Agriculture Equipment Market Overview

The Global Agriculture Equipment Market Size was valued at $121.2 billion in 2022, and is projected to reach $192.5 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032. Leading companies are investing in R&D to create advanced farming equipment that boosts crop yields while minimizing resource use. These innovations help farmers improve efficiency. Additionally, newly launched products meet updated emission standards, significantly reducing carbon emissions on farms and supporting the shift toward more sustainable agricultural practices.

Market Dynamics & Insights

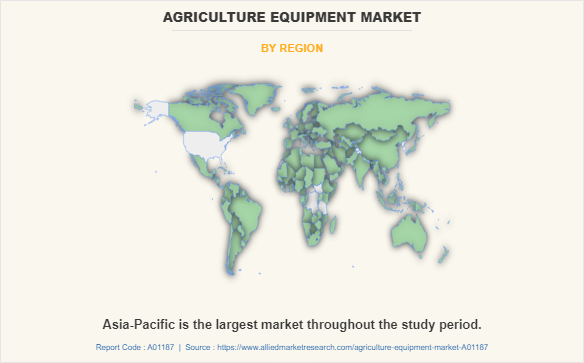

- The agricultural equipment industry in Asia-Pacific held a significant share of over 35.7% in 2022.

- The agricultural equipment industry in India is expected to grow significantly at a CAGR of 5.6% from 2023 to 2032.

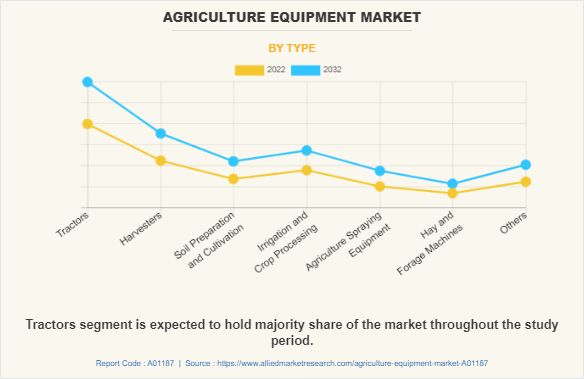

- By type, tractors is one of the dominating segments in the market and accounted for the revenue share of over 32.8% in 2022.

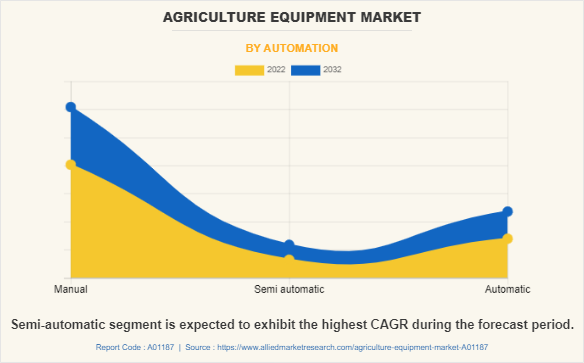

- By automation, the semi-automatic segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $121.2 Billion

- 2032 Projected Market Size: $192.5 Billion

- CAGR (2023-2032): 4.6%

- Asia-Pacific: Largest market in 2022

- LAMEA: Fastest growing market

A device, component of a device, or attachment to a device that is primarily intended to be used for agricultural purposes is referred to as agricultural equipment. "Agricultural equipment" can refer to anything used in the production of crops, animals, horticulture, or floriculture.

Agriculture Equipment Market Dynamics

Agriculture is becoming more mechanized, which reduces the drudgery that labor-intensive farming methods contribute. Thus, the use of sustainable mechanization can boost land productivity by enhancing crop quality and decreasing operating times. During agricultural operations, mechanization techniques can be used to address issues such a lack of labor. In addition, according to the Food and Agriculture Organization (FAO), 60% more food must be produced by 2050 to feed a population of 9.3 billion people worldwide.

Normal farming practices would place too much pressure on our natural resources to accomplish that. Increase agricultural output sustainably by using a variety of ecosystem-friendly methods, reducing the use of outside inputs, and helping farmers adapt to the more frequent weather extremes that occur with climate change to increase their resilience and lower greenhouse gas emissions. Thus, the increase in mechanization of agricultural activities is driving the adoption of agriculture equipment, thereby surging the agriculture equipment industry growth.

