Agriculture Biologicals Testing Market Research, 2032

The global agriculture biologicals testing market size was valued at $2.7 billion in 2022, and is projected to reach $5.5 billion by 2032, growing at a CAGR of 7.3% from 2023 to 2032.

Market Dynamics

Increasing demand for organic food and growing concern about the safety and security of food has been the main driver of this market. Bioassays are important for the detection of harmful organisms, toxins, and pesticides in crops, animals, and other agricultural products. The use of genetically modified organisms (GMOs) also contributes to economic growth. Many countries have very strict regulations regarding the use of GMOs and biological testing is required to comply with these regulations.

According to the U.S. Department of Agriculture, the U.S. agriculture sector extends beyond the farm business to include a range of farm-related industries. In 2021, agriculture, food, and related industries contributed 5.4% to U.S. gross domestic product and provided 10.5% of U.S. employment; Americans' expenditures on food amount to 12% of household budgets on average. Among Federal Government outlays on farm and food programs, nutrition assistance far outpaces other programs which helps to increase the agriculture biologicals testing market size.

Governments around the world are implementing stricter regulations to ensure food safety and reduce the use of harmful chemicals in agriculture. For example, the United States Department of Agriculture (USDA) regulates the production and labeling of organic produce, and organic producers must implement strict standards to ensure the safety and quality of their products. The European Union (EU) also has regulations regulating the safety and quality of organic products. These regulations require chemical testing to ensure agricultural products meet safety standards. Therefore, the agriculture biologicals testing industry is constantly evolving to meet regulatory requirements.

The agriculture biologicals testing market has experienced significant growth from several factors including an increase in the world population which has led to an increase in the demand for food, which in turn has led to the use of agricultural technology. The use of chemical fertilizers in crop production has increased in recent years, as they can reduce dependence on fertilizers and pesticides, thereby improving soil health and providing good harvests and yields. This has increased the need for testing services to ensure the efficacy and safety of these biological products.

Sustainable farming practice has become increasingly important as consumers and governments around the globe emphasize the need for environmentally friendly agriculture. Biological crops are an important part of sustainable agriculture, and the demand for biotesting services is increasing as more farmers adopt these practices. Increasing awareness of the potential harm from the overuse of synthetic chemicals in agriculture has led to the transition to organic farming. Biological products, which are alternatives to synthetic products, have attracted the attention of farmers and consumers, and the demand for biological testing has increased which helps to surge the agriculture biologicals testing market share.

Moreover, effective government policies and regulations also contribute to the growth of the agricultural biological testing market. Governments around the globe are promoting the use of bio-based products in agriculture and encouraging farmers to use these practices, resulting in increased demand for inspection services to comply with regulatory and safety requirements, due to which market is expected to continue to grow as the demand for eco-friendly and sustainable farming practices continues to increase agriculture biologicals testing market demand.

The agriculture biologicals testing market includes large multinational companies and small specialized companies. Some of the biggest companies in this market are Eurofins Scientific, SGS SA, Intertek Group, and Bureau Veritas. These companies offer a wide variety of services, including testing for pesticides, heavy metals, and microbial diseases, as well as genetic testing to identify plant varieties. In addition to these large companies, there are many smaller companies specializing in certain areas of agricultural bioanalysis. For example, some companies specialize in testing for certain pathogens such as mycotoxins or glyphosate, while others specialize in genetic testing or soil analysis. These smaller companies often offer more specialized services and can meet the needs of farmers.

Over the past few years, there has been an increasing focus on agriculture biological testing, as more and more companies analyze the importance of sustainable agriculture and the environment. Key players such as SGS SA, Eurofins Scientific, and ALS Limited are investing in the research and development of new biological tests. These methods include the use of biological agents such as microbes to control pests and diseases, and the development of new genetic engineering techniques to grow environmentally resistant crops helps agriculture biologicals testing market growth.

Top players are also investing in partnerships with agricultural universities and research centers to access the latest advances in chemical testing. These collaborations allow companies to collaborate with regional experts and gain insight into new trends and technologies. Another important step that companies are taking toward agriculture biological testing is the implementation of sustainable farming practices. This includes using good agricultural practices such as soil and water management to reduce waste and increase productivity. In addition, companies use integrated management strategies that combine chemical, cultural, and biological methods to reduce the impact of pests and crop diseases.

