Aircraft Pumps Market Research, 2033

The global aircraft pumps market was valued at $3.5 billion in 2023, and is projected to reach $6.0 billion by 2033, growing at a CAGR of 5.6% from 2024 to 2033.

Market Introduction and Definition

Aircraft pumps are essential components in aviation systems responsible for moving fluids, such as fuel, hydraulic fluid, and lubrication oil, throughout the aircraft. These pumps ensure the proper operation of various aircraft systems by maintaining consistent fluid pressure and flow. There are several types of aircraft pumps, including centrifugal, gear, and diaphragm pumps, each serving specific functions. Fuel pumps transfer aviation fuel from the tanks to the engines, hydraulic pumps power control surfaces and landing gear, and lubrication pumps ensure that engine components remain properly lubricated. Reliable and efficient aircraft pumps are crucial for the safety, performance, and longevity of the aircraft, as they contribute to essential functions such as propulsion, control, and maintenance of the various systems of the aircraft.

Key Takeaways

- The aircraft pumps market overview report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The aircraft pumps market report is fragmented in nature among prominent companies such as CLARCOR Inc., Eaton, Zodiac Aerospace, Freudenberg & Co. KG, Donaldson Inc., Pall Corporation, Parker Hannifin Corporation, Honeywell International Inc., AeroControlex, Woodward.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global aircraft pumps market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3, 100 aircraft pumps industry -related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global aircraft pumps market.

Key Market Dynamics

One of the primary drivers of the aircraft pumps market are continuous technological advancements and innovations within the aerospace industry. Modern aircraft designs demand efficient, lightweight, and reliable components, leading to the development of advanced aircraft pumps. These pumps are being engineered with state-of-the-art materials and cutting-edge technologies to enhance performance, reduce weight, and improve fuel efficiency. Innovations such as electric and hybrid-electric aircraft are also propelling the demand for specialized pumps that support new propulsion systems. The push for greener, more sustainable aviation solutions further fuels the need for technologically advanced pumps that can meet stringent environmental standards while maintaining high performance and reliability.

Furthermore, the rapid growth of global air traffic is another significant driver of the aircraft pumps market. According to a report published by International Civil Aviation Organization in 2022, the aviation sector will increase by an average of 4.3% per annum over the past 20 years. The increasing number of passengers and cargo flights necessitates the expansion and modernization of airline fleets. Airlines are investing heavily in new aircraft to meet the rising demand for air travel, particularly in emerging markets where economic growth is driving increased connectivity. This fleet expansion directly translates to higher demand for aircraft pumps, as each new aircraft requires a range of pumps for various systems, including fuel, hydraulic, lubrication, and cooling. The surge in air travel also drives the need for maintenance, repair, and overhaul (MRO) services, further boosting the demand for replacement pumps and spare parts. These factors altogether may fuel the growth of the aircraft pumps market size during the forecast period.

However, the aviation industry is heavily regulated, with stringent certification processes required for all aircraft components, including pumps. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) impose rigorous standards to ensure the safety and reliability of aircraft systems. Obtaining certification for new or modified aircraft pumps can be a lengthy and complex process, involving extensive testing and validation. This can delay the introduction of new products to the market and increase costs for manufacturers. Additionally, any changes in regulatory requirements can necessitate further modifications and re-certification of existing products, adding to the burden on manufacturers. These regulatory challenges can act as a restraint on the market, as companies may be hesitant to invest in new technologies that require extensive and costly certification processes.

On the contrary, the emergence of electric and hybrid-electric aircraft represents a significant opportunity for the aircraft pumps market. As the aviation industry seeks to reduce its carbon footprint and transition towards more sustainable forms of transportation, there is a growing focus on developing aircraft that use electric or hybrid propulsion systems. These new aircraft designs require specialized pumps for cooling systems, battery management, and other critical functions. The shift to electric and hybrid-electric powertrains necessitates advanced pump technologies that can operate efficiently within the unique parameters of these propulsion systems. This factor may create remunerative opportunities for the aircraft pumps market forecast.

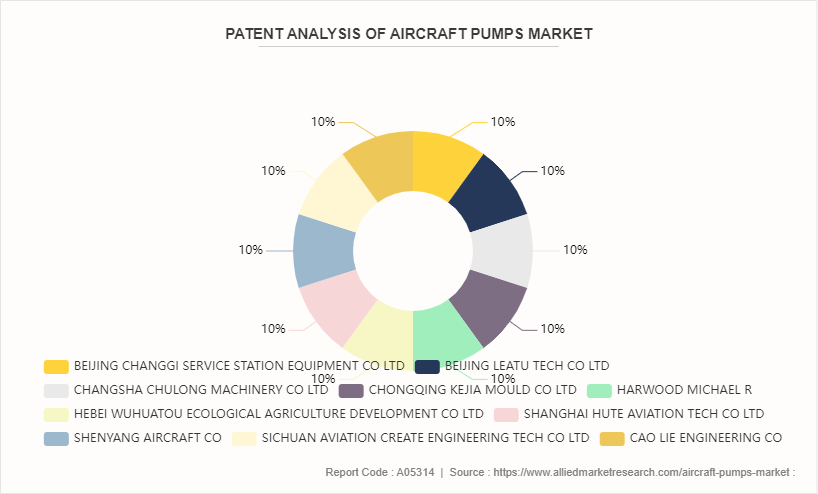

This patent analysis provides a comprehensive overview of patents related to aircraft pumps and its applications across civilian and military aircrafts. The analysis encompasses patent trends, key patent holders, technological advancements, market segmentation, competitive landscape, and future outlook within the aircraft pumps market. Patent filings related to aircraft pumps have shown a steady increase over the past decade, indicating growing interest and investment in aircraft pumps R&D.

