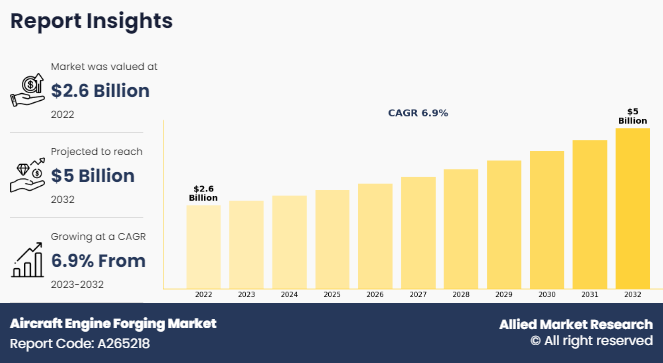

The global aircraft engine forging market size was valued at $2.6 billion in 2022, and is projected to reach $5 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

Report Key Highlighters:

- The aircraft engine forging market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available over the forecast period 2022-2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The aircraft engine forging market share is marginally fragmented, with players such as Precision Castparts Corp., Canton Drop Forge, ATI Inc., Mettis Group, Alcoa, SIFCO Industries, Consolidated Industries, Inc., voestalpine BÖHLER Aerospace GmbH & Co KG, Forgital Group, and Safran. Major strategies such as partnership, acquisition, investment and other strategies of players operating in the market are tracked and monitored.

Aircraft engine forging involves shaping metal components for aircraft engines through the application of compressive force using forging techniques. This manufacturing process, which employs hammers, presses, or dies, is essential for meeting the rigorous standards of strength, durability, and performance demanded by aviation applications. Forging yields components stronger than those produced through casting or machining. During forging, the metal's internal grain deforms to match the part's shape, creating a continuous grain structure that enhances strength. Forgings are categorized as cold, warm, or hot depending on the processing temperature.

Rise in air traffic, increase in aircraft production and deliveries, and government support and initiatives to promote the aviation industry are factors driving the aircraft engine forging market. However, high energy consumption and high costs, and adoption of Additive Manufacturing (AM) hinder the growth of the market. Furthermore, advancement in material science and demand for lightweight engine components provide growth opportunities for the players operating in the aircraft engine forging industry.

