Aircraft Propeller System Market Research, 2034

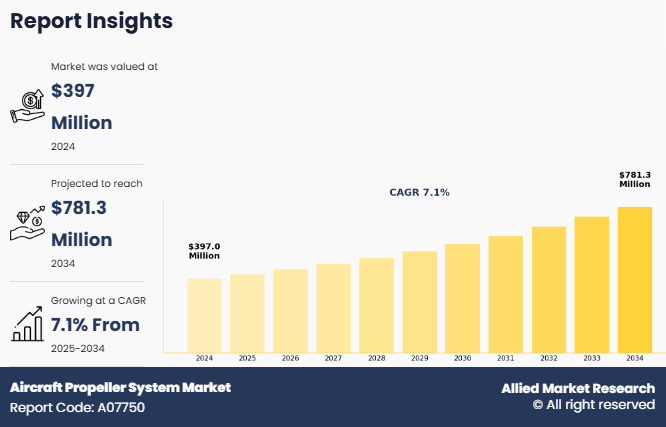

The global aircraft propeller system market size was valued at $397 million in 2024, and is projected to reach $781.3 million by 2034, growing at a CAGR of 7.1% from 2025 to 2034.

Report Key Highlighters:

- The aircraft propeller system industry study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the aircraft propeller system market growth.

- The aircraft propeller system market share is highly fragmented, into several players including General Electric Company, Hartzell Propeller, Inc, MT-Propeller Entwicklung GmbH , Dowty Propellers, Hélices E-Props, Hercules Propellers Ltd., McCauley Propeller Systems, Collins Aerospace, AVIA Propeller s.r.o., and Sensenich Propeller Company. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

An aircraft propeller system is a propulsion mechanism that converts rotational energy from an engine into thrust, propelling the aircraft forward. The system includes several key components, such as blades, hub, spinner, governor, and a pitch control mechanism. In aircraft propeller system the blades are airfoil-shaped which generate lift and thrust as they rotate. All the components in aircraft propeller system works collaboratively to adapt to varying flight conditions, thus ensuring optimal performance and fuel efficiency.

Factors such as increase in air travel, growing advancement in the electric and hybrid aircrafts, and growing orders of new aircraft from developing countries drives the growth of the market. However, stringent government regulations, and high maintenance cost hinders the growth of the market to some extent. On the contrary, factors such as modernization of military aircrafts, and increase in sales of personal aircrafts offers lucrative market growth opportunities.

In recent years, there has been growing advancement in the electric and hybrid aircrafts technology as they have lower operational costs, and improved fuel efficiency. Moreover, government and regulatory bodies are further promoting the use of electric and hybrid aircrafts. In addition, the aviation industry is focus on sustainability and development aircraft which have lower environmental footprints.

Moreover, growing research and development, increasing financial investments, and expanding industry collaborations is further driving the development of electric and hybrid aviation industry. For instance, on June 2023, Airbus SE and STMicroelectronics signed an agreement for the development of technologies related to hybrid and electric aircrafts. The company also announced that the collaboration is expected to develop the next generation of semiconductors, which will be extensively used in hybrid and fully electric aircraft such as the ZEROe demonstrator and CityAirbus NextGen. Such developments are expected to drive the growth of the aircraft propeller system market size during the forecast period.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On January 22, 2024 Hartzell expanded its global service network by appointing Arrow Aviation Services, based in Kolkata, India, as its first Recommended Service Facility in South Asia. This strategic move enhances Hartzell‐™s ability to provide factory-level service and support to customers in the growing Indian general aviation market.

- On October 17, 2023 Hartzell Propeller and its sister companies under Hartzell Aviation were acquired by Arcline Investment Management. This strategic move aims to accelerate innovation throughout the company and expand their service base.

- October 26, 2023 MT-Propeller announced a significant development for its line of hydraulic constant-speed propellers. The company is now focusing on improved aerodynamic efficiency, noise reduction, and vibration damping. As part of this development, the company also introduced optimized blade shapes and advanced composite materials, which offer better overall performance and durability.

Segmental analysis

The global aircraft propeller system industry forecast is segmented into propeller type, engine and aircraft type. On the basis of propeller type the global market is segmented into fixed pitch and variable pitch. Based on engine the market is analysed into conventional and electric & hybrid. Based on aircraft type the global market is segregated into civil and military. Based on region the market is analysed across North America, Europe, Asia-Pacific and LAMEA.

Propeller Type

By propeller type, the aircraft propeller system market opportunities is categorized into fixed pitch propellers and varying pitch propellers. The fixed pitch propellers segment dominated the aircraft propeller system market forecast in 2024. Owing to it extensive use in light aircraft, UAV, and electric aircrafts. Due to their simplicity, cost-effectiveness, and low maintenance make them highly attractive for training aircraft, personal aircraft, and electric aircraft. Moreover, with the growth of general aviation industry especially in regions like Southeast Asia and Africa and the growth of economy aviation the demand for pitch propellers is growing. Additionally, due to the emergence in electric vertical takeoff and landing (eVTOL) segment, many manufacturers are utilizing fixed pitch designs to reduce system weight and mechanical complexity.

Engine

By engine, the aircraft propeller system market segmentation is categorized into conventional and electric and hybrid. The conventional segment dominated the aircraft propeller system market in 2024. Owing to their cost-effectiveness, fuel efficiency, and suitability for regional and tactical operations. These propeller systems are increasingly utilized in turboprop regional airliners, military transport aircraft, and special mission platforms. Moreover, recent advancements, such as variable-pitch systems and electronically controlled propellers, have improved performance and reduced noise of aircraft propeller system in conventional engines.

