Aircraft Lighting Systems Market Summary

The global aircraft lighting systems market size was valued at $1.5 billion in 2020, and is projected to reach $2.3 billion by 2030, growing at a CAGR of 4.9% from 2021 to 2030.

Key Market Trends and Insights

Region wise, Asia-Pacific generated the highest revenue in 2021.

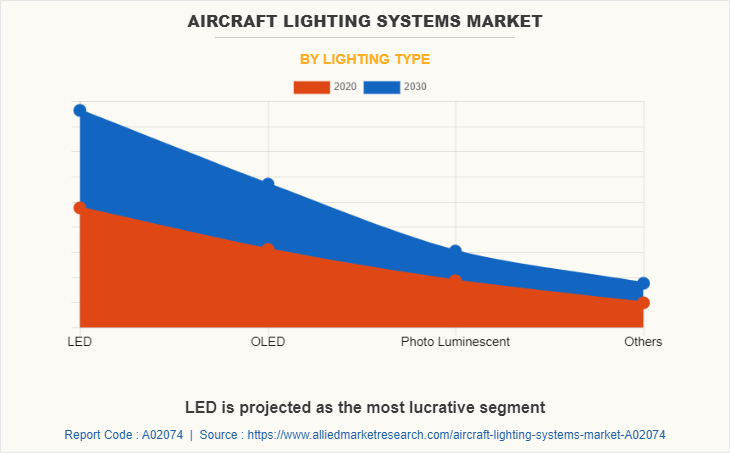

The global aircraft lighting systems market share was dominated by the LED segment in 2021 and is expected to maintain its dominance in the upcoming years

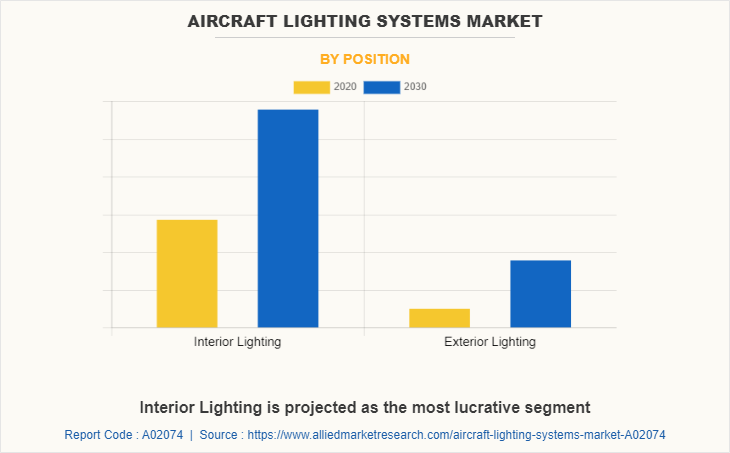

The interior lighting segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2020 Market Size: USD 1.5 Billion

- 2030 Projected Market Size: USD 2.3 Billion

- Compound Annual Growth Rate (CAGR) (2021-2030): 4.9%

- Asia-Pacific: Generated the highest revenue in 2021

The lighting system that is integrated inside or outside of an aircraft to provide illumination is considered under the aircraft lighting system. Aircraft lighting system can be classified into two major categories, interior lighting system and exterior lighting system. The interior lighting system refers to the lighting system that is integrated inside the aircraft body, fuselage, and cockpit. These lightings provide illumination to cabin crew, passengers, and pilots. Floor lights, wall lights, fuselage ceiling lights, leading lights, lavatory lights, cockpit lights, and signage lights are considered under the interior lighting system. Furthermore, the exterior lighting consists of aircraft visibility lighting, pilot visibility lighting, specific purpose lighting, exterior emergency lighting, and navigation lighting. The primary function of exterior lighting is to improve visibility and avoid a collision.