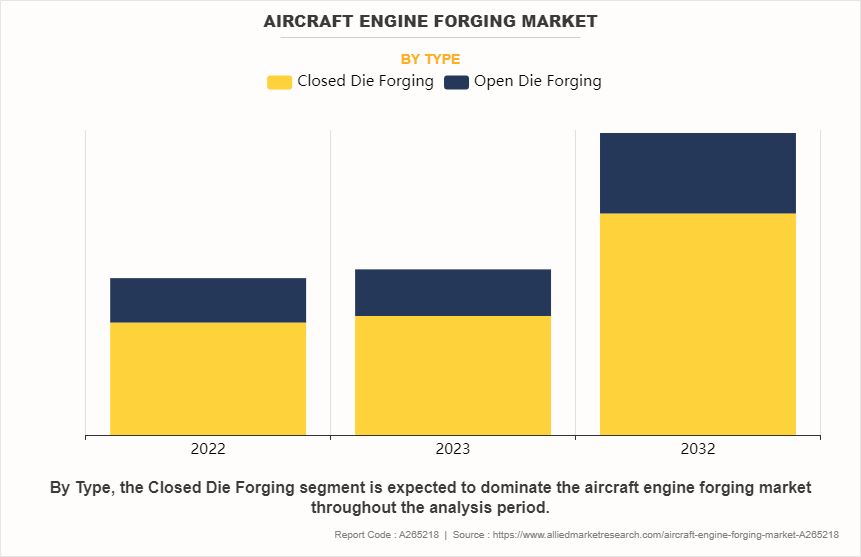

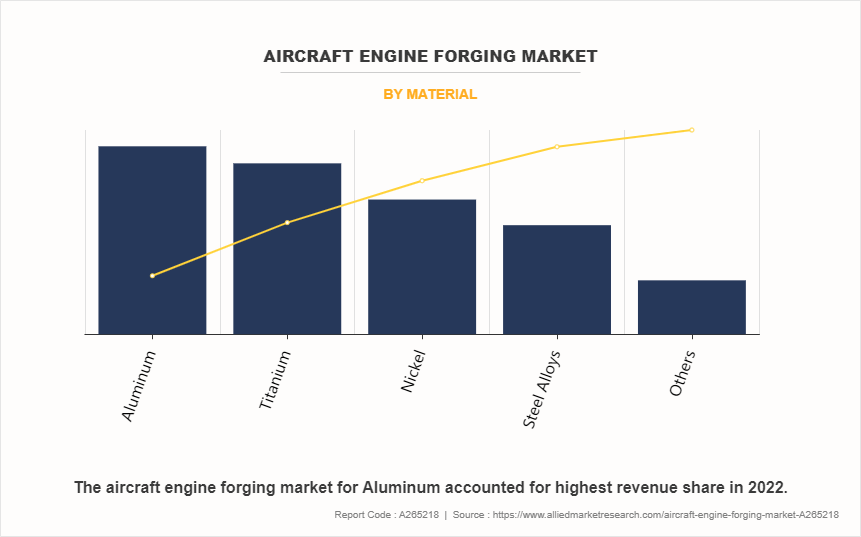

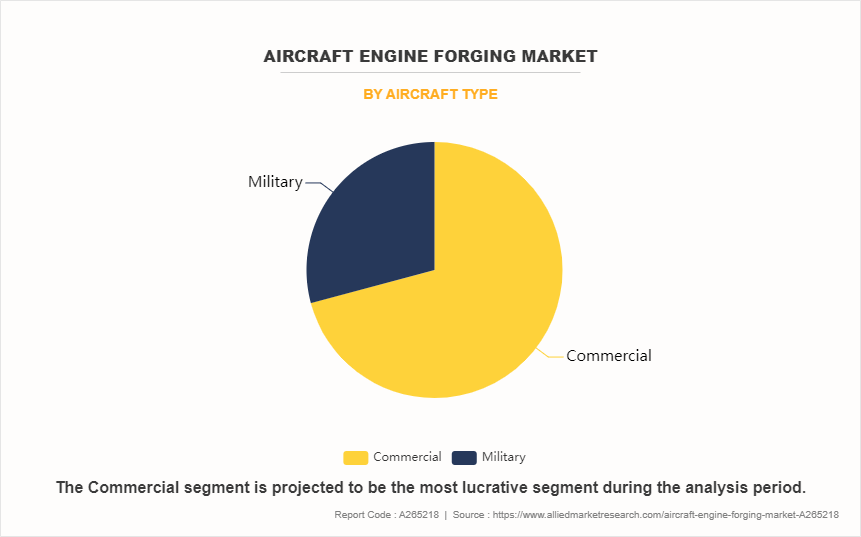

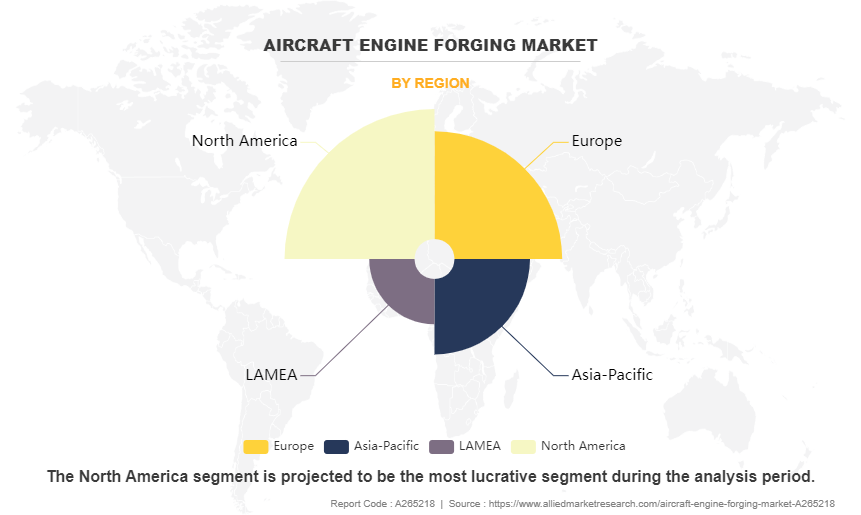

The aircraft engine forging market is segmented on the basis of type, material, aircraft type, and region. On the basis of type, the market is bifurcated into closed die forging and open die forging. On the basis of material, it is categorized into aluminum, titanium, nickel-based superalloys, steel alloys, and others. On the basis of aircraft type, the market is classified into commercial and military. On the basis of region, the market is analyzed in North America, Europe, Asia Pacific, and LAMEA.

The forging industry in North America includes a diverse range of companies involved in the manufacturing of forged components across various sectors including aerospace. According to a 2020 report by the Forging Industry Association (FIA), there were approximately 480 forging operations spread across 38 states. The highest concentration of these operations was found in several key states, including Ohio (79), Pennsylvania (63), Illinois (54), Michigan (54), California (38), Texas (41), New York (16), Indiana (18), Wisconsin (17), Kentucky (13), Massachusetts (10), and South Carolina (9).

