Aircraft Auxiliary Power Unit Market Research, 2033

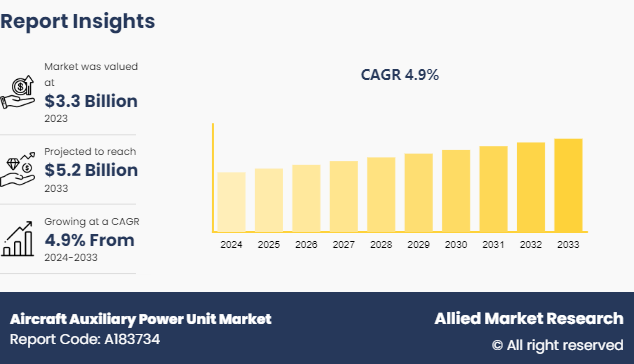

The global aircraft auxiliary power unit market was valued at $3.3 billion in 2023, and is projected to reach $5.2 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

Market Introduction and Definition

Aircraft Auxiliary Power Units (APUs) are tiny jet engines that are usually found in an aircraft's tail section. They are used to supply electrical and pneumatic power to the aircraft while the main engines are not operating. The aircraft APU market may occasionally be found in the wheel well or in an engine nacelle.

The aircraft APU market allows the aircraft to operate autonomously from any ground support systems such as?ground power unit (GPU) , an external air-conditioning unit or a high pressure air start cart. The APU is typically used to power the aircraft's electrical systems, and provide air conditioning and pressurization for the aircraft when it is on the ground. Furthermore, an aircraft auxiliary power unit industry is a self-contained power source located within an aircraft that provides energy for various aircraft systems when the main engines are not running. The aircraft APU market is typically a small gas turbine engine that generates electrical power, hydraulic pressure, and pneumatic pressure.

Key Takeaways

The aircraft auxiliary power unit market trends study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major aircraft auxiliary power units industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In January 2023, Lufthansa Technik AG, and Air France S.A. inked a long-term deal for the technical support of the APUs for the airline's entire fleet of Airbus A350 aircraft. Lufthansa Technik will provide substantial MRO (maintenance, repair, and overhaul) services for the Honeywell HGT1700 APUs at its Hamburg facility until 2029.

In May 2023, Honeywell and MY Airline signed their first contract for APU maintenance on the airline's fleet of Airbus A320 aircraft. As per the terms of the contract, Honeywell would provide APU maintenance services to MY Airline for its 131-9A APUs, to ensure sustained operational uptime, flight safety, and reliability for its fleet of 22 aircraft.

Key Market Dynamics

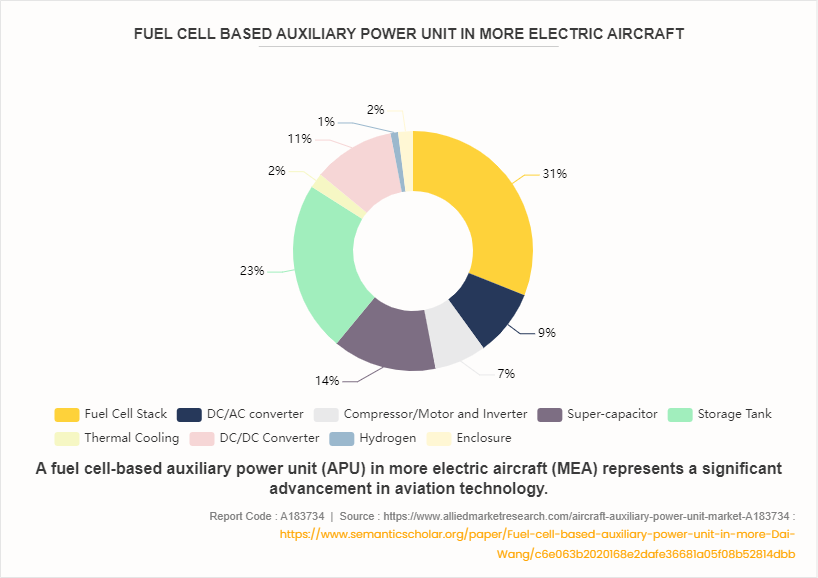

The rise in demand for motor electric aircraft is a significant driver of the aircraft auxiliary power unit market size. The aviation industry is increasingly moving towards more electric aircraft designs to reduce fuel consumption, emissions, and maintenance costs. MEAs require efficient and reliable APUs to power electrical systems, creating a demand driver for APU manufacturers. Furthermore, rise in commercial aircraft fleet, and advancement in APU technology have driven the demand for the aircraft auxiliary power units development cost has hampered the growth of the aircraft auxiliary power unit market size, developing an aircraft auxiliary power units for aviation use involves significant time, resources, and investment. High development costs and regulatory hurdles can act as restraints for aircraft auxiliary power unit market growth, particularly smaller companies or new entrants to the market. Moreover, stringent environmental regulation and market consolidation and competition are major factors that hamper the growth of the aircraft auxiliary power unit market share. On the contrary, the rise in demand of aircraft auxiliary power unit industry and regional aircraft, particularly in emerging markets and remote regions, presents opportunities for aircraft auxiliary power unit market analysis. These aircraft often require lightweight, compact APUs that offer reliable auxiliary power for on-board systems.

