Air Humidifier Market Research, 2033

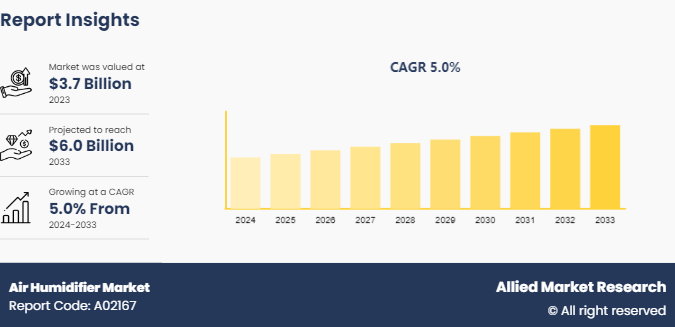

The global air humidifier market size was valued at $3.7 billion in 2023 and is projected to reach $6.0 billion by 2033, growing at a CAGR of 5% from 2024 to 2033.

Market Introduction and Definition

A humidifier is a device designed to increase the moisture level in the air within a room or an enclosed space. It works by emitting water vapor into the air, thus raising humidity levels to achieve optimal comfort and health. The humidification process can alleviate various discomforts caused by dry air, such as dry skin, irritated nasal passages, and sore throats. Moreover, humidifiers can also benefit indoor plants, wooden furniture, and musical instruments by preventing them from drying out and cracking. The market for humidifiers exists primarily to address the needs of individuals and environments where low humidity levels pose problems, especially during dry seasons or in regions with naturally arid climates. As people become more aware of the importance of indoor air quality and its impact on health and well-being, the demand for humidifiers continues to grow, leading to ongoing innovation and advancements in the industry.

Key Takeaways

The air humidifier market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the forecast period 2024-2035.

More than 1, 500 product literature, industry releases, annual reports, and other such documents of major air humidifier industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

An increase in diseases such as asthma, sinusitis, and other allergies owing to dry air has created awareness among customers about maintaining specific humidity in the air by using humidifier appliances. In addition, the low humidity in the air makes breathing less laborious and can also cause lung secretions in infants. This is one of the key reasons that customers rely on air humidifier during the winter months as low humidity causes asthmatic cough. Whereas therapy using an air humidifier adds moisture to the air, thus, preventing dryness in the skin, throat, nose, irritated vocal cord, dry cough, and cracked lips. Also, low humidity causes discomfort in the home in the winter season and when air conditioners are used during the summer season. Therefore, these are the health-related factors that are expected to drive the air humidifier market growth during the forecast period.

The rapid change in lifestyle, growth in concern toward a healthy environment, and surge in living standards are creating a high demand for air humidifiers in the residential sector. In addition, smart connected humidifiers via smartphones for the residential sector are expected to boost air humidifier market demand. The rise in industrialization and growth in concerns regarding a healthy work environment is expected to boost the adoption of humidifiers in industrial sectors such as healthcare, pharmaceuticals, and automotive. Silent operation along with less maintenance is the prime factor driving the ultrasonic air humidifier industry growth in the residential and commercial segment.

The United States Department of Labor has set certain rules standards and regulations for humidity control and temperature control in the industrial workplace. This helps prevent fatigue and dry air diseases among workers and provides a healthy work environment. In addition, these regulations are also followed by other countries with certain modifications according to the suitable temperature and atmosphere in that country. Moreover, the European Union has set guidelines for maintaining humidity, light, and oxygen, for the packaging manufacturing, filling process, warehouse, and other commercial and industrial sectors.