In a report released in 2019, the United Nations Department of Economic and Social Affairs predicted that the world's population would increase to 8.5 billion by 2030 and 9.7 billion by 2050. This raises questions about the future viability of food and nutrition. More than 820 million people were undernourished in 2018, according to data from the Food and Agriculture Organization of the United Nations (FAO). This puts pressure on the agriculture sector to produce enough food for the expanding population and to close the global undernourishment gap.

The ability of the soil to produce high-quality crops is also diminished as a result of the degradation of environmental resources brought on by a growth in agricultural production, which has a detrimental effect on the entire agricultural value chain. The implementation of automatic and semi-automatic agricultural equipment thus motivates sustainable mechanization of agricultural activities, by increasing the cultivation efficiencies. Agricultural equipment not only reduces the operational time of different farming activities but also helps to propel crop production causing minimum environmental degradation. Hence, increase in population is driving the agriculture equipment market growth.

However, agricultural activities are most widely conducted in rural regions of various developing countries. Farmers in these countries are majorly illiterate and unaware of the benefits of employing agriculture equipment for improving crop production. Illiteracy causes continuation of traditional farming practices, which are unsustainable and degrade the soil quality, thereby reducing the crop bearing efficiency of soil. Furthermore, rural areas do not have digital facilities such as resources, skills, and networks, which limits the penetration of advanced agricultural equipment in these areas. Thus, all these factors together restrain the agriculture equipment market growth.

The demand for agricultural equipment decreased in 2020 owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic had shut down the production of agricultural equipment for the end-user, mainly owing to prolonged lockdowns in major global countries. This hampered the growth of the agriculture equipment market share significantly during the pandemic.

The major demand for agricultural equipment was previously noticed from giant manufacturing countries including China, U.S., Germany, India, and the UK, which was severely affected by the spread of coronavirus, thereby halting demand for agricultural equipment. This led to the re-initiation of the manufacturing industry at its full-scale capacities, which helped the agriculture equipment market recover.

Governments from many countries help with the growth of agricultural industries, including financial aid for the purchase of machinery and seeds. The subsidies help to ensure enough food production, lower the inflation rate for food commodities, protect farmer incomes, and strengthen the agricultural industry.

To increase agricultural production, developing countries like India offer a variety of subsidies, debt waiver programs, and other such services. For instance, the Government of India provides several programs for agricultural equipment, including Central Farm Machinery Training & Testing, online farm machinery monitoring, loan-cum-subsidy for the purchase of tractors, pump sets, and power tillers, as well as engineering training services for the use of innovative agricultural equipment. As a result, it is predicted that all these factors working together will present profitable prospects for the advancement of the global agriculture equipment market throughout the forecast period.

Agriculture Equipment Market Segment Review

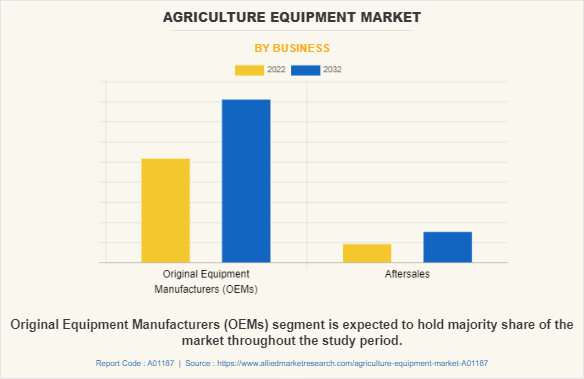

The Agriculture Equipment Market is segmented into type, automation, business, and region. Depending on type, the market is categorized into tractors, harvesters, soil preparation and cultivation, irrigation and crop processing, agriculture spraying equipment, hay and forage machines, and others. By automation, it is segregated into manual, semi-automatic, and automatic equipment. On the basis of business, it is bifurcated into original equipment manufacturers (OEM) and aftersales.

Region wise, the agriculture equipment market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Type:

The agriculture equipment market forecast analysis is categorized into tractors, harvesters, soil preparation & cultivation, irrigation & crop processing, agriculture spraying equipment, hay & forage machines, and others. Tractors are used as agricultural vehicles to provide power for a variety of agricultural tasks like harrowing, tilling, ploughing, and planting. In addition, Soil preparation equipment are mainly utilized to prepare the soil before conducting actual agricultural activities. Equipment such as disc harrows, tillers, rotavators, weeders and other.

