Air Traffic Management Software Market Research, 2034

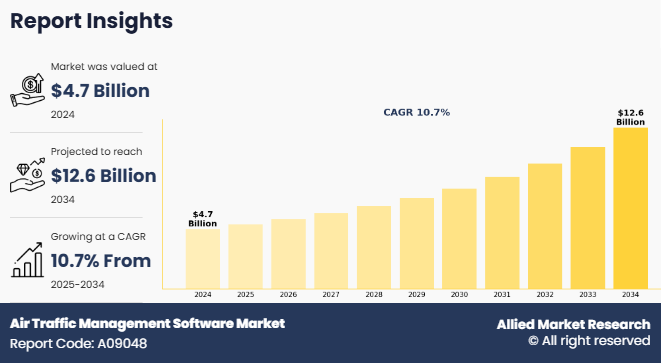

The global air traffic management software market size was valued at $4.7 billion in 2024, and is projected to reach $12.6 billion by 2034, growing at a CAGR of 10.7% from 2025 to 2034.

Air traffic management (ATM) software refers to specialized systems designed to coordinate the safe and efficient movement of aircraft within controlled airspace and at airports. It integrates multiple functions including air traffic control (ATC), airspace management (ASM), and air traffic flow management (ATFM) to optimize flight operations from departure to arrival. These systems support communication, navigation, and surveillance (CNS) capabilities by processing real-time flight data, monitoring aircraft positions, and managing air routes and altitudes.

Key Takeaways

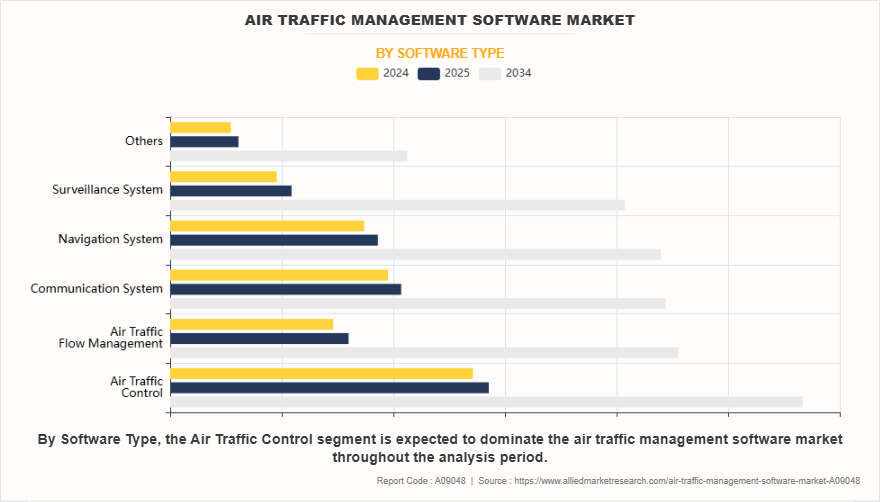

- On the basis of software type, the air traffic control segment held the largest share in the air traffic management software market in 2024.

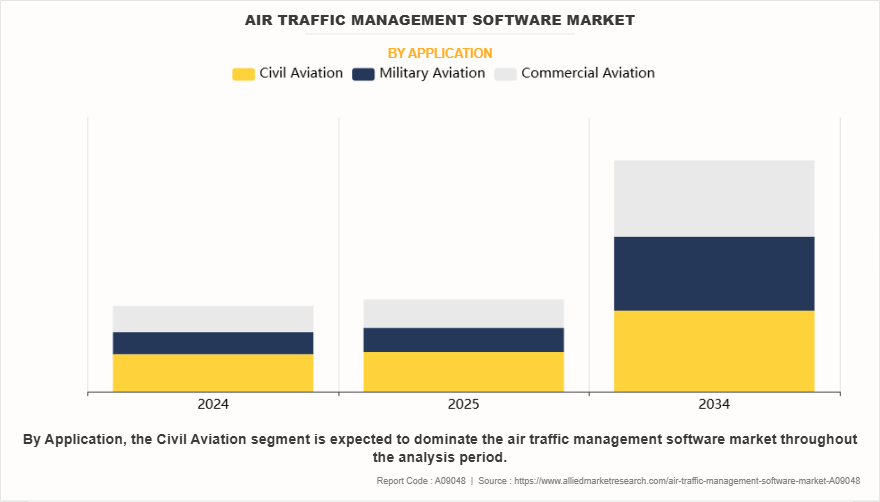

- By application, the civil aviation segment was the major shareholder in 2024.