Aircraft Type

By aircraft type, the aircraft propeller system market demand is categorized into civil and military. The civil segment dominated the aircraft propeller system market in 2024. Owing to, their extensive use in turboprops civil aircrafts, which are significantly more fuel-efficient than jet-powered aircraft. The lower operational cost makes them attractive for airlines seeking to reduce operational costs and environmental impact. Moreover, with increasing air passenger numbers and expanding regional air networks, airlines are investing in modern, fuel-efficient turboprop aircraft to serve more routes.

By Region

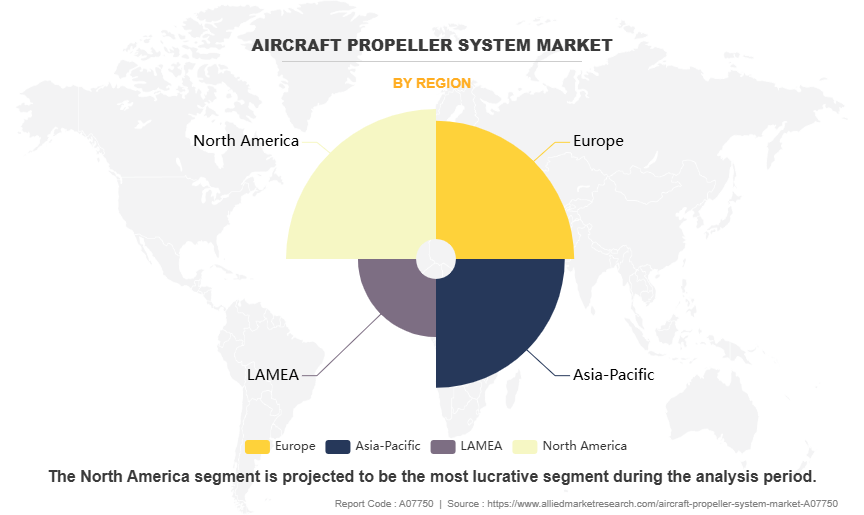

Based on region the global market is analyzed into North America, Europe, Asia-Pacific, and LAMEA. The North America is region dominated the global market share in 2024, owing to increase in military spending in the U.S., Canada, and Mexico. Moreover, rise in geopolitical tension has lead to increased investment in modernizing military aircrafts. Moreover, the U.S. and Canda have pledged their allegiance to NATO, and also works for United Nations peace keeping mission and arctic security, which has resulted in increased need for modern aircrafts.

Moreover, the region has presence of numerous aircraft manufacturing companies such as Boeing, Lockheed Martin, and Textron Aviation which further contribute to the growth of the market. Additionally, the increasing focus on the development of next-generation aircraft technologies and innovations in fuel efficiency standards has spurred advancements in propeller design and materials, further stimulating the market growth.

Increase in air travel

The global aviation industry has witnessed rapid growth in recent years, owing to increase in globalization, technological advancements, and growing affordability of air travel. The increase in demand for air travel has resulted in increased demand for new aircrafts, thus driving the market demand for aircraft propeller system.

According to a data published from the International Air Transport Association as of February 2023 there was a 55.5% increase in total air traffic globally, when compared to data from 2022. The growth in air travel is particularly prominent in developing countries especially in the Asia-Pacific region, due to increase in disposable income among people and increase in need for air travel for business and leisure activities.

For instance, in 2024 according to the data by Government of India‐™s, Press Information Bureau showcased that the number of operational airports in India has also doubled from 74 in 2014 to 157 in 2024, and the country is aiming to increase it by 350-400 by the year 2047. The demand for air travel will continue to grow in coming decade thus driving the market for aircraft propeller system.

Growing advancement in electric and hybrid aircrafts

In recent years, there has been growing advancement in the electric and hybrid aircrafts technology as they have lower operational costs, and improved fuel efficiency. Moreover, government and regulatory bodies are further promoting the use of electric and hybrid aircrafts. In addition, the aviation industry is focus on sustainability and development aircraft which have lower environmental footprints.

Moreover, growing research and development, increasing financial investments, and expanding industry collaborations is further driving the development of electric and hybrid aviation industry. For instance, on June 2023, Airbus SE and STMicroelectronics signed an agreement for the development of technologies related to hybrid and electric aircrafts. The company also announced that the collaboration is expected to develop the next generation of semiconductors, which will be extensively used in hybrid and fully electric aircraft such as the ZEROe demonstrator and CityAirbus NextGen. Such developments are expected to drive the growth of the aircraft propeller system market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft propeller system market analysis from 2024 to 2034 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft propeller system market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Propeller System Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 781.3 million |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2024 - 2034 |

| Report Pages | 280 |

| By Propeller Type |

|

| By Engine |

|

| By Aircraft Type |

|

| By Region |

|

| Key Market Players | AVIA Propeller s.r.o., General Electric Company, Dowty Propellers, Collins Aerospace, MT-Propeller Entwicklung GmbH , McCauley Propeller Systems, Hartzell Propeller, Inc., Sensenich Propeller Company, Hercules Propellers Ltd., Hélices E-Props |

Growing trends towards sustainable propulsion solutions, and advancements in composite materials are the upcoming trends in the aircraft propeller system.

The civil aircraft segment is the leading segment of the aircraft propeller system market.

North America is the largest regional market for aircraft propeller system market.

The aircraft propeller system market was valued at $397.0 million in 2024 and is estimated to reach $781.3 million by 2034, exhibiting a CAGR of 7.1% from 2025 to 2034.

General Electric Company, Hartzell Propeller, Inc, MT-Propeller Entwicklung GmbH , Dowty Propellers are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...