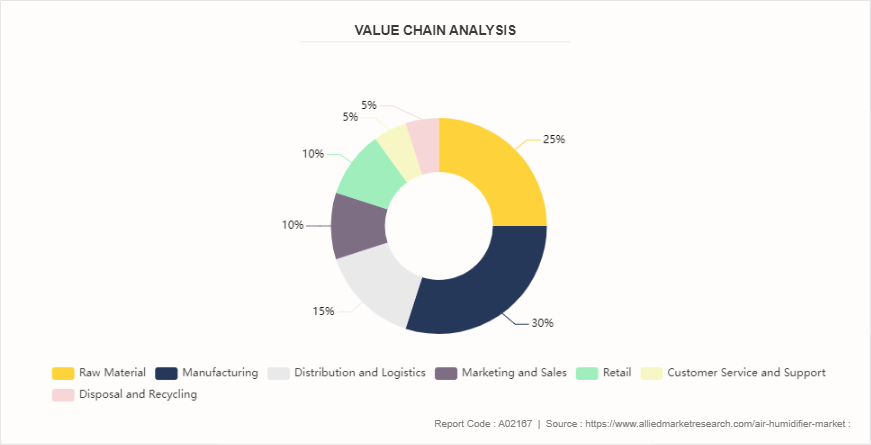

Value Chain Analysis

Each stage in the value chain contributes to the overall value of air humidifiers and influences factors such as pricing, quality, and customer satisfaction. Analyzing each step helps identify areas for improvement and opportunities for innovation in the market.

Raw Material: This involves sourcing materials like plastics, metals, electronic components, and filters required for manufacturing air humidifiers. Suppliers play a crucial role in ensuring the quality and availability of these materials.

Manufacturing: The manufacturing stage involves assembling components, quality control, and packaging. Manufacturers need efficient production processes to ensure timely delivery and cost-effectiveness.

Distribution and Logistics: Once manufactured, air humidifiers need to be transported to wholesalers, retailers, or directly to consumers. Distribution channels may vary from traditional retail stores to online platforms.

Marketing and Sales: Effective marketing strategies are essential to create awareness and promote air humidifiers. This involves advertising, branding, pricing strategies, and sales promotions to attract customers.

Retail: Retailers play a key role in displaying and selling air humidifiers to consumers. They need to ensure adequate stock, provide product information, and offer after-sales support.

Customer Service and Support: Post-sales services such as warranties, repairs, and customer assistance are crucial for maintaining customer satisfaction and loyalty. This includes addressing any issues or queries that consumers may have about the product.

Disposal and Recycling: At the end of the product lifecycle, proper disposal or recycling of air humidifiers is essential to minimize environmental impact. This involves adhering to waste management regulations and promoting sustainable practices.

Market Segmentation

The air humidifier market is segmented into type, application, and region. Based on type, the market is segmented into vaporizers, impeller humidifier, ultrasonic humidifier, and wick/evaporative systems. Based on application, the market is classified into commercial, industrial, and residential. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional Market Outlook

North America held the major air humidifier market share in 2023, particularly owing to the vast presence of manufacturers and product promotion from regulatory bodies such as the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) and the United States Environmental Protection Agency (USEPA) which is expected to further drive the market growth. In addition, LAMEA is expected to witness a significant CAGR during the forecast period. Major players in the industry, including Levoit, Honeywell, Stadler Form, Crane, Koninklijke Philips N.V., and Flextronics International, continue to introduce new products and compete based on factors such as performance, design, and brand reputation. As a result, the air humidifier market in North America is expected to remain dynamic and competitive, with opportunities for further innovation and market expansion during air humidifier market forecast.

Industry Trends

Humidifiers are becoming increasingly sophisticated, with features like smart controls, app connectivity, and automatic humidity monitoring. For example, Levoit makes a smart humidifier that can be controlled with a smartphone app and works with Amazon Alexa and Google Assistant.

Sustainability and Energy Efficiency: Manufacturers are focusing on developing energy-efficient humidifiers that reduce operational costs and environmental impact. This could involve advancements in technology, the use of recycled materials, and features like automatic shut-off to minimize energy consumption.

Focus on Advanced Technologies: Rise in humidifiers with advanced features like built-in aroma diffusers, integration with smart home systems for better control and technologies such as ultraviolet (UV) germicidal irradiation to eliminate bacteria in the mist.

Stadler Form offers several humidifier models with some featuring built-in aroma diffusers and smart home compatibility. Their Oskar Little Air Purifier and Humidifier combines air purification and humidification with aroma diffuser capabilities. It also works with Apple HomeKit and Amazon Alexa for voice control.

