Aircraft Brake System Market Research, 2032

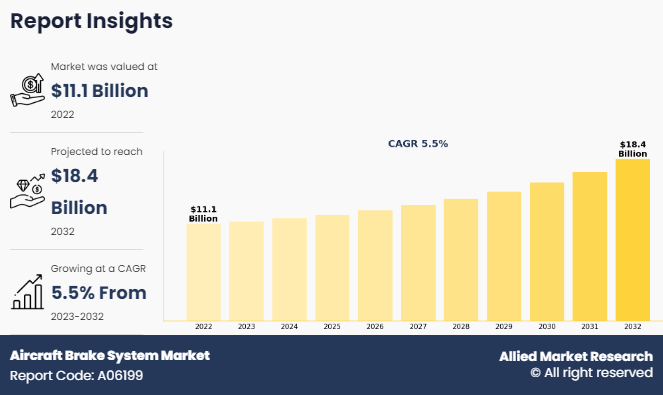

The global aircraft brake system market was valued at $11.1 billion in 2022, and is projected to reach $18.4 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032.

Aircraft brake system is designed to withstand high speed of aircraft for small duration, that is, during take-off and landing. Moreover, brakes are used to stop aircraft during rejected take-off events, in which an attempted take-off is cancelled as the airplane is rolling down the runway before it lifts off from the ground due to engine failure, tire blowout, other system failure, or direction from air traffic control. Aircraft brakes further prevent motion of the aircraft when it is parked, limit its speed during taxing, and can even help steer the aircraft on the ground by applying different levels of brake force to the left- and right-side brakes.

Key Takeaways

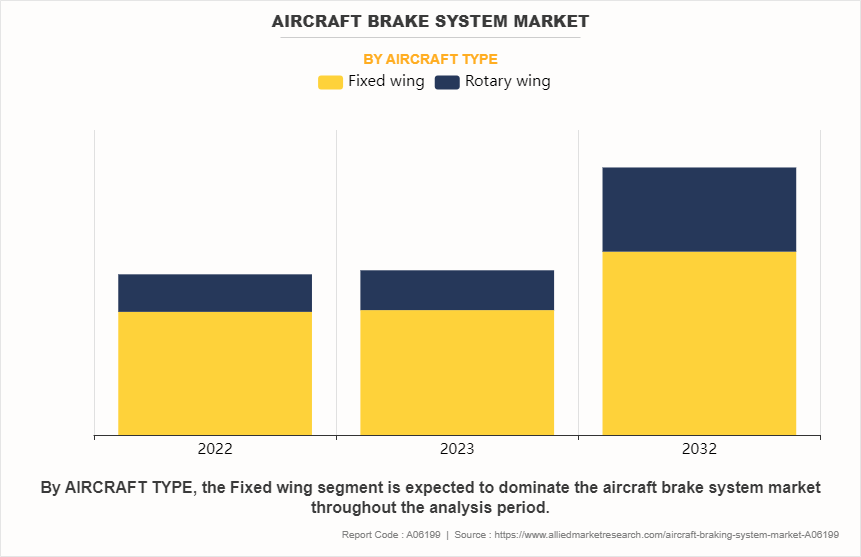

- On the basis of aircraft type, the fixed wing segment held the largest share in the pitot tubes market in 2022.

