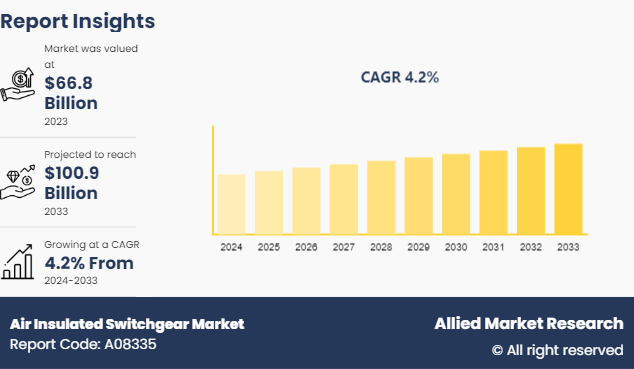

The global air insulated switchgear market was valued at $66.8 billion in 2023, and is projected to reach $100.9 Billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033

Market Introduction and Definition

Air-insulated switchgear (AIS) is a type of electrical switchgear where air is used as the primary insulating medium to protect and isolate electrical components. AIS systems include various devices such as circuit breakers, disconnectors, and busbars, all enclosed within a metal casing. The air acts as an insulator to prevent electrical faults and ensure safe operation. AIS is commonly used in medium to high voltage applications due to its reliability, ease of maintenance, and cost-effectiveness. It is widely utilized in power distribution networks, industrial plants, and infrastructure projects where space is not a critical constraint. Its robust design and capability to handle large electrical loads make it a preferred choice for many utilities and industries.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The air insulated switchgear market is fragmented in nature among prominent companies such as xx.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, and LAMEA regions.

- Latest trends in global air insulated switchgear market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 2, 300 air insulated switchgear-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global air insulated switchgear market.

Key Market Dynamics

As urbanization and industrialization accelerate globally, particularly in emerging economies, there is a rising demand for robust electrical distribution networks to support residential, commercial, and industrial growth. Governments and private sectors are investing heavily in building new power plants, substations, and transmission lines, which require reliable switchgear solutions to ensure efficient and uninterrupted power distribution. In regions like Asia-Pacific and Africa, where electrification projects are rapidly expanding to meet the needs of growing populations and economies, AIS offers a cost-effective and reliable solution. Additionally, the modernization of aging infrastructure in developed countries, such as the U.S. and Europe, also boosts demand for air insulated switchgear (AIS) as utilities upgrade outdated systems to enhance efficiency and reliability. The inherent advantages of AIS, including its relatively lower cost compared to gas-insulated switchgear (GIS) and ease of installation and maintenance, make it an attractive choice for these large-scale infrastructure projects.

Furthermore, global shift towards renewable energy sources is another critical driver of the AIS market. As countries strive to meet their climate goals and reduce carbon emissions, there is an increasing integration of renewable energy sources like wind, solar, and hydro into the power grid. These sources require sophisticated grid infrastructure to manage their variable output and ensure stable power supply where air insulated switchgear (AIS) plays a vital role in this integration by providing reliable and adaptable switchgear solutions that can handle the fluctuations associated with renewable energy. This factor may further augment the growth of the air insulated switchgear market during the forecast period.

However, one of the significant restraints for the air insulated switchgear market is environmental concerns related to the use of air as an insulating medium. While AIS does not use sulfur hexafluoride (SF6) , a potent greenhouse gas used in GIS, air-insulated systems still have environmental impacts. For instance, air-insulated switchgear can contribute to air pollution if not properly maintained or if there are leaks in the system. As environmental regulations become stricter worldwide, there is pressure on manufacturers to reduce the environmental footprint of their products, which could affect the attractiveness of AIS compared to GIS or other eco-friendly alternatives.

On the contrary, technological advancements in AIS are enhancing their performance, reliability, and cost-effectiveness, driving market growth. Innovations in materials, design, and manufacturing processes have led to the development of more compact, efficient, and durable AIS systems. For instance, the use of advanced insulating materials and improved switch mechanisms has enhanced the performance and lifespan of AIS. Thise factor may create remunerative opportunities for the air insulated switchgear market during the forecast period.

