AI Edge Computing Market Insights, 2030

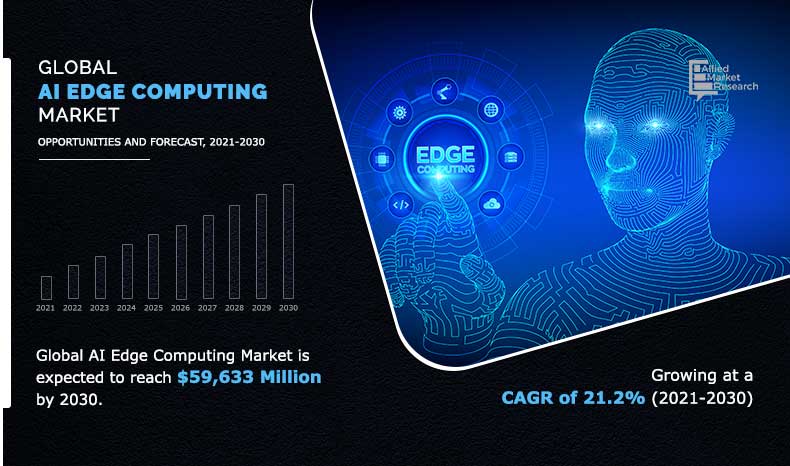

The AI edge computing market size was valued at USD 9,096.0 million in 2020, and is projected to reach USD 59,633.0 million by 2030, registering a CAGR of 21.2%. Ability of the AI edge to overcome cloud computing challenges, rise in demand for real-time operations, and proliferation of edge AI-enabled devices primarily drive the growth of the global AI edge computing market.

On the basis of component, the hardware segment dominated the AI edge computing market in 2020, and is expected to maintain its dominance in the upcoming years. This is due to rise in applications of AI edge computing hardware or physical components such as processors, servers, switches, and routers. In addition, proliferation of smart phones, cameras, robots, and others drives the growth of the hardware segment. However, the services segment is expected to witness highest growth rate during the forecast period.

By Component

Services segment is projected as one of the most lucrative segments.

By organization size, the large enterprises segment dominated the growth in the AI edge computing industry in 2020, and is expected to maintain its dominance in the upcoming years. This is due to significant growth in deployment of edge computing use cases in large enterprises to support IoT or immersive experiences.

By Organization Size

Small and medium enterprises segment is projected as one of the most lucrative segments.

There is proliferation of AI edge computing in large enterprises across the industries such as automotive, health care, and manufacturing. However, the small and medium enterprises segment is expected to experience the highest growth rate during the forecast period.

North America dominates the AI edge computing market. Growth of the market in this region is attributed to several factors such as rise in need for faster processing devices coupled with the huge government funding on innovative technologies, increased number of IoT devices, and a strong technical base. However, Asia-Pacific is expected to witness highest growth rate during the forecast period owing to the proliferation of connected systems fueled by ongoing trend of smart offices and homes in the region along with the government-driven infrastructural projects.

By Region

Asia-Pacific is projected as one of the most lucrative region.

The report focuses on the growth prospects, restraints, and global AI edge computing market share. The study provides Porter’s five forces analysis of the global AI edge computing market forecast to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global AI edge computing market trends.

Segment Review

The AI edge computing market is segmented on the basis of component, organization size, application, industry vertical, and region. On the basis of component, the market is segmented into hardware, software, and services. According to the organization size, the market is fragmented into large enterprises and small & medium sized enterprises. In terms of application, the market is divided into IIoT, remote monitoring, content delivery, video analytics, AR&VR, and others. Depending on industry vertical, it is segregated into automotive, healthcare, chemicals, oil & gas, manufacturing and robotics, public infrastructure, transportation & logistics, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Application

IIoT segment is projected as one of the most significant segments.

Top Impacting Factors

The global AI edge computing industry is influenced by several factors such as ability of the AI edge to overcome cloud computing challenges, rise in demand for real-time operations, and proliferation of edge AI-enabled devices. In addition, a number of lucrative benefits offered by AI edge computing such as faster computing and insights and better data security fuel the growth of this market. However, need for high investment and shortage of skilled IT professionals are projected to hamper growth of the market. On the other hand, advent of the 5G Network connectivity and emerging applications of AI edge computing are estimated to be opportunistic for the AI Edge computing market growth.