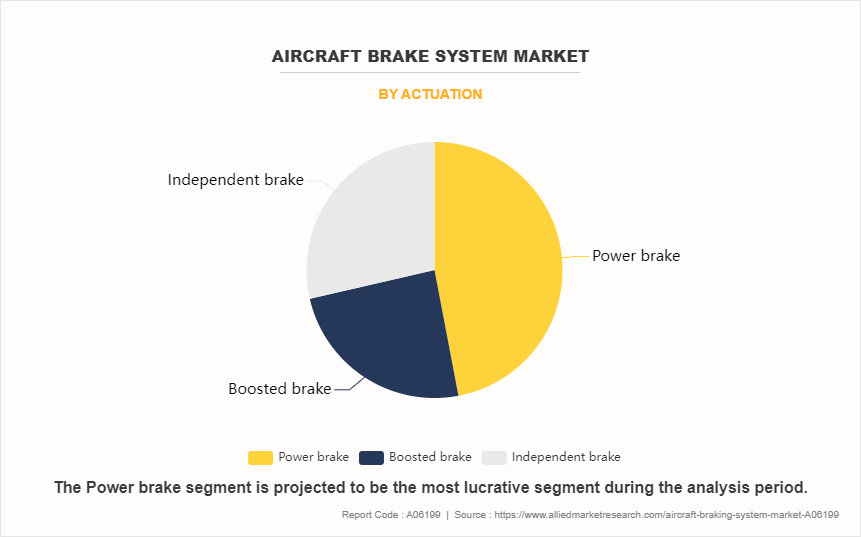

- By actuation, the power brake segment was the major shareholder in 2022.

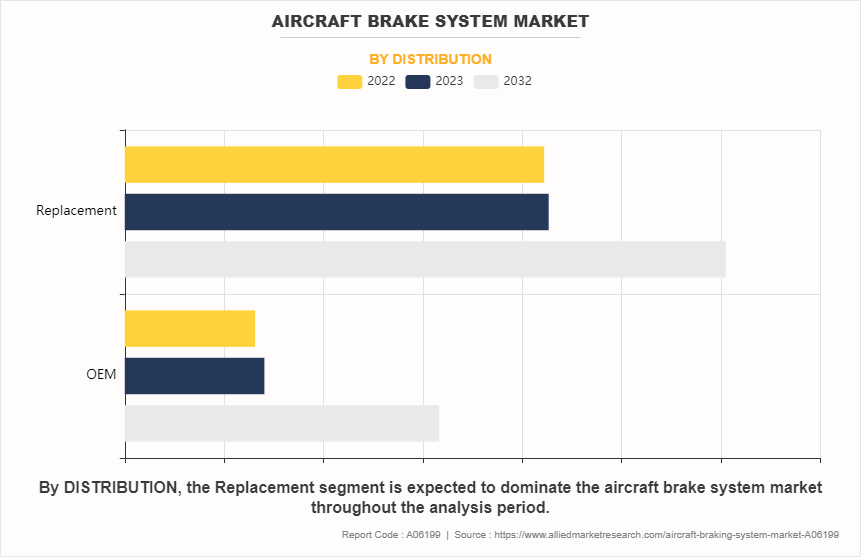

- By distribution, the OEM dominated the market, in terms of share, in 2022.

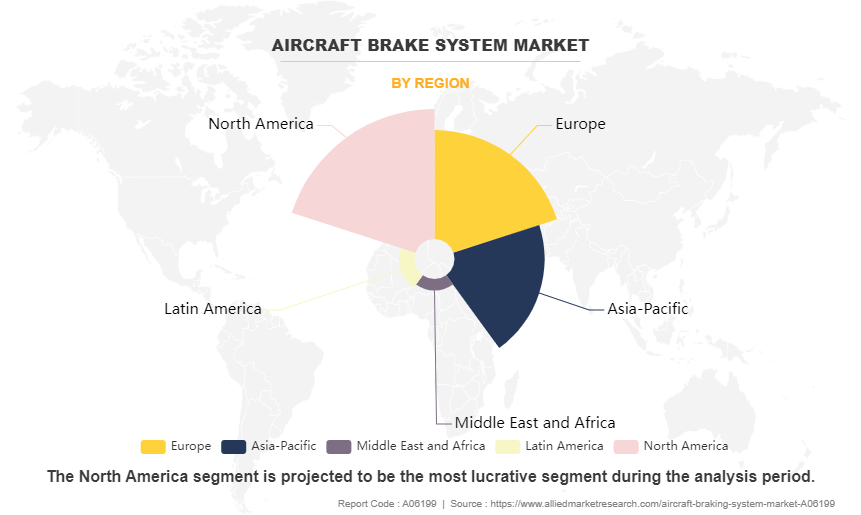

- Region wise, North America held the largest market share in 2022.

The aircraft brake system market refers to the sector of the aerospace industry that focuses on the design, manufacturing, distribution, and maintenance of brake systems for various types of aircraft. These brake systems are essential components that enable aircraft to decelerate and stop safely during landing, taxiing, and other ground operations. For instance, in August 2022, RUAG Australia signed a contract with Honeywell International Inc. to become an authorized service center for the F-35 joint strike fighter wheels and brakes program in Asia-Pacific.

