AI in Fintech Market Overview

The Global AI in Fintech Market was valued at $8.23 billion in 2021, and is projected to reach $61.30 billion by 2031, growing at a CAGR of 22.5% from 2022 to 2031. Rising demand for enhanced automation, personalized customer experiences, fraud detection, data analytics, improved decision-making, regulatory compliance, and increasing adoption of digital banking and payment solutions, are contributing to the growth of the market.

Market Dynamics & Insights

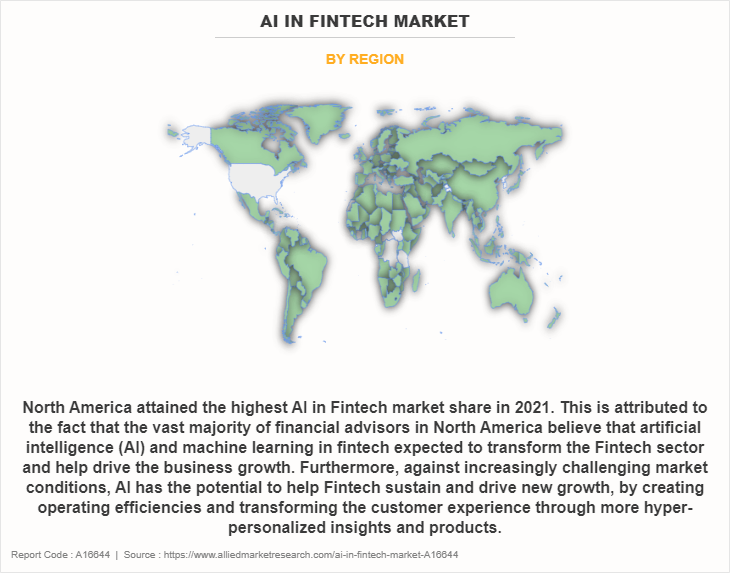

- The AI in fintech industry in North America held a significant share of 36% in 2021.

- By component, the solution segment dominated the market, accounting for the revenue share of 71% in 2021.

- By deployment mode, the on-premises segment dominated the industry in 2021 and accounted for the largest revenue share of 77%.

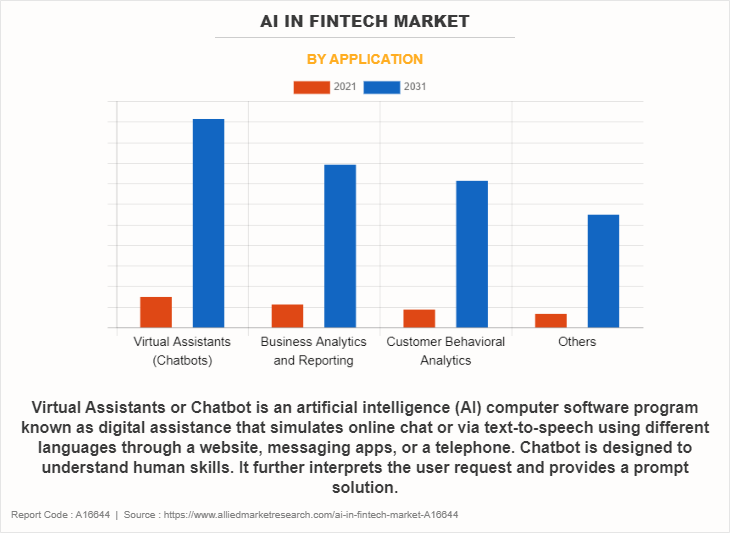

- By application, the virtual assistant (chatbot) segment dominated the industry in 2021 and accounted for the largest revenue share of 37%.

Market Size & Future Outlook

- 2021 Market Size: $8.23 Billion

- 2031 Projected Market Size: $61.30 Billion

- CAGR (2022-2031): 22.5%

- North America: largest market share in 2021

- Asia-Pacific: Fastest growing market

What is Meant by AI in Fintech

AI has proven to be such a success in the FinTech sector as it provides a massive boost to security. AI in cyber security generally comes in the form of chat-bots that convert frequently asked questions into simulated conversations. In addition, they can reset forgotten passwords or grant additional access where necessary. Moreover, customer service is one of the most prominent areas of FinTech that has been improved by artificial intelligence. The increasing sophistication of artificial intelligence has resulted in chatbots, virtual helpers, and artificial intelligence interfaces that can reliably interact with customers. The ability to answer basic queries offers massive potential in reducing front office and helpline costs.

