Aircraft Cabin Lighting Market Research, 2033

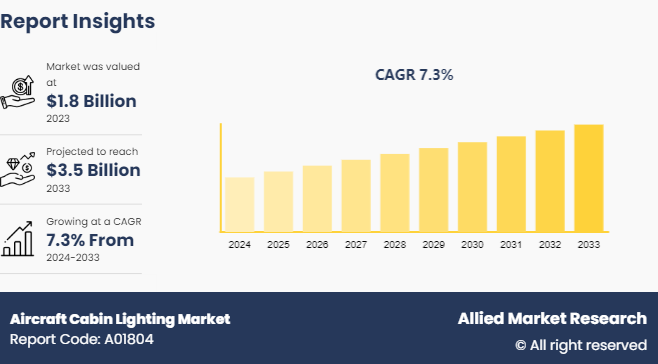

The global Aircraft Cabin Lighting Market Size was valued at $1.8 billion in 2023, and is projected to reach $3.5 billion by 2033, growing at a CAGR of 7.3% from 2024 to 2033. Aircraft cabin lighting refers to the system of lights installed within the passenger compartment of an aircraft. The lighting system is applicable for different purposes such as illumination, safety, comfort, ambiance, and operational efficiency. The aircraft cabin light market encompasses the production, sale, and technological development of lighting systems used within aircraft cabins.

Aircraft cabin light provides the necessary light for passengers to move safely within the cabin, read, eat, and perform other activities during the flight. It also assists in guiding passengers to exits during emergencies through emergency lighting systems. In addition, it enhances passenger comfort by creating a pleasant atmosphere. Mood lighting systems can simulate different times of the day to help reduce the effects of jet lag. Moreover, it assists flight attendants in performing their duties efficiently, such as serving meals and conducting safety demonstrations.

Key Takeaways

The aircraft cabin lighting market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major aircraft cabin lighting vehicle ancillary industry participants along with authentic Aircraft Cabin Lighting Industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Strategies and Developments

In June 2023, Astronics Corporation launched the EmPower UltraLite G2 Power System solution. Utilizing a distributed zonal design, the UltraLite G2 system makes use of an 800W power supply that is more than 93% efficient as well as system intelligence at the seat. This strategic product launch will enhance the market position of Astronics Corporation in the global aircraft cabin lighting market.

In August 2022, Heads Up Technologies, a leading manufacturer of lighting systems, cabin management systems, and flight deck safety products, acquired STG Aerospace, a leading manufacturer of proprietary aircraft cabin lighting products based in Cwmbran, UK, Miami, and Florida. This strategic acquisition will strengthen the market position of Heads-up Technologies in the global aircraft cabin lighting market.

In July 2020, JetBlue Airways launched Honeywell's new UV Cabin System for trial use in its airline. When administered correctly and at recommended levels, JetBlue will be evaluating the Honeywell UV Cabin System's role in its operations while carrying out other cleaning procedures. The system can go through an airplane cabin in less than ten minutes and helps reduce viruses and bacteria. This strategic collaboration will strengthen the market position of Honeywell International in the global aircraft cabin lighting market.

In September 2021, Collins Aerospace, a Raytheon technologies business launched a Lilac-UV, an ultraviolet (UV) lighting solution to sanitize aircraft interiors. Lilac-UV emits a slight violet light that disinfects surfaces in seconds to minutes, depending on lamp configuration and specific pathogen.

On 14th July 2021, Diehl and HAECO formed a joint alliance to deliver a wide range of aircraft cabin projects including complex, bespoke installations, as an integrated supplier. In addition, the duo offers aircraft interior components including sidewalls, stowages, lighting, galleys, lavatories, seating, reconfiguration engineering, certification, and installation.

In June 2023, STG Aerospace launched a flexible cabin lighting solution called “The Curve”. The solution consists of a four-inch section of controllable dynamic lighting and a tight bend radius at 30 millimeters convex and 50 millimeters concave.

Key Market Dynamics

Growing air passenger traffic and increasing advancements in technology are two significant drivers driving the growth of the global aircraft cabin lighting market. High investment costs and technology maintenance issues are two main factors acting as restraints for global aircraft cabin lighting market growth. Sustainability initiatives and growth in retrofit trends are two essential factors providing an opportunity for the growth of the global aircraft cabin lighting market.

Rapid economic growth and a rising middle-class population with disposable income in emerging markets such as Asia-Pacific and Latin America are increasing the growth of the global aircraft cabin lighting market. Furthermore, the integration of smart lighting systems that can adjust brightness and color temperature based on the time of day and flight phase is gaining popularity. These systems improve passenger experience by reducing jet lag and creating a more comfortable cabin environment.