Proliferation of edge AI-enabled devices

There is proliferation of edge AI-enabled devices such as smart phones, smart speakers, laptops, self-driven cars, drones, robots, and surveillance cameras that use video analytics. For instance, the developed countries have about 90% of mobile phone penetration while according to the GSMA report, by 2025, smartphone penetration is projected to reach 80% globally. The countries contributing to this significant increase includes, Indonesia, India, and Pakistan. Edge AI eradicates the need for sending huge amounts of data across network of such smart devices; thus, improving the user experience. Hence, proliferation of edge AI-enabled devices projected to drive the AI edge computing market growth.

Emerging applications of AI edge computing

AI edge computing has enabled to power mission-critical, scalable, and private AI applications. For instance, recently, Intel, an American multinational corporation and technology company developed Visual Processing Units, the special co-processors to power high-performance computer vision applications to edge devices.

In addition, AI Healthcare applications including remote diagnostics and surgery, along with the monitoring of patient vital signs is mainly based on edge devices that perform AI at the edge. On the other hand, emerging applications such as smart factories, intelligent transportation systems, and smart energy coupled with entertainment applications such as virtual reality, augmented reality, and mixed reality are projected to create lucrative growth opportunities for the global AI edge computing market.

Regional Insights

North America is a dominant player in the AI edge computing market, primarily due to significant investments in AI technologies and the presence of leading tech companies. The U.S. is at the forefront, with major enterprises leveraging edge computing to enhance data processing capabilities and improve operational efficiency. Industries such as healthcare, manufacturing, and retail are adopting AI edge solutions to optimize processes, reduce costs, and enhance customer experiences. The growing demand for low-latency applications and the increasing deployment of IoT devices are further fueling AI edge computing market growth in this region.

Europe is also witnessing substantial growth in AI edge computing, with countries like Germany, the U.K., and France leading the charge. The region's strong focus on industrial automation and smart manufacturing is driving the adoption of AI edge solutions. Additionally, the European Union’s commitment to digital transformation and sustainability initiatives is encouraging investments in edge computing technologies. The rise of smart cities and the need for efficient resource management are also significant factors contributing to the market's expansion in Europe.

Asia-Pacific is the fastest-growing region for AI edge computing, with countries like China, India, Japan, and South Korea experiencing rapid adoption of edge technologies. The region's booming IoT sector, coupled with increasing urbanization and digitalization efforts, is driving demand for AI edge computing solutions. China, in particular, is investing heavily in smart manufacturing and AI technologies, while India is focusing on enhancing connectivity and infrastructure. The rising use of AI in various sectors, including transportation, healthcare, and agriculture, is propelling AI edge computing market growth across Asia-Pacific.

Latin America and the Middle East & Africa are emerging markets for AI edge computing. In Latin America, countries like Brazil and Mexico are starting to adopt edge computing solutions as part of their digital transformation strategies. The Middle East, especially the UAE and Saudi Arabia, is investing in AI and edge computing to enhance public services, security, and infrastructure development as part of their national initiatives.

Key Industry Developments:

In August 2020, NVIDIA introduced its EGX platform in August 2020, designed to enable real-time AI at the edge. This platform allows organizations to deploy AI applications across various edge devices, enhancing data processing and analysis capabilities.

- In February 2021, Microsoft announced new features for Azure IoT Edge, integrating AI capabilities that allow users to run machine learning models on edge devices. This development enhances the functionality of IoT devices, enabling faster decision-making processes.

- In December 2020: AWS launched Wavelength in December 2020, allowing developers to build applications that deliver ultra-low latency by embedding AWS services at the edge of telecom networks. This solution targets industries like gaming, autonomous vehicles, and smart factories.

- In April 2023, Intel unveiled new AI edge solutions aimed at optimizing performance for various applications, including smart cities and industrial IoT. These solutions focus on providing advanced analytics and AI capabilities directly at the edge, reducing the need for data transmission to centralized data centers.

