

By region, North America dominated the global agricultural insurance market in 2022. The region's improving economic situation and the government initiatives to expand infrastructure in the insurance sectors are some of the reasons driving the growth of the regional market. The agricultural industry in North America is vulnerable to a wide range of hazards, including weather variations, pests, and market volatility, due to its diversified crop and farming practices.

The COVID-19 pandemic has highlighted the necessity of agricultural insurance in North America since interruptions in supply chains and labor unavailability have shown the sector's vulnerability to unforeseen disasters. This crisis has raised farmers' awareness regarding the importance of comprehensive insurance coverage, resulting in an increase in demand for agricultural insurance products. All these are major factors projected to drive the agricultural insurance market growth in the upcoming years.

Impact of COVID-19 on the Global Agricultural Insurance Market

- The emergence of the COVID-19 pandemic caused a global health disaster, generating enormous disruption and concern across a wide range of industries, including agricultural insurance. The pandemic-induced economic slowdown resulted in changes in consumer behavior, market fluctuations, and supply chain disruptions, undermining the global agricultural insurance industry's overall stability.

- The pandemic affected insurance firms' usual processes, causing delays in processing claims and policy issuance. Lockdowns and social distancing strategies hampered on-site evaluations of agricultural losses.

- Many governments implemented assistance measures, such as subsidies and relief packages, to help farmers and insurers affected by the COVID-19 pandemic.

- The pandemic emphasized the need for insurance plans to account for new risks such as supply chain disruptions and market volatility induced by global health emergencies.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the agricultural insurance market analysis from 2022 to 2032 to identify the prevailing agricultural insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the agricultural insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global agricultural insurance market trends, key players, market segments, application areas, and market growth strategies.

Agricultural Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 67.4 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Chubb, Allianz SE Reinsurance, Great American Insurance Company, Sompo International Holdings Ltd, Agriculture Insurance Company of India Limited (AIC), AXA, Zurich, QBE Insurance Ltd., Munich Re Group, People's Insurance Company (Group) of China Limited |

Increasing climate variability and the rising frequency of extreme weather events, such as droughts, floods, and storms, highlight the need for insurance to manage risks associated with unpredictable weather patterns, which is anticipated to boost the agricultural insurance market.

The major growth strategies adopted by the agricultural insurance market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global agricultural insurance market in the future.

Great American Insurance Company Agriculture Insurance Company of India Limited (AIC), Allianz SE Reinsurance, Munich Re Group, Chubb, Sompo International Holdings Ltd, Zurich, AXA, People's Insurance Company (Group) of China Limited, and QBE Insurance Ltd. are the major players in the agricultural insurance market.

The multi-peril crop insurance (MPCI) sub-segment of the product type acquired the maximum share of the global agricultural insurance market in 2022.

Farmers, agricultural producers, and agricultural cooperatives are the major customers in the global agricultural insurance market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global agricultural insurance market from 2022 to 2032 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...