Market Segmentation

The aircraft cabin lighting market is segmented into aircraft type, fit, technology, sales channel, and region. Based on aircraft type, the market is divided into commercial, military, and others. As per fit, the market is bifurcated into retro-fit and line-fit. Based on technology, the market is divided into halogen, LED, and others. Depending on the sales channel, the market is bifurcated into OEM and aftermarket. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

[KMGUEHIDFSFR]

Regional/ Country Market Outlook

In 2024, leading aircraft cabin lighting manufacturer STG Aerospace stated?that Titan Airways, a renowned British charter airline, is the most recent airline to equip its Boeing 757 aircraft with STG's industry-leading liTeMood?retrofit LED mood lighting system.

Airlines in North America are focusing on modernizing their fleets to improve fuel efficiency and passenger experience. This includes upgrading cabin interiors with advanced lighting systems that enhance comfort and reduce operational costs.

Innovations in LED and OLED lighting technology are prominent in Europe, offering energy efficiency, longer lifespans, and enhanced passenger comfort through mood lighting systems. For instance, a project was introduced in 2020. The project is called Repro-Light. The project aims to transform and convert the European industry to a circular economy by creating Luminaire of Future. The "Luminaire of the Future" adapts the light to its specific needs, allowing it to be the ideal brightness for activities at the ideal time of day.

Major airlines in China, India, and Southeast Asia, have placed substantial orders for new aircraft to meet growing demand and replace older models. This has increased and still continuously increasing the need and requirement for advanced cabin lighting solutions. On September 2023, Boeing's commercial market outlook forecasted that China will require 8, 560 new commercial planes through 2042. ?China's commercial airliner fleet will be more than double to nearly 9, 600 jets over the next 20 years. In addition, in February 2023, the Tata-run Air India group placed an order for 470 planes, comprising 250 Airbus aircraft and 220 American plane maker Boeing aircraft.

UK is developing lighting systems that are designed to mimic natural light cycles, helping reduce jet lag and enhance passenger well-being. Major players in the UK market include STG Aerospace, BAE Systems, Rolls-Royce (for integrated systems) , and various other specialized lighting companies.

Increasing demand for energy-efficient lighting solutions that reduce operational costs and environmental impact and growing demand for customizable lighting solutions that enhance airline branding and passenger experience are two main significant factors adding fuel to the growth of the global aircraft cabin lighting market in the German region. For instance, on 19th September 2023, the municipality of Erkelenz in North Rhine-Westphalia, Germany, has contracted with SPIE, an independent European leader in multi-technical services in the fields of energy and communications, to upgrade its public lighting. 4, 500 street lighting to LED as per 10-year deal.

The U.S. is facing high passenger traffic, both domestically and internationally. For instance, as per Statista source, in 2023, U.S. airlines recorded 862.8 million passengers on domestic and international flights. In reaction to this, U.S. airlines are expanding and modernizing their fleets to accommodate growing passenger numbers and replace aging aircraft.

Competitive Analysis

The major players operating in the market include Astronics Corporation (U.S.), Heads Up Technologies (U.S.), Honeywell International (U.S.), Cobham Limited (UK), Diehl Stiftung & Co KG (Germany), Luminator Technology (U.S.), United Technologies (U.S.), Precise Flight (U.S.), Rockwell Collins (U.S.), Soderberg Manufacturing (U.S.), STG Aerospace (UK) and Zodiac Aerospace (France)

The following players adopted product launches, acquisitions, strategic alliances, collaboration, and other strategies to increase their Aircraft Cabin Lighting Market Share in the global Aircraft Cabin Lighting Industry.

The other players in the market include Raytheon Technologies Corporation (U.S.), Precise Flight (U.S.), Devore Aviation Corporation of America (U.S.), Safran SA (France), Bruce Aerospace (U.S.), Aveo Engineering Group (Czech Republic), AIIM Altitude (UK) and Oxley (UK)

Industry Trends

UK Government invested $400 million in aerospace research and development projects. The new project includes developing high-performance engines, new wing designs, ultra-lightweight materials, energy-efficient electric components, and other new concepts to enhance innovation within the sector.

In December 2022, Chinese plane maker Commercial Aircraft Corporation of China, Ltd. (COMAC) and Boeing collaborated together on a sustainability project to develop and test ramie fiber-reinforced polylactic acid composite (RRP) used in manufacturing civil aircraft cabin components. In contrast to conventional polymers utilized in the production of civil airplane cabin components, the new RRP material is entirely biodegradable, lighter, and stronger. A small batch of RRP aircraft seat tables has been constructed by the project's research and development (R&D) team, the COMAC-Boeing Technology Center. These seat tables have passed technical tests, including flammability and overload testing, and have been tested in real-world flight conditions in preparation for the 2022 Boeing eco-demonstrator program.