Market Segmentation

The air insulated switchgear market is segmented on the basis by voltage, application, and region. By voltage, the market is classified into low, medium, and high. By application, the market is divided into power distribution networks, industrial plants, infrastructure projects, data centers, renewable energy integration, and others. Region-wise, the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Asia-Pacific represents a significant market for air insulating switchgear (AIS) , driven by the fact that Asia-Pacific region is experiencing rapid urbanization and industrialization, particularly in countries like China, India, and Southeast Asian nations. As urban centers expand and industrial sectors grow, there is a significant need for reliable and efficient electrical distribution infrastructure where AIS provides a cost-effective solution for medium to high voltage applications, supporting the establishment of substations, distribution networks, and industrial facilities. This factor may act as one of the key drivers responsible for the growth of the air insulated switchgear market in the Asia-Pacific region.

Additionally, countries in Asia-Pacific such as China and India are investing heavily in expanding their power generation capacity and upgrading transmission infrastructure to meet growing electricity demand. According to a report published by Press Information Bureau in 2024, the power generation industry in India will attract investment of around $400 billion by 2032. AIS is widely used in distribution substations and networks to ensure the reliable distribution of electricity from power plants to end-users. The scalability and modularity of AIS systems make them suitable for accommodating new power generation sources, including renewable energy. This factor may surge the adoption of AIS among the upcoming power projects; thus, fueling the market growth.

Competitive Landscape

The major players operating in the air insulated switchgear market include Hitachi Group, Schneider Electric, Switchgear Company, Siemens, alfanar Group, Mitsubishi Electric Power Products, Inc., Orecco, Eaton, Zhejiang Volcano Electrical Technology Co., Ltd, ABB, and Ghorit .

Industry Trends

- Hitachi, a premier manufacturer of air insulated switchgear (AIS) is focusing on the continual development of new technologies to increase the eco-efficiency, availability and reliability of AIS substation products. AIS primary substation equipment contains a portfolio up to 1100 kV, including live tank circuit breakers (LTB) , dead tank circuit breakers (DTB) , instrument transformers, disconnectors, surge arresters, monitoring and controlled switching. This may surge the utilization of AIS across various industrial power control systems; thus, fueling the growth of the air insulated switchgear market.

- Power utilities in both developed and developing economies are constantly focusing on substation and air insulated switchgear technologies that have less outage and require less space attributed to rise in focus on uninterrupted power supply. This factor is projected to further increase the growth of the air insulated switchgear market during the forecast period.

Public Policy Analysis of Global Air Insulated Switchgear Market

Several acts and regulations have been set-up to safeguard the use of air insulated switchgear across various end-use sectors. For instance:

In U.S.:

- National Electrical Code (NEC) Article 230, provides requirements for electrical installations, including switchgear, to ensure safety and proper installation practices.

- National Fire Protection Association (NFPA) 70E outlines safety standards for electrical equipment, including switchgear, to protect personnel from electrical hazards.

In Europe:

- International Electrotechnical Commission (IEC) (IEC 62271-200) standard applies to high-voltage switchgear and control gear for rated voltages above 1 kV and up to and including 52 kV.

- The European Committee for Electrotechnical Standardization (CENELEC) harmonizes electrical standards across Europe, including those related to AIS under the EN 62271 series of standards.

- The EU F-Gas Regulation (517/2014) regulates the entire electrical industry in terms of handling and emissions management practices associated with AIS.

Key Sources Referred

- National Promotion and Facilitation Agency

- U.S. Development Authority

- International Electrotechnical Commission Science Direct

- International Trade Administration

- Invest In India

- Press Information Bureau

- U.S. Environmental Protection Agency

- European Union (EU) Regulations

Key benefits for stakeholders

- This report provides a quantitative analysis of the air insulated switchgear market segments, current trends, estimations, and dynamics of the air insulated switchgear market analysis from 2023 to 2033 to identify the prevailing air insulated switchgear market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the air insulated switchgear market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global air insulated switchgear market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global air insulated switchgear market trends, key players, market segments, application areas, and market growth strategies.

Air Insulated Switchgear Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 100.9 Billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Voltage |

|

| By Application |

|

| By Region |

|

| Key Market Players | Orecco, Eaton, ABB, Ghorit, Hitachi Group, Schneider Electric, Zhejiang Volcano Electrical Technology Co.,Ltd, Siemens, Switchgear Company, Mitsubishi Electric Power Products, Inc., alfanar Group |

Loading Table Of Content...