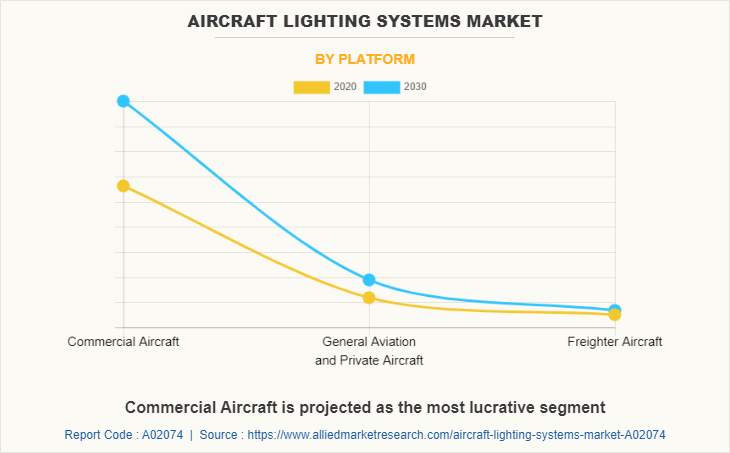

Factors such as revival of the aviation industry and increase in air traffic in metropolitan locations supplement growth of the aircraft lighting system market. Total number of passengers across the globe has reached 47% of the pre-covid level and is expected to reach 83% by the end of 2022. The total number of passengers as of 2024 is expected to reach four billion, exceeding the pre-covid situation. Customized lighting systems offered by industry players to cater to unique demands of customers have emerged as a unique strategic initiative practiced by industry players to increase their market share. The trend of customization is largely noticed in the interior segment of private jets. Rise in acquisition of private jets by business tycoons and ultra-reach individuals across the globe supports business opportunities in the aircraft lighting systems market as well. A total of 197,103, demonstrating a 23% rise as compared to the pre-covid situation.

Revival of aviation industry and increase in flight operations

Revival of the aviation industry is one of the top impacting factors, supporting business opportunities within the aircraft lighting systems market. The market was drastically impacted, owing to the COVID-19 pandemic but is recovering at a notable pace. Rise in air traffic eventually results in increased business activities such as aircraft acquisition, leasing maintenance, repair, and overhaul. The A check of an aircraft that happens after 200-500 flight hours has a clause to check the lighting system. Apart from that, daily check also takes into consideration exterior lighting operations. Such checks promote the aftermarket. Rise in demand for custom lighting in private jets and business aircraft is expected to augment the market growth in the coming years. Companies operating within the vertical offer unique customization as per consumer demand. The same trend can be witnessed in commercial aviation as well. Currently, companies such as STG Aerospace are providing emergency photoluminescent floor mat with custom colors or patterns as requested by clients.

Increasing demand of more efficient and robust lighting system

The COVID-19 pandemic has impacted the aviation industry at multiple levels of operations. Currently, aircraft owners or airline operators are actively looking for options that can reduce operational cost of an aircraft. In such conditions, LED lights developed by industry players are gaining traction. LED lights are capable to convert power into light directly, resulting in 10 times increased efficiency as compared to conventional lighting scheme. It draws notable less energy and does not need any external high voltage converters or supply systems. Furthermore, LED lights do not dissipate heat, are not affected by on/off cycles, are shock resistant as they are in the solid-state, and can last up to a continuous operation of 30,000-50,000 hours, eliminating the need for frequent replacement.

High production cost and increase in market competitiveness

High initial cost in addition to installation costs limits the aircraft lighting systems market growth. Introduction of LED lights had a notable impact on the market, which introduced certain challenges as well. The need to frequently replace burned-out incandescent bulbs has been eliminated through LED lights, however, managing optimal lighting conditions of lens and cover material of LED lights throughout the lifespan is a major challenge, incurring additional costs. Aircraft lighting exteriors are either made from borosilicate/soda-lime silicate compositions or polycarbonate/acrylic materials. These materials tend to degrade after being exposed to harsh conditions. Polycarbonate/acrylic, which is the most economically viable material, tends to degrade at a maximum pace as compared to other materials, increasing casing cost of an aircraft lighting system.

Increase in regional operations

Efforts taken by regional governments of various countries with developing economies such as India, China, and Singapore to increase their footprint in the aviation industry generates notable business opportunities at the global level. These countries have offered notable subsidiaries and tax exemptions on foreign direct investment (FDI) for global companies willing to invest within the aviation segment. In addition, the aim of these countries to become self-dependent and promote indigenous products and services in the international market is expected generate market competitiveness. For instance, a 100% subsidiary is offered by India within a certain category of the aviation industry. However, only 10% of MRO of Indian aviation is done indigenously whereas 90% of work is outsourced to other nations. Developing nations posed a huge business opportunity through investment in developing nations and increasing their regional footprint.