AI in FinTech offer personalized financial advice to help users achieve their financial goals. This personalization is possible primarily due to ai for fintech crypto innovations. Moreover, AI in FinTech provides improved customer services with the help of chatbots, virtual helpers, and artificial intelligence interfaces that can reliably interact with customers. Furthermore, AI in FinTech helps in fraud detection which is a major concern in the FinTech industry. Therefore, these are some of the factors propelling the market growth. However, the finance and banking sectors are regulated by strict laws that ensure fair play and compliance with tax codes. However, AI analytics for financial services is different from traditional, human-powered analytics because it cannot be used for regulatory reporting. In addition, exclusivity of AI in FinTech are some of the major factors limiting the AI in FinTech market. On the contrary, Fintech companies from digital banks to payment gateway providers and stock-trading apps are increasingly harnessing the power of Artificial Intelligence (AI) to automate workflows, improve decision making and add value. Therefore, this is a major factor which is expected to provide lucrative growth opportunities in the coming years.

AI in Fintech Market Segment Review

The AI in FinTech market is segmented on the basis of component, deployment mode, application, and region. By component, it is segmented into solution and services. Solution is further bifurcated into software tools and platforms. Software tools segment is further divided into data discovery, data quality and data governance, data visualization. The services segment is further divided into managed services and professional services. By deployment mode, it is bifurcated into on-premises and cloud. Based on application, it is segregated into virtual assistants (chatbots), business analytics and reporting, customer behavioral analytics, and others. By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

Based on application, the virtual assistant (chatbots) segment attained the highest growth in 2021. This is attributed to the fact that chatbots have become an intelligent solution for the significant financial and banking industry. They have eliminated the long queues at their branches, saving time and energy, giving customers the liberty to get the work done from anywhere without compromising the safety. Therefore, this is a major propelling factor for the virtual assistants or chatbots in the AI in FinTech market.

Based on region, North America attained the highest growth in 2021. This is attributed to the fact that the vast majority of financial advisors in North America believe that artificial intelligence (AI) will transform FinTech sector and help in driving the business growth. Furthermore, against increasingly challenging market conditions, AI has the potential to help FinTech sustain and drive new growth, by creating operating efficiencies and transforming the customer experience through more hyper-personalized insights and products.

The report analyzes the profiles of key players operating in the AI in FinTech market such as Amazon Web Services, Inc., Cisco Systems, Inc., ComplyAdvantage, Cognizant, Capgemini, FICO, Google, Hewlett Packard Enterprise Development LP, HCL Technologies Limited, IBM, Intel Corporation, Inbenta Holdings Inc., Microsoft, Oracle, Saleforce, Inc., SAP SE, and TIBCO Software, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the AI in FinTech market.

COVID-19 Impact Analysis

The COVID-19 pandemic had a positive impact on the AI in FinTech market share, since most of the FinTech companies adopted technology as machine learning in fintech companies since the onset of the COVID-19 economic crisis by making both credit repair and credit monitoring faster and more accurate. From process automation to using biometric identification to reduce credit fraud, AI is fueling improvements that deliver better results for consumers while also helping FinTech industry leaders operate more efficiently and profitably. Moreover, many FinTechs have experienced a surge in demand as working practices and customer banking habits changed during the COVID-19 era. The advent of AI based financial services, has created faster, more efficient and typically cheaper banking compared to traditional financial services. Thus, the COVID-19 had a positive impact on the AI in FinTech market growth.

What are the Top Impacting Factors in AI in Fintech Market

AI in FinTech Provides Improved Customer Services

Customer service is one of the most prominent areas of FinTech that has been improved by artificial intelligence. The increasing sophistication of artificial intelligence has resulted in chatbots, virtual helpers, and artificial intelligence interfaces that can reliably interact with customers. The ability to answer basic queries offers massive potential in reducing front office and helpline costs. Moreover, each chatbot uses a complex sentiment analysis, which is possible due to artificial intelligence. This sentiment analysis focuses on understanding the customer‐™s experience with the FinTech service/application, identifying ways it falls short and training the chatbot itself to address those shortfalls. AI-powered chatbots make communication between a customer and a bank easier and more accessible. They use automated scripts to resolve simple complaints. With the help of chatbots, some banking institutions are growing their customer network. For instance, Bank of America generated over one million new clients in two months after introducing their chatbot. Therefore, this is one of the major driving factor of the AI in FinTech market analysis.