The main challenge of the agricultural biological testing market is the lack of standardized testing methods. There are currently no universally accepted standards testing for agricultural products, and many countries and regions have different regulations and guidelines. This can cause conflict between farmers and consumers and make it difficult for companies to expand into the agriculture biologicals testing market forecast.

Moreover, another challenge facing the industry is the increasing administrative regulation burden. As governments around the world focus more on food safety and environmental protection, they are introducing stricter regulations on the use of chemicals and other inputs in agriculture. This increases the cost and complexity of testing, which restricts companies from higher revenue. Despite these challenges, the market for agricultural biological testing is expected to grow during the forecast period, due to the increasing demand for high-quality food products and the increasing use of biotechnology in agriculture. Companies that can offer quality service at competitive prices while keeping up with technology and management changes will be successful in a dynamic and fast-growing business.

Segmental Overview

The agriculture biologicals testing market is segmented into product type, end-user, and region. By product type, the market is bifurcated into bio pesticides, bio fertilizers, bio stimulants. As per end-user, the market is divided into biological product manufacturers, government agencies, plant breeders, and outsourced contract research organization. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Russia, Spain, Italy, and the rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, Africa).

By Product Type

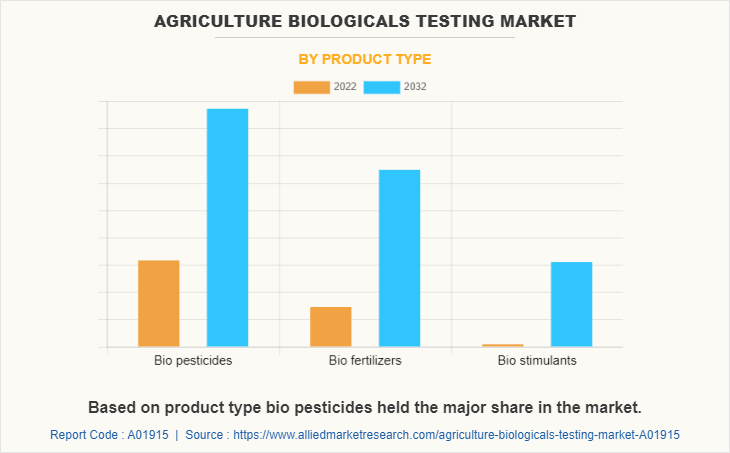

Based on product type, bio pesticides held the major share in the market, as The major trend in the agriculture biologicals testing market for bio pesticides is the development of new methods and technologies. For example, genomic and proteomic methods are increasingly used to evaluate the effects of pesticides on bacteria. However, bio fertilizer is expected to grow with the highest CAGR during the forecast period. Bio fertilizer is a type of fertilizer made from natural organisms such as bacteria and fungi that help increase soil fertility and crop yields. The use of bio fertilizers in agriculture has increased in recent years as farmers and growers seek sustainable and environmentally friendly ways to grow crops.

By End User

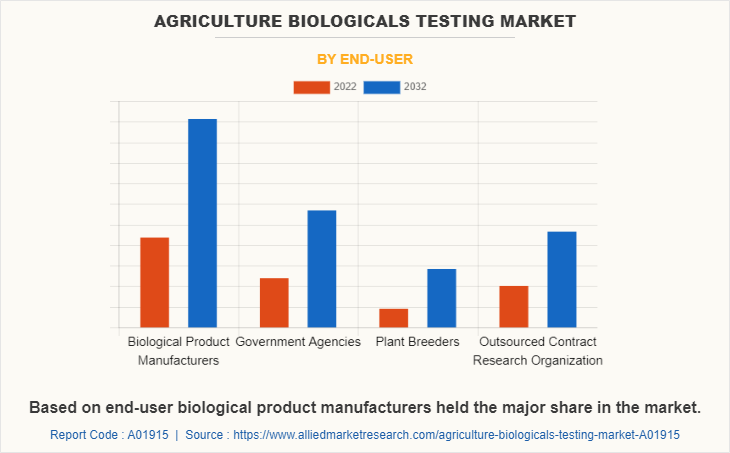

On the basis of end-users, biological product manufacturers held the major share in the agriculture biologicals testing market and are expected to grow with the highest CAGR during the forecast period, as biological product manufacturers in agriculture produce a range of biological products such as biopesticides, bio stimulants, and biofertilizers that are used to stimulate plant growth and protect crops from pests and diseases.