Segment Review

The global aircraft lighting systems market is segmented on the basis of position, platform, lighting type, end use, and region. By position, it is divided into interior lighting and exterior lighting. By platform, the market is classified into commercial aircraft, general aviation and private aircraft, and freighter aircraft. The lighting type segment is divided into LED, OLED, photoluminescent, and others. By end use, it is segmented into original equipment manufacturer (OEM) and aftermarket. By region, the market is analyzed across North, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

Companies have adopted product development and product launch as their key development strategies in the market. Moreover, collaborations and acquisitions are expected to enable the leading players to enhance their product portfolios and expand into different geographical regions. Key players operating in the aircraft lighting systems market are Astronics Corporation, Cobham Aerospace Communications, Collins Aerospace, Diehl Stiftung & Co. KG, Geltronix, Hoffman Engineering, Honeywell International Inc., Luminator Aerospace, Safran, STG Aerospace Limited.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft lighting systems market analysis from 2020 to 2030 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and aircraft lighting systems market opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aircraft lighting systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The aircraft lighting systems market forecast includes the analysis of the regional as well as global aircraft lighting systems market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Lighting Systems Market Report Highlights

| Aspects | Details |

| By Position |

|

| By Platform |

|

| By Lighting Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Honeywell International Inc., Cobham Aerospace Communications, Collins Aerospace, safran, STG Aerospace Limited, Luminator Aerospace, Diehl Stiftung & Co. KG, Hoffman Engineering, Astronics Corporation, Geltronix |

Analyst Review

The aircraft lighting system market is expected undergo a major shift in coming years. Majority of conventional lighting system would be replaced by LED lighting system of self-luminous lighting system. In addition, a notable emphasis is expected to be provided on interior lighting of an aircraft. Stringent government norms related to exterior lighting of an aircraft, regular A and B checks, and multiple aftermarket options are expected to generate a healthy market place. Revival of global economies post the COVID-19 pandemic is accelerating the aviation industry, supporting the aircraft lighting system market. The market in developed countries, such as the U.S., Canada, Mexico, and Germany is projected to report a slower growth rate as compared to developing regions, such as India, South Africa, and the Middle East, owing to rapid industrialization and high sales of vehicles in developed regions.

Companies operating within the aircraft lighting system market is focusing on production of advanced and low-maintenance LED lights, which have longer lifespans, and low maintenance cost. Increase in research and development activities, mergers, acquisitions, and technology transfer contracts are analyzed to be primary strategic initiatives practiced by industry players to ensure business expansion. For instance, in October 2021, a technology transfer agreement was signed between Central Scientific Instruments Organisation (CSIO) and Bharat Electronics Limited (BEL). According to the contract, CSIO would deliver a range of innovative products such as LED-based taxi and landing lights, and LED-based drogue lights along with associated test rigs.

Passenger comfort and seating arrangement has been an integral part of the commercial aviation industry. Increase in efforts of airline operators to reduce operational cost by squeezing more passengers and maintaining luxury and operational standards of an airline is a challenging task. Hence, to address such challenges, airline operators have turned toward improving internal lighting of aircraft. For instance, in October 2021, Lufthansa modified lighting of Airbus A320 neo. Following the upgrade, Swiss, Brussels Airlines, and Euro wings stated that they will be using upgraded lighting on new purchase of Airbus 320 family. The new lighting scheme was designed to be human centric, particularly programmed to be brighter, friendlier, and flexible.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. Asia Pacific is expected to maintain the lead during the forecast period, owing to increased CAGR as compared to other regions.

The global aircraft lighting systems market size was valued at USD 1.5 billion in 2020, and is projected to reach USD 2.3 billion by 2030.

The global aircraft lighting systems market is projected to grow at a compound annual growth rate of 4.9% from 2021-2030 to reach USD 2.3 billion by 2030.

The Key players operating in the aircraft lighting systems market are Astronics Corporation, Cobham Aerospace Communications, Collins Aeropsace, Diehl Stiftung & Co. KG, Geltronix, Hoffman Engineering, Honeywell International Inc., Luminator Aerospace, Safran, and STG Aerospace Limited.

Asia-Pacific

Revival of aviation industry and increase in flight operations, Increasing demand of more efficient and robust lighting system, Increase in regional operations.

Loading Table Of Content...