Furthermore, Mechanized irrigation systems allow proper nourishment of crops with minimum effort and wastage, of both water and soil. Moreover, Sprayers are majorly utilized to apply fertilizers, pesticides, and herbicides to crops. Self-propelled sprayers are used for professional spraying operations on large farms and reduce the time of spraying fertilizers to a large extent. In addition, Hay & forage equipment majorly includes square & round balers, disc mowers, rakes, mower conditioners, and moisture sensors. And other agriculture equipment includes poultry, livestock feeding, and milking equipment.

This equipment assists farmers in managing and feeding the cattle to achieve high productivity from the poultry and livestock businesses. Tractors are expected to be the largest revenue contributor during the forecast period. Agriculture spraying equipment is expected to exhibit the highest CAGR share in the type of segment in the agriculture equipment market during the forecast period.

By Automation:

The agriculture equipment market is classified into manual, semi-automatic, and automatic equipment. Manual equipment includes tractors, sprayers, tillers, and weeders, which are majorly operated manually without the involvement of any automation technologies. In addition, Automatic agriculture equipment includes utilization of automation technologies, which allow remote operations of equipment. It includes driverless tractors, autonomous harvesters, and other automated farm equipment.

Furthermore, Semi-automatic agriculture equipment includes few technologies, which require manual operator. Semi-automatic equipment is suitable for farmers having moderate farm income, as fully automated equipment requires high investment costs, and the return of investment (ROI) is risky. The manual segment is expected to be the largest revenue contributor during the forecast period, and the Semi-automatic segment is expected to exhibit the highest CAGR share in the automation segment in the agricultural equipment market during the forecast period.

By Business:

The agriculture equipment market is divided into original equipment manufacturers (OEM) and aftersales. OEM companies mostly manufacture and develop various parts and accessories of equipment that are marketed under other brand names. However, major original equipment manufacturers (OEMs) may utilize engines and other equipment parts provided by other specialized manufacturing companies. Moreover, After-sales services include repairing, maintenance, and replacement of parts & accessories.

The after-sales agriculture market is not only majorly operated by the equipment providers but may also include local workshops. The original equipment manufacturers (OEMS) segment is expected to exhibit the largest revenue share in the business segment in the agricultural equipment market during the forecast period. The After-sales segment is expected to exhibit the largest CAGR during the forecast period.

By Region:

The Agriculture Equipment Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, Asia-Pacific held the highest revenue in agricultural equipment market share. And LAMEA is expected to exhibit the highest CAGR during the forecast period.

Agriculture Equipment Market Competitive Analysis

The major players profiled in the Agriculture Equipment Market include Mahindra & Mahindra Ltd., Escorts Limited, CNH Industrial N.V., Deere & Company, AGCO Corporation, SDF S.p.A., AGROSTROJ Pelhřimov, a.s., China National Machinery Industry Corporation Ltd. (Sinomach), J C Bamford Excavators Ltd., and Kubota Corporation.

Major companies in the market have adopted acquisition, partnership and product launch as their key developmental strategies to offer better products and services to customers in the agriculture equipment market.

What are the Acquisition, Investment and Expansion in the Agriculture Equipment Market

- In December 2021, AGCO Corporation has acquired Appareo Systems, LLC, through this acquisition, AGCO Corporation will be able to use innovative innovation in mechatronics, automated vehicles, and artificial intelligence produced by Appareo systems for the improvement of its product line.

- In January 2020, AGCO announced its plans for the establishment of a state-of-the-art manufacturing facility in France. The manufacturing facility is designed as an Industry 4.0 site to sustain the demand for agricultural equipment in the region.

- In November 2022, Mahindra & Mahindra in Pithampur, MP, expanded its first Greenfield Farm Machinery Plant. The largest farm equipment facility outside of Punjab is a 23-acre complex. The facility will assist Indian farmers in mechanizing their farming practices and in fulfilling their aspirations.

Which New Products have Been Launched in the Agriculture Equipment Sector

- In august 2021, John Deere launched the new 6155MH Tractor, which delivers all-around performance and dependability that have been demonstrated in the field to be useful for cultivating, harrowing, or towing harvester trailers.

- In November 2022, New Holland launched its first driverless grain cart harvest machine T8 tractor with Raven Autonomy, for harvesting application. It makes use of OMNiDRIVE, the first driverless farming technology in the world for harvesting grain carts. Thanks to a cutting-edge technological stack, the farmer may operate, synchronize, and monitor an autonomous tractor from the harvester's cab.

