Air Filtration Media Market Outlook-2026

The global air filtration media market size is expected to reach $5,347.6 million in 2026, from $3,573.0 million in 2018, growing at a CAGR of 5.0% from 2019 to 2026. The air filtration media is a filter material, which removes and eliminates the dust particles, pollutants, and other particulate matters. These air filter media are made up of variety of materials such as non-woven polyester, glass fiber, activated carbon, and other materials. Different types of air filter media include fiberglass filter, polyester filters, pleated filters, washable filters, and disposable filters. These air filter media are used in air filters and purifiers for applications such as HVAC, face mask, air pollution control, industrial manufacturing, transportation, and others.

There is decrease in the quality of air across the globe due to factors such as industrialization and urbanization. Therefore, pollution has become a health problem globally. It is estimated that the majority of the population in the world is exposed to unsafe air as per the World Health Organization (WHO) guidelines. This high focus to curb pollution is expected to increase the demand for air filters, which in turn drives the demand for air filter media.

Air filters are of great importance to healthcare industry, wherein they are used across hospitals and pharmaceutical and biotechnology manufacturing. In hospitals, air which contains particulates can be harmful to patients, which can further deteriorate the patient health. In addition, unfiltered indoor air can transmit bacteria, infections, germs, and viruses, to patients which can be life threating. Moreover, there is a rise in awareness and sensitivity toward air pollution among the public. The increase in number of programs and campaigns by various institutions such as ClientEarth leads to an increase in awareness. Such awareness programs increase the level of knowledge among citizens, which promotes them to buy air filters. These factors are expected to drive the growth of the air filtration media market in the coming years.

However, in 2018, countries such as U.S., and Germany which are biggest consumers of coal has announced to shut down all 84 coal power plants over the next 19 years. In addition, there is a decline in the new construction of coal power plants. This reduced the demand for the air filters media used in power manufacturing sector, thereby restraining the air filtration media market growth during the forecast period.

Furthermore, the initial purchase price and operating cost of air filters are both high. For example, Heating, Ventilation, and Air Conditioning (HVAC) filters have the ability to remove high particulate matter, but these filters also create significant airflow resistance. This air flow resistance causes HVAC systems to require powerful fans to move air, which results in the consumption of a high amount of energy and CO2 emissions. This factor restricts the growth of the air filtration media market.

There are ample opportunities for companies to explore the nanotechnology to be used in air filter media which increases the benefits for the end consumers, which is expected to drive the growth of the air filtration media market in future.