For instance, in April 2022, the largest cargo aircraft lessor globally, Air Transport Service Group Inc. (ATSG) planned to upgrade more than 30 Boeing 767Fs in its fleet. This will allow the corporation to use a uniform wheel and brake design across its entire fleet. Safran’s provision of conversion kits and maintenance services for the upgraded Boeing 767Fs directly contributes to the enhancement of operating margins, fuel conservation, and expense savings for ATSG and its clients. Safran's carbon brakes offer a competitive edge in weight, strength, and reliability over steel brakes. By utilizing these advanced carbon brakes, ATSG can benefit from reduced maintenance costs, improved fuel efficiency due to lighter weight, and enhanced reliability, ultimately leading to improved operating margins and expense savings. Therefore, Safran's involvement is crucial in achieving the stated objectives of ATSG and its clients.

Increase in air passenger traffic across the globe is a significant driver of the global aircraft brake system market size. With rising number of passengers traveling by air, airlines are expanding their fleets to accommodate the growing demand. This translates to a higher requirement for aircraft brake systems as more airplanes are being manufactured and put into service. Furthermore, rise in operations in the commercial aviation has driven the demand for aircraft brake systems. However, the stringent regulatory environment pertaining to aircraft safety has hampered the growth of the aircraft brake system market, as stringent safety regulations necessitate that aircraft brake systems meet certain standards and undergo rigorous testing and certification processes. Moreover, weight and space constraints are major factors that hamper the growth of the aircraft brake system market size. On the contrary, integration of advanced technologies in aircraft brake systems is expected to provide lucrative opportunities for the expansion of the global aircraft brake system market during the forecast period. Advanced technologies such as carbon brakes, electromechanical brake systems, and brake-by-wire systems offer improved performance over traditional brake systems. They provide better control, shorter stopping distances, and increased reliability, which are highly desirable features for aircraft operators.

Segment Review

The global aircraft brake system market is segmented on the basis of aircraft type, actuation, distribution, and region. On the basis of aircraft type, the market is bifurcated into solution fixed wing and rotary wing. By actuation, it is divided into power brake, boosted brake, and independent brake. Depending on distribution channel, it is classified into OEM and replacement. Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Aircraft Type

On the basis of aircraft type, the fixed wing segment attained the highest market share in 2022 and is expected to dominated the market during the forecast period. This is attributed to the fact that the fixed wing aircraft, particularly commercial airliners, make up the bulk of the aviation industry. These aircraft require highly reliable and efficient brake systems due to their frequent takeoff and landing cycles. The absolute volume of commercial aircraft in operation contributes significantly to the dominance of the fixed wing segment. Furthermore, implementation of stringent safety restrictions on fixed wing aircraft by international aviation authority contributes toward the growth of the segment. According to such rules, brake systems must be certified to meet certain performance requirements. The regulation applies to companies that make fixed wing aircraft brake systems, guaranteeing a high caliber and dependability of their services.

By Actuation

On the basis of actuation, the power brake segment acquired the highest market share in 2022 and is projected to grow at the fastest rate during the forecast period. This be attributed to the fact that the power brakes, also known as hydraulic brakes, have been a standard technology in aircraft brake systems for decades. Their widespread adoption across various types of aircraft, including commercial airliners, military aircraft, and general aviation, contributes to their dominant market share. Meanwhile, the power brake segment is. In addition, operators may choose more traditional brake systems, such as power brakes, in the event that a significant number of older aircraft suddenly need to be replaced. This is because such systems have a history of dependability and are less expensive than modern alternatives. Thus, the share of power brakes is expected to increase rapidly in the coming years as a result of this widespread replacement.