According to the Forging Industry Association (FIA) report 2020, the North America forging sector generates revenue ranging between $13.5 billion and $15.5 billion, with custom forgings contributing nearly $11 billion in sales. Moreover, the presence of companies in the North America aircraft engine forging market such as Canton Drop Forge and Precision Castparts Corp. (PCC) that provide forged components for the aerospace industry is expected to drive the growth of the market in the region.

In addition, the demand for air travel is significantly increasing in various parts of the world. For instance, according to International Air Transport Association (IATA), in 2023, North American airlines experienced a significant increase in annual traffic, with a rise of 28.3% as compared to 2022. This surge was accompanied by a 22.4% increase in capacity, leading to a 3.9% point climb in the load factor, which reached 84.6%. Therefore, there is an increase in the production and deliveries of aircraft owing to factors such as strong air travel demand and surge in the aircraft requirements from airlines and leasing companies.

For instance, in January 2024, Boeing announced the completion of its jet delivery goal for 2023 and recorded a 70% increase in the net orders in 2023. The company delivered 528 aircraft in 2023 and booked 1,314 net new orders. Thus, rise in aircraft deliveries directly translates to a higher demand for aircraft engines and engine components. Forging companies specializing in manufacturing engine components such as turbine discs, compressor blades, and shafts are likely to experience increased demand for their products to meet the needs of aircraft manufacturers such as Boeing and Airbus.

Rise in the Air Traffic

There is surge in individuals seeking and utilizing air transportation services due to various factors such as economic growth, enhanced affordability of air travel, the expansion of travel and tourism, and globalization. For instance, according to International Air Transport Association (IATA), total air traffic, measured in revenue passenger kilometers (RPKs), increased by an impressive 55.5% in February 2023 as compared to the same month in 2022. Globally, the overall traffic level reached 84.9% of the levels recorded in February 2019.

Moreover, according to Eurostat, in 2021, there was a substantial increase of 34.9% in the number of passengers traveling by air in the European Union (EU), totaling 373 million people. This increased demand directly impacts on the aircraft industry, leading to rise in the need for additional aircraft to accommodate the growing numbers of passengers. Therefore, the escalating demand for air travel necessitates engine systems for each aircraft. Consequently, the growing demand for air travel serves as a key driver for the aircraft engine forging market, prompting the requirement for various engine and engine components to cater to the needs of aviation.

Increase in Aircraft Production and Deliveries

With rise in global demand for air travel, airlines are driven to augment their fleets to meet the growing needs of passengers. This results in increased demand for new aircraft, consequently fueling the demand for aircraft engines. For instance, in 2022, Airbus witnessed a significant increase in its commercial aircraft deliveries, providing 661 aircraft to 84 customers. This marked an 8% increase as compared to the previous year. In addition, the company reported 820 net new orders, surpassing the 2019 figure of 768. As of the conclusion of 2022, Airbus' backlog stood at 7,239 aircraft, representing the highest count since 2019.

Moreover, ADS Group, a UK-based trade association projected the delivery of 1,190 aircraft in total by Q1 2023. The estimate is 4% higher than that of 2022. This forecast reflects a 4% increase compared to 2022, with anticipated production rate escalations leading up to 2024. The increased demand for aircraft engines translates into a higher need for engine components, including forged parts.

Aircraft engines comprise numerous complex components that require precision engineering and high-quality materials to ensure optimal performance and safety. Therefore, rise in demand for aircraft engines directly drives the demand for forged engine components, thus propelling the aircraft engine forging market growth.

High Energy Consumption and High Costs

Aircraft engine components require materials with high strength and durability to withstand extreme operating conditions. Forging, a process of shaping metal by applying localized compressive forces, is often used to produce these components. The materials used in forging, such as titanium, nickel alloys, and steel, often require high temperatures for shaping, leading to high energy consumption. The forging industry uses a lot of energy, which costs them a significant amount of money. As the world moves towards cleaner energy sources, the forging industry is also trying to reduce its energy consumption. According to the 2020 Forging Industry study reference, 18 % of survey participants indicated that energy costs posed a noteworthy challenge for their operations. Therefore, the high cost are expected to aircraft engine forging market trends.

