Air Fryer Market Research, 2032

The global air fryer market size was valued at $1 billion in 2022, and is projected to reach $1.9 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032.Air fryer is a multipurpose kitchen equipment that cooks food by rapidly rotating hot air around it. This unique cooking appliance employs advanced convection technology similar to that of an oven using convection; however, in a small and more efficient package. Air fryers have gained popularity due to their potential to make crispy, golden-brown food while using significantly less oil than conventional deep-frying methods. A heating component and a blower that swiftly distributes hot air inside cooking chamber are the crucial components of the equipment. This continuous air circulation provides uniform and speedy frying. In addition, various air fryers possess temperature and timing control parameters, which allow users to tailor the cooking process as per the unique needs of different recipes.

Rise in health consciousness among consumers has emerged as an important factor in the air fryer market growth. As individuals are becoming more health-conscious and mindful of their food choices, easy & healthy cooking options such as air fryer cooking are gaining traction. Traditional deep-frying procedures make use of excessive oil as well as unhealthy trans fats, which increase the prevalence of different health issues, including obesity and heart diseases. On the contrary, air fryers utilize a minimal amount of oil and provide the food with a crisp texture & delectable flavors of fried meals. Through usage of less oil for cooking, users consume few calories and are less susceptible to risks of having oily food.

Less oil-using technique of air fryers has made them popular among health-conscious residents globally. Air fryers offer the versatility to cook a wide range of dishes, from guilt-free french fries to baked chicken, which increases the appeal of the equipment. Therefore, consumers are prioritizing their health while indulging in their favorite dishes more healthily and cautiously. This is projected to augment the growth of the air fryer market.

In the current decade, environmentally conscious consumers seek for appliances which offer convenience as well as minimize energy use & carbon emissions. Air fryers consume less energy than traditional ovens and stovetops due to their small size and have low energy requirement to heat up & sustain cooking temperatures. Air fryers efficiently apply heat to the food, as compared to ovens, thereby resulting in lower energy usage.

Furthermore, air fryers cook food faster than traditional methods. Their use of powerful convection fans and swift hot air circulation leads to speedy cooking, which saves gas & energy. Moreover, various air fryers offer adjustable timers and temperature settings, thus providing users precise control over frying temperatures & durations. This level of control aids in reducing energy waste or overcooking. These attributes of air fryers, including cheap energy expenses and minor environmental effects, propel the development of the air fryer market.

However, the air fryer market is restrained due to several factors. High cost of air fryers in comparison to conventional kitchen equipment such as deep fryers or microwaves is a key restraint of the market growth. Many potential customers, price-sensitive sectors, and areas with low consumer purchasing power retreat from buying air fryers due to their high cost. This benefits the less expensive cooking equipment & solutions sectors while hampering the development of the air fryer market.

On the contrary, the air fryer market holds considerable potential to reshape the kitchen appliance industry through the use of smart technologies. Attributes such as enhanced convenience, accuracy, and connection provided by smart air fryers possess lucrative opportunities for market players as they meet the dynamic needs & preferences of contemporary customers. Moreover, smart air fryers are gaining traction as they offer users the ease to remotely manage and monitor their cooking through mobile applications and voice commands, thereby freeing up time & introducing a new degree of freedom. Smart technology offers consistent & effectively cooked outcomes, appealing to both beginners and seasoned chefs.

In addition, the large number of recipe libraries & cooking methods present in smart air fryers provide consumers with a richness of culinary ideas, making meal preparation easy and allowing for a variety of cooking styles. Furthermore, environmental awareness and energy efficiency are addressed with smart features that streamline the cooking process and offer information on energy consumption. Smart air fryers are projected to become an essential component of the connected kitchen with the development of smart home technology, thereby driving innovation and differentiation in the air fryer market.

Segmental Overview

The air fryer market is segmented into end user, distribution channel, and region. On the basis of end user, the market is bifurcated into residential and commercial. Depending on distribution channel, the market is classified into hypermarket/supermarket, specialty stores, and online channels. According to region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, the UK, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, ASEAN, and the rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, the Middle East, and the rest of LAMEA).