Competitive Landscape

The major players operating in the air humidifier market include Levoit, Honeywell, Stadler Form, Crane, Koninklijke Philips N.V., Aprilaire, BONECO, Dyson, VicTsing, Miro, Guardian Technologies, Venta, AIRCARE, Befeuchtung, Euromate, and ElectriCal.

Recent Key Strategies and Developments

In January 2023, Levoit launched the Vital 200S Smart True HEPA Air Purifier, a new smart air purifier designed to support a healthier lifestyle while removing particles in the air with a particle removal rate at 99.97 percent to ensure the purest air quality featuring high-performance technology, powerful purification, and smart customizations.

In September 2023, Panasonic Life Solutions India introduced a new range of refrigerators, under Panasonic’s proprietary Prime Convertible series, which comes with higher capacities and upgraded features like a bottom-mounted freezer where the freezer compartment is situated at the bottom of the refrigerator offering convenient storage and easy access to vegetables and fruits in the fridge compartment.

In September 2022, Levoit announced a collaboration with SHOWFIELDS that showcases the brand's smart air purifiers and allows customers for the first time ever to test the products before purchasing. Launched first-ever brick-and-mortar consumer retail experience inside SHOWFIELDS in New York City.

In August 2020, LG Electronics USA introduced the industry's first line of smart ranges to offer the exclusive InstaView knock-on technology plus Air Fry capability. The goal is to help provide meal inspiration and faster, more convenient prep for all those homeowners who are now cooking more at home.

Key Sources Referred

Association of Home Appliance Manufacturers (AHAM)

U.S. Energy Information Administration (EIA)

National Kitchen & Bath Association (NKBA)

International Association of Home Inspectors (InterNACHI)

U.S. Department of Energy (DOE)

Canadian Appliance Manufacturers Association (CAMA)

U.S. Environmental Protection Agency (EPA)

American Council for an Energy-Efficient Economy (ACEEE)

National Association of Home Builders (NAHB)

Canadian Home Builders' Association (CHBA)

International Energy Agency (IEA)

American Gas Association (AGA)

Canadian Gas Association (CGA)

National Fire Protection Association (NFPA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the air humidifier market analysis from 2024 to 2033 to identify the prevailing air humidifier market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the air humidifier market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global air humidifier market trends, key players, market segments, application areas, and market growth strategies.

Air Humidifier Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.0 Billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 315 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Venta, AirCare, Aprilaire, Koninklijke Philips N.V., VicTsing, Euromate, Boneco, Honeywell, Dyson Technology Limited, ElectriCal, Miro, Levoit, Guardian Technologies International, LLC, Stadler Form AG, Crane |

Analyst Review

Over the last five to six years, the air humidifier market has witnessed substantial growth owing to increase in health awareness, and government standards and regulations to maintain humidity. This has further fueled the adoption of air humidifier among health-conscious consumers.

The United States Department of Labor, and European Union has formulated strict rules and regulations to maintain humidity at commercial and industrial places, which is expected to further boost the market growth. North America and Europe were early adopters of air humidifier, thereby collectively accounting for 59.2% share in 2017. In terms of growth, Asia-Pacific is expected to be a lucrative market, due to the significant increase in adoption of air humidifiers in China, India, and Japan. Growth in adoption of humidifiers in various end-user industries such as healthcare, paper, textile, and others, drives the market in the region. Air humidifiers are widely used in commercial spaces such as offices, and hotels as well as in households, to maintain a healthy environment. Residential usage of air humidifier accounted for the highest revenue share, constituting over 45.6% in 2017.

The global air humidifier market was valued at $3.7 billion in 2023 and is projected to reach $6.0 Billion by 2033, growing at a CAGR of 5% from 2024 to 2033.

The air humidifier market is segmented into type, application, and region. Based on type, the market is segmented into vaporizers, impeller humidifier, ultrasonic humidifier, and wick/evaporative systems. Based on application, the market is classified into commercial, industrial, and residential. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

North America is the largest regional market for air humidifiers

Which are the top companies to hold the market share in the air humidifier market?

The global air humidifier market report is available on request on the website of Allied Market Research.

Loading Table Of Content...