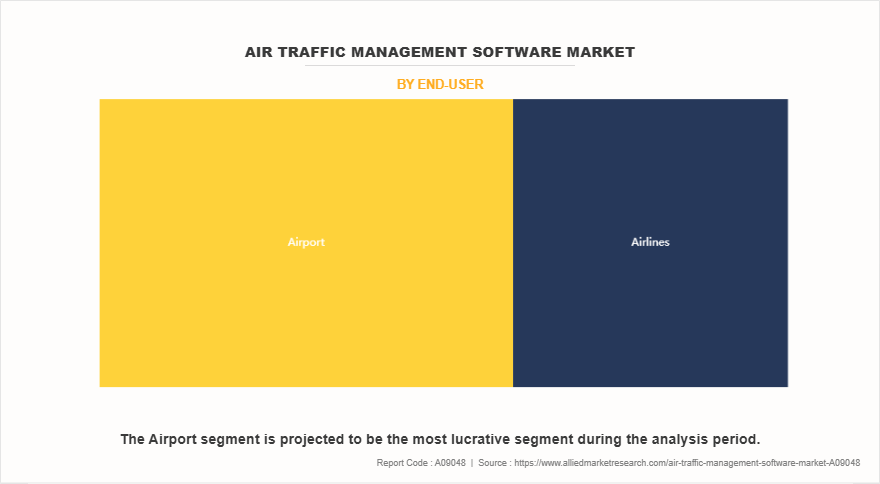

- By end user, the airport segment dominated the market, in terms of share, in 2024.

- By deployment mode, the on-premise segment dominated the market, in terms of share, in 2024.

- Region wise, North America region held the largest market share in 2024.

Air traffic management software industry helps controllers minimize delays, avoid collisions, and ensure the best use of airspace by automating routine tasks and providing decision-support tools. It also plays a key role in managing high traffic volumes and responding to emergencies or changing weather conditions. As air travel increases globally, modern ATM software incorporates artificial intelligence, machine learning, and data analytics to improve safety, reduce fuel consumption, and lower emissions—making it vital to both current and future airspace management infrastructure.

For instance, in May 2025, IBM partnered with Raytheon Technologies, which is playing a key role in modernizing the nation's aging system for air traffic control by contributing advanced technologies and software solutions, which aligns with the growing demand in the air traffic management software for automation, data integration, and enhanced operational efficiency. Moreover, in June 2023, Raytheon Technologies' Collins Aerospace has been selected to participate in several EU SESAR 3 air traffic management projects aimed at advancing the Digital European Sky. These initiatives focus on enhancing airspace efficiency, safety, and integration of emerging airspace users such as drones and air taxis. Through contributions in AI, automation, connectivity, and trajectory-based operations, Collins Aerospace supports the development of next-generation ATM solutions that reduce pilot and controller workload while improving system performance and security.

The rise in global air passenger and cargo traffic is significantly increasing the demand for air air traffic management software industry. As airports experience higher volumes of flights, there is a growing need to efficiently manage airspace, minimize delays, and enhance safety. ATM software plays a critical role in streamlining flight operations, enabling real-time monitoring, and supporting smooth coordination among controllers, which becomes essential amid increasing air travel activity worldwide. Furthermore, modernization initiatives for aging air traffic control infrastructure, and integration of AI and data analytics in ATM systems have driven the demand for air traffic management software market share.

However, high initial investment and maintenance costs are hampering the demand for the air traffic management software market growth. Implementing advanced ATM systems requires substantial capital for hardware, software, and infrastructure upgrades, which can be a burden for governments and airport authorities, especially in developing regions. Ongoing maintenance and the need for skilled personnel further increase operational costs, making it challenging for smaller airports to adopt and sustain such technologies. Moreover, regulatory and standardization challenges across regions are major factors that hamper the growth of the air traffic management software industry.

On the contrary, the expansion of air traffic management in emerging economies presents a air traffic management software market opportunities. As these regions experience rapid economic growth and an increase in air travel, there is a rising demand for efficient airspace management systems. Investing in advanced ATM software allows these countries to enhance safety, optimize air traffic flow, and modernize infrastructure, creating significant growth potential for vendors in these emerging Air traffic management software market growth.