AI in FinTech Industry is Unregulated

The finance and banking sectors are regulated by strict laws that ensure fair play and compliance with tax codes. However, AI analytics for financial services is different from traditional, human-powered analytics because it cannot be used for regulatory reporting. This reason is that it is not possible to extract the propensity model from the neural network to show to the regulator. This barrier to legal regulation of fintech when AI is used may lend itself to law-breaking and corruption by the financial institution, either intentionally or unintentionally. Therefore, this is a major factor limiting the growth of the AI in FinTech industry.

AI is Recognized as being more Powerful than the Traditional Data Analytics Capabilities of Financial Institutions

Fintech companies from digital banks to payment gateway providers and stock-trading apps are increasingly harnessing the power of Artificial Intelligence to automate workflows, improve decision making and add value. In addition, AI will become more and more prevalent in the financial sector, being used on a daily basis to aid productivity and help in decision making. Moreover, Artificial intelligence holds great potential in the fintech industry. It can help in many ways in empowering the organization to improve efficiency, reduce costs, and automate processes. Therefore, these factors will provide major lucrative opportunities for the growth of the AI in Fintech market size in the upcoming years.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the AI in FinTech market forecast from 2021 to 2031 to identify the prevailing AI in FinTech market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the AI in FinTech market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global AI in FinTech market trends, key players, market segments, application areas, and market growth strategies.

AI in Fintech Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 61.3 billion |

| Growth Rate | CAGR of 22.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 382 |

| By Component |

|

| By Deployment Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | HCL Technologies Limited, Oracle Corporation, Hewlett Packard Enterprise Development LP, Cognizant, SAP SE, TIBCO Software, Inc., Saleforce, Inc., Cisco Systems, Inc., Capgemini, IBM, Intel Corporation, Amazon Web Services, Inc., Google, FiCO, Microsoft, ComplyAdvantage, Inbenta Holdings Inc. |

Analyst Review

The term FinTech, or financial technology, refers to the combination of advanced technologies and financial services to improve or automate banking and investment operations. Artificial intelligence (AI) is widely used in financial institutions for detecting and preventing frauds through digital banking channels. It involves digital lending, credit scoring, mobile banking, asset management, insurance, and trading processes. In addition, AI is also used in FinTech to run robo-advisors, which offer financial planning services based on the goals, risk tolerance, financial situation, budget, and spending patterns of the clients. Moreover, it also identifies any personally identifiable information (PII) leaked on the dark web and undertakes necessary actions to secure the data.

The evolution of AI-powered platforms is transforming the FinTech industry in new ways with the rise of conversational artificial intelligence. The old process of continually connecting consumers to a live agent in customer care is becoming obsolete. While human agents are still important and available to deal with increased customer concerns, more and more financial institutions are opting to implement specialized software to deal with basic customer service issues. In addition, conversational AI, such as the one created by Aisera, is designed to operate in sync with employees, establishing an integrated, more efficient, faster customer service experience. Furthermore, natural language processing (NLP) technology is advancing quickly. For instance, Aisera’s solutions understand more than five billion intents and one trillion phrases across 74 languages. This ability of Aisera is to not only provide faster customer service but to engage with customers. It balances emotions and language, which makes Aisera a tool that satisfies more than just the speed of the customer interaction. Some of the key players profiled in the report include, Amazon Web Services, Inc., Cisco Systems, Inc., ComplyAdvantage, Cognizant, Capgemini, FICO, Google, Hewlett Packard Enterprise Development LP, HCL Technologies Limited, IBM, Intel Corporation, Inbenta Holdings Inc., Microsoft, Oracle, Saleforce, Inc., SAP SE, and TIBCO Software, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The global AI in Fintech market size was valued at $8.23 billion in 2021, and is projected to reach $61.30 billion by 2031, growing at a CAGR of 22.5% from 2022 to 2031.

the market value of AI in Fintech Market by the end of 2031 is projected to reach $61.30 billion.

The Fintech industry is distinguished by its high degree of innovation within a complex ecosystem that includes, financial service providers and start-ups. Furthermore, in recent years, AI for fintech crypto has been adopted by various Fintechs for strategic decision making, customer insights, understanding consumer purchasing behavior, and improving the digital transaction experience.

Cisco Systems, Inc., Oracle, IBM, and Saleforce, Inc. are the leading players in AI in Fintech Market.

The AI in Fintech market is segmented on the basis of component, deployment mode, application, and region. By component, it is segmented into solution and services. The solution segment is further bifurcated into software tools and platforms. The software tools segment is further divided into data discovery, data quality and data governance, and data visualization. The services segment is further divided into managed services and professional services. By deployment mode, it is bifurcated into on-premises and cloud. By application, it is segregated into virtual assistants (chatbots), business analytics and reporting, customer behavioral analytics, and others. By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...