In October 2020, using ultraviolet light (UV) in conjunction with other cleaning techniques, LATAM Brasil is the first corporation in Latin America to develop an autonomous robot for airplane cleaning. This technology can eradicate up to 99.9% of viruses and germs from an aircraft. The robot prototype was entirely developed by LATAM, and the company's Maintenance Center (MRO) in São Carlos (SP) conducted the efficacy and final testing.

United Airlines became the first American airline to introduce Braille to airplane interiors in July 2023, making it easier for millions of passengers with visual impairments to independently navigate the cabin. Currently, the airline has installed Braille markers inside and outside the restrooms, as well as for individual rows and seat numbers, on around a dozen of its planes.

Key Sources Referred

Astronics Corporation Press Release

Heads-up.com

Aerospace.honeywell.com

Stgaerospace.com

Aviation Business News

Statista

American Bright LED

SPIE

Business Standard

Open Access Government

Www. Gov.UK

Belt and Road Portal

Aeroflap

United Airlines

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft cabin lighting market analysis from 2024 to 2033 to identify the prevailing aircraft cabin lighting market opportunities.

The market research is offered along with information related to key drivers, restraints, and Aircraft Cabin Lighting Market Opportunity.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global aircraft cabin lighting market trends, key players, market segments, application areas, and market growth strategies and Aircraft Cabin Lighting Market Forecast.

Aircraft Cabin Lighting Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.5 Billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 257 |

| By Aircraft |

|

| By Fit |

|

| By Technology |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | United Technologies (U.S.), Bruce Aerospace (U.S.), Precise Flight (U.S.), Honeywell International (U.S.), Aveo Engineering Group (U.S.), AIIM Altitude (U.S.), STG Aerospace (UK), Safran SA (France), Rockwell Collins (U.S.), Soderberg Manufacturing (U.S.), Luminator Technologies (U.S.), Cobham Limited (UK), Diehl Stiftung & Co KG (Germany), Head Up Technologies (U.S.), Raytheon Technologies Corporation (U.S.), Oxley (UK), Astronics Corporation (U.S.), Devore Aviation Corporation of America (U.S.), Zodiac Aerospace (France) |

Analyst Review

The adoption of aircraft cabin lighting has increased significantly in the recent years, owing to increase in air traffic, rise in focus on enhancing travel experience for passengers, and growth in demand for energy-efficient lighting systems. The lighting systems include wall, floor, and ceiling lights, reading lights, signage lights, and lavatory lights. Technological advancements, in terms of miniaturization of components, and implementation of advanced technologies such as LED and organic LED lighting systems, integration of lightweight products, implementation of smart lighting, use of energy efficient lighting equipment, and associated software, have encouraged airline operators to invest in advanced aircraft lighting system for long-term benefits. There has been a shift from fluorescent lighting to LED lighting by aircraft, owing to its power savings of around 50–70%, enhanced aesthetics, low heat emission, and higher light quality. In January 2015, Thomson Airways, a UK based leisure airlines, awarded a contract to STG Aerospace for retrofit cabin lighting program. Through this contract, STG Aerospace retrofitted 23 aircraft with a plug-and-play programmable blue/white LED cabin lighting system. This liTeMood system is up to 40 kg lighter than original-fit fluorescent lighting, and consumes 70% less power, providing increased reliability over traditional lighting systems, and reduces ongoing maintenance costs.

High costs associated with aircraft cabin lighting hamper market growth. The key players in the industry have focused on providing low-cost and innovative aircraft cabin lighting systems with high efficiency, owing to technological advancements, thereby increasing its adoption among private airline operators. Several companies have periodically introduced advanced cabin lighting systems by integrating new and innovative technologies to expand their offerings and cater to the growing consumer demand. Market players have acquired other companies and expanded their product portfolio to increase their customer base and improve their geographical outreach. North America is the major revenue contributor to the global market, owing to increase in air travel and surge in use of aircraft in the defense and military sector.

There is a significant shift towards using LED lighting in aircraft cabins as LEDs offer energy efficiency, longer lifespan, and reduced maintenance costs compared to traditional lighting systems.

The commercial segment is the leading application of Aircraft Cabin Lighting Market. This is due to the significant expansion of airline fleets and the increasing focus on enhancing passenger experience and energy efficiency within the commercial aviation sector.

North America is the largest regional market for Aircraft Cabin Lighting. This is due to the presence of major aerospace companies, airlines, and technological innovation hubs in the region.

$3.5 billion is the estimated industry size of Aircraft Cabin Lighting.

Astronics Corporation (U.S.), Heads Up Technologies (U.S.), Honeywell International (U.S.), Cobham Limited (UK), Diehl Stiftung & Co KG (Germany), Luminator Technology (U.S.), United Technologies (U.S.), Precise Flight (U.S.), Rockwell Collins (U.S.), Soderberg Manufacturing (U.S.), STG Aerospace (UK) and Zodiac Aerospace (France) are the top companies to hold the market share in Aircraft Cabin Lighting.

Loading Table Of Content...