Market Segmentation

The aircraft pumps market is segmented on the basis of type, application, and region. By type, the market is classified into fuel pumps, hydraulic pumps, lubrication pumps, and others. By application, the market is divided into commercial aviation, and military aviation. Region-wise, the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America represents a significant aircraft pumps market share . This is attributed to the fact that the U.S. has one of the highest levels of air traffic in the world. The continued growth in both commercial and private air travel demands a larger fleet of aircraft, which in turn increases the demand for aircraft pumps. With more flights and more aircraft, the need for reliable and efficient fuel, hydraulic, and lubrication systems becomes paramount. Furthermore, many airlines in North America are investing in modernizing their fleets to improve fuel efficiency, reduce emissions, and enhance passenger comfort. Newer aircraft models require advanced, more efficient aircraft pumps to support their sophisticated systems. This modernization effort drives demand for the latest pump technologies that can meet the stringent performance and environmental standards of modern aviation.

Furthermore, the U.S. and other North American countries continue to invest heavily in their military and defense capabilities. This includes the procurement of advanced military aircraft, which require specialized and robust aircraft pumps to operate under extreme conditions. The strong defense sector contributes significantly to the demand for aircraft pumps, as new and existing military aircraft require reliable systems for fuel, hydraulics, and cooling. These factors altogether may surge the utilization of aircraft pumps in the North America region; thus, fueling the aircraft pumps market growth.

Competitive Landscape

The major players operating in the aircraft pumps market include CLARCOR Inc., Eaton, Zodiac Aerospace, Freudenberg & Co. KG, Donaldson Inc., Pall Corporation, Parker Hannifin Corporation, Honeywell International Inc., AeroControlex, Woodward.

Public Policy Analysis of Global Aircraft Pump Market

Several acts and regulations have been imposed to avoid safeguard the manufacturing and utilization of aircraft pumps for various applications. For instance:

- In U.S. Federal Aviation Administration (FAA) (14 CFR Part 21) outlines the requirements for the certification of aircraft products, including aircraft pumps, ensuring they meet safety and performance standards.

- Furthermore, 14 CFR Part 25 of Federal Aviation Administration (FAA) covers the airworthiness standards for transport category airplanes, including the systems and components like hydraulic and fuel pumps, ensuring their reliability and safety.

- In Europe, European Union Aviation Safety Agency (EASA) defines the certification requirements for aircraft products and components, including pumps.

- Moreover, CS-25 of European Union Aviation Safety Agency (EASA) sets the airworthiness standards for large aircraft, encompassing the requirements for various systems and components, including fuel, hydraulic, and lubrication pumps.

- In China, Civil Aviation Administration of China (CAAC) (CCAR-21) regulation outlines the certification procedures for civil aviation products, ensuring that components like aircraft pumps meet safety and performance standards.

- In India, Directorate General of Civil Aviation (DGCA) (CAR 21) establishes the certification procedures for aircraft products, including pumps, ensuring compliance with safety and performance standards.

Industry Trends

- According to a report published by Journal of Physics in May 2024, researchers from China have developed flow metering for aircraft oil pump with speed range of 2000rpm∼9000rpm, temperature range of 270K∼325K, pressure between the input and output of pump do not exceed 0.6MPa, and aviation 8B aircraft oil as medium. This novel invention is significant for the metering and control of electric aircraft oil pump systems.

- PARKER HANNIFIN CORP, a leading aircraft pump manufacturing company has developed aerospace in-line portable water pump that is equipped with electromagnetic induction (EMI) filtering technology, sensor-less control, and locked rotor protection software. This factor may surge the demand for Parker’s new aircraft pump across both civilian and fighter jet aircrafts; thus, fueling the market growth.

Key Sources Referred:

- National Promotion and Facilitation Agency

- United States Department of Energy

- U.S. Development Authority

- United States Department of Defense

- Jet Propulsion Laboratory

- Invest In India

- Press Information Bureau

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft pumps market analysis from 2024 to 2033 to identify the prevailing aircraft pumps market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aircraft pumps market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft pumps market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Pumps Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.0 Billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Zodiac Aerospace, Eaton, Woodward, Donaldson Inc., Freudenberg & Co. KG, Parker Hannifin Corporation, AeroControlex, CLARCOR Inc, Pall Corporation, Honeywell International Inc. |

| Other Key Market Players | Safran, Woodward, Inc. |

Growth in air traffic, technological, advancements, fleet modernization, and expansion of aviation sector are the upcoming trends of aircraft pumps market in the globe.

Commercial aviation is the leading application of aircraft pumps market.

North America is the largest regional market for aircraft pumps

The aircraft pumps market was valued at $3.5 billion in 2023, and is projected to reach $6.0 billion by 2033, growing at a CAGR of 5.6% from 2024 to 2033.

CLARCOR Inc., Eaton, Zodiac Aerospace, Freudenberg & Co. KG, Donaldson Inc., Pall Corporation, Parker Hannifin Corporation, Honeywell International Inc., AeroControlex, Woodward are the top companies to hold the market share in Aircraft Pumps.

Loading Table Of Content...