Segment Review

The global air traffic management software market is segmented on the basis of software type, application, end-user, deployment mode, airport size and region. On the basis of software type, the market is divided into air traffic control, air traffic flow management, communication system, navigation system, surveillance system, and others. By application, it is classified into civil aviation, military aviation, and commercial aviation. On the basis of end-user, it is categorized into airport, and airlines. By deployment mode, the market is bifurcated into on-premise, and cloud-based. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Software Type

On the basis of software type, the air traffic control segment acquired the highest air traffic management software market share in 2024. This is due to its critical for ensuring the safe and efficient movement of aircraft within controlled airspace, guiding them during takeoff, flight, and landing. These systems enable air traffic controllers to manage and monitor aircraft positions, clearances, and altitudes in real time. With the increasing volume of air traffic globally, the demand for sophisticated ATC systems has surged, driving the market share of this air traffic control.

By Application

On the basis of application, the civil aviation segment attained the highest market share in 2024 in the air traffic management software market size. This is driven by the largest contributor to global air traffic, with a significant number of commercial flights operating daily. ATM software in this segment focuses on optimizing flight routes, ensuring airspace safety, reducing delays, and managing air traffic flow efficiently across airports and national airspaces. The growing number of passengers and cargo demand, along with the need for modernized infrastructure, drives the adoption of advanced ATM software in civil aviation. This trend is further supported by government investments and technological advancements to handle the increasing air traffic volume.

By End-User

On the basis of end-user, the airport segment attained the highest market share in 2024 in the air traffic management software market demand. This is due to airports play a critical role in managing the flow of air traffic, ensuring safety, and coordinating ground operations. The adoption of ATM software by airports is driven by the need for efficient airspace management, optimizing air traffic flow, reducing delays, and improving operational efficiency. With increasing air traffic, airports require advanced technologies to manage crowded airspaces, integrate with airlines, and enhance safety protocols. The growing focus on modernizing airport infrastructure to accommodate the surge in global air travel has further contributed to the expansion of the ATM software market in this airport.

By Region

Region wise, North America attained the highest market share in 2024 and emerged as the leading region in the air traffic management software market. This is driven by robust investments in airport expansion and modernization initiatives across the U.S. and Canada. The U.S. Federal Aviation Administration (FAA) has been instrumental in upgrading aging ATM systems to enhance operational efficiency and accommodate increasing air traffic volumes. This includes the implementation of advanced technologies such as cloud-based platforms and automation systems.

However, Asia-Pacific is projected to grow at the fastest rate during the forecast period. This due to rapid economic development, coupled with increasing air travel demand, necessitates the modernization of air traffic control systems. Countries like China and India are investing heavily in expanding and upgrading airport infrastructure, including the construction of new airports and the implementation of advanced ATM technologies.

The report focuses on growth prospects, restraints, and trends of the air traffic management software market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the air traffic management software market.

Competitive Analysis

The report analyses the profiles of key players operating in the air traffic management software market report such as Raytheon Systems Limited, IBM, Indra Sistemas, S.A., NAVBLUE, Amadeus IT Group SA, SITA, L3Harris Technologies, Inc., SAAB AB, Leonardo S.p.A., and Honeywell International Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the air traffic management software market.

Rise in Global Air Passenger and Cargo Traffic.

The rise in global air passenger and cargo traffic is significantly driving the demand for Air Traffic Management (ATM) software. For instance, in April 2024, The Cargo Airline Association (CAA) has expressed strong support for the House Committee on Transportation and Infrastructure’s reconciliation provision, which aims to make a landmark investment in modernizing America’s air traffic control infrastructure, technology, and workforce, to enhance air traffic management software and improve the efficiency of air cargo operations. Moreover, as the number of air passengers and the volume of cargo continue to increase, airspace congestion becomes a major challenge. Efficient air traffic management is essential to ensure safe and timely flights, as well as to optimize airspace usage. To handle the growing traffic, airports and air navigation service providers are implementing advanced ATM software solutions to improve operational efficiency, reduce delays, and enhance safety protocols. These software systems provide capabilities such as real-time traffic monitoring, route optimization, and better coordination between various air traffic controllers. In addition, the demand for cargo air transportation has spurred the need for specialized software that can handle freight logistics, routing, and tracking. This trend is expected to continue as global travel and trade volumes rise, further accelerating the adoption of ATM software solutions. therefore, rise in global air passenger and cargo traffic is increase the demand for the air traffic management software market.

Modernization Initiatives for Aging Air Traffic Control Infrastructure.