By Distribution

By distribution channel, the original equipment manufacturing (OEM) segment attained the highest market share in 2022. This is attributed to the fact that many commercial aircraft in service are aging and require regular maintenance, repair, and overhaul (MRO) activities. As aircraft age, their brake systems also wear out and require replacement to ensure continued safe operation. The need for replacement brake systems is particularly significant for older aircraft models, which constitute a substantial portion of the global fleet. Meanwhile, OEMs invest heavily in R&D to innovate and improve their brake system offerings. By staying at the forefront of technological advancements, OEMs can deliver cutting-edge solutions that meet the evolving needs of aircraft manufacturers and operators, thereby capturing market share from competitors.

By Region

Region wise, North America attained the highest market share in 2022 and emerged as the leading region in the aircraft brake system market. This is attributed to the fact that the North American aerospace industries are leading the way in technological innovation for airplane systems, particularly brake systems. To increase the effectiveness, dependability, and safety of brake systems, they make significant investments in R&D, which drives the growth of the market in the region.

However, Asia-Pacific is projected to grow at the fastest rate during the forecast period. This growth is attributed to the fact that the aviation industry is growing significantly in Asia-Pacific's emerging markets. There is a sudden increase in demand for aircraft brake systems as a result of airlines extending their fleets to accommodate the rising number of passengers.

Competitive Analysis

The report analyzes the profiles of key players operating in the aircraft brake system market such as AAR Corp, Beringer Aero, Collins Aerospace, Crane Co., Honeywell International Inc., Lufthansa Technik AG, Meggitt PLC, Parker-Hannifin Corporation, Parker Hannifin Corp, Safran, and The Carlyle Johnson Machine Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the aircraft brake system market.

Increase in Air Passenger Traffic Across the Globe

The growth of the global aircraft brake system market is majorly driven by increase in air passenger traffic. According to the International Civil Aviation Organization’s (ICAO) yearly worldwide statistics, the total number of commuters carried on scheduled flights reached 4.38 billion in 2019, which was 3.65% higher than the previous year. For instance, in May 2021, the International Air Transport Association (IATA) stated that the global air passenger traffic is anticipated to recover to almost 88% of pre-COVID levels during 2022, and is projected to outdo this level by 2023. This signifies a robust demand for air travel across the globe.

With the rising number of passengers traveling by air, airlines are expanding their fleets to accommodate the growing demand. This translates to a higher requirement for aircraft brake systems as more airplanes are being manufactured and put into service. Furthermore, the aviation industry is highly regulated, with stringent safety standards. Brake systems are crucial components for ensuring safe landings and takeoffs. As air traffic increases, there is a greater emphasis on maintaining and upgrading brake systems to meet safety regulations. Therefore, increase in air passenger traffic across the globe drives the demand for aircraft brake system market.

Rise in Operations in Commercial Aviation

The commercial aviation industry consists of two segments, passenger aircraft and cargo aircraft. In recent years, both segments have performed well and has witnessed rapid rise in operations, which boosted the growth of the global commercial aircraft industry. With globally rising air passenger traffic, the industry has witnessed significant growth. However, the unprecedented occurrence of COVID-19 pandemic has affected the industry in terms of revenue growth.

As commercial airlines expand their fleets to meet the increasing demand for air travel, there is a proportional increase in the demand for aircraft brake systems. Each new aircraft added to the fleet requires brake systems to ensure safe landings, takeoffs, and ground operations. Furthermore, with rising in operations, commercial aircraft are flying more frequently, leading to higher usage of brake systems. This increased operational tempo necessitates robust and reliable brake systems that can withstand frequent use while maintaining safety and performance standards. Therefore, rise in operations in the commercial aviation is driving the demand for aircraft brake system market share.

Technological Improvement in Brake Components

Technological advancements lead to improved performance in brake systems. This includes shorter stopping distances, better control during landing & taxiing, and increased reliability. Aircraft operators seek brake systems that can provide superior performance, particularly in critical situations, driving the demand for advanced technologies.

Furthermore, advanced materials and design techniques enable the development of lighter brake components without sacrificing performance. Lighter components contribute to overall weight reduction in aircraft, leading to fuel savings and increased operational efficiency. As airlines strive to optimize fuel consumption and reduce operating costs, they are inclined to adopt brake systems with advanced lightweight components. Therefore, technological improvement in brake components aircraft brake system systems is hampering the growth of the aircraft brake system market growth.