- In February 2023, TAFE, manufacturer of Massey Ferguson tractors, has launched TAFE, manufacturer of Massey Ferguson tractors, has launched its brand-new DYNATRACK Series, an innovative line of tractors that combine potent power with dynamic performance, smart technology, unrivalled usefulness, and versatility.

- In June 2023, Mahindra & Mahindra ltd has launched India's new Sarpanch Plus Tractor series. This tractor comes with a 6-year warranty from Mahindra and has 2 HP (1.49 kW) more power, a higher maximum torque, and back-up torque to quickly cover more ground.

- In December 2023. Sonalika Tractors has launched its field-ready electric tractor for the domestic market called Tiger Electric.

- In January 2020, CASE IH launched a new suspended front axle for its CASE IH Quantum V, N, and F model tractors. The new suspended axle offers front suspension option, which allows manual setting of the suspension height from the cab to provide comfort during operations.

- In February 2020, Fendt, a brand of AGCO, The Momentum planter has been launched into the North American row crop producing sector. The product is made to help with difficult planting circumstances. In addition, it has Smart Frame technology, which may be utilized for automatic, intelligent, and configurable vertical contour toolbars.

- In January 2020, Fendt, a brand of AGCO, has introduced Australia's broadest selection of hay tools. Slicer TLX mower, Former 2 and 4 rotor rakes, and Rotana round balers are the models that are featured. There are two different cutting widths for the Fendt Slicer TLX: 3.1 meters and 3.6 meters.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the agriculture equipment market analysis from 2022 to 2032 to identify the prevailing agriculture equipment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the agriculture equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global agriculture equipment market trends, key players, market segments, application areas, and market growth strategies.

Agriculture Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 192.5 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 220 |

| By Type |

|

| By Automation |

|

| By Business |

|

| By Region |

|

| Key Market Players | AGCO Corporation, Escorts Limited, SDF S.p.A., Deere & Company, Mahindra & Mahindra Ltd., CNH Industrial N.V., AGROSTROJ Pelh?imov, a.s., KUBOTA Corporation., J C Bamford Excavators Ltd. (JCB), China National Machinery Industry Corporation Ltd. (Sinomach) |

Analyst Review

According to the insights of the CXOs of leading companies, technological advancements in the field of agricultural machinery have led to increased crop production. The agricultural equipment market witnessed a huge demand in Asia-Pacific. The highest share of the Asia-Pacific market is attributed to increase in demand for agricultural equipment in the Original Equipment Manufacturers (OEMs) industries in the region.

Agricultural equipment manufacturers have focused on designing and upgrading their equipment portfolios with automation and sensor technologies, which reduce the downtime of equipment, thereby offering improved operational times. In addition, key players now produce machinery conforming to the latest emission standards to tackle the environmental challenges on farms. The development of new hybrid equipment, which can work on both fuel as well as batteries, decreases operational costs and significantly increases productivity. These efforts assist in cultivation of better crops to cater to the surge in demand for food globally.

Moreover, the agricultural sector plays a vital role in developing and underdeveloped countries, where the majority of the population is engaged in farming activities. Thus, the economic growth of these countries is majorly dependent on the volume of crops produced, which is assisted using advanced agricultural machinery. Furthermore, governments in these nations offer incentives and loans to farmers to motivate the use of agricultural equipment, which increases the cultivation of crops. Thus, all these factors collectively are anticipated to create lucrative growth opportunities for the agriculture equipment market during the forecast period.

The global agriculture equipment market was valued at $121,196.0 million in 2022, and is projected to reach $192,534.5 million by 2032, registering a CAGR of 4.6% from 2023 to 2032.

The forecast period considered for the global agriculture equipment market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2031 is the forecast year.

The latest version of the global agriculture equipment market report can be obtained on demand from the website.

The base year considered in the global agriculture equipment market report is 2022.

The major players profiled in the agriculture equipment market include Mahindra & Mahindra Ltd., Escorts Limited, CNH Industrial N.V., Deere & Company, AGCO Corporation, SDF S.p.A., AGROSTROJ Pelh?imov, a.s., China National Machinery Industry Corporation Ltd. (Sinomach), J C Bamford Excavators Ltd., and Kubota Corporation.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on type, the tractor segment dominated the market in 2022.

Loading Table Of Content...

Loading Research Methodology...