Air Filtration Media Market Segment Overview

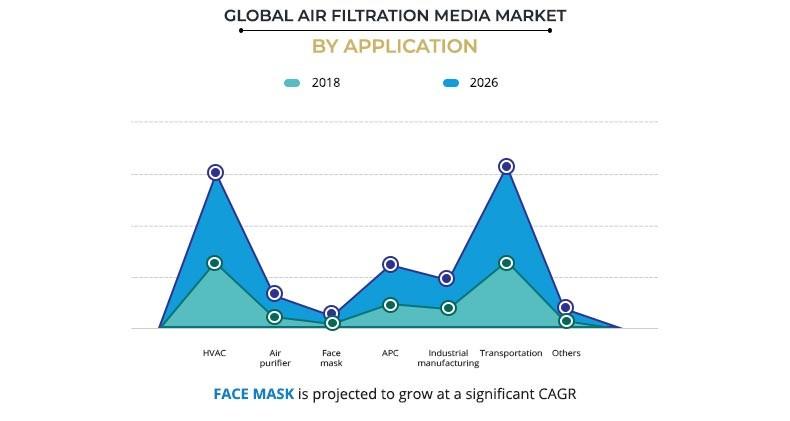

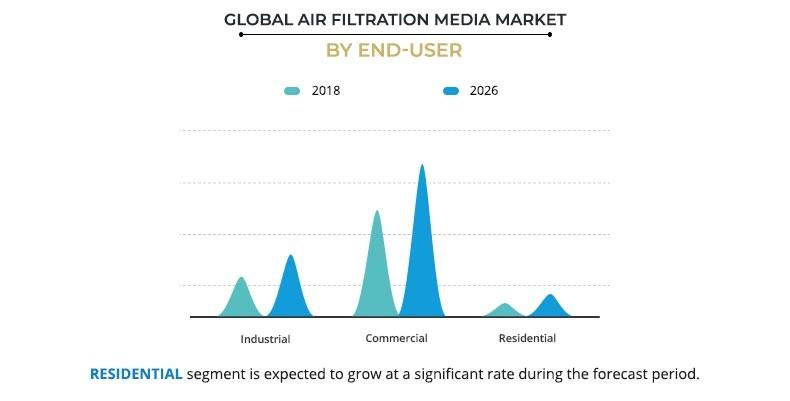

The global air filtration media is segmented based on end user, application, media type, usage, Rating, business, and region. Based on end user, it is classified into industrial, commercial, and residential. In 2018, the air filtration media market share is highest among the commercial segment, owing to the growth in commercial sector. Based on application, it is divided into HVAC, air purifier, face mask, air pollution control, industrial manufacturing, transportation, and others. In 2018, transportation segment contributed high revenue due to adoption of synthetic fibers such as polyurethane-based adhesive filter, and gasoline particulate filter by the various companies for controlling emission & air pollution.

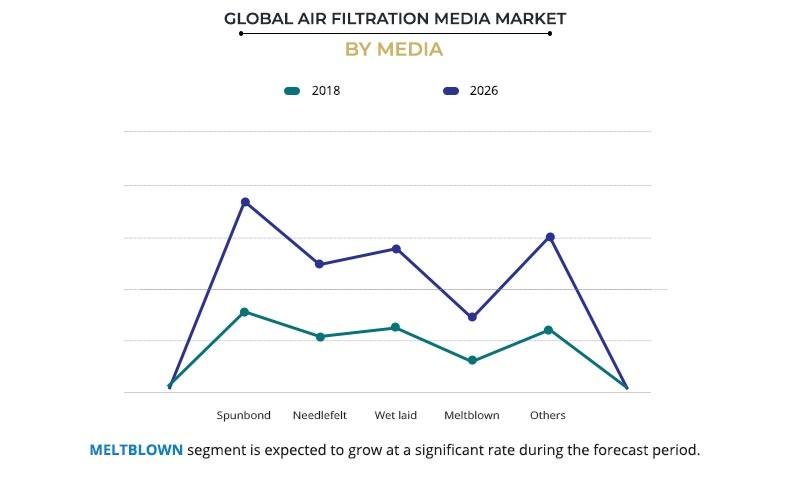

Based on media type, it is categorized into spunbond, needlefelt, wet laid, meltblown, and others. By usage, it is bifurcated as disposable and washable. Based on the rating, the air filtration media market is segmented as MERV, HEPA, ULPA, and others. By business, it is divided into OEM and aftermarket. Based on region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

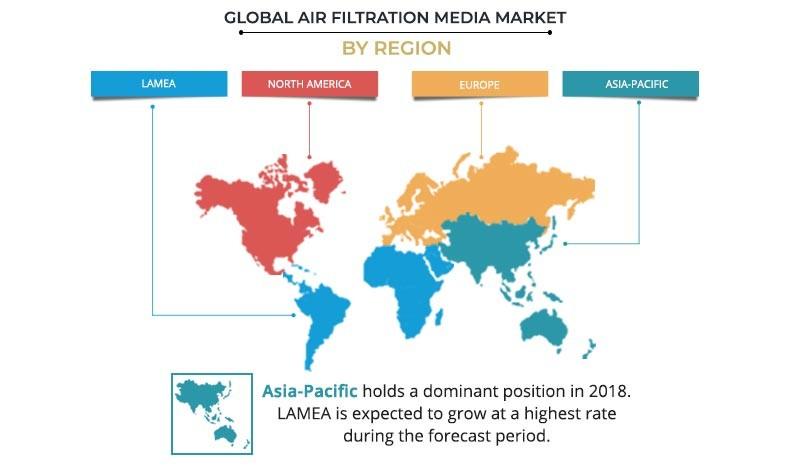

In 2018, Asia-Pacific has the largest share in global air filtration media market, owing to the emerging economies of the Asia-Pacific region such as China, India, South Korea, Vietnam, and others are witnessing rapid industrialization, which led to increase in adoption of air filter media for industrial application such as dehumidifiers, beverage dispensers, and ventilation.