Stringent Regulatory Environment Pertaining to Aircraft Safety

Stringent regulations have been implemented pertaining to passenger and aircraft safety. As a result, the aviation industry has regulatory obligations and continues to modify them to attain the optimum safety standard for the aviation industry's safety and improvement. Thus, aircraft baking system makers have to design new products to meet these requirements. One of these regulatory criteria is related with the replacement of steel brakes with carbon brakes; as a result, the maintenance services provided by the key actors in the aircraft brake system operate as a vital service to comply with the industry's safety and regulatory standards.

One of the major regulations by the Federal Aviation Administration that gives mandates regarding the operation of aircraft brakes under section 25.375 of the aviation regulations involves various tests and certifications that major component manufacturers of brake systems have to follow. According to the regulation, each assembly consisting of a wheel(s) and brake(s) must be approved.

Brake system, associated systems, and components must be designed and constructed in such a way that if any electrical, pneumatic, hydraulic, or mechanical connecting or transmitting element fails, or if any single source of hydraulic or other brake operating energy supply is lost, it is possible to bring the airplane to rest with a braked roll stopping distance of not more than two times obtained in determining the landing distance as prescribed under the standards as mentioned in the regulation. The regulation consists of various standards and stringent requirements to be met by aircraft brake manufacturers. Such regulations are expected to limit the growth of the aircraft brake system market during the forecast period. Therefore, stringent regulatory environment pertaining to aircraft safety is hampering the growth of the aircraft brake system industry.

Weight and Space Constraints

Weight is a critical consideration in aircraft design as it directly impacts performance, including fuel efficiency, range, and payload capacity. Brake systems must be designed to meet performance requirements while minimizing weight to ensure optimal aircraft performance. Heavy brake systems can negatively affect aircraft performance, leading to higher operating costs and reduced competitiveness for airlines.

In addition, every additional pound of weight added to an aircraft reduces its payload capacity or range. Aircraft manufacturers and operators strive to minimize weight wherever possible to maximize payload capacity and range. This constraint can limit the inclusion of brake system components or necessitate the use of lightweight materials to meet weight targets. Therefore, weight and space constraints is hampering the growth of the aircraft brake system industry.

Integration of Advanced Technologies in Aircraft Brake Systems

Increase in air passenger traffic in recent years has propelled the demand for aircraft worldwide. In addition, airlines all over the world are ordering new planes equipped with cutting-edge technology. The aircraft industry is developing airplanes with advanced systems and components to suit the demand from airlines. With rise in demand for airplanes, the demand for aircraft brake systems will increase correspondingly.

As a result of surge in demand for technological upgrades in existing airplane brake systems, the aircraft brake system market is expected to grow significantly over the years. Furthermore, as brakes have to operate under harsh settings, the risks of brake material degradation due to corrosion increases, which presents prospects for the aftermarket companies. Another important factor driving the market for aircraft brake systems is the R&D for making lighter aircraft brake system market forecast.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft brake system market analysis from 2022 to 2032 to identify the prevailing aircraft brake system market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aircraft brake system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft brake system market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Brake System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 18.4 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 485 |

| By AIRCRAFT TYPE |

|

| By ACTUATION |

|

| By DISTRIBUTION |

|

| By Region |

|

| Key Market Players | Crane Co., The Carlyle Johnson Machine Company, LLC., Honeywell International Inc., Lufthansa Technik AG, Parker-Hannifin Corporation, Safran, Beringer Aero, AAR Corporation, Meggitt PLC, Collins Aerospace |

Upcoming trends in the aircraft brake system market include electrification, advanced materials, predictive maintenance, integration with autonomous and electric aircraft, enhanced safety features, regulatory compliance, supply chain resilience, and sustainable aviation initiatives.

Power Brake is the leading application of Aircraft Brake System Market

North America is the largest regional market for Aircraft Brake System

$18420.25 million is the estimated industry size of Aircraft Brake System

AAR Corp, Beringer Aero, Collins Aerospace, Crane Co., Honeywell International Inc., Lufthansa Technik AG, Meggitt PLC, Parker-Hannifin Corporation, Parker Hannifin Corp, Safran, and The Carlyle Johnson Machine Company.

Loading Table Of Content...

Loading Research Methodology...