Modernization initiatives for aging air traffic control infrastructure are significantly increasing the demand for Air Traffic Management (ATM) software. For instance, in November 2024, Saab, Thales, and ST Engineering have signed a Memorandum of Understanding (MoU) to collaborate on the long-term innovation and modernization of Singapore's Air Traffic Management (ATM) infrastructure, aiming to enhance the efficiency and safety of air traffic operations in the region. Furthermore, many countries, particularly in North America and Europe, are facing the challenge of outdated air traffic systems that struggle to manage growing air traffic volumes. These legacy systems require advanced technologies to optimize airspace, improve safety, and ensure efficient operations. Moreover, modern ATM software solutions are designed to provide real-time data, enhance decision-making capabilities, and automate various tasks within air traffic control. This software can integrate multiple functionalities, including air traffic flow management, communication systems, surveillance, and navigation, to streamline air traffic operations. Furthermore, the push for more sustainable aviation operations and the need to reduce delays and environmental impact have made the modernization of air traffic control systems a top priority. As governments and aviation authorities invest in upgrading infrastructure, the demand for advanced ATM software solutions is poised to grow rapidly in the coming years. Therefore, modernization intiatives for aling air traffic control infrastrucutre is increase the demand for the air traffic management software market.

Integration of AI and Data Analytics in ATM Systems.

The integration of AI and data analytics in air traffic management (ATM) systems is driving significant growth in the ATM software market. These advanced technologies enable real-time processing of vast amounts of data, allowing air traffic controllers to make more informed decisions quickly and accurately. For instance, in December 2024, GMR Airports has launched India’s first Airport Predictive Operations Centre (APOC) and AI-powered digital platform at Hyderabad’s Rajiv Gandhi International Airport, with plans to expand to Delhi. The APOC integrates data from key stakeholders—including airlines, ground handling teams, and air traffic control—to proactively identify and address potential operational bottlenecks. This initiative aims to enhance situational awareness, improve flight punctuality, and optimize resource allocation, aligning with broader trends in air traffic management software focused on predictive analytics and collaborative decision-making for efficient airport operations. Moreover, as AI-powered systems enhance predictive capabilities, such as forecasting traffic congestion, optimizing flight paths, and minimizing delays. Data analytics allows for improved resource allocation, better management of airspace, and the identification of potential safety risks before they become critical issues. Furthermore, AI can assist in automating routine tasks, reducing the workload on air traffic controllers and increasing operational efficiency. The ability to harness big data helps manage growing air traffic volumes and respond to unpredictable scenarios like weather changes or emergencies. As air traffic continues to grow globally, the demand for ATM software solutions that integrate AI and data analytics is expected to rise, offering smarter, more sustainable, and safer air traffic control systems. Therefore, integration of AI and data analytics in ATM System is driving the demand for the air traffic management software market.

High Initial Investment and Maintenance Costs.

High initial investment and ongoing maintenance costs are significantly hampering the demand for air traffic management (ATM) software. Developing and deploying advanced ATM systems requires substantial capital expenditure, including the cost of sophisticated hardware, software integration, skilled personnel, and infrastructure upgrades. These high upfront costs can deter small- and medium-sized airports and aviation authorities from adopting modern ATM solutions, especially in developing economies. In addition, maintenance and periodic system upgrades add to the total cost of ownership, making it financially burdensome for many stakeholders. The requirement for continuous technical support, cybersecurity measures, and compliance with regulatory standards further escalates operational expenses. Moreover, the complexity of integration with legacy systems in older air traffic infrastructure creates additional challenges and expenses. As a result, despite the potential benefits of ATM software in improving safety, efficiency, and capacity, cost-related barriers remain a critical restraint for widespread adoption, particularly in cost-sensitive regions and constrained public sector budgets. Therefore, high intial investment and maintenances costs is hampering the demand for the air traffic management software market.

Regulatory and Standardization Challenges Across Regions.

Regulatory and standardization challenges across regions are hampering the demand for Air Traffic Management (ATM) software. The global aviation industry is governed by a complex framework of national and international regulations, which vary significantly from one country or region to another. This lack of uniformity makes it difficult for software providers to develop universally compatible ATM systems, leading to increased customization costs and prolonged deployment times. Discrepancies in certification requirements, safety standards, data sharing protocols, and technology adoption timelines further hinder the seamless integration of ATM software across borders. In addition, coordinating between multiple aviation authorities, such as the FAA in the U.S. and EASA in Europe, can lead to bureaucratic delays, adding friction to international projects. These regulatory inconsistencies also complicate cross-border operations and limit scalability for service providers. As a result, the lack of harmonized standards acts as a major barrier to innovation, adoption, and global growth of ATM software solutions. Therefore, regulatory and standardization challenges across region is hampering the demand for the air traffic management software market.