Market Segmentation

The aircraft auxiliary power units market is segmented into type, aircraft type, product, and region. On the basis of type, the market is segmented into commercial aviation, military aviation, and general aviation. As per aircraft type, the market is segregated into fixed wing and rotary wing. On the basis of product, the market is segmented into battery power, electric ground power, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America is home to several major aircraft manufacturers, including Boeing and Airbus (with significant operations in the region) , as well as Bombardier, Gulfstream, and Textron Aviation, among others. These companies produce a large number of commercial, military, and business aircraft, all of which require APUs. North America boasts a robust aerospace industry with a well-established supply chain, advanced manufacturing capabilities, and extensive research and development facilities. The region's aerospace sector drives innovation and technological advancements in APU design, production, and integration. North America has one of the largest commercial aviation markets globally, with numerous airlines operating a diverse fleet of passenger and cargo aircraft. Commercial airlines in North America rely heavily on APUs for ground operations, cabin amenities, and in-flight systems, contributing to the region's high APU demand.

The U.S., in particular, allocates significant resources to military aviation, including the development, procurement, and maintenance of military aircraft. APUs are essential components of military aircraft for ground support, auxiliary power, and mission-critical operations, driving demand in the region. North America has a thriving business aviation sector, with a large number of private and corporate aircraft owners, charter operators, and fractional ownership programs. Business jets and other private aircraft utilize APUs for ground support, avionics power, and cabin amenities, further boosting APU demand in the region.

In February 2024, China Southern Airlines and Lufthansa Technik have inked an exclusive eight-year contract, focusing on technical support for the Aircraft Auxiliary Power Units (APUs) within the Chinese carrier's A350 fleet, totaling 20 aircraft. Under this long-term agreement, Lufthansa Technik will deliver comprehensive maintenance, repair, and overhaul (MRO) services for the Honeywell HGT1700 in the company's dedicated APU workshops situated in Hamburg, Germany.

Honeywell's renowned 131 Series of aircraft auxiliary power units (APUs) has achieved remarkable success, accumulating over 100 million hours of in-service use. Originally designed for the Boeing MD-90, the 131-9D quickly garnered popularity and became standard equipment for the Boeing 737NG family of aircraft. Additionally, it was selected by airlines for the Airbus A320 family and chosen as the APU for Airbus A220 aircraft, further solidifying its position as a trusted and widely adopted auxiliary power unit in the aviation industry.

January 2021:Sichuan Airlines has chosen Honeywell's 131-9A aircraft auxiliary power units (APUs) for its A320 fleet, marking a significant five-year agreement. Under this deal, Honeywell will supply the 131-9A APU for Sichuan Airlines’ upcoming 93 new A320 aircraft, set to be operational by 2025.

In June 2023, PBS, a renowned aerospace manufacturer, unveiled a new auxiliary power unit (APU) at the Paris Air Show. The Paris Air Show is a prestigious event in the aviation industry, serving as a platform for companies to showcase their latest innovations and technologies.

Competitive Landscape

The report analyzes the profiles of key players operating in the aircraft auxiliary power unit market such as AEGIS Power Systems Inc., Eaton Corporation plc, Honeywell International Inc., JSC NPP Aerosila, Motor Sich JSC, PBS Group, a. s., Pratt & Whitney (Raytheon Technologies Corporation) , Rolls-Royce plc, Safran, and Technodinamika (Rostec) . These players have adopted various strategies to increase their market penetration and strengthen their position in the aircraft auxiliary power units market.

Industry Trends

In May 2023, Honeywell has secured a contract from Malaysian startup MY Airline to support aircraft auxiliary power units (APUs) installed on the carrier's Airbus A320s. The agreement covers 131-9A APUs for 22 jets.

In July 2022, Whitney & Pratt Canada signed an eight-year maintenance and fleet improvement deal with Turkish Airlines. The deal includes the 82 APS3200 aircraft auxiliary power units (APUs) on the airline's fleet of Airbus A320 planes.

In January 2023, Lufthansa Technik AG, and Air France S.A. inked a long-term deal for the technical support of the APUs for the airline's entire fleet of Airbus A350 aircraft. Lufthansa Technik will provide substantial MRO (maintenance, repair, and overhaul) services for the Honeywell HGT1700 APUs at its Hamburg facility until 2029.

Parent Market Overview of Global Aircraft Auxiliary Power Units Market

Commercial aviation includes airlines, aircraft manufacturers, leasing companies, and airport operators involved in passenger and cargo transportation. This sector drives significant demand for APUs, as commercial aircraft require auxiliary power for ground operations, in-flight systems, and cabin services. Military aviation comprises defense organizations, government agencies, and aerospace contractors engaged in the development, production, and operation of military aircraft. Military aircraft often utilize APUs for auxiliary power during ground operations, mission support, and remote deployments. Business aviation encompasses private and corporate aircraft operators, including business jet owners, charter companies, and fractional ownership programs. Business jets and other private aircraft rely on APUs for auxiliary power during ground operations, avionics support, and cabin amenities.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the segments, current trends, estimations, and dynamics of the aircraft auxiliary power units market 2022 to 2032 to identify the prevailing aircraft auxiliary power unit market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the aircraft auxiliary power units market segmentation assists to determine the prevailing aircraft auxiliary power unit market forecast.

Major countries in each region are mapped according to their revenue contribution to the global aircraft auxiliary power units market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global aircraft auxiliary power units market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Auxiliary Power Unit Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.2 Billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 488 |

| By Type |

|

| By Aircraft Type |

|

| By Product |

|

| By Region |

|

| Key Market Players | Rolls-Royce plc., Technodinamika (Rostec), Motor Sich JSC, PBS Group, a. s., Safran, AEGIS Power Systems Inc., Pratt & Whitney (Raytheon Technologies Corporation), Eaton Corporation plc, JSC NPP Aerosila, Honeywell International Inc. |

Loading Table Of Content...