By Region

The North American agricultural biological testing market has seen significant growth in recent years, driven by the growing demand for sustainable agriculture and the need to ensure food security. In addition, the increasing number of crop diseases and the development of genetically modified organisms (GMOs) are also contributing to the growth of this industry. Among the various tests used in agricultural bio testing, disease testing is the most urgent need as it can detect and prevent crop diseases. There is a growing trend for food security and sustainable agriculture in Asia-Pacific. The region is the most populated region in the world and food safety has become a major concern due to the presence of foodborne diseases.

Competition Analysis

The players in the agriculture biologicals testing market have adopted acquisition, business expansion, partnership, collaboration, and product launch as their key development strategies to increase profitability and improve their position in the market. Some of the key players profiled in the agriculture biological testing market analysis include SGS SA, Eurofins Scientific, Bionema Limited, Anadiag Group, Syntech Research Group, Staphyt SA, Laus GmbH, ALS Limited, RJ Hill Laboratories Limited, Eurofins APAL Pty Ltd.

Recent Developments in the Agriculture Biologicals Testing Market

- In February 2021, SGS SA announced a partnership with RLP AgroScience, which will allow more complex, tailor-made experimental designs to be provided for environmental and human safety assessments of pesticides, chemicals, biocides, and human drugs/veterinary drugs.

- In September 2022, ALS Limited announced the acquisition of HRL Holdings in order to expand its portfolio in food and environmental & agricultural testing services.

- In November 2022, ALS Limited announced the acquisition of Serambiente which has 15 years of experience in environmental testing services and agricultural testing services.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the agriculture biologicals testing market analysis from 2022 to 2032 to identify the prevailing agriculture biologicals testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the agriculture biologicals testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global agriculture biologicals testing market trends, key players, market segments, application areas, and market growth strategies.

Agriculture Biologicals Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.5 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Product Type |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Laus GmbH, Staphyt SA, Bionema Limited, Syntech Research Group, Eurofins APAL Pty Ltd, Eurofins Scientific, RJ Hill Laboratories Limited, Anadiag Group, ALS Limited, SGS SA |

Analyst Review

According to CXO market have a positive view on the Agriculture Biological Testing market. The market is expected to experience growth in the coming years due to various factors, including the increasing demand for food safety and quality, the implementation of stringent regulations and standards for agricultural products, and the development of new technologies for testing agricultural products.

The rising global population and increasing demand for food have created a need for efficient and effective testing methods to ensure the safety and quality of agricultural products. This has led to an increased demand for agriculture biological testing services, which is expected to drive market growth.

Regulatory bodies across the globe are implementing stringent standards and regulations to ensure the safety and quality of agricultural products, further driving the demand for testing services. For instance, the European Union has implemented regulations on pesticides and maximum residue levels, which require regular testing of agricultural products. The development of new technologies, such as genomics and proteomics, has also contributed to the growth of the market. These technologies allow for more accurate and efficient testing of agricultural products, reducing the time and cost associated with traditional testing methods.

The global agriculture biologicals testing market was valued at $2.7 billion in 2022, and is projected to reach $5.5 billion by 2032

The global Agriculture Biologicals Testing market is projected to grow at a compound annual growth rate of 7.3% from 2023 to 2032

Some of the key players profiled in the agriculture biological testing market analysis include SGS SA, Eurofins Scientific, Bionema Limited, Anadiag Group, Syntech Research Group, Staphyt SA, Laus GmbH, ALS Limited, RJ Hill Laboratories Limited, Eurofins APAL Pty Ltd.

The North American agricultural biological testing market has seen significant growth in recent years

Increased adoption of molecular diagnostics, The growing importance of soil testing, Increased use of biopesticides and biofertilizers, Expansion of the organic food industry

Loading Table Of Content...

Loading Research Methodology...