Expansion of Air Traffic Management in Emerging Economies.

The expansion of air traffic management in emerging economies presents a lucrative opportunity for the air traffic management (ATM) software market. Rapid economic growth, increasing urbanization, and rising disposable incomes in countries across Asia-Pacific, Latin America, the Middle East, and Africa have led to a significant increase in air travel demand. For instance, in June 2024, U.S. and European partners have announced plans to develop a dedicated satellite constellation aimed at enhancing global air traffic surveillance. The objective is to provide continuous, real-time tracking of aircraft worldwide, improving flight safety, optimizing airspace management, and supporting the evolution of next-generation Air Traffic Management Software systems. Furthermore, governments in these regions are investing heavily in aviation infrastructure, including the construction of new airports and the modernization of existing ones, to accommodate growing passenger and cargo traffic. As airspace becomes more congested, there is an urgent need for advanced ATM software to enhance flight safety, reduce delays, and optimize route planning. Moreover, the implementation of digital technologies and government-led initiatives to adopt smart airport solutions are creating new opportunities for ATM software providers. These markets offer high growth potential due to underdeveloped aviation infrastructure and increasing focus on efficient airspace management, positioning them as key targets for global ATM system vendors. Therefore, expansion of air traffic managmenet in emerging econimies is lucurative opportunity for the air traffic management software market.

Satellite-based Navigation and Surveillance Advancements.

Satellite-based navigation and surveillance advancements represent a lucrative opportunity for the air traffic management (ATM) software market. As the aviation industry moves towards more efficient and precise methods of air traffic control, technologies like Global Navigation Satellite Systems (GNSS), Automatic Dependent Surveillance–Broadcast (ADS–B), and satellite-based augmentation systems (SBAS) are gaining traction. These technologies enable real-time aircraft tracking, improved navigation accuracy, and greater airspace utilization, especially in remote or oceanic regions where traditional radar coverage is limited or unavailable. For instance, in February 2025, Thales partnered with Spire Global, and the European Satellite Services Provider (ESSP) to develop a space-based air traffic surveillance service utilizing a constellation of over 100 satellites. The aims of this partnership are to enhance global air traffic management by providing real-time, high-precision tracking of aircraft through Automatic Dependent Surveillance-Broadcast (ADS-B) signals. Moreover, as global air traffic continues to rise, especially in regions with limited ground-based infrastructure, satellite-based systems offer a cost-effective and scalable solution for enhancing airspace safety and efficiency. ATM software must adapt and integrate these advanced satellite capabilities to support seamless communication, navigation, and surveillance across national boundaries. This evolution not only boosts airspace capacity but also supports global harmonization efforts, making it an attractive growth avenue for ATM software developers and vendors.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the air traffic management software market analysis from 2025 to 2034 to identify the prevailing Air traffic management software market forecast.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the air traffic management software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global air traffic management software market trends, key players, market segments, application areas, and market growth strategies.

Air Traffic Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 12.6 billion |

| Growth Rate | CAGR of 10.7% |

| Forecast period | 2024 - 2034 |

| Report Pages | 349 |

| By Application |

|

| By End-User |

|

| By Deployment Mode |

|

| By Software Type |

|

| By Region |

|

| Key Market Players | Honeywell International Inc., Amadeus IT Group SA, SAAB AB, L3Harris Technologies, Inc., IBM, Leonardo S.p.A., Raytheon Systems Limited, Indra Sistemas, S.A., SITA, NAVBLUE |

Increased automation and AI/ML integration for predictive routing, capacity optimization, and controller workload reduction

Civil Aviation is the leading application of Air Traffic Management Software Market

North America is the largest regional market for Air Traffic Management Software.

$4,683.6 million is the estimated industry size of Air Traffic Management Software

Raytheon Systems Limited, IBM, Indra Sistemas, S.A., NAVBLUE, Amadeus IT Group SA, SITA, L3Harris Technologies, Inc., SAAB AB, Leonardo S.p.A., and Honeywell International Inc.

Loading Table Of Content...

Loading Research Methodology...