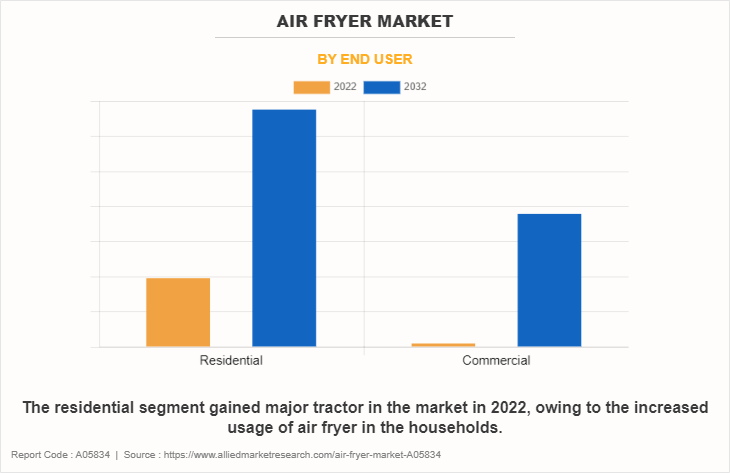

By End User

As per end user, the residential segment dominated the market in 2022 and is anticipated to propel during the forecast period. There is rise in demand for home cooking and healthy eating among residential end users owing to changes in lifestyle and increase in their disposable income. The market is witnessing surge in the trend of smart portable appliances among household consumers. End users are opting for advanced & sophisticated air fryers to enhance their effectiveness and provide time-saving solutions. Furthermore, the launch of technology-driven appliances is encouraging consumers to transform their traditional cooking into smart cooking.

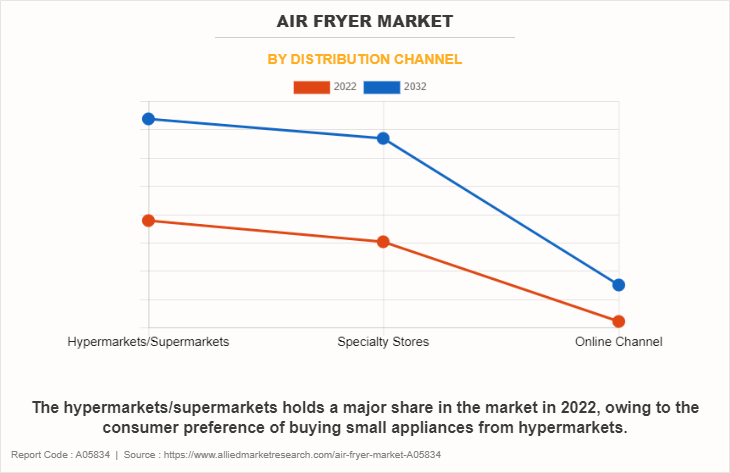

By Distribution Channel

According to the air fryer market demand, on the basis of distribution channel, the hypermarkets/supermarkets segment dominated the market in 2022 and is projected to continue the same trend during the forecast period. Consumers currently prefer to purchase appliances from hypermarkets/supermarkets since they offer a wide variety of brands under a single roof. They are becoming aware of different purchasing trends which exist in society with improvements in technology and home delivery services becoming more readily available.