COVID-19 Impact Analysis

The AI edge computing market was valued at $9,096.00 million in 2020, and is projected to reach $59,633.0 million by 2030, registering a CAGR of 21.2%. The current estimation of 2027 is projected to be higher than pre-COVID-19 estimates. During the COVID-19 pandemic, edge computing and edge data centers are playing a vital role in conveying stored content and cloud computing resources across the globe. In addition, edge computing is ending up to be a life-saving technology for the medical care industry due to different IoT medical applications.

The advantages of edge computing have become more obvious during the COVID-19 pandemic. The overall lockdown has constrained organizations to move toward digitalization for the arrangement of work from home officers to their employee. The effect of the COVID-19 pandemic is altogether driving the interest for edge computing as the main technology companies are integrating automation and intelligence into their organizations.

Key Benefits for Stakeholders

This study includes the Global AI edge computing market analysis, trends, and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and Global AI edge computing market opportunity.

- The Global AI edge computing market size is quantitatively analyzed from 2020 to 2030 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in Global AI edge computing industry.

AI Edge Computing Market Report Highlights

| Aspects | Details |

| By COMPONENT |

|

| By ORGANIZATION SIZE |

|

| By APPLICATION |

|

| By INDUSTRY VERTICAL |

|

| By Region |

|

| Key Market Players | SAGUNA NETWORKS LTD., HUAWEI TECHNOLOGIES CO. LTD, FOGHORN SYSTEMS, NOKIA, RIGADO LLC, CISCO SYSTEMS, INC., HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP, International Business Machine Corporation, CLEARBLADE, INC., VAPOR IO |

Analyst Review

In accordance with the insights by the CXOs of leading companies, the global AI edge computing market is projected to witness prominent growth, especially in Asia-Pacific and Europe regions. This growth is attributed to the ability of the AI edge to overcome cloud computing challenges, rise in demand for real-time operations, and proliferation of edge AI-enabled devices.

Edge computing is a type of cloud computing approach that brings computer data storage closer to the location where it is required. Unlike conventional cloud computing platforms that integrate storage and processing in a single data center, edge computing pushes the computation or data processing power to the edge devices to handle. However, AI Edge or Edge Intelligence, is the amalgamation of edge computing and AI. It provides a form of on-device AI to take advantage of rapid response times with low latency, more robustness, high privacy, and efficient use of network bandwidth. This field of AI Edge is entirely new and is continuously evolving. It is anticipated to drive the AI future, by moving AI capabilities close to the physical world.

On the other hand, edge computing has brought AI processing tasks from the cloud to the end devices while overcoming the intrinsic problems associated with the traditional cloud, such as the lack of security and high latency. Furthermore, the 5G in high-growth areas such as real-time virtual reality experiences, fully self-driving cars, and mission-critical applications is projected to drive innovation across the global edge computing and AI Edge industry.

The global edge computing market is dominated by key players such as Cisco Systems, Inc., International Business Machine Corporation, Clearblade, Inc., Foghorn Systems, Hewlett Packard Enterprise Development LP, Huawei Technologies Co. Ltd., Nokia, Rigado Llc, Saguna Networks Ltd., Vapor IO., and others. The key players have adopted various growth strategies to enhance and develop their product portfolio, strengthen their edge computing market share, and to increase their market penetration.

For instance, in February 2021, Foghorn Systems collaborated with IBM on Edge-to-Hybrid Cloud solutions. Through this collaboration their goal is to provide an open and secured next-generation hybrid cloud platform with advanced, edge-powered artificial intelligence and closed-loop system control capabilities.

The AI edge computing market size was valued at USD 9,096.0 million in 2020, and is projected to reach USD 59,633.0 million by 2030

The global AI edge computing market is projected to grow at a compound annual growth rate of 21.2% from 2020-2030 to reach USD 59,633.0 million by 2030

The global edge computing market is dominated by key players such as Cisco Systems, Inc., International Business Machine Corporation, Clearblade, Inc., Foghorn Systems, Hewlett Packard Enterprise Development LP, Huawei Technologies Co. Ltd., Nokia, Rigado Llc, Saguna Networks Ltd., Vapor IO., and others.

Asia-Pacific is the fastest-growing & largest region for AI edge computing

Ability of the AI edge to overcome cloud computing challenges, rise in demand for real-time operations, and proliferation of edge AI-enabled devices primarily drive the growth of the global AI edge computing market.

Loading Table Of Content...