In 2021, this number increased to 20%. With energy prices rising, managing energy use has become more challenging for forging companies. Moreover, the cost of die materials directly impacts the overall cost of manufacturing aircraft engine components through forging. Achieving precise dimensions in forging dies requires CNC machining. In addition to the expense of high-quality materials for the dies, the machining process adds to the overall cost. Thus, forging dies are significantly more costly than casting molds. Typically, a pair of forging dies for aircraft engine components range from $1,500 to $3,000. Such factors are expected to hamper the growth of the market.

Advancement in Technology and Material Science

Advancements in technology drive continuous improvement and innovation in the aircraft engine forging market, leading to more efficient, reliable, and environmentally sustainable engines for the aerospace industry. For instance, The Defence Research and Development Organisation (DRDO) announced on May 28, 2021, that their lab, Defence Metallurgical Research Laboratory (DMRL) in Hyderabad developed near isothermal forging technology. This technology is used to make all five stages of high-pressure compressor discs from a tough-to-deform titanium alloy. They achieved this using their unique 2000 MT isothermal forge press. This breakthrough indicates that India is making strides towards achieving independence in the production of critical components for aeroengines.

Moreover, material science advancements have led to the development of high-performance alloys that offer superior strength, durability, and heat resistance. For instance, companies such as FRISA provide aerospace forging made of superalloy grades including Alloy 718, Alloy 718 Plus, Waspaloy, Alloy 242, Alloy C263, and Alloy 783. Forging these advanced alloys allows manufacturers to produce engine components capable of withstanding the extreme conditions within aircraft engines, such as high temperatures and pressures. Therefore, advancements in technology and material science have a profound impact on the aircraft engine forging market.

Impact of Russia-Ukraine war on Aircraft Engine Forging Industry

The Russia-Ukraine war is expected to potentially impact the aircraft engine forging market. Ukraine is a significant producer of titanium, a crucial material used in aircraft engine forgings. Any disruption in the supply chain due to the conflict could lead to shortages of titanium, affecting the production of engine components. For instance, according to KPMG Aerospace & Defence Outlook 2023, titanium shortages have been identified as one of the top supply chain concerns in the aerospace industry.

The conflict may lead to geopolitical instability, which could disrupt global trade and investment flows. Uncertainty in the geopolitical landscape can dampen investor confidence and affect business decisions, including investment in aircraft engine forging facilities and research and development activities. Moreover, the economic sanctions imposed on Russia or Ukraine, or both, can have ripple effects on the global economy. Reduced trade, financial market volatility, and currency fluctuations can impact the cost of raw materials, transportation, and other operational expenses for companies in the aircraft engine forging market.

Recent Developments in the Aircraft Engine Forging Industry

- In January 2024, Aubert & Duval acquired by Safran and Airbus invested approximately $80 million in new forging technology to support the decarbonization trend in aerospace, energy, and defense. They have ordered a 60 MN hydraulic closed-die forging press from SMS group for their Pamiers site in France. This press will enable precise forging of turbine disks, shafts, and structural parts.

- In October 2023, HAL, a defense PSU entered a Memorandum of Understanding (MoU) with Safran Aircraft Engines to collaborate on ring forging manufacturing for commercial engines. This collaboration aims to develop industrial cooperation in producing forgings for Leading Edge Aviation Propulsion (LEAP) engines, which are used to power aircraft like the Airbus A320 Neo family and the Boeing 737 Max.

- In April 2023, Airbus, Safran, and Tikehau Capital through their holding company completed the acquisition of Aubert & Duval from Eramet. Aubert & Duval is a key supplier of critical parts and materials to industries such as aerospace, defense, nuclear, and medical.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft engine forging market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Engine Forging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 200 |

| By Type |

|

| By Material |

|

| By Aircraft Type |

|

| By Region |

|

| Key Market Players | Mettis Group, Forgital Group, ATI Inc., Canton Drop Forge, Consolidated Industries, Inc., Safran, SIFCO Industries, Alcoa, voestalpine BÖHLER Aerospace GmbH & Co KG, Precision Castparts Corp. |

The global aircraft engine forging market was valued at $2,571.3 million in 2022, and is projected to reach $4,951.0 million by 2032, registering a CAGR of 6.9% from 2023 to 2032.

The top companies to hold the market share in aircraft engine forging are Precision Castparts Corp., Canton Drop Forge, ATI Inc., Mettis Group, Alcoa, SIFCO Industries, Consolidated Industries, Inc., voestalpine BÖHLER Aerospace GmbH & Co KG, Forgital Group, and Safran

The largest regional market for aircraft engine forging is North America

The leading type of aircraft engine forging market is closed die forging.

The upcoming trends of aircraft engine forging market in the world are advancement in material science and demand for lightweight engine components.

Loading Table Of Content...

Loading Research Methodology...