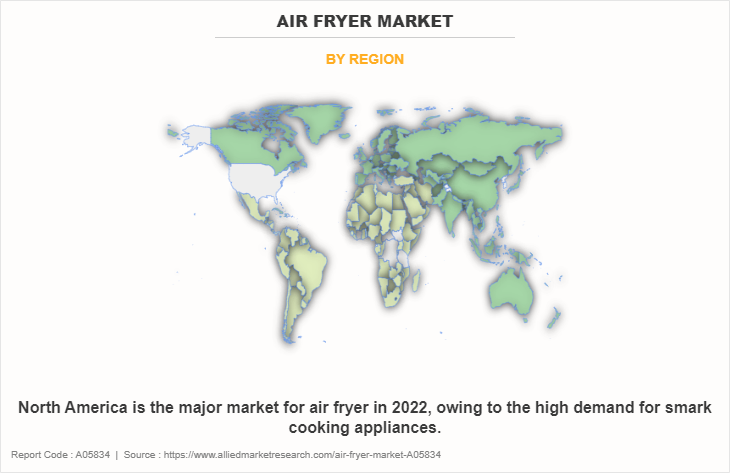

By Region

According to region, North America dominated the air fryer industry in 2022 and is expected to continue the same trend during the air fryer market forecast period. Adoption of air fryers in North American countries is increasing continuously due to rise in trend of using smart cooking appliances among consumers. Furthermore, due to surge in health consciousness and obesity concerns among customers, air fryers are substantially being used to prepare meals.

Competition Analysis

Players operating in the air fryer industry have adopted various developmental strategies to expand their air fryer market share, increase profitability, and remain competitive in the market. Key players profiled in this report include Kent RO Systems Ltd., Newell Brands (Oster), Koninklijke Phillips N.V., Bajaj Electricals Ltd, TTK Prestige Limited, Havells India Ltd, Taurus Group (Inalsa), NuWave LLC, Arovast Corporation (Cosori), and Wonderchef Home Appliances PVT Ltd.

Examples of Acquisition in the Global Robotic Lawn Mower Market

- In November 2023, Wonderchef Home Appliances Pvt. Ltd. opened Kent RO Systems Ltd., Newell Brands (Oster), Koninklijke Phillips N.V., Bajaj Electricals Ltd, TTK Prestige Limited, Havells India Ltd, Taurus Group (Inalsa), NuWave LLC, Arovast Corporation (Cosori), and Wonderchef Home Appliances PVT Ltd.an exclusive store in India in Mumbai, Malad to offer more products and increase its customer base.

- In October 2022, TTK Prestige Limited launched its first multi-category exclusive flagship store in Shakti Nagar, Udaipur, India. The store will offer a wide range of 700 products across 27 categories.

- In January 2021, Taurus Group began the construction of a new operations center in Oliana (Alt Urgell) to strengthen its international strategy and consolidate Oliana as a logistics hub to supply the European market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the air fryer market analysis from 2022 to 2032 to identify the prevailing air fryer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the air fryer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global air fryer market trends, key players, market segments, application areas, and market growth strategies.

Air Fryer Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.9 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 200 |

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Havells India Ltd., NuWave, LLC, TTK Prestige Limited, GoWISE USA, Arovast Corporation, Newell Brands Inc., Taurus Group, Wonderchef Home Appliances Pvt. Ltd., Koninklijke Philips N.V., Kent RO Systems Ltd. |

Analyst Review

Leading players in the air fryer market are providing customized solutions to improve kitchen aesthetics along with continuously striving to introduce innovative products to enhance their market reach. In addition, leading manufacturers are introducing energy-saving illumination and maintenance-free, highly efficient air fryers to attract large segments of consumers. Moreover, warranty and services play an important role in long-term customer engagement and retention. Therefore, upsurge in personalized discounts and offers is luring the customers. While discounts and offers have always been in tradition, providing specific offers according to demography remains a major challenge for engaged stakeholders in the industry.

The air fryer market was valued at 1,003.8 million in 2022 and is projected to reach 1,854.8 million by 2032, growing at a CAGR of 6.5% from 2023-2032.

The global air fryer market registered a CAGR of 6.5% from 2023 to 2032

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the air fryer market report is from 2023 to 2032.

The top companies that hold the market share in the air fryer market include Kent RO Systems Ltd., Newell Brands (Oster), Koninklijke Phillips N.V., Bajaj Electricals Ltd, and others.

The air fryer market report has 2 segments. The segments are end user, and distribution channel.

The emerging countries in the air fryer market are likely to grow at a CAGR of more than 7.0% from 2023 to 2032.

Post-COVID-19, global industry is expected to grow at a high rate as market leaders adopt new partnerships for introducing smart appliances and offer unique experience to the consumers.

North will dominate the air fryer market by the end of 2032

Loading Table Of Content...

Loading Research Methodology...