Competition Analysis

The key market players profiled in the report of air filtration media market include 3M, Ahlstrom-Munksjo, AIM Nonwovens and Interiors Private Limited, Air filters, Inc., Berry, Cabot Corporation, Calgon Carbon Corporation, Clean & Science, Donaldson company, Inc., Elta Group, H&V, HVDS, Innovatec, Irema, Johns Manville, Lydall, P. H. Glatfelter Company, Permatron Corporation, Porvair Filtration Group, Sandler, Schweitzer-Mauduit International, Inc., Superior Felt And Filtration, LLC, and Toray

Many competitors in the air filtration media market adopted product launch, as their key developmental strategies to improve their product portfolio and sustain the intense competition. For instance, in November 2018, Ahlstrom-Munksjö Oyj launched Extia 1000 filtration media for air pollution control applications. The new filter media offers 40% more efficiency than the standard filter media. Similarly, in March 2018, Ahlstrom-Munksjö Oyj also launched Trinitex Advance W3200 filtration media, which is specifically designed for pulse jet gas turbine applications. It provides 30 times purer air and also provides protection of gas turbines from humid environments in the industry.

Key Benefits for Air Filtration Media Market:

- The report provides an extensive analysis of the current and emerging air filtration media market trends and dynamics.

- In-depth the air filtration media market analysis is conducted by constructing market estimations for the key market segments between 2018 and 2026.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- Global air filtration media market forecast analysis from 2018 to 2026 is included in the report.

- Key market players within air filtration media market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the air filtration media industry.

Air Filtration Media Market Report Highlights

| Aspects | Details |

| By End-user |

|

| By Application |

|

| By Media |

|

| By Usage |

|

| By Rating |

|

| By Business |

|

| By Region |

|

| Key Market Players | Ahlstrom-Munksjo, Cabot Corporation, Innovatec, Permatron Corporation, 3M, Lydall, Johns Manville, HVDS, P. H. Glatfelter Company, Calgon Carbon Corporation, Elta Group, Air filters, Inc., AIM Nonwovens And Interiors Private Limited, H&V, DONALDSON COMPANY, INC, Toray, Superior Felt And Filtration, LLC, Porvair Filtration Group, Berry, Sandler, Clean & Science, Schweitzer-Mauduit International, Inc., Irema |

Analyst Review

The air filtration media market holds high potential in the HVAC and transportation industry. The current business scenario experiences rapid development in air purifiers leading to the readiness to adopt this technology, particularly in the developed regions such as North America and Europe. Companies in this industry adopt various innovative techniques to provide customers with advanced and innovative features.

Improved efficiency and high durability are some of the major drivers for this market. However, high cost and entry of hackers into the driving operation impede the growth of this market. In the near future, there will be rise in demand for the air filter media due to rise in air pollution and government regulation. Such factors are expected to create lucrative opportunities for the key players operating in the air filtration media market. In the near future, rise in demand for the air purifiers and favorable government policies are expected to create lucrative opportunities for the key players operating in the air filtration media market.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the global market throughout the forecast period (2019-2026) followed by LAMEA, North America, and Europe.

The key companies have focused on product launch, and joint venture to strengthen their foothold in the market. For instance, in October 2018, Toray Industries, Inc. established a joint venture company along with MCM Co., Ltd. named M&T Engineering Co. Ltd. The joint venture was aimed at providing integrated design and development of fibers and filter membranes as well as to expand the business in Republic of Korea.

Degradation of air quality to increase focus on curbing air pollution, and rise in demand for air filters in healthcare industry factors drive the growth of air filtration media market.

The global air filtration media market size was valued at $3,573.0 million in 2018.

To get latest version of air filtration media market report

Asia-Pacific will provide more business opportunities for air filtration media in future.

Rise in awareness about the ill effects of air pollution on health, and environmental protection law enforced by the various governments for controlling emission are the key trends in the air filtration media market.

On the basis of top growing big corporation, we select top 10 players.

Product launch and acquisition are key growth strategies of air filtration media market players.

3M, Ahlstrom-Munksjo, AIM Nonwovens and Interiors Private Limited, Air filters, Inc, Avgol Industries 1953 Ltd, Berry, Cabot Corporation, Calgon Carbon Corporation, Clean & Science, and Donaldson company, Inc.

Based on end user, in 2018, the commercial segment was the highest revenue contributor across the globe.

HVAC, air purifier, and transportation sectors are the potential customers of air filtration media industry.

Loading Table Of Content...